Statement of Beneficial Ownership (sc 13d)

June 30 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. ________)*

BioLargo, Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

09065a100

(CUSIP Number)

Jack B. Strommen

7108 31

st

Avenue North

Minneapolis, MN 55427

(763) 512-5100

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

Copy to:

|

|

John R. Browning, Esq.

BioLargo, Inc.

14921 Chestnut St.

Westminster, CA 92683

(949) 643-9540

|

Edward R. Culhane

Winthrop & Weinstine, P.A.

225 S. 6

th

St., Ste. 3500

Minneapolis, MN 55402

(612) 604-6732

|

June 19, 2017

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [X]

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP No. 09065a100

|

|

13D

|

|

Page 2 of 4 Pages

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

NAMES OF REPORTING PERSON

Jack B. Strommen

|

|

|

|

2.

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a)

☐

(b)

☐

|

|

|

|

3.

|

|

SEC USE ONLY

|

|

|

|

4.

|

|

SOURCE OF FUNDS (see instructions)

PF, OO

|

|

|

|

5.

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

|

|

6.

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

|

|

NUMBER OF

|

|

7.

|

|

SOLE VOTING POWER

6,935,577

|

|

SHARES

BENEFICIALLY

OWNED BY

|

|

8.

|

|

SHARED VOTING POWER

0

|

|

EACH

REPORTING

PERSON WITH

|

|

9.

|

|

SOLE DISPOSITIVE POWER

6,935,577

|

|

|

|

10.

|

|

SHARED DISPOSITIVE POWER

0

|

|

11.

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,935,577

1

|

|

|

|

12.

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions)

☐

|

|

|

|

|

|

|

|

|

|

13.

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.8%

2

|

|

|

|

14.

|

|

TYPE OF REPORTING PERSON (see instructions)

IN

|

|

|

1

Beneficial ownership of shares of Common Stock of the Issuer includes ((i) 3,257,143 shares of Common Stock issuable upon conversion of convertible promissory notes; (ii) 3,257,143 shares of Common Stock issuable upon exercise of outstanding warrants; and (iii) 10,000 shares of Common Stock issuable upon exercise of outstanding options.

2

Based upon 94,988,597 shares of Common stock outstanding as of March 31, 2017, plus the 6,524,286 shares of Common Stock issuable to the Reporting Person upon conversion of convertible promissory notes and exercise of outstanding warrants and options.

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP No. 09065a100

|

|

13D

|

|

Page 3 of 4 Pages

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. Security and Issuer.

This Schedule 13D relates to shares of Common Stock, par value $0.00067 per share (“

Common Stock

”), of BioLargo, Inc., a Delaware corporation (the “

Issuer

”). The principal executive offices of the Issuer are located at 3500 W. Garry Avenue, Santa Ana, California 92704.

Item 2. Identity and Background.

|

|

(a)

|

This Schedule 13D is being filed by Jack B. Strommen (the “

Reporting Person

”).

|

|

|

(b)

|

The principal business address for the reporting person is 7108 31

st

Avenue North, Minneapolis, MN 55427.

|

|

|

(c)

|

The Reporting Person serves as the Chief Executive Officer of PD Instore.

|

|

|

(d)

|

During the last five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors).

|

|

|

(e)

|

During the last five years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

(f)

|

The Reporting Person is a citizen of the United States of America.

|

Item 3. Source or Amount of Funds or Other Consideration.

The Reporting Person initially acquired a beneficial interest in Common Stock of the Issuer through the Reporting Person’s investment of personal funds in series of convertible promissory notes and associated warrants issued in a private placement by the Issuer.

The convertible promissory notes acquired by the Reporting Person in such transaction were immediately convertible upon issuance, at the option of the Reporting Person, into up to 3,257,143 shares of Common Stock. Interest on the convertible promissory notes was, pursuant to the terms of such notes, payable in shares of the Issuer’s Common Stock on a quarterly basis, and, as of the date of this Schedule 13D, the Issuer has issued to the Reporting Person 411,291 shares of Common Stock in payment of accrued interest under the notes.

