UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

|

|

|

|

þ

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the fiscal year ended December 31, 2016

|

|

OR

|

|

|

|

|

¨

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the transition period from to

|

Commission File Number 1-3526

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

AGL Resources Inc. Retirement Savings Plus Plan

|

|

|

|

B.

|

Name of the issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

The Southern Company

30 Ivan Allen Jr. Boulevard, NW

Atlanta, Georgia 30308

AGL Resources Inc. Retirement Savings Plus Plan

Financial Statements and Supplemental Schedule

As of December 31, 2016 and 2015 and

For the Year Ended December 31, 2016

AGL Resources Inc. Retirement Savings Plus Plan

Table of Contents

_________________________________________________________________________________________________

|

|

|

|

|

|

|

|

|

Page(s)

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

1

|

|

|

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

As of December 31, 2016 and 2015

|

2

|

|

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2016

|

3

|

|

|

|

|

|

|

|

Notes to Financial Statements

|

4 - 10

|

|

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

|

|

Schedule H, line 4(i) – Schedule of Assets (Held at End of Year)

As of December 31, 2016

|

12

|

|

|

|

|

|

|

|

Signature

|

13

|

|

|

|

|

|

|

|

Exhibit Index

|

14

|

|

|

|

|

|

|

Note:

|

Other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are not applicable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BDO

|

|

Tel: 404-688-6841

Fax: 404-688-1075

www.bdo.com

|

|

1100 Peachtree Street, Suite 700

Atlanta, GA 30309

|

Report of Independent Registered Public Accounting Firm

To the Plan Administrator

AGL Resources Inc. Retirement Savings Plus Plan

Atlanta, Georgia

We have audited the accompanying statements of net assets available for benefits of the AGL Resources Inc. Retirement Savings Plus Plan (the “RSP Plan”) as of December 31, 2016 and 2015, and the related statement of changes in net assets available for benefits for the year ended December 31, 2016. These financial statements are the responsibility of the RSP Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The RSP Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the RSP Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the RSP Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the year ended December 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

The accompanying supplemental schedule of Schedule H, line 4(i) – Schedule of Assets (Held at End of Year) as of December 31, 2016 has been subjected to audit procedures performed in conjunction with the audit of the RSP Plan’s financial statements. The supplemental schedule is the responsibility of the RSP Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ BDO USA, LLP

Atlanta, Georgia

June 28, 2017

AGL Resources Inc.

Retirement Savings Plus Plan

Statements of Net Assets Available for Benefits

As of December 31, 2016 and 2015

______________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Assets:

|

|

|

|

|

Investments, at fair value:

|

|

|

|

|

Registered investment companies

|

$

|

561,782,426

|

|

|

$

|

419,878,685

|

|

|

Collective trust

|

76,888,203

|

|

|

62,148,355

|

|

|

Southern Company common stock

|

61,828,848

|

|

|

-

|

|

|

AGL Resources Inc. common stock

|

-

|

|

|

183,772,254

|

|

|

Total investments

|

700,499,477

|

|

|

665,799,294

|

|

|

Receivables:

|

|

|

|

|

Notes receivable from participants

|

13,319,952

|

|

|

13,213,254

|

|

|

Employer contributions

|

2,131,921

|

|

|

1,929,628

|

|

|

Participant contributions

|

755,066

|

|

|

721,813

|

|

|

Due from broker for securities sold

|

72,745

|

|

|

51,660

|

|

|

Total receivables

|

16,279,684

|

|

|

15,916,355

|

|

|

Accrued interest

|

20,887

|

|

|

20,886

|

|

|

Net assets available for benefits

|

$

|

716,800,048

|

|

|

$

|

681,736,535

|

|

The accompanying notes are an integral part of these financial statements.

2

AGL Resources Inc. Retirement Savings Plus Plan

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2016

|

|

|

|

|

|

|

|

|

2016

|

|

Additions:

|

|

|

Investment income

|

$

|

45,481,808

|

|

|

Interest income on notes receivable from participants

|

550,278

|

|

|

Contributions:

|

|

|

Participant

|

26,515,096

|

|

|

Employer

|

15,889,206

|

|

|

Rollover

|

1,504,157

|

|

|

Total contributions

|

43,908,459

|

|

|

Total additions

|

89,940,545

|

|

|

Deductions:

|

|

|

Benefits paid to participants

|

(55,194,536

|

)

|

|

Administrative expenses

|

(183,644

|

)

|

|

Total deductions

|

(55,378,180

|

)

|

|

Net increase before transfers in from related plan

|

34,562,365

|

|

|

Transfers in from related plan

|

501,148

|

|

|

Net increase after transfers in from related plan

|

35,063,513

|

|

|

Net assets available for benefits:

|

|

|

Beginning of year

|

681,736,535

|

|

|

End of year

|

$

|

716,800,048

|

|

The accompanying notes are an integral part of these financial statements.

