UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 11-K

______________________

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended: December 31, 2016

Commission File No. 001-36228

Navient 401(k) Savings Plan

(Full title of the plan)

Navient Corporation

(Name of issuer of securities)

123 Justison Street, Wilmington, Delaware 19801

(Address of issuer's principal executive offices)

Navient 401(k) Savings Plan

Financial Statements and Supplemental Schedule

December 31, 2016 and 2015

Navient 401(k) Savings Plan

Table of Contents

December 31, 2016 and 2015

Page

Report of Independent Registered Public

Accounting Firm

........................................................................................1

Financial

Statements

Statements of Net

Assets Available for Benefits

As of

December 31, 2016 and 2015

.....................................................................................................................................2

Statement of

Changes in Net Assets Available for Benefits

Year

Ended December 31, 2016

.............................................................................................................................................3

Notes

to Financial Statements

..............................................................................................................................................4

Supplemental

Schedule*

Schedule of Assets

(Held at End of

Year) ...........................................................................................................................10

ERISA

have been omitted because they were not applicable.

Report of Independent Registered Public Accounting

Firm

To the

Employee Benefits Fiduciary Committee

Navient

401(k) Savings Plan

We have

audited the accompanying statements of net assets available for

benefits of Navient 401(k) Savings Plan (the "Plan") as of December

31, 2016 and 2015, and the related statement of changes in net

assets available for benefits for the year ended December 31, 2016.

These financial statements are the responsibility of the Plan's

management. Our responsibility is to express an opinion on these

financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public

Company Accounting Oversight Board (United States). Those standards

require that we plan and perform the audit to obtain reasonable

assurance about whether the financial statements are free of

material misstatement. The Plan is not required to have, nor were

we engaged to perform, an audit of internal control over financial

reporting. Our audit included consideration of internal control

over financial reporting as a basis for designing audit procedures

that are appropriate in the circumstances, but not for the purpose

of expressing an opinion on the effectiveness of the Plan’s

internal control over financial reporting. Accordingly, we express

no such opinion. An audit also includes examining, on a test basis,

evidence supporting the amounts and disclosures in the financial

statements, assessing the accounting principles used and

significant estimates made by management, as well as evaluating the

overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly,

in all material respects, the net assets available for benefits of

the Plan as of December 31, 2016 and 2015, and the changes in its

net assets available for benefits for the year ended December 31,

2016, in conformity with accounting principles generally accepted

in the United States of America.

The

supplemental information in the accompanying schedule of assets

(held at end of year) as of December 31, 2016 has been subjected to

audit procedures performed in conjunction with the audit of the

Plan’s financial statements. The supplemental information is

presented for the purpose of additional analysis and is not a

required part of the financial statements but includes supplemental

information required by the Department of Labor’s Rules and

Regulations for Reporting and Disclosure under the Employee

Retirement Income Security Act of 1974. The supplemental

information is the responsibility of the Plan’s management.

Our audit procedures included determining whether the supplemental

information reconciles to the financial statements or the

underlying accounting and other records, as applicable, and

performing procedures to test the completeness and accuracy of the

information presented in the supplemental information. In forming

our opinion on the supplemental information in the accompanying

schedule, we evaluated whether the supplemental information,

including its form and content, is presented in conformity with the

Department of Labor’s Rules and Regulations for Reporting and

Disclosure under the Employee Retirement Income Security Act of

1974. In our opinion, the supplemental information in the

accompanying schedule is fairly stated in all material respects in

relation to the financial statements as a whole.

/s/ CohnReznick LLP

Bethesda,

Maryland

June

29, 2017

Navient 401(k) Savings Plan

Statements of Net Assets Available for Benefits

As of December 31, 2016 and 2015

|

|

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

|

Investments, at fair value

|

$ 488,137,307

|

|

$ 455,872,168

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

Notes receivable from participants

|

12,537,496

|

|

11,669,058

|

|

|

Total receivables

|

12,537,496

|

|

11,669,058

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$ 500,674,803

|

|

$ 467,541,226

|

|

|

|

|

|

|

|

|

See

Notes to Financial Statements

.

