As filed with the Securities and Exchange Commission on

June 27, 2017

Registration No.

333-217548

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Amendment No. 2

to

FORM

F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SPHERE 3D CORP.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of

Registrant’s name into English)

|

Ontario, Canada

|

240 Matheson Blvd. East

|

98-1220792

|

|

(State or other jurisdiction of

|

Mississauga, Ontario L4Z 1X1

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Identification No.)

|

(858) 571-5555

(Address and telephone number

of

Registrant’s principal executive offices)

Eric L. Kelly

Chief Executive Officer

9112 Spectrum Center Boulevard

San Diego, California 92123

(858) 571-5555

(Name, address, and telephone number of

agent for service)

Copy to:

Warren T. Lazarow, Esq.

Paul L. Sieben, Esq.

O’Melveny & Myers LLP

2765 Sand Hill Road

Menlo Park, California 94025

(650) 473-2600

Approximate date of commencement of proposed sale to the

public:

From time to time after the effective date of this registration

statement.

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. [X]

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. [

]

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company [X]

If an emerging growth company that prepares its financial

statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to

Section 7(a)(2)(B) of the Securities Act. [ ]

The term “new or revised financial accounting standard” refers

to any updated issued by the Financial Accounting Standards Board to its

Accounting Standards Codification after April 5, 2012.

|

CALCULATION

OF REGISTRATION FEE

|

Title of each class of

securities to be

registered

|

Amount

to be

registered(1)

|

Proposed

maximum

offering price

per unit(2)

|

Proposed

maximum

aggregate

offering

price(2)

|

Amount of

registration

fee(3)

|

|

Secondary

Shares

|

|

|

|

|

|

Common shares, no par value per share

|

22,596,607

|

$0.20

|

$4,519,321

|

$524

|

|

(1)

|

Pursuant to Rule 416 of the Securities Act of 1933, as

amended, this registration statement shall also cover any additional

common shares that become issuable by reason of any stock dividend, stock

split or other similar transaction effected without the receipt of

consideration that results in an increase in the number of the outstanding

common shares of the registrant. This registration statement relates to

the resale of common shares issuable upon exercise or exchange of warrants

previously issued to the selling shareholders.

|

|

|

|

|

(2)

|

Estimated solely for the purpose of calculating the

amount of registration fee pursuant to Rule 457(c) under the Securities

Act. The proposed maximum offering price per share and proposed maximum

aggregate offering price are based upon the average of the high $0.20 and

low $0.19 sales prices of the registrant’s common shares on The NASDAQ

Capital Market on April 24, 2017. The registrant is not selling any common

shares in this offering and, therefore, will not receive any proceeds from

this offering.

|

|

|

|

|

(3)

|

$524 was previously paid in the initial filing of the

registration statement on Form F-1, filed on April 28,

2017 and Amendment No. 1 filed on June 26, 2017.

|

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment that specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933, as amended, or until this registration statement shall

become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus is

not complete and may be changed. The selling shareholders may not sell these

securities pursuant to this prospectus until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not

an offer to sell these securities, and the selling shareholders are not

soliciting offers to buy these securities in any state where the offer or sale

of these securities is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 27,

2017

PROSPECTUS

22,596,607 Common Shares

This

prospectus relates to the resale or other disposition by certain selling

shareholders identified in this prospectus, or their transferees, of up to an

aggregate of 22,596,607 common shares issuable upon the exercise or exchange of

(i) 20,454,546 warrants issued to the selling stockholders in connection with a

private placement under a Securities Purchase Agreement entered into on March

24, 2017 and (ii) up to 2,142,061 warrants issued to Opus Bank in connection

with our Credit Agreement.

The

selling shareholders may, from time to time, sell, transfer, or otherwise

dispose of any or all of their common shares on any stock exchange, market or

trading facility on which the shares are traded or in private transactions.

These dispositions may be at fixed prices, at prevailing market prices at the

time of sale, at prices related to the prevailing market price, at varying

prices determined at the time of sale, or at negotiated prices. See “Plan of

Distribution” for additional information.

We

are not offering any common shares for sale under this prospectus, and we will

not receive any of the proceeds from the sale or other disposition of the common

shares covered hereby. However, we will receive the exercise price of any

warrants exercised for cash.

Our

common shares are traded on The NASDAQ Capital Market under the symbol “ANY”. On

June 23, 2017, the last reported sale price for our common shares on NASDAQ was

$0.17 per share.

