By Anne Steele, Sharon Terlep and Brent Kendall

Walgreens Boots Alliance Inc. and Rite Aid Corp. nixed their

$9.4 billion merger agreement, which had been heavily scrutinized

by antitrust regulators, and reached a new deal in which Walgreens

will buy half of Rite Aid's stores for $5.18 billion in cash.

The companies said the decision to spike the previous deal comes

after it got feedback from the Federal Trade Commission that the

merger likely wouldn't have gotten government approval.

FTC staff had not backed away from concerns that the deal would

have harmed competition, and the companies were facing the real

prospect of a legal challenge had they not terminated the deal,

according to people familiar with the matter.

Among the antitrust concerns was that the resulting drugstore

giant -- which would have challenged CVS Health Corp. -- would have

been able to bully pharmacy-benefit managers steering corporate and

government drug plans. The deal was announced in October 2015.

The new transaction terminates the previous deal, as well as

Rite Aid's agreement to sell 865 of its stores to regional chain

Fred's Inc. The new deal represents about half of the 4,523 stores

Rite Aid operated as of the end of the first quarter.

On a conference call Thursday, Walgreens Chief Executive Stefano

Pessina said the smaller transaction addresses 'all substantive'

FTC concerns. The company will be adding stores in regions where it

currently lacks a large presence, including the Northeast and

MidAtlantic. Asked whether that could be a concern for the FTC,

Walgreens General Counsel Marco Pagni said, "you should assume that

we have taken account of specific feedback in formulating the

plan."

The transaction would still leave two national drugstore chains

that dwarf a far smaller No. 3 player. The firms, however, also

compete with pharmacies at grocery chains and discounters like

Wal-Mart Stores Inc.

Tad Lipsky, the acting head of the FTC's bureau of competition,

said the FTC would review any new transaction proposed by the

parties.

Mr. Lipsky said commission staff "thoroughly investigated the

potential impact that the proposed Walgreens/Rite Aid merger may

have had on competition and evaluated a number of divestiture

proposals put forward by the parties." His statement declined to

offer further details of the FTC review.

Walgreens said it expects $400 million in cost savings from the

new deal within three to four years of closing, and said the

transaction will add to its adjusted earnings in the first

year.

Walgreens will pay Rite Aid a $325 million termination fee. Rite

Aid said it would use the cash to cut down its debt and shore up

its balance sheet.

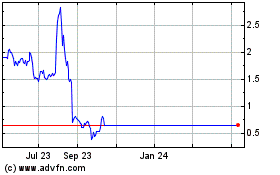

Shares of Rite Aid tumbled 22% in early trading while shares of

Walgreens added 3.8% to $80.02.

The five-member FTC is currently short-handed, with only two

commissioners, one Republican and one Democrat. But that hasn't

stopped the commission from taking action in some cases, including

earlier this month when it sued to block the proposed merger of

fantasy sports companies DraftKings Inc. and FanDuel Inc.

Walgreens-Rite Aid is the latest in a string of high-profile

deals to fall apart at the hands of regulators. Earlier this year,

two pairs of health insurers -- Aetna Inc. and Humana Inc. and

Anthem Inc. and Cigna Corp. -- said they would terminate their

mergers, worth a combined $82 billion, after courts sided with

regulators and found they violated antitrust law.

Last year, Pfizer Inc. abandoned its $150 billion takeover of

Allergan PLC after the Obama administration took aim at the deal,

which would have moved the U.S.'s biggest drug company to Ireland

and lowered its taxes. Halliburton Co. and Baker Hughes Inc. also

called off merger plans after they encountered regulatory

opposition on several continents. And a tie-up of Office Depot Inc.

and Staples Inc. was blocked in 2016 by a federal judge on the

grounds that it could lead to higher prices.

Both Rite Aid and Walgreens -- which has about 8,200 stores --

have a major presence in California, New York and Massachusetts,

while in other states, including Florida, Texas and Illinois, there

isn't any overlap.

In an attempt earlier this year to assuage regulators, the two

companies had agreed to sell as many as 1,200 of Rite Aid's 4,600

locations.

The FTC has increased its scrutiny of buyers of divested assets

since a high-profile settlement in 2015 quickly went sour. In that

matter, the FTC allowed the acquisition of supermarket operator

Safeway Inc. by the owner of Albertsons after the companies agreed

to sell 168 stores, mostly to a small grocery chain, Haggen

Holdings LLC.

Haggen struggled with the expansion and filed for bankruptcy

protection in a matter of months. Albertsons eventually bought back

some of the stores the government had required it to sell.

Fred's operates 601 pharmacy and retail stores mainly in the

southeastern U.S.

In a statement, Fred's called the termination a "disappointing

outcome," but that it has no impact on the company's transformation

strategy. Shares of Fred's, which said the acquisition of 865 of

Rite Aid's stores would "accelerate our transformation, not define

it," dropped 23%; the stock had jumped sharply when the deal to buy

stores was announced.

Write to Anne Steele at Anne.Steele@wsj.com, Sharon Terlep at

sharon.terlep@wsj.com and Brent Kendall at

brent.kendall@wsj.com

(END) Dow Jones Newswires

June 29, 2017 10:17 ET (14:17 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024