Walgreens Scores Deal With Purchase of Rite Aid Stores

June 29 2017 - 6:37PM

Dow Jones News

By Richard Teitelbaum

Walgreens Boots Alliance Inc. is getting a better deal on stores

it is buying from Rite Aid Corp. than it would have under its

merger plan, analysts said.

Walgreens announced Thursday that it would pay $5.18 billion for

2,186 stores and drop its proposed deal with Rite Aid, which was

plagued by antitrust concerns.

"If you look at the purchase price per store, it is paying $2.5

million per store," said Ajay Jain, senior analyst at Pivotal

Research Group, comparing a preliminary analysis of the new deal

with the valuation of the last iteration of the proposed

merger.

By contrast, he calculates that under the $9.4 billion amended

merger plan announced in January, Walgreens would have been paying

some $4 million per store. "The terms are more attractive," Mr.

Jain said.

Under that plan, Rite Aid would have, in effect, sold about

3,600 stores to Walgreens and up to 1,200 to regional chain Fred's

Inc.

"All around, it's a pretty good deal for Walgreens," said Vishnu

Lekraj, a senior equity analyst at Morningstar Inc., referring to

the purchase announced Thursday. "I don't believe they picked up

any debt."

Walgreens may already be putting its savings to use. In its

fiscal third-quarter earnings report Thursday, the company

announced it had authorized a share repurchase program for up to $5

billion.

A spokeswoman for Rite Aid didn't immediately return a phone

call seeking comment. Walgreens declined to comment.

The new deal also achieves many of the same strategic goals

Walgreens sought through a merger with Rite Aid.

"With the new agreement [Walgreens] will still gain incremental

scale and volume to optimize efficiency, as well as 70% [to] 80% of

the geographic coverage of the merger," wrote Charles Rhyee, senior

equity analyst at Cowen & Co. in a research note.

One uncertainty is how much Walgreens will have to spend to

upgrade the stores it acquires. "The stores could take a good

amount of investment," said Mr. Lekraj.

Rite Aid, as part of the new agreement, has an option to

purchase its generic drugs through an affiliate of Walgreens at

cost for 10 years, Rite Aid said in a statement. The prices it pays

will be close to what Walgreens pays for generics.

"It's probably the cheapest source for generics globally," said

Mr. Lekraj. "That should help them improve their position to stay

in preferred pharmacy networks."

Write to Richard Teitelbaum at Richard.Teitelbaum@wsj.com

(END) Dow Jones Newswires

June 29, 2017 18:22 ET (22:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

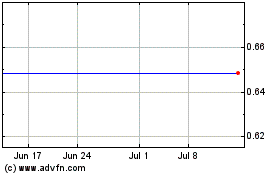

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024