FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of June

, 2017

National Bank of Greece S.A.

(Translation of registrant’s name into English)

86 Eolou Street, 10232 Athens, Greece

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

Form 20-F

x

Form 40-F

o

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes

o

No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

ANNUAL GENERAL MEETING

of 30 June 2017

Draft Resolutions/Board Remarks

on the items on the agenda of the General Meeting

1.

Submission for approval of the Board of Directors Report on the Annual Financial Statements of the Bank and the Group for the financial year 2016 (1.1.2016

—

31.12.2016), and submission of the respective Auditors

’

Report.

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

The Board of Directors (the Board) shall propose that the AGM approve the Board’s Report on the Parent Bank and Consolidated Financial Statements of NBG for 2016, as approved by the Board at its meeting of

30 March 2017, and also submits the Auditors’ Report for information purposes.

These reports can be viewed by

the shareholders on the Bank’s website at:

http://www.nbg.gr/el/the-group/investor-relations/financial-information/annual-interim-financial-statements/Documents/

*

Please see

Number of Shares and Voting Rights below

|

|

National Bank of Greece S.A.

|

2.

Submission for approval of the Annual Financial Statements of the Bank and the Group for the financial year 2016 (1.1.2016

—

31.12.2016).

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

The Board shall propose that the AGM approve the Bank

’s and the Group’s Annual Financial Statements for the financial year 2016, including the comparative data for 2015. The Financial Statements of the Group and the Bank are comprised of the Statement of Financial Position, the Income Statement, the Statement of Comprehensive Income, the Statement of Changes in Equity, the Cash Flow Statement, and the Notes to the Financial Statements. The Financial Statements were approved by the Board on 30 March 2017 and can be viewed on the Bank’s website at:

http://www.nbg.gr/el/the-group/investor-relations/financial-information/annual-interim-financial-statements/Documents/

The Bank

’s website also includes a Press Release and a Presentation accompanying the announcement of the full-year results for 2016.

In brief, the Group’s results for 2016 were as follows:

In 2016, the Bank reported profit of €9 million compared to loss €4,540 million in 2015, while the Group in 2016 reported loss of €2,887 million compared to loss of €4,227 million in 2015. The improvement in 2016 is mainly due to decreased loan and other provisions in 2016 of €819 million and €809 million for the Bank and the Group, respectively (2015: €4,344 million and €4,175 million, respectively).

In more detail, in 2016, the Group’s profit / (loss) after tax from continuing operations, reached €53 million against losses of €2,608 million in 2015, mainly due to the decreased loan and other provisions in 2016, the savings of €143 million due to the cancellation of Pillar II & III securities and guarantees under Law 3723/2008 and the gain on disposal of the Astir Palace Vouliagmenis S.A.

The key landmark events for 2016 were:

Completion of disposal of subsidiaries

In 2016 the Bank completed the disposal of the following subsidiaries:

Finansbank A.S.

NBGI Private Equity Funds

Astir Palace Vouliagmenis S.A. and Astir Marina Vouliagmenis S.A.

2

Repayment of the contingent convertible bonds (“CoCos”) issued in favor of the Hellenic Financial Stability Fund (“HFSF”)

The Bank, on 15 December 2016, following relevant resolution of its Board of Directors and in accordance with the Commitments stemming from Bank’s revised Restructuring Plan, as this was approved by the European Commission on 4 December 2015, fully repaid of the CoCos amounting to €2,029 million, issued in December 2015 and held by the HFSF, following approval by the SSM in accordance with the applicable regulatory framework. Following the repayment of the CoCos, the Group’s CET1 ratio as of 31 December 2016 stood at CET1 16.3% confirming the Group’s strong capital base.

Agreed disposals of subsidiaries

In addition to the completed disposals in 2016, the Bank on 30 December 2016 entered into a definitive agreement with KBC for the divestment to KBC of its 99.91% stake in its Bulgarian subsidiary UBB and its 100% stake in Interlease E.A.D. The disposal transaction was completed on 14 June 2017. Furthermore, on 22 December 2016 the Bank entered into a definitive agreement with AFGRI, a company incorporated in the Republic of South Africa for the divestment to AFGRI of its 99.81% stake in its South African subsidiary SABA. The disposal is expected to be completed by the end of 2017.

Voluntary exit scheme

On 9 December 2016, the Bank announced to its employees the terms of the Voluntary Exit Scheme (“VES”), which applied also to certain domestic subsidiaries. The deadline for applications was on 22 December 2016 and 1,171 and 1,125 employees participated for the Group and the Bank, respectively. The Bank had recognized as of 31 December 2015 a relevant provision, in the context of its commitment under the 2015 Revised Restructuring Plan and as a result the cost of the VES was included in the 2015 Income Statement and did not have an impact on the Group’s and the Bank’s income statement for the year ended 31 December 2016.

3

3

.

Discharge of the members of the Board of Directors and the Auditors of the Bank from any liability for indemnity regarding the Annual Financial Statements and management for the year 201

6

(1.1.201

6

—

31.12.201

6

).

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

It is proposed that the members of the Board of Directors and Auditors of NBG be discharged from any liability for indemnity regarding the Annual Financial Statements and management for the year 201

6. More specifically:

The Board of NBG:

Panayotis (Takis) - Aristidis Thomopoulos, Leonidas Fragkiadakis, Dimitrios Dimopoulos, Paul Mylonas, Petros Sabatacakis, Claude Piret, Haris Makkas, Mike Aynsley, Marianne Økland, Spyros Lorentziadis, Eva Cederbalk, Stavros Koukos, Panagiotis Leftheris, Louka Katseli, Efthymios Katsikas, Spyridon Theodoropoulos, Dimitris Afendoulis, Angeliki Skandaliari, Kurt Geiger, Andreas Boumis

Certified Auditors of NBG:

The audit firm “Deloitte Hadjipavlou, Sofianos & Cambanis SA” and the regular auditor Ms Alexandra Kostara.

