American Express Plans to Increase Quarterly Dividend by 9 Percent & Buy Back up to $4.4 Billion of Common Shares Through Q2 ...

June 28 2017 - 4:36PM

Business Wire

American Express Company (NYSE: AXP) said today that the Board

of Governors of the Federal Reserve System did not object to its

adjusted capital plan submitted as part of the 2017 Comprehensive

Capital Analysis and Review (CCAR). The plan included:

- Increasing the Company’s quarterly

dividend to 35 cents per share beginning with the third quarter

2017 dividend declaration, subject to approval by the Company’s

board of directors;

- Repurchasing up to $4.4 billion of

common shares during the CCAR approval period of Q3’17 to Q2’18.

This compares to an authorization of $3.3 billion for the same

period twelve months earlier. This new authorization enables the

Company to repurchase up to $4.3 billion of common shares in

calendar year 2017, and up to an additional $1.7 billion in the

first half of 2018.

The timing and amount of common shares purchased under the

Company’s authorized capital plans will depend on various factors,

including the Company’s business plans, financial performance and

market conditions. Repurchase of common shares will be pursuant to

the share repurchase program previously authorized by the Company’s

board of directors on September 26, 2016.

As required under the Dodd-Frank Wall Street Reform and Consumer

Protection Act, the Company has also published on June 22, 2017 a

summary of the results of the Company-run stress tests performed

under the Federal Reserve’s severely adverse scenario. These

disclosures do not reflect the capital plan described above, but

reflect certain assumptions and capital actions as required under

the Federal Reserve’s rules.

The results are available on the Company’s Investor Relations

site at ir.americanexpress.com.

About American Express

American Express is a global services company, providing

customers with access to products, insights and experiences that

enrich lives and build business success. Learn more at

americanexpress.com, and connect with us on

facebook.com/americanexpress, instagram.com/americanexpress,

linkedin.com/company/american-express, twitter.com/americanexpress,

and youtube.com/americanexpress.

Key links to products, services and corporate responsibility

information: charge and credit cards, business credit cards, Plenti

rewards program, travel services, gift cards, prepaid cards,

merchant services, Accertify, corporate card, business travel, and

corporate responsibility.

This release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements are based on the Company’s expected business and

financial performance and are subject to risks and uncertainties.

Actual results may differ from those set forth in the

forward-looking statements due to a variety of factors, including

those contained in the Company's Annual Report on Form 10-K for the

year ended December 31, 2016, the Company’s Quarterly Report on

Form 10-Q for the quarter ended March 31, 2017 and the Company’s

other filings with the Securities and Exchange Commission. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they are made.

The Company undertakes no obligation to update or revise any

forward-looking statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170628006420/en/

Media:Marina H. Norville,

+1.212.640.2832marina.h.norville@aexp.comorInvestors/Analysts:Toby

Willard, +1.212.640.5574sherwood.s.willardjr@aexp.comorShreya

Patel, +1.212.640.5574shreya.patel@aexp.com

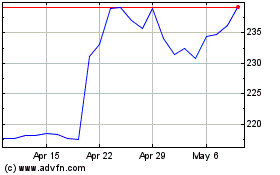

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

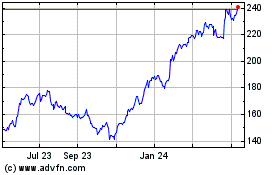

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024