3

AGL Resources Inc. Retirement Savings Plus Plan

Notes to Financial Statements

The following description of the AGL Resources Inc. Retirement Savings Plus Plan (the “RSP Plan”) is provided for general information. Participants should refer to the RSP Plan document for a more complete description of the RSP Plan’s provisions.

General

The RSP Plan is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). Generally, all regular full-time and part-time employees of Southern Company Gas (the “Company”) (formerly known as AGL Resources Inc.) and its subsidiaries are eligible to participate in the RSP Plan after receiving their first paycheck. Leased employees, interns, co-op students and union employees whose collective bargaining agreements do not provide for participation in the RSP Plan are not eligible to participate.

The RSP Plan consists of both a profit sharing plan and an employee stock ownership plan (“ESOP”). The ESOP consists of the portion of the RSP Plan which is invested in The Southern Company (“Southern Company”) common stock or that was invested in AGL Resources Inc. common stock prior to the merger on July 1, 2016 described below. Both the ESOP and the non-ESOP portions of the RSP Plan are intended to constitute a single plan.

On June 28, 2013, assets from the Nicor Companies Savings Investment Plan (the “SIP Plan”) merged into the RSP Plan. Participants in the SIP Plan became immediately eligible to participate in the RSP Plan. These participants included employees hired at Northern Illinois Gas Company (doing business as Nicor Gas Company) and Pivotal Home Solutions, and collectively are referred to as “Nicor participants.”

On July 1, 2016, the Company completed its previously announced merger with Southern Company and became a wholly-owned, direct subsidiary of Southern Company. On the effective date of the merger, each share of AGL Resources Inc. common stock converted to a cash payment of $66 per share. The cash proceeds for the stock were held in a temporary money market fund until the participants reallocated the funds. If a participant did not reallocate the funds by September 1, 2016, the amount in the temporary money market fund was moved to the RSP Plan’s qualified default investment fund. Effective with the acquisition, Southern Company Services, Inc. (“SCS”) became the Plan Sponsor and assumed responsibility for administration of the RSP Plan.

RSP Plan Merger

The Board of Directors of the Plan Sponsor approved a merger of the RSP Plan into The Southern Company Employee Savings Plan effective January 1, 2018. All participants in the RSP Plan will become participants in The Southern Company Employee Savings Plan at that time. The eligibility for participants will not change as a result of the RSP Plan merger.

Administration

The RSP Plan is administered by The Southern Company Benefits Administration Committee (the “Committee”), which is appointed by the Company’s Board of Directors. The Committee has the sole discretion and authority to interpret the provisions of the RSP Plan, including determinations as to eligibility, amounts of benefits payable, and the resolution of all factual questions arising in connection with the administration of the RSP Plan.

The Committee has engaged Bank of America, N.A. (“Trustee”) to maintain a trust under which contributions to the RSP Plan are invested in various investment funds and Southern Company common stock. Merrill Lynch, Pierce, Fenner & Smith, Incorporated (“Merrill Lynch”) serves in the role of record keeper and custodian for the RSP Plan.

Contributions

Employee Contributions

. Participants may elect to make either before-tax contributions, Roth after-tax contributions, traditional after-tax contributions, or a combination thereof. The amount a participant elects to contribute is withheld from his or her compensation through payroll deductions, and such contributions are transferred by the Company to the Trustee of the RSP Plan at each payroll period and credited to the participant’s account as soon as administratively practicable after such transfer. An automatic before-tax contribution deferral of 3% of eligible compensation is generally provided for employees hired or rehired on or after January 1, 2012, when no other election is made. The automatic enrollment will become effective on the first day of the first full pay period beginning 30 days after

AGL Resources Inc. Retirement Savings Plus Plan

Notes to Financial Statements

the eligible new employee enters the RSP Plan. Effective January 1, 2018, the automatic deferral election for new hires will be 6%.