4

4. Election of regular and substitute Certified Auditors for the audit of the Financial Statements of the Bank and the Financial Statements of the Group for the financial year 2017, and determination of their remuneration.

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

For the audit of the Bank

’s and the Group’s Annual and Semi-annual Financial Statements for the financial year ending 31 December 2017, following proposal of the Audit Committee, the Board of Directors shall propose the appointment of PriceWaterhouseCoopers (PwC), which is responsible by law to appoint at least one regular and one substitute certified auditor, at its discretion.

The selection of PwC

, that was carried out following the examination of alternative choices, was subject to the publication of Greek law 4449/2017 “Statutory audit of annual and interim financial statements”, which incorporated EU regulation 537/2014 “Specific requirements regarding statutory audit of public interest entities” in the Greek legislation which was passed on 24 January 2017.

Moreover, it is proposed that the AGM authorize the Board to determine the remuneration of the certified auditors, following proposal of the Audit Committee, in accordance with the law.

5

5. Approval of the remuneration of the Board of Directors of the Bank for the financial year 2016 (pursuant to Article 24.2 of Codified Law 2190/1920). Determination of the remuneration of the Chairman of the Board, the CEO, the Deputy CEOs and non-executive Directors through to the AGM of 2018. Approval, for the financial year 2016, of the remuneration of the Bank

’

s Directors in their capacity as members of the Bank

’

s Audit, Corporate Governance & Nominations, Human Resources & Remuneration, Risk Management, and Strategy Committees, determination of their remuneration through to the AGM of 2018, and approval of contracts as per Article 23a of Codified Law 2190/1920.

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

The Board of Directors, based on a proposal by the Human Resources & Remuneration and the Corporate Governance & Nominations Committees, taking into account a) the provisions of legal and regulatory framework on remuneration according to Law 4261/2014

and law 3016/2002, b) the provisions on maximum amount of remuneration of Art. 10 Par. 3 of Law 3864/2010, c) the Commitments of the Hellenic Republic to the European Commission and the Communication from the European Commission on the application from 1 August 2013 of State aid rules to support measures in favor of banks in the context of the financial crisis (2013/C, 216/01), and d) the consultation with the competent bodies according to Law 3864/2010, as in force, shall propose for approval by the Annual General Meeting, the remuneration of the members of the Board, up until the Chair, the CEO and deputy CEOs of the Bank, for the financial year 2016, for their participation in the BoD and its Committees, pursuant to Art.24 Par.2 of Codified Law 2190/1920, as amended, and Article 28 of the Bank’s Articles of Association, as presented within the following table, which includes remuneration paid during 2016, totaling €825,290.34 (following any withholding for insurance fund and income tax requirements), in line with the financial statements already approved. It is noted that, with respect to members who assumed duties or resigned during 2016, according to the notes listed by event under the table of fees, the amounts listed in the table relate to the period during which they were employed at the Bank.

6

|

Name and

Surname

|

|

Capacity

|

|

Gross BoD and

BoD

Committee

Remuneration

in Euros

|

|

Net BoD and

BoD

Committee

Remuneration

in Euros

|

|

Gross

Remuneration

for Dependent

Employment in

Euros

|

|

Remuneration

for Dependent

Employment

excluding

Insurance and

Tax

Contributions in

Euros*

|

|

|

Panayotis (Takis) — Aristidis Thomopoulos(1)

|

|

Chair

|

|

—

|

|

—

|

|

38,463.54

|

|

18,611.12

|

|

|

Louka Katseli(2)

|

|

Chair

|

|

13,500.00

|

|

6,954.59

|

|

218,263.38

|

|

115,058.41

|

|

|

Leonidas Fragkiadakis

|

|

CEO

|

|

13,500.00

|

|

7,044.28

|

|

287,680.44

|

|

141,299.67

|

|

|

Dimitrios Dimopoulos

|

|

Deputy CEO

|

|

13,500.00

|

|

7,054.39

|

|

268,223.78

|

|

132,781.15

|

|

|

Paul Mylonas

|

|

Deputy CEO

|

|

13,500.00

|

|

7,096.83

|

|

267,669.51

|

|

131,659.31

|

|

|

Petros Sabatacakis

|

|

Independent- Non Executive Member

|

|

78,333.50

|

|

46,672.90

|

|

—

|

|

—

|

|

|

Haris Makkas

|

|

Independent- Non Executive Member

|

|

55,055.66

|

|

35,941.51

|

|

—

|

|

—

|

|

|

Mike Aynsley(3)

|

|

Independent- Non Executive Member

|

|

47,166.80

|

|

27,942.62

|

|

—

|

|

—

|

|

|

Marianne Økland(4)

|

|

Independent- Non Executive Member

|

|

42,639.04

|

|

25,294.88

|

|

—

|

|

—

|

|

|

Claude Piret(5)

|

|

Independent- Non Executive Member

|

|

12,222.24

|

|

7,351.60

|

|

—

|

|

—

|

|

|

Spyridon Theodoropoulos(2)

|

|

Independent- Non Executive Member

|

|

37,472.27

|

|

26,289.29

|

|

—

|

|

—

|

|

|

Dimitrios Afendoulis(2)

|

|

Independent- Non Executive Member

|

|

45,361.19

|

|

29,861.84

|

|

—

|

|

—

|

|

|

Andreas Boumis(6)

|

|

Independent- Non Executive Member

|

|

3,125.00

|

|

2,282.15

|

|

—

|

|

—

|

|

|

Efthymios Katsikas(7)

|

|

Non-Executive Member

|

|

23,833.33

|

|

16,139.36

|

|

—

|

|

—

|

|

|

Stavros Koukos

|

|

Non-Executive Member

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Eva Cederbalk(8)

|

|

Non-Executive Member

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Spyros Lorentziadis(5)

|

|

Non-Executive Member

|

|

8,000.01

|

|

5,424.31

|

|

—

|

|

—

|

|

|

Panagiotis Leftheris(9)

|

|

Representative of the Hellenic Financial Stability Fund

|

|

36,222.38

|

|

21,875.76

|

|

—

|

|

—

|

|

|

Angeliki Skandaliari(10)

|

|

Greek State Representative

|

|

15,722.23

|

|

12,654.37

|

|

—

|

|

—

|

|

|

TOTAL

|

|

|

|

459,153.65

|

|

285,880.68

|

|

1,080,300.65

|

|

539,409.66

|

|

7

*Insurance contributions, tax, solidarity contribution, stamp duty are not included

