Companies Pressed to Disclose More Climate-Change Risk

June 29 2017 - 2:29AM

Dow Jones News

By Sarah Kent

LONDON -- A panel of large financial institutions and companies

has launched a set of voluntary guidelines for more disclosure

about the impact of climate change, demonstrating rising concern

about potential investment risks posed by global warming.

The task force commissioned by a group of global regulators

known as the Financial Stability Board and led by former New York

City Mayor Michael Bloomberg said companies should disclose in

financial filings how they are planning for risks and opportunities

related to climate change. It also called for companies to develop

specific metrics and targets that could be used to measure

performance.

Climate-change risks have become an increasingly mainstream

concern for financial institutions and big companies, which see

both a real menace from global warming and a regulatory threat from

governments seeking to lessen its impact. The task force included

executives from J.P. Morgan Chase & Co., mining giant BHP

Billiton Ltd., and other large companies.

The recommendations have support from over 100 firms with market

capitalizations totaling more than GBP3.3 trillion and financial

firms responsible for more than $24 trillion worth of assets, the

task force said. The report will be presented to the G-20 in

July.

The recommendations' "widespread adoption will ensure that the

effects of climate change become routinely considered in business

and investment decisions," said Mark Carney, the Bank of England

governor and chairman of the Financial Stability Board.

Not everyone has welcomed the panel's work. A recent report by

IHS Markit funded by oil companies including BP PLC, Chevron Corp.

and Total SA warned that recommendations contained in an earlier

draft of the task force's report "could obscure material

information and create a false sense of certainty around the

financial implications of climate-related risks."

The task force's report, which took over a year to compile,

extends its recommendations for more disclosure to all public

companies. But the panel singled out the energy industry as one of

four sectors most at risk from climate change that should consider

providing more information to investors.

Last month, Exxon Mobil Corp. faced a revolt when 62% of its

investors voted in favor of a resolution calling for more

information about how climate change and regulations could affect

it, despite management objections. Exxon declined to comment. Chief

Executive Darren Woods previously said the company would "step back

and reflect" on how it could better express its position.

Faced with a similar vote, Chevron published a report on its

approach to managing climate risks in March. The company said it

uses a similar framework to the one recommended by Mr. Bloomberg's

task force.

"We believe Chevron's risk management and planning processes are

effectively managing the current risk exposure to the Company," a

spokeswoman said. "The current risk from climate change regulation,

even in a restricted greenhouse gas scenario, is minimal and

manageable over time."

A major criticism from investors is that many big operators are

making claims similar to Chevron's: that their assets and strategic

capabilities will allow them to win out in even the most severe of

climate-change scenarios. The fact that most say they will be among

the last oil-and-gas companies standing has prompted calls for

greater transparency and more standardized reporting.

In Europe, some big oil companies have embraced demands for more

climate disclosure. Royal Dutch Shell PLC and BP PLC both endorsed

proposals asking for more disclosure on climate change risk in

2015.

Shell welcomed the task force's report but warned that detailed

disclosure of forward-looking and potentially commercially

sensitive information within official financial filings could be

difficult.

"Companies should be clear about how they plan to be resilient

in the face of climate change and energy transition," said Shell

Chief Ben van Beurden.

In the U.S., shareholder support for more disclosure from

oil-and-gas companies revealed in recent weeks is largely

nonbinding.

The calls for more disclosure and transparency come even as the

Trump administration says it is pulling the U.S. from the Paris

climate accord, citing the need to boost the nation's industry and

independence.

"This was done by industry for industry, and there are

compelling reasons for companies to begin this journey," said Mary

Schapiro, a former Securities and Exchange Commissioner chairman

who is advising Mr. Bloomberg. "In the U.S. I have no expectation

that there will be a regulatory framework around these

recommendations."

The pressure from some regulators has begun to mount. The Bank

of England said earlier this month that it will probe the U.K.

banking sector's exposure to climate change. Others, including

Dutch, Swedish and German authorities have also been examining the

financial risks presented by the environment.

--Bradley Olson in Houston contributed to this article.

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

June 29, 2017 02:14 ET (06:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

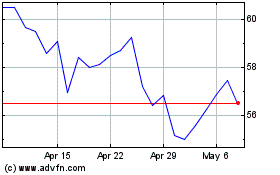

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

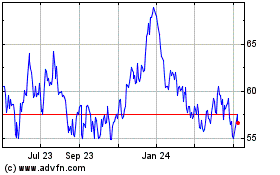

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024