Participants who have attained age 50 before the end of the RSP Plan year are eligible to make additional catch-up contributions. The RSP Plan also accepts certain rollover contributions representing distributions from other qualified plans. Participants direct the investment of their contributions, Company contributions and account balances into various investment options offered by the RSP Plan. To the extent a participant does not elect to invest their account balances in any investment fund, the RSP Plan has designated a qualified default investment fund. Maximum contributions cannot exceed limits as set forth in the Internal Revenue Code (“IRC”).

Company Contributions.

Generally, on behalf of each participant who makes before-tax and/or Roth after-tax contributions, the Company makes a matching contribution each payroll period. The Company also makes a matching contribution on traditional after-tax contributions for Nicor participants each payroll period.

|

|

|

|

•

|

Participants eligible for the legacy AGL defined benefit pension plan receive a matching contribution equal to 65% of the participant’s before-tax and Roth after-tax contributions up to 8% of the participant’s compensation. Effective January 1, 2018, the matching contribution will change to 100% of the participant’s first 4% of contributions and 55% of the next 2% of contributions and will also apply to traditional after-tax contributions.

|

|

|

|

|

•

|

Participants not eligible for the legacy AGL defined benefit pension plan (including Nicor participants) receive a matching contribution equal to 100% of the participant’s first 3% of contributions and 75% of the participant’s next 3% of contributions. Effective January 1, 2018, the matching contribution will change to 100% of the participant’s first 4% of contributions and 55% of the next 2% of contributions and will also apply to traditional after-tax contributions.

|

|

|

|

|

•

|

For employees who are not eligible to accrue benefits under a defined benefit pension plan, the Company makes a non-discretionary annual profit sharing contribution of 1.5% of the participant’s eligible pay. To be eligible, an employee must be either employed on the last day of the plan year or have terminated employment during the year due to death, disability, or retirement. Nicor participants must also have completed a year of service to begin receiving this contribution. The Company will make a final non-discretionary annual profit sharing contribution for the 2017 plan year. Effective January 1, 2018, this group of employees and new hires will be eligible to participate in The Southern Company Pension Plan via a 5.5% cash balance formula.

|

Participant Accounts

Each participant’s account is credited with the participant’s contributions and allocations of the Company’s matching contributions, as well as allocations of the Company’s non-discretionary annual profit sharing contribution, and RSP Plan earnings. Participant accounts are charged with an allocation of administrative expenses that are paid by the RSP Plan. Allocations are based on participant earnings, account balances, or specific participant transactions. A participant is entitled to the benefits that can be provided from the participant’s vested account.

Vesting

A participant’s contributions and earnings thereon, and all Southern Company common stock dividends are vested immediately. The Company’s contributions and earnings thereon are vested upon occurrence of any one of the following:

|

|

|

|

•

|

Completion of three years of vesting service;

|

|

|

|

|

•

|

Attainment of age 65 while employed by the Company;

|

|

|

|

|

•

|

Eligible to receive benefits under the Company’s Long-Term Disability Plan; or

|

|

|

|

|

•

|

Death while employed by the Company.

|

AGL Resources Inc. Retirement Savings Plus Plan

Notes to Financial Statements

Partial vesting of the Company’s contributions occurs during the three years of vesting service as follows:

AGL participants must complete 1,000 hours of service during the RSP Plan year to receive a year of vesting service. Nicor participants receive a year of vesting service on each anniversary of employment.

Effective January 1, 2018, active participants will become 100% vested in their account balance and future Company contributions.

Withdrawals

A participant’s traditional after-tax contributions (including earnings) may be withdrawn. Participants also may be eligible for hardship withdrawals from their before-tax contributions and Roth after-tax contributions (but not the earnings on those contributions earned after 1988) if they meet certain “immediate and heavy financial need” hardship requirements. An additional 10% income tax generally will be imposed on the taxable portion of the withdrawal unless the participant has reached age 59½ (or has satisfied certain other criteria established in the IRC) at the time of withdrawal. Additionally, participants over age 59½ are permitted to take a distribution from the RSP Plan without an early withdrawal penalty.

Distribution of Benefits

The RSP Plan provides that distribution of benefits may be made as soon as practicable after an employee’s death, disability, or separation from service. If the vested account balance is $1,000 or less, the RSP Plan may make an immediate distribution without the consent of the participant. For balances of more than $1,000 but not over $5,000, if participants do not choose a method of distribution, the account balance will be automatically rolled over by the RSP Plan to an individual retirement account with Merrill Lynch upon separation of service. Otherwise, a participant may delay the distribution of his or her account until the date the participant reaches age 70 ½.

