UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One)

|

[X]

|

Annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934

|

|

|

For the fiscal year ended December 31, 2016

|

|

|

|

OR

|

|

|

|

[ ]

|

Transition report pursuant to Section 15(d) of the Securities Exchange Act of 1934

|

|

|

For the transition period from _______________ to _________________

|

Commission File Number: 0‑21660

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

PAPA JOHN'S INTERNATIONAL, INC. 401(k) PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

PAPA JOHN’S INTERNATIONAL, INC.

2002 Papa John’s Boulevard

Louisville, Kentucky 40299-2367

(502) 261‑7272

Papa John’s International, Inc. 401(k) Plan

Financial Statements and Supplemental Schedules

Years ended December 31, 2016 and 2015

Contents

Report of Independent Registered Public Accounting Firm

To

the 401(k) Plan Committee

Papa John’s International, Inc. 401(k) Plan

We have audited the accompanying statements of net assets available for benefits of the Papa John’s International, Inc. 401(k) Plan (the “Plan”) as of December 31, 2016 and 2015, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying Schedule of Assets (Held at End of Year) as of December 31, 2016 and the accompanying Schedule of Delinquent Participant Contributions for the year ended December, 31, 2016 have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedules is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ Mountjoy Chilton Medley LLP

Louisville, Kentucky

June 29, 2017

Papa John’s International, Inc. 401(k) Plan

Statements of Net Assets Available for Benefits

December 31, 2016 and 2015

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

22

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

|

Papa John’s International, Inc. common stock

|

|

|

6,718,426

|

|

|

4,483,389

|

|

Mutual funds

|

|

|

26,326,182

|

|

|

21,397,715

|

|

Pooled separate accounts

|

|

|

15,649,379

|

|

|

14,904,367

|

|

Collective trust fund

|

|

|

2,736,897

|

|

|

2,299,476

|

|

Total investments

|

|

|

51,430,884

|

|

|

43,084,947

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Contributions receivable from participants

|

|

|

—

|

|

|

61,540

|

|

Contributions receivable from employer

|

|

|

1,490,232

|

|

|

1,281,244

|

|

Notes receivable from participants

|

|

|

1,917,927

|

|

|

1,731,525

|

|

Total receivables

|

|

|

3,408,159

|

|

|

3,074,309

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

54,839,065

|

|

$

|

46,159,256

|

See accompanying notes.

Papa John’s International, Inc. 401(k) Plan

Statements of Changes in Net Assets Available for Benefits

Years ended December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Additions (deductions):

|

|

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

$

|

5,255,328

|

|

$

|

(553,633)

|

|

Interest and dividend income

|

|

|

647,475

|

|

|

559,142

|

|

Net investment income

|

|

|

5,902,803

|

|

|

5,509

|

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

|

|

Participant

|

|

|

4,237,935

|

|

|

3,563,558

|

|

Rollover

|

|

|

1,452,257

|

|

|

895,515

|

|

Employer

|

|

|

1,490,232

|

|

|

1,281,244

|

|

Total contributions

|

|

|

7,180,424

|

|

|

5,740,317

|

|

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

|

(4,153,668)

|

|

|

(3,093,359)

|

|

Administrative fees

|

|

|

(249,750)

|

|

|

(228,188)

|

|

Net increase

|

|

|

8,679,809

|

|

|

2,424,279

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits at beginning of year

|

|

|

46,159,256

|

|

|

43,734,977

|

|

Net assets available for benefits at end of year

|

|

$

|

54,839,065

|

|

$

|

46,159,256

|

See accompanying notes.

Table of Contents

Papa John’s International, Inc. 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

1. Description of Plan

The following description of the Papa John’s International, Inc. 401(k) Plan (the “Plan”) provides general information.

Participants should refer to the Summary Plan Description for a more complete description of the Plan’s provisions.

General

Papa John’s International, Inc. (the “Company”) established the Plan on October 1, 1995. The Plan is a defined contribution plan available to all eligible employees of the Company and its subsidiaries, who have attained the age of twenty-one and have completed one year of service as defined by the Plan. Highly compensated employees, as defined by the Plan, are restricted from deferring contributions to the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). Although it has not expressed any intent to do so, the Company has the right under the Plan to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100 percent vested in their accounts.