(1)Elected BoD member on 02.11.2016, Elected Chair of the BoD on 09.11.2016

(2)Resigned on 02.11.2016

(3)Elected on 26.05.2016

(4)Elected on 29.06.2016

(5)Elected on 02.11.2016

(6)Resigned on 26.01.2016

(7)Resigned on 27.12.2016

(8) Elected on 27.12.2016

(9)HFSF Representative from 19.07.2016 until 30.03.2017

(10) Greek state Representative until 22.07.2016

Mr. Koukos, who served as Employee Representative — Non-Executive Member of the Board, and resigned on 07.06.2017 had renounced remuneration as member of the BoD.

Insurance contributions for the above remuneration amount to €73,938.18.

Additional to the above, there was early termination payment of €187,471.41 made.

Moreover, the Board shall propose, the determination of the remuneration for Board members through to the AGM of 2018 and the approval of contracts as per Article 23a of Codified Law 2190/1920.

Specifically, the Board of Directors proposes to the Annual General Meeting the approval of the below remuneration, which is equal to the existing remuneration paid, to be granted until the Annual General Meeting of 2018, to the executive and non-executive members of the Board of Directors, up until the Chair, the Chief Executive Officer, and the Deputy Chief Executive Officers of the Bank, pursuant to Article 24, Par. 2 of Codified Law 2190/1920 as in force, as well as in accordance with Article 28 of the Bank’s Articles of Association, as per the two tables below:

|

Proposed Remuneration of Non-Executive Members of the Board

of Directors of the National Bank of Greece S.A.

|

|

Proposed

Gross Annual

Remuneration

Per Position of

Responsibility

|

|

|

Basic Board Member Remuneration

|

|

€

|

30,000

|

|

|

Additional — added to the basic — Remuneration per Board Committee

|

|

€

|

10,000

|

|

|

Additional — added to the basic — Remuneration in the case of Chairmanship of the Audit Committee / the Risk Committee

|

|

€

|

30,000

|

|

|

Additional — added to the basic — Remuneration in the case of Chairmanship of the Corporate Governance and Nominations Committee / the Human Resources and Remuneration Committee / the Strategy Committee

|

|

€

|

20,000

|

|

8

Note 1

: The Bank will be covering Directors’ expenses relating to performance of their duties as Board Members, including accommodation, travel expenses, meals etc. There will be no other additional benefits provided.

Note 2

. The Position of Vice-Chair has been established officially for all Board Committees.

Note 3

: The Chair of the BoD and executives of the Bank do not receive additional remuneration as members of the BoD.

Note 4:

Depending on the number of Committee participations and the Chair positions held in each case, the total remuneration of each Director is formed. Upper limits on annual remuneration are set as follows:

·

An upper limit of €100,000 is set for the Chair of the Audit Committee and the Chair of the Risk Committee

·

An upper limit of €90,000 is set for the Chair of the Corporate Governance and Nominations Committee, the Chair of the Human Resources and Remuneration Committee and the Chair of the Strategy Committee

·

An upper limit of €80,000 is set for the Members of the Board and for the Representative of the Hellenic Financial Stability Fund at the Board

·

In case the Chair of the Human Resources and Remuneration Committee is also the Chair of the Corporate Governance and Nominations Committee, the total compensation for the two Chairmanships should be capped to €30,000

PROPOSED REMUNERATION OF THE CHAIRMAN OF THE BOARD AND EXECUTIVE BOARD MEMBERS

|

Capacity

|

|

Proposed Gross Annual Remuneration

for Dependent Employment for year

2017 in Euros

|

|

|

Chair of the BoD

|

|

256,429.80

|

|

|

CEO

|

|

298,922.00

|

|

|

Deputy CEO

|

|

279,000.00

|

|

It is noted that the approval of the above remuneration applies up to the Ordinary General Meeting of Shareholders of year 2018 and of course on condition that in any case the conditions and limits laid down in Art.10 Par.3 of Law 3864/2010 are met, and the Communication from the European Commission on the application from 1 August 2013 of State aid rules to support measures in favor of banks in context of the financial crisis (2013/C, 216/01), as in force.

Moreover, in view of the volatile and highly competitive conditions in the domestic banking sector, the Board of Directors informs the General Meeting of Shareholders that it will continue to examine on an ongoing basis the level of remuneration of the

members of the Board of Directors taking into consideration the conditions of competition in the domestic banking sector as well as the work provided by the members of the Board of Directors and that it could adjust such remuneration, in compliance with the provisions of the legal and regulatory framework, including Law 3864/2010, and subject to approval by the next Annual General Meeting of Shareholders.

9

6.

Granting of permission for

members of the Board of Directors

, General Managers, Assistant General Managers and Managers to participate on the Board of Directors or in the Management of NBG Group companies pursuing similar or related business goals, as per Article 23.1 of Codified Law 2190/1920 and Article 30.1 of the Bank

’

s Articles of Association.

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

It is proposed that the AGM grant permission for the Board members, General Managers, Assistant General Managers and Managers to participate on the Boards of Directors or in the management of NBG Group companies pursuing similar or related business goals.