A participant’s distribution may be made in a single sum of cash. Partial distributions, and monthly, quarterly, semi-annual, or annual installments of a fixed amount or period are also allowed. To the extent a participant’s account is invested in Southern Company common stock on the date of distribution, at the option of the participant, the distribution may be made in the form of whole shares of Southern Company common stock (and cash representing any fractional share).

Distributions of cash or Southern Company common stock from a participant’s account (other than amounts attributable to the participant’s Roth after-tax contributions and traditional after-tax contributions) which are made upon the participant’s termination of employment, disability or death, generally will be taxable in the year of distribution. Such distributions generally will be subject to 20% federal income tax withholding.

Notes Receivable from Participants

Participants may borrow from their participant accounts. Such borrowings represent loans to the participant and notes receivable to the RSP Plan. The minimum loan amount to a participant is $1,000 and may not exceed the lesser of either the limit established by the Committee or the lesser of (i) $50,000 minus the participant’s highest outstanding loan balance during the previous twelve months, (ii) 50% of the participant’s vested account balance less the participant’s current outstanding loan, or (iii) 50% of the participant’s vested account balance. Participants generally repay loans through payroll withholdings over a period not to exceed 5 years, except for residential loans, which may not exceed 10 years. The currently outstanding notes receivable from participants are secured by the vested portion of the participant’s account and bear interest at fixed rates that range from 3.25% to 9.25%. The rate of interest is established at the date of the loan

AGL Resources Inc. Retirement Savings Plus Plan

Notes to Financial Statements

and is based on the prime rate plus 1%. The interest rate remains fixed over the life of the loan and interest is computed monthly.

A participant may not have more than two loans outstanding at any time, and only one can be residential. In the event that a participant terminates employment for any reason, any outstanding loan balance(s) will become due and payable in full at that time. The RSP Plan provides that the Committee may take certain actions (as appropriate) to allow the participant to cure a default on a RSP Plan loan.

Forfeited Accounts

Any forfeited amounts resulting from employee terminations prior to completion of the vesting period may be used to reduce future Company contributions or may be applied to RSP Plan expenses incurred with respect to administering the RSP Plan. Forfeited non-vested accounts totaled $2,156 at December 31, 2016 and $4,566 at December 31, 2015. The RSP Plan used $136,654 of the forfeited non-vested account balances to decrease Company contributions in 2016.

Administrative Expenses

Loan origination and maintenance fees associated with notes receivable from participants, overnight check service fees, and the RSP Plan’s investment advisory and shareholder servicing fees are paid by the RSP Plan and are reflected in the financial statements as administrative expenses. Investment management fees are charged to the RSP Plan as a reduction of investment return and included in the investment income reported by the RSP Plan. All other expenses of the RSP Plan are paid by the Company.

|

|

|

|

2.

|

Summary of Accounting Policies

|

Basis of Accounting

The accompanying financial statements are prepared on the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires the RSP Plan’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Investment Valuation

The RSP Plan’s investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The RSP Plan’s investment committee determines the RSP Plan’s valuation policies utilizing information provided by the investment advisors and custodians. See Note 3 - Fair Value Measurements for discussion of fair value.

Income Recognition

Purchases and sales of securities are recorded on a trade basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

The RSP Plan presents, in the Statement of Changes in Net Assets Available for Benefits, the net change in the fair value of its investments as investment income, which consists of the realized gains or losses and the unrealized appreciation or depreciation of those investments.

Payment of Benefits

Benefits are recorded when paid.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is reported on the accrual basis. No allowance for credit loss has been recorded as of December 31, 2016 or 2015. If a participant ceases to make loan repayments and the RSP Plan administrator deems the participant loan to be in default, the participant loan balance is taxable and, if the participant is eligible to receive a distribution, a benefit payment is recorded.

AGL Resources Inc. Retirement Savings Plus Plan

Notes to Financial Statements

Accounting Standard Adopted in 2016

In May 2015, the Financial Accounting Standards Board (“FASB”) issued authoritative guidance on disclosures for entities that calculate net asset value (“NAV”) per share for investments. The update removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the NAV per share practical expedient. The update also removes the requirement to make certain disclosures for all investments that are eligible to be measured at fair value using the NAV per share practical expedient. Investments that calculate NAV per share (or its equivalent), but for which the practical expedient is not applied, continue to be included in the fair value hierarchy along with the related required disclosures. This guidance became effective for the RSP Plan on January 1, 2016 and impacted disclosures only.

|

|

|

|

3.

|

Fair Value Measurements

|

As defined in authoritative guidance related to fair value measurements and disclosure, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The guidance establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement).