We

will pay the expenses related to the registration of the common shares covered

by this prospectus. The selling shareholders will pay any commissions and

selling expenses they may incur.

Our

business and an investment in our securities involve significant risks. You

should read the section entitled "

Risk Factors

" on page 8

of this prospectus and the risk factors incorporated by reference into this

prospectus as described in that section before investing in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal

offense.

The date of this prospectus is June 27, 2017.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-1 that we filed with

the Securities and Exchange Commission using a “shelf” registration or

continuous offering process.

You

should read this prospectus, the information and documents incorporated by

reference, and the additional information described under the heading “Where You

Can Find Additional Information” below carefully because these documents contain

important information you should consider when making your investment decision.

Whenever we make reference in this prospectus to any of our contracts,

agreements or other documents, the references are not necessarily complete and

you should refer to the exhibits attached to the registration statement or the

documents incorporated by reference for copies of the actual contract,

agreements or other document. See “Where You Can Find More Information” and

“Information Incorporated by Reference.”

You

should rely only on the information provided in this prospectus and the

information and documents incorporated by reference into this prospectus. We

have not, and the selling shareholders have not, authorized anyone to provide

you with different information. This prospectus is not an offer to sell these

securities, and the selling shareholders are not soliciting offers to buy these

securities, in any state where the offer or sale of these securities is not

permitted. The information contained in this prospectus is accurate only as of

the date of this prospectus, regardless of the time of delivery of this

prospectus or of any sale of common shares. You should not assume that the

information contained in this prospectus is accurate as of any date other than

the date on the front cover of this prospectus, or that the information

contained in any document incorporated by reference is accurate as of any date

other than the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus or any sale of a security. As described

under the heading “Incorporation of Certain Documents By Reference,” some of the

information contained herein may be modified or superseded by documents

incorporated by reference herein and, to such extent, you should rely on the

later-dated information.

In

this prospectus, unless otherwise indicated or the context otherwise requires,

references to “Sphere,” “we,” “Company,” “us,” or “our” refer to Sphere 3D Corp.

and its consolidated subsidiaries, and references to “selling shareholders”

refer to those shareholders listed herein under “Selling Shareholders,” and

their transferees.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We

are subject to the informational requirements of the Securities Exchange Act of

1934, as amended, applicable to foreign private issuers. We anticipate filing

with the SEC, within three months after the end of each fiscal year, an Annual

Report on Form 20-F containing financial statements audited by an independent

accounting firm. We also furnish or file with the SEC Reports of Foreign Private

Issuer on Form 6-K and other information with the SEC as required by the

Exchange Act. We, as a “foreign private issuer,” are exempt from the rules under

the Exchange Act prescribing certain disclosure and procedural requirements for

proxy solicitations, and our officers, directors and principal shareholders are

exempt from the reporting and “short-swing” profit recovery provisions contained

in Section 16 of the Exchange Act, with respect to their purchases and sales of

shares. In addition, we are not required to file annual, quarterly and current

reports and financial statements with the SEC as frequently or as promptly as

U.S. companies whose securities are registered under the Exchange Act. You can

find, copy and inspect information we file with the SEC (including exhibits to

such documents) at the SEC’s Public Reference Room at 100 F Street, N.E.,

Washington, D.C. 20549. You may obtain additional information about the Public

Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC

maintains a site on the Internet at http://www.sec.gov which contains reports

and other information that we file electronically with the SEC. You may also

review such reports and other documents we file with the SEC on our website at

http://www.sphere3d.com. Information included on our website is not a part of

this prospectus. This prospectus is part of a registration statement that we

filed with the SEC. The registration statement contains more information than

this prospectus regarding our common shares and us, including exhibits.

- 1 -

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We

are “incorporating by reference” information into this prospectus. This means

that we are disclosing important information to you by referring you to another

document that has been separately filed with or furnished to the SEC. The

information incorporated by reference is considered to be part of this

prospectus, and certain information that we later file with or furnish to the

SEC will automatically update and supersede the information contained in

documents earlier filed with or furnished to the SEC or contained in this

prospectus. The following documents filed with or furnished to the SEC are

incorporated herein by reference:

|

|

•

|

Our Annual Report on Form 20-F (File No. 001-36532) filed

with the SEC on March 31, 2017;

|

|

|

|

|

|

|

•

|

The description of our common shares contained in our

Registration Statement on Form 8-A (File No. 001- 36532) filed with the

Commission on July 7, 2014 pursuant to Section 12 of the Exchange Act, and

any other amendment or report filed for the purpose of updating such

description;