10

7. Election of regular and substitute members of the Audit Committee.

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

Pursuant to Law 4449/2017, the Audit Committee members are elected by the AGM. According to the

Charter of the Audit Committee, its members are appointed by the AGM following a proposal by the Corporate Governance & Nominations Committee. Furthermore, in accordance with the provisions of the revised Relationship Framework Agreement (RFA) between the Bank and the HFSF, the members of the Committee shall not exceed 40% of total Board members (excluding the representatives of the HFSF on the Board) and cannot be fewer than three. All members of the Committee shall be non-executive members of the Board, while 75% of the members are independent non-executive members of the Board (excluding the representatives of the HFSF on the Board).

In this context, and taking into account: (a) the provisions of Greek Law 3016/2002, as in force, (b) the existing corporate governance framework and the Bank’s Articles of Association, and (c) the current legal and regulatory framework, including Greek Law 4449/2017,

Regulation (EU) No 537/2014, Greek Law 3864/2010, the Relationship Framework Agreement with the HFSF and the Audit Committee Charter and following the proposal of the Corporate Governance & Nominations Committee, it is proposed that the General Meeting elects the following Board members as regular members of the Audit Committee, with a term of office until the Annual General Meeting of year 2018:

1.

Mr. Claude Piret (Chairman of the Audit Committee)

2.

Mr. Petros Sabatacakis (Vice-Chairman of the Audit Committee)

3.

Mr. Mike Aynsley

4.

Ms Marianne Økland

5.

Ms. Eva Cederbalk

6.

Ms Panagiota Iplixian

and

Mr. Haris Makkas as substitute member of the Audit Committee, with a term of office until the Annual General Meeting of year 2018.

11

8. Approval of the transaction concerning the sale by the National Bank of Greece of a majority equity holding in the subsidiary “Ethniki Hellenic General Insurance S.A.”

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

The Bank’s revised Restructuring Plan, which was approved by the European Commission on 4 December 2015 and includes commitments of the Hellenic Republic to the European Commission relating to the provision of state support to NBG within the context of its recapitalisation, inter alia, provides for the Bank’s mandatory divestment of its insurance activities in Greece and abroad.

For the disposal of the Bank’s shareholding in Ethniki Hellenic General Insurance S.A. (“Ethniki Insurance”), an international auction process was conducted with the objective of achieving the most beneficial outcome for the Bank and its shareholders. The process followed was according to the approved Divestment Policy of the Bank, whereas the Bank was supported by financial and legal advisers with significant expertise in the successful execution of similar international transactions. The process included the assessment of potential investors’ primary interest, the submission of Non-binding Offers based on the Information Memorandum, financial, tax and legal due diligence of Ethniki Insurance by the selected potential investors, the submission of Binding Offers, further Confirmatory Due Diligence and the submission of Final Binding Offers, with all steps taking place from October 2016 to 26 May 2017. It is noted that the transaction incorporates a 10-year mutual agreement for the exclusive sale of Ethniki Insurance’s insurance products via the Bank’s network (Bancassurance Agreement).

Following the assessment of 3 Final Binding Offers, the Board of Directors of the Bank (BoD), after taking into consideration the significant difference in the price consideration between the first and the second Final Binding Offers, assigned Exin Financial Services Holding BV (“EXIN”), a company headquartered in the Netherlands, as the Preferred Bidder and subsequently extended an exclusivity period for the completion of the negotiations. It is noted that Exin Group has significant experience and increasing presence in the insurance, reinsurance and asset management sectors worldwide and lately in Greece, as in December 2016 it completed the acquisition of a stake in AIG Greece. Founding member of the group is the US-based investment company Calamos Investments.

After negotiations and the finalization of the transaction documents, the BoD at its meeting held on the 27

th

of June 2017, approved the signing of the Share Sale and Purchase Agreement (SPA) of the 75% of Ethniki Insurance’s stake held by NBG Group and a shareholders agreement which will govern the relationship of NBG and Exin as shareholders in Ethniki Insurance in the future (Shareholders Agreement), as

12

well as the exclusive agreement for the sale of insurance products (Bancassurance Agreement) together with certain other minor ancillary transaction documents.

The aforementioned approval was granted subject to the receipt of consent by the Hellenic Financial Stability Fund, as per the terms of the Relationship Framework Agreement, which was granted on 28

th

June 2017.

The key terms included in the relevant SPA for the said transaction with Exin Group as the counterparty are as follows:

·

Price: € 718m for the 75% of the Ethniki Insurance’s share capital, payable in cash at the closing date of the transaction.

·

Assignment of the Subordinated Debt at its par value (€ 50m) plus accrued and unpaid interest on the closing date of the transaction.

·

Conditions Precedent to Closing: the completion of the Transaction requires the fulfillment of specific conditions, namely the approvals by the competent regulatory and supervisory authorities, being the Bank of Greece, as well as the Greek and European Competition authorities (if required).

·

The Share Sale and Purchase Agreement also includes, according to standard practice, specific representations and warranties and as well Indemnities.

The key terms contained in the relevant agreement for the sale of insurance products via the Bank’s network (Bancassurance Agreement) are as follows:

·

The agreement has an initial duration of 10 years with a 5-year extension option and relates to the mutually exclusive sale of insurance products via the Bank’s network.

·

Establishment of an appropriate organizational structure for the effective and efficient cooperation between executives from both parties.

·

Bank entitled to receive commissions from the sale of Ethniki Insurance’s products.

·

The Bank reserves the control over the right of use of brands and trademarks related to NBG, whereas Ethniki Insurance reserves its ability to use the aforementioned brands and trademarks in its insurance business throughout the whole duration of the Bancassurance Agreement.

The key terms that are included in the Shareholders Agreement are the following:

·

NBG will nominate the 3 out of the 11 members of the BoD of Ethniki Insurance.