Contributions

Participants may voluntarily elect to contribute from 1 to 75 percent of annual eligible wages to their accounts within the Plan. Participant contributions are subject to Internal Revenue Code (“IRC”) limits. The Company may, at its discretion, make matching or profit sharing contributions to the Plan. The Company contributed, to participants who completed 1,000 hours of service and were actively employed on the last day of the 2016 and 2015 Plan years, an amount equal to 50 cents for every dollar contributed by the participants up to a maximum of the first 6 percent of the participants’ eligible compensation contributed to the Plan. Participants who die, retire, or are disabled during the Plan year also received Company matching contributions.

Participant Accounts

Individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions and Company matching contributions, as well as allocations of the Company’s profit sharing contribution and Plan earnings. All contributions are allocated at the direction of the participant among selected investment funds. Each fund’s investment income or loss, less any investment management fee, is allocated to participants’ accounts based on their proportionate interest in the fund. The value of participant accounts will fluctuate with the market value of the securities in which the accounts are invested.

Vesting

Participant contributions and the earnings on those contributions are immediately vested to the participant. Company discretionary contributions and related earnings vest subject to a five-year graded vesting schedule which is based on years of vesting service. To receive vesting service for a Plan year, a participant must have completed at least 1,000 hours of service during the Plan year.

Payment of Benefits

Vested account balances are payable upon retirement, death or disability, or termination of employment. In-service distributions are also permitted upon meeting certain requirements as defined by the Plan.

Notes Receivable from Participants

Eligible participants may borrow from their accounts a minimum loan amount of $1,000 up to a maximum equal to the lesser of $50,000 or 50 percent of their vested account balance. Loans are secured by the balances in the participants’ accounts and are interest bearing at the prime rate plus one percentage point at the time of the loans. The loans are measured at their unpaid principal balance plus any accrued but unpaid interest.

Table of Contents

Papa John’s International, Inc. 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

Forfeitures

Forfeited balances of terminated participants’ non-vested accounts are used to reduce future Company contributions. Forfeitures of approximately $20,500 and $6,200 were used to reduce the amount of the employer matching contributions receivable as of December 31, 2016 and 2015, respectively. Forfeited amounts approximated $20,300 and $6,700 at December 31, 2016 and 2015, respectively.

Administrative Expenses

Administrative expenses of the Plan are paid by the Company or Plan participants, as defined by the Plan.

2. Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Contributions

Contributions from participants are recorded when the Company makes payroll deductions. Discretionary employer contributions are determined, funded and recorded annually. Contributions receivable represent amounts not yet deposited into the participants’ individual accounts.

Valuation of Investments and Income Recognition

The Plan’s investments are stated at fair value (see Note 3). Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

The Plan presents in the accompanying Statements of Changes in Net Assets Available for Benefits the net appreciation (depreciation) in the fair value of its investments which consists of the realized gains or losses and the unrealized appreciation (depreciation) on those investments.

Management fees and operating expenses charged to the Plan for investments are deducted from income earned on a daily basis and are not separately reflected. Consequently, management fees and operating expenses are reflected as a reduction of investment return for such investments.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Plan’s management to make estimates and assumptions that affect the amounts reported in these financial statements and accompanying notes. Actual results could differ from those estimates.

Subsequent Events

Subsequent events for the Plan have been considered through the date of the Independent Auditor’s Report, which represents the date the financial statements were available to be issued.

Table of Contents

Papa John’s International, Inc. 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

3. Fair Value Measurements

The Financial Accounting Standards Board Accounting Standards Codification establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three-tier fair value hierarchy includes the following categories:

|

|

·

|

|

Level 1: Quoted market prices in active markets for identical assets or liabilities. An active market for the asset or liability is a market in which the transaction for the asset or liability occurs with sufficient frequency and volume to provide pricing information on an ongoing basis.

|

|

|

·

|

|

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data, such as quoted prices for similar assets or liabilities or model-derived valuations.

|

|

|

·

|

|

Level 3: Unobservable inputs that are not corroborated by market data. These inputs reflect a company’s own assumptions about the assumptions a market participant would use in pricing the asset or liability.

|

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. The methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following is a description of the valuation methodologies used for the investments measured at fair value. There have been no changes in the methodologies used at December 31, 2016 and 2015.