|

|

|

|

|

|

|

•

|

the consolidated audited balance sheets of Overland

Storage, Inc. and subsidiaries as of June 30, 2014 and 2013, and the

related audited consolidated statements of operations, equity and

comprehensive income (loss), and cash flows for the fiscal years ended

June 30, 2014 and 2013; the unaudited pro forma condensed combined

financial information of our company, the Overland companies and the

Tandberg companies giving effect to the acquisition of the Overland

companies and derived from the historical consolidated financial

statements and notes thereto of our companies; the description of the

terms of our merger with Overland Storage, Inc., together with Annex A;

and the description of the rights of our shareholders contained in our

Registration Statement on Form F-4 (File No. 333- 197569) filed with the

SEC on July 23, 2014, as subsequently amended;

|

|

|

|

|

|

|

•

|

Our Report of Foreign Private Issuer on Form 6-K (File

No. 001-36532) furnished to the SEC on June 19, 2017, March 29, 2017,

March 24, 2017, November 14, 2016, September 22, 2016, September 15, 2016,

August 12, 2016, August 11, 2016, May 13, 2016, May 12, 2016, April 21,

2016, and April 7, 2016.

|

Unless

otherwise identified, documents or information deemed to have been furnished and

not filed in accordance with SEC rules shall not be deemed incorporated by

reference into this registration statement.

Any

statement contained herein or in a document, all or a portion of which is

incorporated or deemed to be incorporated by reference herein, shall be deemed

to be modified or superseded for purposes of this registration statement to the

extent that a statement contained herein or in any other subsequently filed

document which also is or is deemed to be incorporated by reference herein

modifies or supersedes such statement. Any such statement so modified or

superseded shall not be deemed, except as so modified or amended, to constitute

a part of this registration statement.

You

may obtain copies, without charge, of documents incorporated by reference in

this prospectus, by requesting them in writing or by telephone from us as

follows:

Sphere 3D Corp.

240 Matheson Blvd. East

Mississauga,

Ontario L4Z 1X1

Attention: Investor Relations

(800) 729-8725

Exhibits

to the filings will not be sent unless those exhibits have been specifically

incorporated by reference in this prospectus.

- 2 -

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements in this prospectus and the documents we incorporate by reference in

this prospectus constitute forward-looking information that involves risks and

uncertainties. This forward-looking information includes, but is not limited to,

statements with respect to management’s expectations regarding our future growth

and business plans, business planning process, results of operations, uses of

cash, performance, and business prospects. This forward-looking information may

also include other statements that are predictive in nature, or that depend upon

or refer to future events or conditions. Statements with the words “could”,

“expects”, “may”, “will”, “anticipates”, “assumes”, “intends”, “plans”,

“believes”, “estimates”, “guidance” and similar expressions are intended to

identify statements containing forward-looking information, although not all

forward-looking statements include such words. In addition, any statements that

refer to expectations, projections or other characterizations of future events

or circumstances contain forward-looking information. Statements containing

forward-looking information are not historical facts but instead represent

management’s expectations, estimates and projections regarding future events.

Although

management believes the expectations reflected in such forward-looking

statements are reasonable, forward-looking statements are based on the opinions,

assumptions and estimates of management at the date the statements are made, and

are subject to a variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those projected in the

forward-looking statements. These factors include, but are not limited to:

-

our ability to maintain the listing of our common shares on the NASDAQ

Capital Market;

-

our limited operating history;

-

our ability to generate cash to fund operations;

-

our ability to refinance our credit facilities prior to maturity or

otherwise raise additional debt or equity financing;

-

our ability to integrate the businesses of HVE ConneXions, LLC, and

Unified ConneXions, Inc.;

-

the impact of competition;

-

any defects in components or design of our products;

-

the retention or maintenance of key personnel;

-

the possibility of significant fluctuations in operating results;

-

currency fluctuations;

-

our ability to maintain business relationships;

-

financial, political or economic conditions;

-

financing risks;

-

future acquisitions;

-

our ability to protect our intellectual property;

-

third party intellectual property rights;

-

volatility in the market price for our common shares;

-

our compliance with financial reporting and other requirements as a public

company;

-

conflicts of interests;

-

future sales of our common shares by our directors, officers and other

shareholders;

-

dilution and future sales of common shares;

-

acquisition-related risks; and

-

other factors described under the heading “Risk Factors” and other risk

factors described in the documents incorporated by reference in this

prospectus supplement and the accompanying prospectus.