·

Certain important decisions that are approved by Ethniki Insurance’s General Meeting and relate to the share capital and core business activity of Ethniki Insurance will require the consent of the two shareholders whereas certain other important decisions of a more operational nature will be approved by Ethniki

13

Insurance’s Board of Directors with the approval of the BoD members that have been nominated by both shareholders.

·

The agreement includes a mechanism for potential divestment of the minority stake of NBG, in certain circumstances.

The completion of the transaction will significantly benefit NBG Group’s capital adequacy and liquidity. The estimated impact from the disposal of Ethniki Insurance on the Bank’s and the Group’s profit and loss, equity and CET 1 ratio (pro-forma for 31 March 2017), is set out below.

|

|

|

Group

31.3.2017

|

|

Bank

31.3.2017

|

|

|

Estimated impact on the profit and loss (

€ millions

)

|

|

219

|

|

95

|

|

|

Estimated impact on equity (

€ millions

)

|

|

188

|

|

95

|

|

|

Estimated impact on CET 1 ratio (basis points)

|

|

110

|

|

140

|

|

Pursuant to the above, it is proposed that the AGM approves the sale of the 75% of NBG Group’s shareholding in Ethniki Insurance for an amount equal to € 718m, in accordance with the relevant approval of the BoD.

In this context, it is proposed that the AGM approves all actions taken so far by the executive and non-executive members of the Bank’s BoD and of other executives of the Bank in relation to the said transaction, including the signing of the transaction documents as of 28 June 2017, by the authorized executive members of the BoD, namely the Chief Executive Officer Mr. Leonidas Fragkiadakis or the Deputy Chief Executive Officer Mr. Paul Mylonas.

14

9. Announcement of the election by the Board of Directors of new non-executive Board members in order to fill vacant positions of non-executive members, as per Article 18 par. 7 of Codified Law 2190/1920 and Article 18.3 of the Bank’s Articles of Association. The Announcement concerns the following non-executive Board members: Messrs. Panayotis-Aristidis Thomopoulos (Chairman of the BoD), Haris Makkas (Independent non-executive member), Claude Piret (Independent non-executive member), Spyros Lorentziadis (Non-executive member), Ms Eva Cederbalk (Non-executive member), Mr Panagiotis Leftheris (Representative of the Hellenic Financial Stability Fund), Ms Panagiota Iplixian (Representative of the Hellenic Financial Stability Fund).

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

Under Article 18.1 of the Articles of Association and the Corporate Governance Code, the Bank is managed by the Board of Directors, which is composed of nine (9) to fifteen (15) members. Furthermore, under Article 18.3 as above, in the event that as a result of resignation, death or incapacity for whatever reason a director ceases to be on the Board, and his replacement by substitute members elected by the GM is not feasible, the remaining Board members may, by decision taken as provided for in article 26: a) either provisionally elect another Board member to fill the vacancy for the remaining term of office of the member replaced, or (b) continue to manage and represent the Bank without replacing the missing Board member(s), provided that the number of the remaining members is at least nine (9). In the event that a new Board member is elected, the election shall be valid for the remaining term of office of the Board member replaced, and announced by the Board to the immediately following GM, which may replace the Board members elected even if no relevant item is included in the agenda.

In addition, the exact number of Board members is defined each time by the GM, in compliance with Article 18.2. Pursuant to the resolution of the General Meeting held on 19.06.2015, 13 directors were elected.

Thus, following proposal by the Corporate Governance & Nominations Committee, taking into consideration: a) the new corporate governance regulatory framework, particularly Article 10 of Law 3864/2010, as amended by provisions of Laws 4340/2015 and 4346 /2015, which established stricter eligibility criteria regarding the Board members of credit institutions, and b) the membership of the Board following the resignation of

non-executive and independent non-executive members, of the Hellenic Republic Representative and of the representatives of the Hellenic Financial Stability Fund each time appointed, as well as the need to fill the vacancies under Article 18.3 of the Bank’s Articles of Association and the applicable corporate governance principles, the Board of Directors proceeded to the following elections:

15

At its meeting held on 19 July 2016, the Bank’s Board of Directors appointed Mr. Panagiotis Leftheris as the new Representative of the Hellenic Financial Stability Fund (Mr. Leftheris’ resignation

as Board member submitted in March 2017).

At its meeting held on 28 July 2016, the Bank’s Board of Directors elected Mr. Haris Makkas as non-executive member.

Furthermore, at its meeting held on 2 November 2016, the Bank’s Board of Directors elected Mr. Panayotis — Aristidis Thomopoulos as non-executive member of the Board of Directors, and on 9 November 2016, Mr. Thomopoulos was appointed Chair of the Board of Directors.

Additionally, on 2 November 2016, Mr. Claude Piret was elected as independent non-executive Board member and Mr. Spyros Lorentziadis as non-executive Board member.

At its meeting held on 27 December 2016, the Bank’s Board of Directors elected Ms. Eva Cederbalk as non-executive Board member.

At its meeting held on 30 March 2017, the Bank’s Board of Directors appointed Ms. Panagiota Iplixian as the new Representative of the Hellenic Financial Stability

Fund.

These elections took place so as to fill the relevant vacancies and the new members will serve through to the AGM of 2018, i.e. for the remaining term of office of the Board members replaced, in accordance with the aforementioned provisions of the Bank’s Articles of Association.

Below there are brief resumes of members elected and now serving on the Board of Directors of the Bank in accordance with the aforementioned:

Mr. Panayotis-Aristidis Thomopoulos

has significant experience of 40 years in the financial sector and deep knowledge of European banking regulatory framework, having served, among others, for a number of years, as Deputy Governor of the Bank of Greece, Chair of Eurobank, independent non-executive member of the Board of the National Bank as well as Executive Chairman of the Hellenic Financial Stability Fund.

