Yogurt Declines Continue to Hurt General Mills

June 28 2017 - 8:34AM

Dow Jones News

By Austen Hufford

General Mills Inc.'s new chief executive said he would invest in

turning its sales declines around as struggling yogurt sales

continue to weigh on the company.

Revenue "fell well short of our standards," Chief Executive Jeff

Harmening said in a statement. "Our entire organization is moving

with urgency" to improve sales trends.

The Minneapolis-based food giant also acknowledged that margin

growth would suffer as it invests in efforts to restore sales

growth.

Still, shares were flat in premarket trading as the company's

latest quarterly results beat Wall Street expectations.

Gross margin fell to 34.7% in the quarter from 35.1%, as

unfavorable commodity impacts offset cost savings.

The company expects organic net sales, which excludes currencies

and deals, to continue to fall in the new fiscal year, declining 1%

to 2% in all. Organic sales fell 3% in the company's just-completed

fourth quarter.

Mr. Harmening recently took the top job at General Mills after

completing a transition plan where he pushed deals that targeted

consumer's hunger for fresh and natural foods.

The industry has been working to adapt to consumers who are

increasingly looking for healthier and fresher brands.

Lower food costs and other savings helped General Mills and its

peers deliver solid earnings on lower revenues for a time. Now

sales declines are catching up with them, and falling food prices

are sparking price wars on some products.

In the quarter, General Mills' North American retail sales fell

3%, driven by a double-digital fall in yogurt.

General Mills in recent years has made Cheerios gluten-free,

removed artificial colors from Trix cereal, bought Annie's

Homegrown natural and organic snacks, and removed aspartame from

Yoplait Light.

The company also raised its dividend by 1 cent to 49 cents, the

smallest increase since 2010.

In all, for the quarter that ended May 28, General Mills

reported net income of $408.9 million, or 69 cents a share, up from

$379.6 million, or 62 cents a share, in the year-ago period.

Revenue fell 3.1% to $3.81 billion.

Analysts polled by Thomson Reuters expected per-share profit of

71 cents and revenue of $3.75 billion.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 28, 2017 08:19 ET (12:19 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

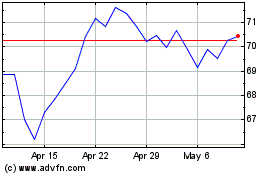

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

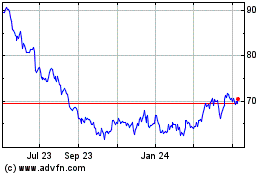

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024