In

addition, if any of the assumptions or estimates made by management prove to be

incorrect, actual results and developments are likely to differ, and may differ

materially, from those expressed or implied by the forward-looking information.

Accordingly, investors are cautioned not to place undue reliance on such

statements.

All

of this forward-looking information is qualified by these cautionary statements.

Statements containing forward-looking information are made only as of the date

of such document. We expressly disclaim any obligation to update or alter

statements containing any forward-looking information, or the factors or

assumptions underlying them, whether as a result of new information, future

events or otherwise, except as required by law.

- 3 -

PROSPECTUS SUMMARY

The

following is only a summary and therefore does not contain all of the

information you should consider before investing in our securities. We urge you

to read this entire prospectus, including the matters discussed under “Risk

Factors” and the risk factors incorporated by reference into this prospectus as

described in that section, and the more detailed consolidated financial

statements, notes to the consolidated financial statements and other information

incorporated by reference from our other filings with the SEC.

Our Company

We

are a virtualization technology and data management solutions provider with a

portfolio of products that address the complete data continuum. We enable the

integration of virtual applications, virtual desktops, and storage into

workflow, and allow organizations to deploy a combination of public, private or

hybrid cloud strategies. We achieve this through the sale of solutions that are

derived from our primary product groups: disk systems, virtualization, and data

management and storage.

We

have a global presence and maintain offices in multiple locations. Executive

offices and our primary operations are conducted from our San Jose and San

Diego, California locations. Our main office is located at 9112 Spectrum Center

Blvd., San Diego, CA 92123. Our virtualization product development is primarily

done from its research and development center near Toronto, Canada. Our European

headquarters are located in Germany. We maintain additional offices in

Singapore, Japan, and the United Kingdom.

We

were incorporated on May 2, 2007 under the Business Corporations Act (Ontario)

as “T.B. Mining Ventures Inc.”. Our registered office is located at 240 Matheson

Blvd. East Mississauga, Ontario L4Z 1X1 and our main telephone number is (858)

571-5555. Our Internet address is

http://www.sphere3d.com

. Except for the

documents referred to under “Where You Can Find Additional Information” which

are specifically incorporated by reference into this prospectus, information

contained on our website or that can be accessed through our website does not

constitute a part of this prospectus. We have included our website address only

as an interactive textual reference and do not intend it to be an active link to

our website.

The Offering

|

Securities offered by the selling shareholders:

|

22,596,607 common shares issuable upon the exercise or

exchange of (i) 20,454,546 warrants issued to the selling shareholders in

connection with a private placement under a Securities Purchase Agreement

entered into on March 24, 2017 and (ii) 2,142,061 warrants issued to Opus

Bank in connection with our Credit Agreement.

|

|

|

|

|

Common shares to be outstanding after the offering:

|

126,757,255

(1)

|

|

|

|

|

NASDAQ Capital Market symbol:

|

ANY

|

|

|

|

|

Use of proceeds:

|

The common shares being offered by this prospectus are

solely for the account of the selling shareholders. We will not receive

any proceeds from the sale or disposition of common shares being offered

by this prospectus. See “Use of Proceeds” beginning on page 16.

|

|

|

|

|

Risk factors:

|

See “Risk Factors” beginning on page 8 and the risk

factors incorporated by reference into this prospectus as described in

that section, and the other information included in this prospectus or

incorporated by reference for a discussion of factors you should consider

before making an investment decision

|

|

(1)

|

The number of common shares shown to be outstanding is

based on the number of common shares outstanding as

of

June

7, 2017 is 104,160,648, and excludes as of such date:

|

- 4 -

-

3,113,866 common shares subject to outstanding options issued to employees

and consultants having a weighted- average exercise price of $1.99 per share;

-

2,468,914 common shares reserved for issuance in connection with future

awards under our 2015 Performance Incentive Plan and 5,778,500 restricted

share units outstanding and unreleased under our stock plans;

-

2,000,000 common shares reserved for future sale under our Employee Stock

Purchase Plan; and

-

69,484,730 common shares issuable pursuant to outstanding warrants having a

weighted-average exercise price of $0.59 per share, including warrants to

purchase up to, in aggregate, 800,000 common shares issued on February 19,

2015, March 6, 2015, March 20, 2015 and December 2015 to FBC Holdings S.à r.l.

in connection with draws on our Revolving Credit Agreement with FBC (with each

such warrant’s exercise price being determined by reference to 110% of the

closing price for our common shares on The NASDAQ Global Market on the last

complete trading day immediately prior to issuance) and a warrant to purchase

up to, in aggregate, 500,000 common shares issued on February 26, 2016 in

connection with the amendment to our 8% Senior Secured Convertible Debenture

with FBC (with each such warrant's exercise price being determined by

reference to 110% of the closing price for our common shares on the NASDAQ

Global Market on the last complete trading day immediately prior to issuance).