Papa John’s International, Inc. common stock:

Papa John’s International, Inc. common stock is traded on The NASDAQ Global Select Market tier of The NASDAQ Stock Market under the symbol PZZA. The common stock is valued at its quoted market price at the daily close of NASDAQ on the last business day of the Plan year and is classified as a Level 1 investment.

Mutual funds:

Mutual funds are valued at quoted market prices in an exchange and active market and are classified as Level 1 investments.

Pooled separate accounts:

Pooled separate accounts (“PSA”) are privately managed through investment companies and are not publicly quoted. PSA’s are comprised, primarily, of shares of registered investment companies held through sub-accounts of an insurance company. The PSA’s are valued using net asset value (“NAV”) as a practical expedient to estimate fair value where NAV is based on the value of the underlying investment assets held through sub-accounts of a separate account of an insurance company. This practical expedient is not used when it is determined to be probable that the account will sell the investment for an amount different than the reported NAV. The Plan has concluded that the NAVs reported by the investment companies approximate the fair value of the investments. There are currently no redemption restrictions or unfunded commitments on these investments.

Collective trust fund:

The Principal Stable Value Fund, held in a collective trust fund, invests in conventional and synthetic guaranteed investment contracts (“GICs”) issued by life insurance companies, banks and other financial institutions with excess cash

Table of Contents

Papa John’s International, Inc. 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

invested in cash equivalents. The objective of the stable value fund is to provide preservation of capital and relatively stable returns regardless of the volatility of the financial markets. The investments are valued using NAV as a practical expedient to estimate fair value where NAV is based on the value of the underlying investment assets owned by the fund, minus its liabilities. This practical expedient is not used when it is determined to be probable that the account will sell the investment for an amount different than the reported NAV. Participant transactions (purchases and sales) may occur daily. Were the Plan to initiate a full redemption of the collective trust, the issuer reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner. There are currently no redemption restrictions or unfunded commitments on these investments.

The Plan’s investments measured at fair value on a recurring basis as of December 31, 2016 and 2015 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2016

|

|

|

|

Fair Value Measurements

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Papa John’s International, Inc. common stock

|

|

$

|

6,718,426

|

|

$

|

—

|

|

$

|

—

|

|

$

|

6,718,426

|

|

Mutual funds

|

|

|

26,326,182

|

|

|

—

|

|

|

—

|

|

|

26,326,182

|

|

Total assets in fair value hierarchy

|

|

$

|

33,044,608

|

|

$

|

—

|

|

$

|

—

|

|

|

33,044,608

|

|

Investments measured at NAV (a)

|

|

|

|

|

|

|

|

|

|

|

|

18,386,276

|

|

Investments at fair value

|

|

|

|

|

|

|

|

|

|

|

$

|

51,430,884

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2015

|

|

|

|

Fair Value Measurements

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Papa John’s International, Inc. common stock

|

|

$

|

4,483,389

|

|

$

|

—

|

|

$

|

—

|

|

$

|

4,483,389

|

|

Mutual funds

|

|

|

21,397,715

|

|

|

—

|

|

|

—

|

|

|

21,397,715

|

|

Total assets in fair value hierarchy

|

|

$

|

25,881,104

|

|

$

|

—

|

|

$

|

—

|

|

|

25,881,104

|

|

Investments measured at NAV (a)

|

|

|

|

|

|

|

|

|

|

|

|

17,203,843

|

|

Investments at fair value

|

|

|

|

|

|

|

|

|

|

|

$

|

43,084,947

|

(a) Includes pooled separate accounts and a collective trust fund which are measured using NAV as a practical expedient and are not classified in the fair value hierarchy. The fair value amounts presented in this table are shown for the purpose of reconciling to the Statements of Net Assets Available for Benefits.

4. Tax Status

The Internal Revenue Service (“IRS”) ruled on March 2, 2015 that the Plan and related trust is in compliance with the applicable requirements of the IRC. The Plan has been amended since receiving the determination letter. However, the Plan administrator believes the Plan is being operated in compliance with the applicable requirements of the IRC and, therefore, believes the Plan is qualified and the related trust is tax exempt.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan. The financial statement effects are recognized when the Plan has taken an uncertain position that more likely than not would be sustained upon examination by the Internal Revenue Service. The Plan administrator has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2016 and 2015, there are no uncertain tax positions taken or expected to be taken.