Mr. Haris Makkas

started his banking career in NY in 1978, where he held several positions in the areas of Treasury Management, Investment Banking and Risk management until 1992. He returned to Greece in 1993, briefly joining National Bank of Greece as Global Treasurer before becoming Managing Director at Bank of America Athens for the next 7 years. Next he helped set up and ran the joint venture of ING Bank and Piraeus Bank in Asset Management until 2008, and for the following couple of years he joined a private equity fund in Switzerland. He has served on the boards of several companies in the public as well as the private sector. Mr Makkas serves as member of the Board of Director of Helbio S.A. Mr. Makkas was born in Kerasohori Evrytanias, studied on various scholarships at Athens College (1971), Brandeis University in Boston (BA, 1975), and Columbia Unviversity in New York (MA, 1977

16

and M. Phil, 1978), and has taught econometrics and money and banking at several colleges.

Mr. Claude Piret

has been member of the Board of Directors of National Bank of Greece since November 2016. Mr Piret possesses extensive experience in the international financial sector, having a career of over 35 years in international banking institutions. He has served in high-ranking positions for a number of years at Dexia Group, and has extensive experience in audit and in the areas of risk management and management of non-performing loans. Mr Piret serves as Chairman of the Board at Dexia Israel Bank LTD since March 2017, while in the past he has served among others as Chief Risk Officer at Dexia Group. Mr Piret holds a Diploma in Civil Engineering from The Université catholique de Louvain (Belgium) and a Post-graduate degree in Management (Finance) from The Université libre de Bruxelles (ULB) -Solvay Institute.

Ms. Eva Cederbalk

has been member of the Board of Directors of National Bank of Greece since December 2016. Ms. Cederbalk has her background in the financial sector. She has served as Chief Executive Officer of SBAB Bank, a Swedish retail bank 2004 — 2011. Prior to that she served as Chief Executive Officer of Netgiro International 2002 — 2003, Executive Vice President, responsible for e-business at If Skadeförsäkring (Nordic insurance company) and as Chief Executive Officer of DAIL Försäkring (insurance company). Ms. Cederbalk serves as a Member of the Board of Ikano Group S.A. since May 2012, Bilia AB since 2016 and Svolder AB since 2015. She has served as Chairman of the Board for Klarna AB 2009- 2016 and S:t Eriks Ögonsjukhus AB 2001-2006. She has served as Chairman of AB Sveriges Sakerstallda Obligationer (publ) (The Swedish Covered Bond Corp.) until December 2011. Ms. Cederbalk holds an M.Sc. in Economics from the Stockholm School of Economics.

Mr. Spyros Lorentziadis

has been member of the Board of Directors of National Bank of Greece since November 2016. He has extensive experience in audit and in the financial sector. He is a Certified Auditor and former Partner of Arthur Andersen and EY with significant experience on consulting services in the areas of corporate governance, internal audit and financial reporting. He has been a member of numerous Boards, mainly in the financial sector, while for ten years he had been an independent non-executive member of the Board of Eurobank Group.

Ms. Panagiota Iplixian

has been Member of the Board of Directors of National Bank of Greece, representing the Hellenic Financial Stability Fund, since March 2017. During the period 1972-1987 Ms. Iplixian worked for consulting firms. From 1987 until 2000 she worked for commercial banks in the United States and from 2000 until 2009 for EFG Eurobank Ergasias. From 2010 until 2012 she was a Non-Executive Independent Member of the Board of Directors of the Hellenic Financial Stability Fund. From October 2011 until December 2013 she was Non-Executive Vice President of the Board of Directors of New Proton Bank, representing the Hellenic Financial Stability Fund. She has been a Member of the Board of Directors of Alpha Bank, representing the Hellenic Financial Stability Fund, from January 2014 until February 2017. She holds a BA in Business Administration and a Postgraduate Diploma in

17

Management Studies from the University of Northumbria, Newcastle upon Tyne, England, and specialised in “Organisation and Methods” at the British Institute of Administrative Management.

The CVs of the new Board members shall be available to shareholders at the Secretariat of the Meeting.

The new members meet the required eligibility, suitability and independence criteria set out in a) the applicable regulatory framework, particularly Law 3864/2010, as amended, b) the Relationship Framework Agreement with the Hellenic Financial Stability Fund, c) the Corporate Governance Code and Nominations Policy for Board Membership, d) the current framework under the Single Supervisory Mechanism (SSM) and European Banking Authority (EBA) guidelines for reviewing suitability, and e) relevant declarations by said new members regarding non-conflict of interests.

It is noted that under the provisions of the legal and regulatory framework, the election of new members to the Board of credit institutions is subject to the approval and ongoing control of the ECB’s SSM.

18

10. Various announcements

[This item usually includes announcements regarding issues of which the Board of Directors wishes to notify the GM, but which do not require voting or decision taking.]

19

ANNEX 1

HOW SHAREHOLDERS CAN EXERCISE THEIR SHAREHOLDER RIGHTS

Any person listed as a shareholder (i.e. holder of common registered shares of the Bank) in the registry of the Dematerialized Securities System managed by Hellenic Exchanges S.A. (HELEX), at the start of the 5th day prior to the date of the General Meeting, i.e. on 25.06.2017 (

“Record Date”), is entitled to participate in the GM. Each common share is entitled to one vote.

If this is the case, at the 1st Repeat AGM any person listed as a shareholder, as above, on 16.07.2017, i.e. at the start of the 4th day prior to the date of the 1st Repeat AGM of 20.07.2017 is entitled to participate in the said GM. In the case of the 2nd Repeat GM, shareholder status must exist on 03.09.2017, i.e. at the start of the 4th day prior to the date of the 2nd Repeat GM of 07.09.2017.

The Hellenic Financial Stability Fund participates in the General Meeting as per Law 3864/2010, as amended.