Navient 401(k) Savings Plan

Statement of Changes in Net Assets Available for

Benefits

Year Ended December 31, 2016

|

Additions

to net assets attributed to:

|

|

|

|

|

Investment

gain:

|

|

|

|

|

Net

appreciation in fair value of investments

|

|

$

22,501,075

|

|

|

|

Dividends

and interest

|

|

14,155,433

|

|

|

|

|

|

36,656,508

|

|

|

|

|

|

|

|

|

Interest

on notes receivable from participants

|

|

389,379

|

|

|

|

|

|

|

|

|

Contributions

|

|

|

|

|

|

Employer

|

|

17,143,638

|

|

|

|

Participant

|

|

18,552,939

|

|

|

|

Rollover

|

|

2,007,794

|

|

|

|

|

|

37,704,371

|

|

|

|

|

|

|

|

|

|

Total

net additions

|

|

74,750,258

|

|

|

|

|

|

|

|

Deductions

from net assets attributed to:

|

|

|

|

|

Benefits

paid to participants

|

|

41,461,882

|

|

|

Administrative

expenses

|

|

154,799

|

|

|

|

Total

deductions

|

|

41,616,681

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

increase

|

|

33,133,577

|

|

|

|

|

|

|

|

Net

assets available for benefits

|

|

|

|

|

Beginning

of year

|

|

467,541,226

|

|

|

End of

year

|

|

$

500,674,803

|

|

|

|

|

|

|

See

Notes to Financial Statements

.

Navient 401(k) Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

General

The

Navient 401(k) Savings Plan (the “Plan”) is a defined

contribution plan established for the benefit of certain eligible

employees of Navient Corporation (the “Company”) and

its participating subsidiaries (the “Participants”).

The Plan is subject to the provisions of the Employee Retirement

Income Security Act of 1974, as amended (“ERISA”). The

following description of the Plan provides only general

information. Participants should refer to the Plan documents for a

more complete description of the Plan's provisions.

The

Plan covers substantially all employees of the Company and its

participating subsidiaries. Eligible employees may participate in

the Plan after one month of service.

Fidelity Management

Trust Company (“Fidelity”) is the Plan Trustee. An

affiliate of Fidelity, Fidelity Investments Institutional

Operations Company, Inc. (“FIIOC”), serves as

recordkeeper.

Contributions

and vesting

Participants are

eligible to contribute from 1 to 75 percent of their eligible

compensation to the Plan, in increments of whole percentages, up to

the Internal Revenue Service (“IRS”) annual maximum

limits. The Plan allows participants who will attain age 50 in the

current Plan year to make catch-up contributions into the Plan up

to the IRS maximum. Participants may also contribute amounts into

the Plan from other qualified employer plans in which they had

previously participated. Participants direct the investment of

their contributions into various investment options offered by the

Plan.

The Company makes a safe harbor matching

contribution on behalf of each Participant after the Participant

has accrued six months of service.

This matching contribution is 100

percent of employee contributions (i.e., a dollar-for-dollar match)

up to the first three percent of a Participant’s

compensation and 50 percent on the next two percent of a

Participant’s compensation. These matching contributions and

related earnings vest immediately. The Company also makes a

contribution in an amount equal to one percent of eligible

compensation to each eligible employee after one month of service,

which vests after one year of service. Employees subject to the

Service Contract Act may be eligible to receive fully-vested

employer contributions based on the service contract fringe benefit

differential rate compared with the company cost of benefits they

have elected. Participants also direct the investments of Company

contributions.

Effective January

1, 2017, a qualified automatic enrollment arrangement was added to

the Plan. Eligible employees are automatically enrolled to

contribute three percent of their eligible compensation each pay

period. This contribution amount automatically increases each year

by one percent of eligible compensation, up to a maximum employee

contribution equal to 10% of eligible compensation. Participants

have the ability to opt out of automatic enrollments and automatic

increases. Effective January 1, 2017, the one percent Company

contribution was eliminated and matching contributions were

enhanced to 100% up to five percent of a Participant’s

compensation.

Participants

forfeit their right to Company contributions that are unvested at

the time of their termination of service. During 2016, Company

contributions were reduced by $79,644 from previously forfeited

non-vested accounts. Unused forfeitures at December 31, 2016 and

2015 totaled $941 and $1,796, respectively, which will be used to

offset future Company contributions.