The Plan is subject to audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Table of Contents

Papa John’s International, Inc. 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

5. Transactions with Parties-in-Interest

Transactions in shares of Papa John’s International, Inc. (“Papa John’s”) common stock qualify as allowable party-in-interest transactions under the provisions of ERISA. The Plan held $6,718,426 and $4,483,389 of Papa John’s common stock at December 31, 2016 and 2015, respectively. During the years ended December 31, 2016 and 2015, the Plan had purchases of Papa John’s common stock of approximately $580,000 and $409,000 and sales of $681,000 and $438,000, respectively.

At December 31, 2016 and 2015, the Plan held units in various pooled separate accounts and a stable value fund managed by affiliates of Principal Trust Company, the Plan trustee. These transactions qualify as allowable party-in-interest transactions under the provisions of ERISA.

6. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statements of Changes in Net Assets Available for Benefits.

7. Reconciliation to the Form 5500

The following is a reconciliation of net assets available for benefits from the Form 5500, “Annual Return/Report of Employee Benefit Plan” (“Form 5500”), which is filed with the Department of Labor, to the financial statements:

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Net assets available for benefits per the Form 5500

|

|

$

|

54,839,945

|

|

$

|

46,165,316

|

|

Adjustment from fair value to net asset value as a practical expedient for collective trust fund

|

|

|

(880)

|

|

|

(6,060)

|

|

Net assets available for benefits per the financial statements

|

|

$

|

54,839,065

|

|

$

|

46,159,256

|

The following is a reconciliation of net income per the Form 5500 to net increase per the financial statements:

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Net income per the Form 5500

|

|

$

|

8,674,629

|

|

$

|

2,406,446

|

|

Change in adjustment from fair value to net asset value as a practical expedient for collective trust fund

|

|

|

5,180

|

|

|

17,833

|

|

Net increase per the financial statements

|

|

$

|

8,679,809

|

|

$

|

2,424,279

|

Papa John’s International, Inc. 401(k) Plan

Schedule of Assets (Held at End of Year)

Form 5500, Schedule H, Line 4i

EIN: 61‑1203323, Plan Number: 001

December 31, 2016

|

|

|

|

|

|

|

|

|

|

Identity of Issuer, Borrower,

|

|

|

|

Shares Held or

|

|

Current

|

|

Lessor, or Similar Party

|

|

Description of Investment

|

|

Rate of Interest

|

|

Value

|

|

Common stock:

|

|

|

|

|

|

|

|

|

*Papa John’s International, Inc.

|

|

Common Stock

|

|

78,505 shares

|

|

$

|

6,718,426

|

|

|

|

|

|

|

|

|

|

|

Mutual funds:

|

|

|

|

|

|

|

|

|

Pimco

|

|

Pimco Total Return Institutional Fund

|

|

111,791 shares

|

|

|

1,121,264

|

|

Robert W. Baird & Co. Inc

|

|

Baird Mid Cap Institutional Fund

|

|

141,942 shares

|

|

|

2,242,687

|

|

Vanguard Group

|

|

Vanguard Target RMT Income INV Fund

|

|

7,177 shares

|

|

|

91,941

|

|

Vanguard Group

|

|

Vanguard Target RMT 2010 INV Fund

|

|

5,364 shares

|

|

|

135,912

|

|

Vanguard Group

|

|

Vanguard Target RMT 2020 INV Fund

|

|

108,916 shares

|

|

|

3,077,964

|

|

Vanguard Group

|

|

Vanguard Target RMT 2030 INV Fund

|

|

201,728 shares

|

|

|

5,890,447

|

|

Vanguard Group

|

|

Vanguard Target RMT 2040 INV Fund

|

|

155,898 shares

|

|

|

4,709,670

|

|

Vanguard Group

|

|

Vanguard Target RMT 2050 INV Fund

|

|

105,958 shares

|

|

|

3,220,072

|

|

Dimensional Fund Advisors

|

|

DFA U.S. Targeted Value I Fund

|

|

63,563 shares

|

|

|

1,526,144

|

|

Vanguard Group

|

|

Vanguard Equity-Income ADM Fund

|

|

21,835 shares

|

|

|

1,492,832

|

|

Vanguard Group

|

|

Vanguard Target RMT 2060 INV Fund

|

|

12,834 shares

|

|

|

372,710

|

|

Franklin Templeton Investments

|

|

Franklin Small Cap Growth R6 Fund

|

|

31,265 shares

|

|

|

622,167

|

|

Pimco

|

|

Pimco Real Return Institutional Fund

|

|

8,147 shares

|

|

|

88,967

|

|

Franklin Templeton Investments

|

|

Franklin U.S. Government Securities R6 Fund

|

|

54,524 shares

|

|

|

339,141

|

|

Blackrock Advisors, LLC

|

|

Blackrock High Yield Bond K Fund

|

|

181,784 shares

|

|

|

1,388,833

|

|

Blackrock Advisors, LLC

|

|

Blackrock U.S. Total Bond Index K Fund

|

|

542 shares

|

|

|

5,431

|

|

|

|

|

|

|

|

|

26,326,182

|

|

Pooled separate accounts:

|

|

|

|

|

|

|

|

|

*Principal Life Insurance Company

|

|

Mid-Cap Value III Separate Account

|

|

6,227 shares

|

|

|

881,400

|

|

*Principal Life Insurance Company

|

|

International Emerging Markets Separate Account

|

|

9,999 shares

|

|

|

544,879

|

|

*Principal Life Insurance Company

|

|

Diversified International Separate Account

|

|

22,797 shares

|

|

|

1,747,754

|

|

*Principal Life Insurance Company

|

|

Large-Cap S&P 500 Index Separate Account

|

|

16,679 shares

|

|

|

1,840,257

|

|

*Principal Life Insurance Company

|

|

Small-Cap S&P 600 Index Separate Account

|

|

16,887 shares

|

|

|

942,712

|

|

*Principal Life Insurance Company

|

|

Mid-Cap S&P 400 Index Separate Account

|

|

22,106 shares

|

|

|

1,140,691

|

|

*Principal Life Insurance Company

|

|

Capital Appreciation Separate Account

|

|

185,281 shares

|

|

|

5,098,311

|

|

*Principal Life Insurance Company

|

|

Large-Cap Growth I Separate Account

|

|

157,657 shares

|

|

|

3,453,375

|

|

|

|

|

|

|

|

|

15,649,379

|

|

Collective trust fund:

|

|

|

|

|

|

|

|

|

*Principal Global Investors Trust Company

|

|

Principal Stable Value Z Fund

|

|

127,275 shares

|

|

|

2,736,897

|

|

|

|

|

|

|

|

|

2,736,897

|

|

|

|

|

|

|

|

|

|

|

*Participant Loans

|

|

|

|

4.25% to 9.25 % per annum

|

|

|

1,917,927

|

|

|

|

|

|

|

|

$

|

53,348,811

|

*Represents party-in-interest to the Plan.

Cost information not required due to Plan being participant directed.

See accompanying independent auditor’s report

Papa John’s International, Inc. 401(k) Plan

Schedule of Delinquent Participant Contributions

Form 5500, Schedule H, Line 4a

EIN: 61‑1203323, Plan Number: 001

Year Ended December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant Contributions

Transferred Late to Plan

|

|

Contributions Not Corrected

|

|

Total That Constitute Nonexempt Prohibited Transactions

Contributions Corrected Outside of

VFCP

|

|

Contributions Pending Corrections in

VFCP

|

|

Total Fully Corrected Under

VFCP and PTE 2002‑51

|

|

$

|

—

|

|

$

|

—

|

|

$

|

75

|

|

$

|

—

|

|

$

|

—

|

See accompanying independent auditor’s report

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Administrator has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

PAPA JOHN’S INTERNATIONAL, INC. 401(k) PLAN

|

|

|

|

|

Date: June 29, 2017

|

/s/ Lance F. Tucker

|

|

|

Lance F. Tucker

|

|

|

Senior Vice President, Chief Financial Officer,

Chief Administrative Officer and Treasurer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

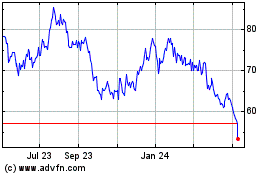

Papa Johns (NASDAQ:PZZA)

Historical Stock Chart

From Mar 2024 to Apr 2024

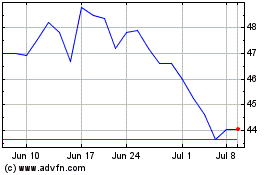

Papa Johns (NASDAQ:PZZA)

Historical Stock Chart

From Apr 2023 to Apr 2024