The three levels of the fair value hierarchy defined by the guidance are as follows:

|

|

|

|

Level 1

|

Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. Active markets are those in which transactions for the assets or liabilities occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

|

|

|

|

|

Level 2

|

Pricing inputs are other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date.

|

|

|

|

|

Level 3

|

Pricing inputs include significant unobservable inputs that are used to determine management’s best estimate of fair value from the perspective of market participants.

|

The asset or liability fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques maximize the use of relevant observable inputs and minimize the use of unobservable inputs.

It is important to note that the principal market and market participants should be considered from the reporting entity’s perspective, as differences may occur between and among entities with differing activities.

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2016 and 2015.

Common Stock

Shares of AGL Resources Inc. and Southern Company common stock are valued at the closing price per unit on each business day on the active market in which the securities are traded.

Collective Trust

The collective trust provides participants a stable value investment option that simulates the performance of a guaranteed investment contract and invests primarily in a pool of investments, including contracts that are issued by insurance companies and commercial banks and in contracts that are backed by high quality bonds, bond trusts and bond mutual funds. Depending on the type of underlying investment, fair value is comprised of: i) the expected future cash flows for each contract discounted to present value, ii) the aggregate NAV of the underlying investments in mutual funds and bond trusts as determined by their quoted market prices and iii) the value of wrap contracts, if any. The collective trust uses the practical expedient to measure fair value at NAV of the fund’s participation units as reported in the audited financial statements of the fund. The fund generally provides for daily redemptions at reported NAV per share with no advance notification requirements.

AGL Resources Inc. Retirement Savings Plus Plan

Notes to Financial Statements

Registered Investment Companies

Registered investment companies are valued at the NAV of shares held by the RSP Plan each business day.

The methods described above may provide a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. While the RSP Plan believes its valuation methods are appropriate and consistent with other market participants, it is possible that different fair value measurements may arise due to the use of different methodologies or assumptions in determining the fair value measurement at the reporting date.

The fair value of the RSP Plan’s investments measured on a recurring basis is categorized in the table below based upon the valuation inputs as of December 31, 2016 and 2015. There were no Level 2 or 3 inputs at December 31, 2016 and 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

NAV

|

|

Total

|

|

December 31, 2016

|

|

|

|

|

|

|

|

Registered investment companies (1)

|

|

$

|

561,782,426

|

|

|

$

|

—

|

|

|

$

|

561,782,426

|

|

|

Collective trust (2)(3)

|

|

—

|

|

|

76,888,203

|

|

|

76,888,203

|

|

|

Southern Company common stock

|

|

61,828,848

|

|

|

—

|

|

|

61,828,848

|

|

|

Total investments at fair value

|

|

$

|

623,611,274

|

|

|

$

|

76,888,203

|

|

|

$

|

700,499,477

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

Registered investment companies

|

|

$

|

419,878,685

|

|

|

$

|

—

|

|

|

$

|

419,878,685

|

|

|

AGL Resources Inc. common stock

|

|

183,772,254

|

|

|

—

|

|

|

183,772,254

|

|

|

Collective trust (2)(3)

|

|

—

|

|

|

62,148,355

|

|

|

62,148,355

|

|

|

Total investments at fair value

|

|

$

|

603,650,939

|

|

|

$

|

62,148,355

|

|

|

$

|

665,799,294

|

|

|

|

|

|

(1)

|

On the effective date of the merger between AGL Resources Inc. and Southern Company, each share of AGL Resources Inc. common stock converted to a cash payment of $66 per share. The cash proceeds for the stock were held in a temporary money market fund until the participants reallocated the funds. If a participant did not reallocate the funds by September 1, 2016, the amount in the temporary money market fund was moved to the RSP Plan’s qualified default investment fund.

|

|

|

|

|

(2)

|

Certain investments measured at NAV per unit (or its equivalent) have not been classified in the fair value hierarchy. The fair value amounts presented are intended to permit reconciliation of the fair value hierarchy to the Statements of Net Assets Available for Benefits.

|

|

|

|

|

(3)

|

Measured using the NAV per unit (or its equivalent) as a practical expedient and held in a fund that files a Form 5500, Annual Return/Report of Employee Benefit Plan, as a direct filing entity.

|

The Company has the right under the RSP Plan to discontinue its contributions at any time and to terminate the RSP Plan subject to the provisions of ERISA. In the event of the RSP Plan termination, participants would become 100% vested in their employer contributions and earnings thereon. Refer to Note 1 “RSP Plan Merger” for additional information.