The

Plan also allows the Company to make a discretionary profit sharing

contribution, whereby the Company determines the amount of net

profits, if any, to contribute to the Plan. The Company did not

make any profit sharing contributions for year ended December 31,

2016.

Notes

receivable from Participants

Participants may

generally borrow up to 50 percent of their vested benefit to a

maximum of $50,000. Participants may have no more than two loans

outstanding at any time. The term of a loan will be three or five

years, at the election of the Participant, except for a loan to

purchase the Participant's principal residence, which can be repaid

over 20 years. Loans are secured by the Participant's account

balance, bear interest at the prime rate established monthly by the

Federal Reserve, and are repaid biweekly through automatic payroll

deductions. In addition, Participants may repay all or a portion

(in $500 increments) of such loans at any time. Loans allowable

under the Plan, collateralized by Participant account balances, are

due in varying installments through 2036, with interest rates

ranging from 3.25% to 9%.

Investment

elections

The

Plan offers a variety of investment options, including various

registered investment companies and a unitized employer stock fund.

In addition, Participants have the option to direct investments

through a self-directed brokerage account. Under the self-directed

brokerage account, Participants may direct investments in any

security other than Company stock or other investments offered by

Fidelity, regardless of whether they are included as investment

options offered by the Plan. The one percent Company contribution,

eliminated effective January 1, 2017, is made to a qualified

default investment if a Participant does not make an investment

election. The qualified default investment is the Fidelity Freedom

Fund, based on the Participant’s date of birth and year in

which the Participant attains age 65.

Participant

accounts

Each

Participant’s account is credited with the

Participant’s and the Company’s contributions and their

portion of the Plan’s earnings (losses). Plan earnings

(losses) are allocated based on the Participant’s designated

investments of their account balances, as defined. The benefit to

which a Participant is entitled is the benefit that can be provided

from the Participant’s vested account.

Payment

of benefits

Participants may

withdraw funds from their account upon retirement, disability,

separation from employment, attainment of age 59-1/2, and certain

other times as specified in the Plan document. Distributions shall

be made in a lump sum in cash, in the Company’s common stock,

or a combination thereof, reduced by the outstanding balance of any

loans not repaid by the Participant.

Administrative

expenses

Participants pay

fees relating to Participant’s loans and withdrawals.

Additionally, Participants may pay for commissions associated with

common stock purchases and sales and short term transaction fees in

certain funds when Participants trade in and out of the funds

within the time restriction specified for such funds. Participant

costs, including investment management fees charged by the

respective funds, are charged directly to the Participant's account

and are reflected in the statement of changes in net assets

available for benefits. The Company bears the remaining cost of

Plan administration.

Plan

administration

The

Navient Corporation Employee Benefits Fiduciary Committee

administers the Plan and is responsible for development of Plan

investment policies and guidelines. Officers of the Company or its

subsidiaries presently serve as Committee members. The Plan did not

pay the Company, its subsidiaries or the Committee members for

their services.

2.

Summary

of Significant Accounting Policies

Basis

of accounting

The

financial statements of the Plan are prepared on the accrual basis

of accounting in accordance with accounting principles generally

accepted in the United States of America.

Fair

Value Measurements

Financial Accounting Standards Board’s

("FASB") Accounting Standards Codification Topic 820,

Fair Value

Measurements and Disclosures

(“ASC 820”) defines fair value as the

price that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants at

the measurement date. ASC 820 specifies a fair value hierarchy

which prioritizes the inputs to valuation techniques used to

measure fair value into three broad levels. Classification is based

on the lowest level of input that is significant to the fair value

of the instrument. The three levels are as

follows:

Level 1

– Quoted prices (unadjusted) in active markets for identical

assets or liabilities that the reporting entity has the ability to

access at the measurement date. The types of financial instruments

included in level 1 are highly liquid instruments with quoted

prices.

Level 2

– Inputs to the valuation methodology include: quoted prices

for similar assets or liabilities in active markets; quoted prices

for identical or similar assets or liabilities in inactive markets;

inputs other than quoted prices that are observable for the asset

or liability; inputs that are derived principally from or

corroborated by observable market data by correlation or other

means. If the asset or liability has a specified (contractual)

term, the level 2 input must be observable for substantially the

full term of the asset or liability.