The warrants acquired by the Reporting Person were immediately exercisable upon issuance, at the option of the Reporting Person, for up to 3,257,143 shares of Common Stock.

In connection with the election of the Reporting Person to the Issuer’s Board of Directors, the Issuer issued to the Reporting Person, effective June 19, 2017, an option to purchase up to 10,000 shares of Common Stock.

Item 4. Purpose of Transaction.

The information set forth in Item 3 of this Schedule 13D is incorporated by reference into this Item 4.

As described in Item 3 of this Schedule 13D, the shares of Common Stock beneficially owned by the Reporting Person were originally acquired in connection with (i) a private placement by the Issuer of promissory notes and associated warrants and (ii) his services as a member of the Issuer’s Board of Directors.

The Reporting Person has no present plans or proposals that relate to or would result in any of the events set forth in Items 4(a) through (j) of Schedule 13D.

The Reporting Person reserves the right to change plans and take any and all actions that he may deem appropriate to maximize the value of his investments in the Issuer, including, among other things, purchasing or otherwise acquiring additional securities of the Issuer, selling or otherwise disposing of any securities of the Issuer beneficially owned by him, in each case in the open market or in privately negotiated transactions, or formulating other plans or proposals regarding the Issuer or its securities to the extent deemed advisable by the Reporting Person in light of his general investment policies, market conditions, subsequent developments affecting the Issuer and general business and future prospects of the Issuer.

Item 5. Interest in Securities of the Issuer.

The information set forth in Items 3 and 4 of this Schedule 13D are incorporated by reference into this Item 5.

|

|

(a)

|

The Reporting Person is the beneficial owner of 6,935,577 shares of Common Stock, which includes (i) 3,257,143 shares of Common Stock issuable upon conversion of convertible promissory notes; (ii) 3,257,143 shares of Common Stock issuable upon exercise of outstanding warrants; and (iii) 10,000 shares of Common Stock issuable upon exercise of outstanding options. The shares of Common Stock beneficially owned by the Reporting Person represents 6.8% of the Issuer’s outstanding shares of Common Stock, based upon 94,988,597 shares of Common stock outstanding as of March 31, 2017, plus the 6,524,286 shares of Common Stock issuable to the Reporting Person upon conversion of convertible promissory notes and exercise of outstanding warrants and options.

|

|

|

(b)

|

The Reporting Person has sole power to vote and dispose of all shares of Common Stock of which it is the beneficial owner. The Reporting Person has no shared voting or shared dispositive power over any Common Shares.

|

|

|

(c)

|

Other than as set forth in Item 3, no transactions were effected by the Reporting Person during the 60 day period immediately preceding June 19, 2017.

|

|

|

(d)

|

To the knowledge of the Reporting Person, no on other than the Reporting Person has the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, any shares of Common Stock beneficially owned by the Reporting Person.

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

No contracts, arrangements, understandings or similar relationships exist with respect to the securities of the Issuer between the Reporting Person and any other person or entity.

Item 7. Material to Be Filed as Exhibits.

None.

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP No. 09065a100

|

|

13D

|

|

Page 4 of 4 Pages

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

/s/ Jack B. Strommen

|

|

Jack B. Strommen

|

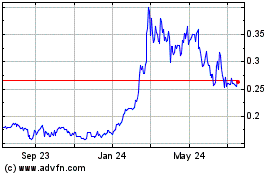

BioLargo (QB) (USOTC:BLGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

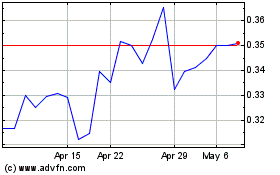

BioLargo (QB) (USOTC:BLGO)

Historical Stock Chart

From Apr 2023 to Apr 2024