The Internal Revenue Service (“IRS”) has determined and informed the Company by a letter dated May 29, 2014, that the RSP Plan and related trust are designed in accordance with applicable sections of the IRC. The RSP Plan has been amended since the IRS made its determination. The RSP Plan administrator and tax counsel believe that the RSP Plan and related trust are designed and are currently being operated in compliance with the applicable requirements of the IRC; and therefore believe the RSP Plan is qualified and the related trust is tax exempt.

U.S. GAAP requires RSP Plan management to evaluate tax positions taken by the RSP Plan and recognize a tax liability (or asset) if the RSP Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The RSP Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

|

|

|

|

6.

|

Transfers In from Related Plan

|

When the employment status of a participant changes from a position covered by a collective bargaining agreement that participates in the Nicor Gas Thrift Plan (“Thrift Plan”) to becoming eligible for the RSP Plan, eligibility for participation shifts between the Thrift Plan and the RSP Plan. When eligibility changes, the account balance of the participant is transferred to the related plan. Amounts transferred in to the RSP Plan from the Thrift Plan were $501,148 in 2016.

AGL Resources Inc. Retirement Savings Plus Plan

Notes to Financial Statements

|

|

|

|

7.

|

Related Party Transactions and Party-in-Interest Transactions

|

ERISA defines a party-in-interest to include fiduciaries or employees of the RSP Plan, any person who provides service to the RSP Plan, and an employee organization whose members are covered by the RSP Plan, a person who owns 50% or more of such an employer or employee association or relative of such persons.

Notes receivable from participants qualify as party-in-interest transactions, which are exempt from the prohibited transaction rules.

Fees incurred by the RSP Plan for the investment management services are included in investment income, as they are paid through revenue sharing, rather than a direct payment. Certain administrative functions are performed by officers or employees of the Company and its affiliates. No such officer or employee receives compensation from the RSP Plan. The Company pays directly any other fees related to the RSP Plan’s operations.

The RSP Plan allows participants to direct investments in the common stock of the RSP Plan Sponsor’s parent company. At December 31, 2016, the RSP Plan held 1,256,939 shares of Southern Company common stock with a fair value of $61,828,848. The RSP Plan recorded dividend income of $766,769 in 2016 related to Southern Company common stock.

At December 31, 2015, the RSP Plan held 2,879,991 shares of AGL Resources Inc. common stock with a fair value of $183,772,254. The RSP Plan recorded dividend income of $2,609,983 in 2016 related to AGL Resources Inc. common stock.

|

|

|

|

8.

|

Risks and Uncertainties

|

The RSP Plan invests in various investment securities, including Southern Company common stock. Investment securities, in general, are exposed to various risks such as interest rate, liquidity, credit and overall market volatility. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

Supplemental Schedule

AGL Resources Inc. Retirement Savings Plus Plan

Schedule H, line 4(i) – Schedule of Assets (Held at End of Year)

As of December 31, 2016 (EIN No. 63-0274273 / Plan Number 202)

Former EIN No. 58-2210952 / Plan Number 003

Signature

The RSP Plan

. Pursuant to the requirements of the Securities Exchange Act of 1934, the Benefits Administration Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

AGL RESOURCES INC. RETIREMENT SAVINGS PLUS PLAN

|

|

|

|

|

|

|

|

|

|

|

|

Date:

June 28, 2017

|

/s/ Nancy E. Sykes

|

|

|

Nancy E. Sykes, Chair

The Southern Company

Benefits Administration Committee

|

Exhibit Index

|

|

|

|

|

|

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

|

|

|

|

23

|

|

Consent of BDO USA, LLP

|

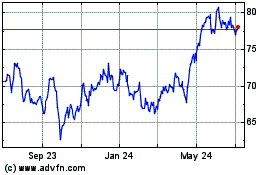

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

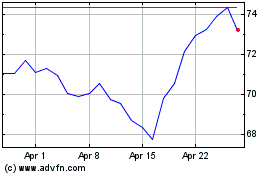

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024