Level 3

– Pricing inputs significant to the valuation are

unobservable. Inputs are developed based on the best information

available; however, significant judgment is required by management

in developing the inputs.

The

related disclosures are in note 3.

Investment

valuation and income recognition

Investments held by

the Plan at December 31, 2016 consist of various registered

investment companies, a unitized employer stock fund, and a

self-directed brokerage option. Common stock, securities and

brokerage account investments traded on national securities

exchanges are carried at market value based on the closing price on

the last business day of the year. The fair value of registered

investment companies is determined based on quoted market prices,

which represents the net asset value for shares held at year-end.

The unit value of the Navient Stock Fund is based on the closing

price of the Company’s stock and the value of the money

market component on the last business day of the Plan year. The

Company’s stock is listed and traded on the NASDAQ Global

Select Market. Investments traded in the over-the-counter market

and listed securities for which no sale was reported on that date

are valued at the average of the last reported bid and asked

prices.

Dividend income is

recorded on the ex-dividend date. Interest earned on investments is

recorded on the accrual basis. Purchases and sales of securities

are recorded on the trade date.

Notes Receivable from Participants

Notes

receivable from participants are measured at their unpaid principal

balance plus any accrued but unpaid interest. Interest income is

recorded on the accrual basis. No allowance for credit losses has

been recorded as of December 31, 2016 or 2015. If a Participant

ceases to make loan repayments and the Plan administrator deems the

participant loan to be in default, the participant loan balance is

reduced and a benefit payment is recorded.

Contributions

Contributions made

by employees electing to participate in the Plan under salary

reduction agreements and Company contributions are recorded when

payable into the Plan.

Use

of estimates

The

preparation of financial statements in accordance with accounting

principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and changes therein,

and disclosure of contingent assets and liabilities. Actual results

could differ from those estimates.

Risks

and uncertainties

The

Plan provides for various investment options. Such investments are

subject to various risks such as interest rate, market and credit

risks. Due to the level of risk associated with certain investment

securities, it is reasonably possible that changes in the value of

investment securities will occur in the near term, including a

decrease in value, and that such changes could materially affect

Participants' account balances and the amounts reported in the

statement of net assets available for benefits.

Benefit

payments

Benefits are

recorded when paid.

Adoption

of accounting standard

In July

2015, the Financial Accounting Standards Board (“FASB”)

issued Accounting Standards Update (“ASU”)

2015-12,

Plan

Accounting: Defined Benefit Pension Plans (Topic 960), Defined

Contribution Pension Plans (Topic 962), Health and Welfare Benefit

Plans (Topic 965).

The

ASU is effective for fiscal years beginning after December 15,

2015, with early adoption permitted. Management has elected

to adopt the relevant parts of the ASU for the year ended December

31, 2015.

The ASU

eliminates the requirements to disclose individual investments that

represent 5 percent or more of net assets available for benefits

and the net appreciation or depreciation in fair value of

investments by general type. The ASU also simplifies the

level of disaggregation of investments that are measured using fair

value by general type; however, plans are no longer required to

also disaggregate investments by nature, characteristics and

risk. Further, the disclosure of information about fair value

measurements shall be provided by general type of plan asset. The

Plan early adopted ASU 2015-12 for the year ended December 31,

2015.

Navient 401(k) Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

3.

Fair

Value Measurements

The

fair value of Plan investments at December 31, 2016 and 2015 are

shown in the tables below.

|

|

|

|

Based

on

|

|

|

|

Fair

Value at December 31, 2016

|

Quoted

prices in active markets (Level 1)

|

Other

observable inputs (Level 2)

|

Unobservable

inputs (Level 3)

|

|

|

|

|

|

|

|

Mutual

Funds

|

$

462,717,621

|

$

462,717,621

|

$

-

|

$

-

|

|

Navient

Stock Fund

|

12,631,170

|

-

|

12,631,170

|

-

|

|

Self-directed

brokerage account

|

12,788,516

|

12,788,516

|

-

|

-

|

|

|

|

|

|

|

|

Total

Investments

|

$

488,137,307

|

$

475,506,137

|

$

12,631,170

|

$

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Based

on

|

|

|

|

Fair

Value at December 31, 2015

|

Quoted

prices in active markets (Level 1)

