Capital One Gets 'Conditional' Passing Grade on Fed Stress Test -- 2nd Update

June 28 2017 - 5:41PM

Dow Jones News

By AnnaMaria Andriotis and Christina Rexrode

The Federal Reserve conditionally approved Capital One Financial

Corp.'s capital plan in the regulator's annual "stress tests,"

saying the firm will have to resubmit its plan later this year to

address shortcomings in its process.

Capital One's plan was approved Wednesday after the Fed found

the bank could keep lending in a severe economic downturn. The

approval clears the way for the firm to reward investors by

returning more capital.

But the Fed didn't give Capital One a clean pass. Rather, the

firm received a "conditional non-objection" after the Fed said

Capital One "exhibited material weaknesses in its capital planning

practices." Capital One must resubmit its plan by Dec. 28. If the

revised plan doesn't satisfy the Fed, the regulator said that it

may restrict the firm's capital distributions.

However, Capital One was also one of just two firms to revise

lower its capital-return request since results from the first round

of stress tests were released last week. If it hadn't revised its

request, its hypothetical common equity Tier 1 ratio would have

fallen to 5.6%.

It wasn't immediately clear why Capital One revised its request

since its initial results didn't breach any of the Fed's required

minimum capital ratios.

The other firm to revise its request lower was American Express

Co.

The bank is "fully committed to addressing the Federal Reserve's

concerns with our capital planning process in a timely manner."

said Richard Fairbank, Capital One chairman and chief executive

officer, in a company statement. The bank said it expects to

maintain its quarterly dividend of 40 cents per share, subject to

board approval. Its board has approved the repurchase of up to

$1.85 billion of shares of the company's common stock beginning in

the third quarter of 2017 through the second quarter of 2018.

In after-hours trading, following the stress-test results,

shares of Capital One fell 2.3% to $81.05.

The Fed's test report criticized Capital One's senior management

for not being "in a position to provide the firm's board of

directors with a reliable assessment upon which to determine the

reasonableness of the capital plan." Capital One's capital plan

didn't appropriately take into account the potential impact of the

risks in one of its most material businesses, according to the Fed,

which didn't specify which business. The report added that the

bank's internal controls didn't identify those issues.

Capital One was the only bank to receive conditional approval.

But other banks have received similar results in years past,

including Morgan Stanley last year. Its revised plan was eventually

accepted.

This is the latest in a string of run ins with regulators for

Capital One. That has included a consent order with the Office of

the Comptroller of the Currency over deficiencies in its

anti-money-laundering program. In February, Capital One disclosed

that it was under investigation by the New York District Attorney's

Office, the Justice Department and the Treasury Department's

Financial Crimes Enforcement Network for similar issues. The

company has said it is cooperating with the agencies.

The stress tests measure how the banks would fare in a severe

recession. The results did find that Capital One has the capital to

keep lending in a severe economic downturn. At the low point of a

hypothetical recession, Capital One's common equity Tier 1 ratio

would be 5.9%, exceeding the 4.5% level the Fed views as a minimum,

the central bank estimated.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Christina Rexrode at christina.rexrode@wsj.com

(END) Dow Jones Newswires

June 28, 2017 17:26 ET (21:26 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

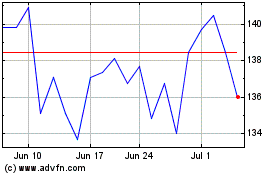

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

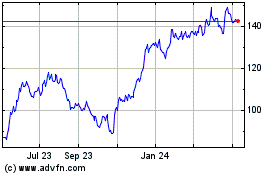

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024