Proof of shareholder status should be provided by presenting to the Bank relevant certification from HELEX or alternatively through direct electronic link-up of the Bank with the records of the Dematerialized Securities System of HELEX. The relevant written certification by HELEX or the electronic verification of shareholder status must have been received by the Bank by 27 June 2017 at the latest, i.e. on the 3rd day prior to the date of the AGM. The same deadline, i.e. the third day at the latest prior to the date thereof, also applies to the Repeat General Meetings. Specifically, with respect to the 1st Repeat General Meeting, the certification or verification of shareholder status must have been received by the Bank by 17.07.2017 at the latest, while with respect to the 2nd Repeat GM, by 04.09.2017 at the latest.

Shareholders who are legal entities must also, by the same deadline, file, pursuant to the law, their legalisation documents, unless these documents have already been filed with our Bank, in which case it is sufficient to state where they have been filed in the relevant proxy form.

Shareholders who do not comply with the provisions of article 28a of Codified Law 2190/1920, as above, may participate in the General Meeting only after the Meeting has authorized them to do so.

To exercise the said rights, it is not necessary to block the shares or follow any other similar process that may restrict the ability to sell and transfer shares in the period between the Record Date and the AGM.

20

PROCEDURE FOR VOTING BY PROXY

The shareholder may participate in the AGM and may vote either in person or by proxy. Each shareholder may appoint up to 3 proxy holders. Legal entities may participate in the General Meeting by appointing up to 3 natural persons as proxy holders. However, if the shareholder owns shares in the Bank that are held in more than one Investor Securities Account, such limitation shall not prevent the shareholder from appointing, in respect of the AGM, separate proxy holders for the shares appearing in each Account. A proxy holder holding proxies from several shareholders may cast votes differently for each shareholder. Before the AGM commences, the proxy holder must disclose to the Bank any particular facts that may be of relevance for shareholders in assessing the risk that the proxy holder may pursue interests other than those of the shareholder. Within the meaning intended in this paragraph, a conflict of interest may arise in particular when the proxy holder: (i) is a controlling shareholder of the Bank or is another entity controlled by such shareholder; (ii) is a member of the Board of Directors or in general the management of the Bank, or of a controlling shareholder or an entity controlled by such shareholder; (iii) is an employee or an auditor of the Bank, or of a controlling shareholder or an entity controlled by such shareholder; (iv) is a spouse or close relative (1st degree) of a natural person referred to in (i) to (iii) hereinabove.

The appointment and revocation of appointment of a proxy holder shall be made in writing and shall be notified to the Bank in writing at least 3 days prior to the date of the AGM.

To participate in the AGM either in person or by proxy, shareholders are kindly requested to fill in and submit to the Bank the form

“DECLARATION — AUTHORIZATION FOR PARTICIPATION IN THE ANNUAL GENERAL MEETING OF SHAREHOLDERS OF NATIONAL BANK OF GREECE TO BE HELD ON 30.06.2017, AND ANY REPEAT MEETINGS THEREOF”. The Bank shall make available the said form on its website (www.nbg.gr) and through its Branch network. The said form, filled in and signed by the shareholder, must be filed with the Bank’s Subdivision for Governance of NBG Shareholder Register & Shareholder Affairs (ground floor, 93 Eolou St., Athens) or any branch of the Bank’s network, or, filled in and signed by the shareholder, sent by fax to +30 2103343404, +30 2103343410 and +30 2103343095 or by e-mail to inikol@nbg.gr at least 3 days prior to the date of the General Meeting. Shareholders should confirm that the appointment-of-proxy form has been successfully received by the Bank by calling +30 2103343419, +30 2103343422, +30 2103343417 and +30 2103343411.

21

ANNEX 2

BALLOT PAPER FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

30 JUNE 2017

(and of any adjourned or postponed meetings thereof)

|

|

|

|

|

NO

|

|

ABSTAIN

|

|

ITEM 1:

|

|

Submission for approval of the Board of Directors Report on the Annual Financial Statements of the Bank and the Group for the financial year 2016 (1.1.2016 – 31.12.2016), and submission of the respective Auditors’ Report.

|

|

|

|

|

|

ITEM 2:

|

|

Submission for approval of the Annual Financial Statements of the Bank and the Group for the financial year 2016 (1.1.2016 – 31.12.2016).

|

|

|

|

|

|

ITEM 3:

|

|

Discharge of the members of the Board of Directors and the Auditors of the Bank from any liability for indemnity regarding the Annual Financial Statements and management for the year 2016 (1.1.2016 – 31.12.2016).

|

|

|

|

|

|

ITEM 4:

|

|

Election of regular and substitute Certified Auditors for the audit of the Financial Statements of the Bank and the Financial Statements of the Group for the financial year 2017, and determination of their remuneration.

|

|

|

|

|

|

ITEM 5:

|

|

Approval of the remuneration of the Board of Directors of the Bank for the financial year 2016 (pursuant to article 24.2 of Codified Law 2190/1920). Determination of the remuneration of the Chairman of the Board, the CEO, the Deputy CEOs and non-executive Directors through to the AGM of 2018. Approval, for the financial year 2016, of the remuneration of the Bank’s Directors in their capacity as members of the Bank’s Audit, Corporate Governance & Nominations, Human Resources & Remuneration, Risk Management, and Strategy Committees, determination of their remuneration through to the AGM of 2018 and approval of contracts as per Article 23a of Codified Law 2190/1920.

|

|

|

|

|

|

ITEM 6:

|

|

Granting of permission for members of the Board of Directors, General Managers, Assistant General Managers and Managers to participate on the Board of Directors or in the Management of NBG Group companies pursuing similar or related business goals, as per Article 23.1 of Codified Law 2190/1920 and Article 30.1 of the Bank’s Articles of Association.

|

|

|

|

|

|

ITEM 7:

|

|

Election of regular and substitute members of the Audit Committee.

|

|

|

|

|

|

ITEM 8:

|

|

Approval of the transaction concerning the sale by the National Bank of Greece of a majority equity holding in the subsidiary “Ethniki Hellenic General Insurance S.A.”.