|

Other

observable inputs (Level 2)

|

Unobservable

inputs (Level 3)

|

|

|

|

|

|

|

|

Mutual

Funds

|

$

434,441,186

|

$

434,441,186

|

$

-

|

$

|

|

Navient

Stock Fund

|

9,758,258

|

-

|

9,758,258

|

-

|

|

Self-directed

brokerage account

|

11,672,724

|

11,672,724

|

-

|

-

|

|

|

|

|

|

|

|

Total

Investments

|

$

455,872,168

|

$

446,113,910

|

$

9,758,258

|

$

-

|

Navient 401(k) Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

Although it has not expressed any intent to do

so, the Company has the right under the Plan to discontinue its

contributions at any time and to terminate the Plan subject to the

provisions of ERISA and the Internal Revenue Code. In the event of

Plan termination, Participants would become 100 percent vested in

their

Company contributions.

5.

Related-Party

Transactions and Party-In-Interest Transactions

Certain

Plan investments are shares of registered investment companies, the

self-directed brokerage account or amounts of the Navient Stock

Fund managed by Fidelity. Fidelity is the trustee as defined by the

Plan and therefore these transactions qualify as party-in-interest

transactions. Fees paid by the Plan for administrative services

were $161,049 for the year ended December 31, 2016. Fees incurred

by the Plan for the investment management services are included in

net appreciation in fair value of the investment, as they are paid

through revenue sharing, rather than a direct payment. The Plan

also receives funding from Fidelity Management Trust Company.

During 2016, the Plan received $173,750 which is recorded net of

administrative expenses.

Additionally, the

Plan has investments in the Navient Stock Fund comprised

principally of Navient Corporation common stock. At December 31,

2016 and 2015, the Plan held 997,480 and 1,104,015 units,

respectively, valued at $12,631,170 and $9,758,258, respectively.

During 2016, 255,998 units in the amount of $2,517,902 were

purchased and 362,534 units in the amount of $3,746,475 were sold

related to the Navient Stock Fund. Such transactions qualify as

party-in-interest transactions, as Navient Corporation is the

Plan’s sponsor. During 2016, the Plan recorded dividend

income in the amount of $513,770 from Participants’

investments in the Navient Stock Fund.

The IRS

has determined and informed the Company by a letter dated August

10, 2016, that the Plan is designed in accordance with applicable

sections of the IRC. Although the Plan has been amended since

receiving the determination letter, the Plan administrator believes

that the Plan and related trust are operating in accordance with

the IRC and are qualified under Section 401(a) of the IRC.

Accordingly, no provision for income taxes has been

made.

Accounting

principles generally accepted in the United States of America

require plan management to evaluate tax positions taken by the Plan

and recognize a tax liability if the Plan has taken an uncertain

position that more likely than not would not be sustained upon

examination by the IRS. The Plan is subject to routine audits by

taxing jurisdictions for years since inception; however, there are

currently no audits for any tax periods in progress.

Navient

401(k) Savings Plan

Schedule

H, Line 4i – Schedule of Assets (Held at End of

Year)

EIN:

46-4054283 Plan: 001

Year

Ended December 31, 2016

|

|

Identity of issuer, borrower of similar entity

|

|

Description of Investment

|

|

Current value

|

|

*

|

Fidelity 500 Index Inst

|

|

Registered Investment Company

|

|

$ 63,197,288

|

|

*

|

Fidelity Contrafund K

|

|

Registered Investment Company

|

|

46,383,521

|

|

*

|

Fidelity Retirement Govt MM

|

|

Registered Investment Company

|

|

31,473,416

|

|

*

|

Fidelity Freedom K 2030

|

|

Registered Investment Company

|

|

27,701,651

|

|

*

|

Fidelity OTC K

|

|

Registered Investment Company

|

|

27,449,128

|

|

|

Victory Estb Value 1

|

|

Registered Investment Company

|

|

25,605,141

|

|

*

|

Fidelity Balanced K

|

|

Registered Investment Company

|

|

25,563,745

|

|

*

|

Fidelity Freedom K 2040

|

|

Registered Investment Company

|

|

21,518,456

|

|

|

Metwest Tot Rtn BD P

|

|

Registered Investment Company

|

|

21,036,428

|

|

*

|

Fidelity Freedom K 2020

|

|

Registered Investment Company

|

|

20,674,986

|

|

|

Loomis SM CP Grth IS

|

|

Registered Investment Company

|

|

19,248,438

|

|

*

|

Fidelity US Bond Index Is

|

|

Registered Investment Company

|

|

18,860,100

|

|

|

ABF Intl Equity Inst

|

|

Registered Investment Company

|

|

16,472,205

|

|

|

Invs Comstock R5

|

|

Registered Investment Company

|

|

15,614,998

|

|

|

Janus Enterprise N

|

|

Registered Investment Company

|

|

15,034,333

|

|

|

Brokeragelink

|

|

Self-directed brokerage account

|

|

12,788,516

|

|

|

Navient Stock Fund

|

|

Common Stock Fund

|

|

12,631,170

|

|

|

GS Small Cap Value Inst

|

|

Registered Investment Company

|

|

9,905,077

|

|

*

|

Fidelity Freedom K 2025

|

|

Registered Investment Company

|

|

9,284,791

|

|

*

|

Fidelity Freedom K 2055

|

|

Registered Investment Company

|

|

8,811,938

|

|

*

|

Fidelity Freedom K 2035

|

|

Registered Investment Company

|

|

7,892,425

|

|

*

|

Fidelity Freedom K 2050

|

|

Registered Investment Company

|

|

6,420,269

|

|

*

|

Fidelity Freedom K 2045

|

|

Registered Investment Company

|

|

5,828,434

|

|

*

|

Fidelity Intl Index PR

|

|

Registered Investment Company

|

|

5,588,514

|

|

*

|

Fidelity Freedom K 2010

|

|

Registered Investment Company

|

|

4,114,344

|

|

*

|

Fidelity Mid Cap Index PR

|

|

Registered Investment Company

|

|

2,710,445

|

|

*

|

Fidelity Sm Cap Index PR

|

|

Registered Investment Company

|

|

1,960,387

|

|

*

|

Fidelity Freedom K Income

|

|

Registered Investment Company

|

|

1,905,488

|

|

*

|

Fidelity Freedom K 2060

|

|

Registered Investment Company

|

|

1,581,206

|

|

*

|

Fidelity Freedom K 2015

|

|

Registered Investment Company

|

|

790,456

|

|

*

|

Fidelity Freedom K 2005

|

|

Registered Investment Company

|

|

90,014

|

|

|

|

|

|

|

|

|

|

Participant Loans:

|

|

|

|

|

|

*

|

Plan Participants

|

|

Loans allowable under the plan instrument, collateralized by

Participant account balances, are due in varying installments

through 2036, with interest rates ranging from 3.25% to

9%

|

|

12,537,496

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

$ 500,674,803

|

|

|

|

|

|

|

|

|

|

* Denotes a party-in-interest

|

|

|

|

|

|

|

Note: Cost information is not required for participant-directed

investments and therefore is not included.

|

|

See

Report of Independent Registered Public Accounting

Firm.

SIGNATURES

The Plan

. Pursuant to the requirements of the Securities

Exchange Act of 1934, the Plan Administrator has duly caused this

annual report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

NAVIENT

401(K) SAVINGS PLAN

|

|

Date: June 29,

2017

|

/s/ TED

A. MORRIS

|

|

|

Ted A.

Morris

|

|

|

Senior Vice

President and Controller

|

|

|

On behalf of the

Navient

Corporation

Employee Benefits Fiduciary Committee

|

|

|

|

EXHIBIT INDEX

|

Exhibit

No.

|

Description

|

|

23.1

|

Consent

of Independent Registered Public Accounting Firm –

CohnReznick LLP

|

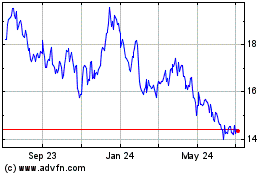

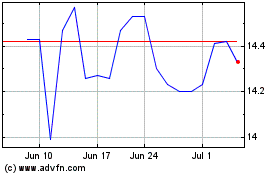

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024