Unless

otherwise indicated, this prospectus supplement reflects and assumes no exercise

of our outstanding warrants or options to purchase common shares described

above.

- 5 -

Recent Developments

Private Placement and Concurrent Registered Direct

Offering

On

March 29, 2017, the Company closed a registered direct offering of 20,454,546 of

the Company’s common shares, no par value per share (the “Shares”), and warrants

(the “Warrants”) exercisable to purchase up to 20,454,546 of the Company’s

common shares, no par value per share, at an exercise price of $0.30 per share

by private placement (the “March Private Placement”). The Company sold the

Shares at a price of $0.22 per Share, and received gross proceeds from the

offering, before deducting placement agent fees and other estimated offering

expenses payable by the Company, of approximately $4,500,000. Roth Capital

Partners, LLC acted as the placement agent for the offering.

Private Placement

Between

December 30, 2016 and March 16, 2017, the Company issued a total of 18,139,998

“Units,” at a purchase price of U.S. $0.30 per Unit. Each Unit consisted of one

common share and one warrant from each of two series of warrants. The first

series of warrants is exercisable to purchase 18,139,998 common shares in the

aggregate and has an exercise price of U.S. $0.40 per share, a one-year term,

and is exercisable in whole or in part at any time prior to expiration. The

second series of warrants is exercisable for 18,139,998 common shares in the

aggregate and has an exercise price of U.S. $0.55 per share, a five-year term,

and is exercisable in whole or in part at any time prior to expiration. The

Company received gross proceeds of U.S. $5.4 million in connection with the sale

of the Units.

Consent, Waiver, Reaffirmation and Amendment Number One to

Credit Agreement

On

April 6, 2016, Overland Storage, Inc., a California corporation (“Overland”) and

wholly owned subsidiary of the Company, Tandberg Data GmbH, a limited liability

company organized under the laws of Germany (“Tandberg” and, together with

Overland, collectively the “Borrowers”), and Opus Bank, a California commercial

bank, as Lender (“Lender”), entered into a Credit Agreement (the “Credit

Agreement”) pursuant to which the Lender provided the Borrowers a $10 Million

revolving credit facility and Overland $10 Million term loan facility. On

December 30, 2016, the Borrowers and Lender entered into a Consent, Waiver,

Reaffirmation and Amendment Number One to Credit Agreement (the “First

Amendment”) pursuant to which (i) the maturity date for the revolving and term

loan credit facilities were amended to be the earlier of the maturity date in

the 8% Senior Secured Convertible Debenture, dated December 1, 2014, issued to

FBC Holdings S.a r.l. (the “Debenture”), or March 31, 2017, (ii) the Lender

granted a waiver of specified defaults under the Credit Agreement relating to a

minimum asset coverage ratio, (iii) the Lender provided its consent to the

consummation of the Acquisition (as defined below), and (iv) certain other terms

of the Credit Agreement were amended, including but not limited to terms related

to collateral coverage, milestone deliverables, and financial covenants.

Further,

as a condition of the entry into the First Amendment, the Company (i) cancelled

the warrant issued to Lender for the purchase of 1,541,768 common shares at an

exercise price of $1.30 per common share and (ii) issued to the Lender a warrant

for the purchase of up to 862,068 common shares at an exercise price of $0.01

per common share. In addition, the First Amendment warrant provide for

“piggyback” registration rights. These “piggyback” registration rights would be

triggered by the filing of a registration statement to register the resale of

the warrants and common shares issuable upon the exercise of the warrants. The

exercise price and number of common shares issuable upon exercise of the

warrants may be adjusted in certain circumstances including in the event of a

share dividend, extraordinary cash dividend or our recapitalization,

reorganization, merger or consolidation.