|

|

|

|

|

22

|

ITEM 9:

|

|

Announcement of the election by the Board of Directors of new non-executive Board members in order to fill vacant positions of non-executive members, as per Article 18 par. 7 of Codified Law 2190/1920 and Article 18.3 of the Bank’s Articles of Association. The Announcement concerns the following non-executive Board members: Messrs. Panayotis-Aristidis Thomopoulos (Chairman of the BoD), Haris Makkas (Independent non-executive member), Claude Piret (Independent non-executive member), Spyros Lorentziadis (Non-executive member), Ms Eva Cederbalk (Non-executive member), Mr Panagiotis Leftheris (Representative of the Hellenic Financial Stability Fund), Ms Panagiota Iplixian (Representative of the Hellenic Financial Stability Fund).

|

|

|

|

|

|

ITEM 10:

|

|

Various announcements

|

|

|

|

|

NOTICE: IF YOU WISH TO VOTE IN FAVOUR OF ALL THE ABOVE ITEMS, SIMPLY DELIVER THIS BALLOT PAPER WITH NO MARKS HEREON

23

NATIONAL BANK OF GREECE

*Number of shares and voting rights

In line with the provisions of Article 27.3(b) of Codified Law 2190/1920, as amended, National Bank of Greece hereby discloses the total number of shares and voting rights existing as at 26.05.2017, the date of the invitation to shareholders to attend the Bank

’s forthcoming Annual General Meeting:

Specifically, the total share capital of the Bank amounts to 9,147,151,527 common registered shares, of which:

·

9,012,331,540 are common registered shares with the right to vote at the AGM.

·

134,819,987 are common registered shares owned by the HFSF by virtue of the share capital increase of 2013, subject to voting restrictions under Article 7a, Par. 2 of Law 3864/2010, as in force, without the right to vote on the items on the agenda of the AGM, with the exception of Item 8 on the Agenda concerning which the shares owned by the HFSF by virtue of the share capital increase of 2013 have a voting right.

24

DECLARATION — AUTHORIZATION FOR PARTICIPATION IN THE ANNUAL GENERAL MEETING OF SHAREHOLDERS OF NATIONAL BANK OF GREECE TO BE HELD ON

30

/06/201

7

, AND ANY REPEAT MEETINGS THEREOF

To National Bank of Greece S.A.

Subdivision for Governance of NBG Shareholder Register & Shareholder Affairs

93 Eolou St., Athens 102 32

SHAREHOLDER’S PARTICULARS

|

NATURAL PERSON

|

|

LEGAL ENTITY

|

|

|

|

|

|

|

Surname:

|

|

Name:

|

|

|

|

|

|

|

|

First name:

|

|

Representative:

|

|

|

|

|

|

|

|

Father’s name:

|

|

Authorized contact person:

|

|

|

|

Type of ID:

|

ID card

o

|

Passp

ort

o

|

|

|

|

|

|

|

ID card No./ Passport No.:

|

|

Registered Office:

|

|

|

|

|

|

|

|

Telephone No.:

|

|

Telephone No.:

|

|

|

|

|

|

|

|

INVESTOR’S ACCOUNT:

|

|

INVESTOR’S ACCOUNT:

|

|

|

|

|

|

|

|

|

|

Share

|

|

Number of shares

|

|

GRS003003027

|

|

|

|

NATIONAL BANK OF GREECE S.A.

|

|

|

AUTHORIZATION

I, the undersigned Shareholder, solemnly declare that I am a shareholder of the Bank on the Record Date (as stated in the Invitation to the General Meeting) and intend to participate in the above General Meeting. Furthermore, I hereby appoint Mr/Mrs/Ms:

to be my proxy, granting authority (jointly or to each one separately) to represent me in the Annual General Meeting of Shareholders of National Bank of Greece to be held on

30/06/2017 and repeat meeting(s), if any, declaring in advance that I approve of any action taken by him/her in respect thereof. I further authorize my proxy to appoint another proxy to act for him/her in the event of impediment.

|

It is hereby certified* that the shareholder’s signature

|

Date

|

|

|

|

appears genuine

(required in case a proxy is appointed)

|

The Shareholder

|

|

|

|

|

|

|

|

|

(*by the Greek consulate authorities or any NBG branch)

|

(Shareholder’s signature)

|

|

|

|

|

|

|

|

Note for Natural Persons:

If no proxy is declared, it shall be understood that you will participate

in person

at the General Meeting.

You are requested to fill in, sign and send this form to the Bank’s Subdivision for Governance of NBG Shareholder Register & Shareholder Affairs (93 Eolou St., Athens, ground floor) or to any branch of the Bank, or by fax to: +30 210334340

4

, +30 2103343410 and +30 2103343

095

, or by e-mail to inikol@nbg.gr at the latest by

Tuesday

27/06/201

7

, and for the 1st Repeat GM of 20/07/2017, by Monday 17/07/2017 at the latest, and for the 2nd Repeat GM of

0

7/09/2017, by Monday

0

4/09/2017 at the latest.

25

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

National Bank of Greece S.A.

|

|

|

|

|

|

|

|

|

/s/ Ioannis Kyriakopoulos

|

|

|

(Registrant)

|

|

|

|

|

Date: June 29

th

, 2017

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

/s/ George Angelides

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: June 29

th

, 2017

|

|

|

|

|

|

|

Director, Financial Division

|

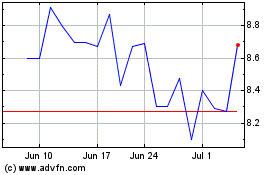

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

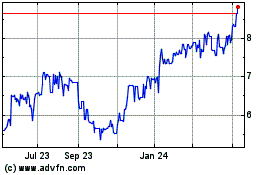

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Apr 2023 to Apr 2024