Amendments Number Two and Three to Credit Agreement,

Amendment Number One to Amendment Number 1, Waiver and Reaffirmation, Amendment

Number Four to Credit Agreement and Reaffirmation, and Amendment Number Five to

Credit Agreement and Reaffirmation

On

March 12, 2017, the Borrowers and Lender entered into an Amendment Number Two to

Credit Agreement, Amendment Number One to Amendment Number 1, Waiver and

Reaffirmation (the “Second Amendment”). On March 21, 2017, the Borrowers and

Lender entered into an Amendment Number Three to Credit Agreement (the “Third

Amendment”) further amending the Second Amendment. On April 28, 2017, the

Borrowers and Lender entered into an Amendment Number Four to Credit Agreement

and Reaffirmation (the “Fourth Amendment”). On June 10, 2017, the Borrowers and

Lender entered into an Amendment Number Five to Credit Agreement and

Reaffirmation (the “Fifth Amendment” and, together with the First Amendment,

Second Amendment, Third Amendment and Fourth Amendment, the “Opus Amendments”).

Under the terms of the Second Amendment, as modified by the Third Amendment, (i)

the maturity date for the revolving and term loan credit facilities were amended to be the earlier of (a) the maturity

date in the Debenture or (b) (x) June 30, 2017 if the Maturity Extension Trigger

Date (as defined below) occurs on or before March 31, 2017 or (y) if the

Maturity Extension Trigger Date has not occurred by such date, March 31, 2017,

(ii) the Lender granted a waiver of specified defaults under the Credit

Agreement relating to obligations to deliver to the Lender an executed letter of

intent with respect to refinancing the credit facility, and (iii) certain other

terms of the Credit Agreement were amended, including but not limited to terms

related to collateral coverage, milestone deliverables, and financial covenants.

The Maturity Extension Trigger Date, which occurred prior to March 31, 2017, was

the date upon which (a) the Company received gross cash proceeds of at least

$3,000,000 from the issuance of the common shares and related warrants and (b)

the Company deposited at least $2,500,000 of the funds raised in an equity

offering into the primary operating account that Overland maintains at Opus

Bank. Pursuant to the Opus Amendments, in the event of certain specified events

of default, including failure to meet certain monthly revenue and EBITDA targets

or failure to retain a financial advisor with respect to a sale of a significant

portion of the Company’s assets by June 30, 2017, all amounts under the Credit

Agreement may be accelerated and become immediately payable.

- 6 -

Further,

as a condition of the entry into the Second Amendment, the Company issued to the

Lender (i) a warrant, exercisable for 398,936 shares at an exercise price of

$0.01 per common share and (ii) a warrant, exercisable in the event that the

Company has not repaid all outstanding amounts due under the Credit Agreement on

or prior to May 31, 2017, for the purchase of 881,057 shares at an exercise

price of $0.01 per common share. In addition, the warrants provide for

“piggyback” registration rights. These “piggyback” registration rights would be

triggered by the filing of a registration statement to register the resale of

the warrants and common shares issuable upon the exercise of the warrants. The

exercise price and number of common shares issuable upon exercise or exchange of

the warrants may be adjusted in certain circumstances including in the event of

a share dividend, extraordinary cash dividend or our recapitalization,

reorganization, merger or consolidation.

Acquisition

In

January 2017, the Company completed its acquisition (the “Acquisition”) of all

of the outstanding equity interests of HVE ConneXions, LLC and Unified

ConneXions, Inc. (the “Sellers”). The Company initially purchased 19.9% of the

outstanding equity interests of the Sellers in December 2016, and in connection

with such purchase, issued 3,947,368 common shares. In January 2017, in

connection with the Company’s purchase of the remaining equity interests of the

Sellers, the Company paid to the Sellers $1,100,000 in cash and issued 2,205,883

common shares.

Grant of Inducement RSUs

In

January 2017, we granted 5,156,030 inducement RSUs in connection with the hiring

of additional employees, which will vest over the next one to three years.

- 7 -

RISK FACTORS

An

investment in our securities involves a high degree of risk. In addition to the

other information included in this prospectus, you should carefully consider the

risk factors set forth in our most recent Annual Report on Form 20-F on file

with the SEC, which is incorporated by reference into this prospectus, as well

as the following risk factors, which supplement or augment the risk factors set

forth in our Annual Report on Form 20-F. Before making an investment decision,

you should carefully consider these risks as well as other information we

include or incorporate by reference in this prospectus and the accompanying

prospectus supplement. The risks and uncertainties not presently known to us or

that we currently deem immaterial may also materially harm our business,

operating results and financial condition and could result in a complete loss of

your investment.

Risks Related to Our Common Shares and this Offering

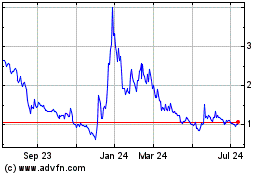

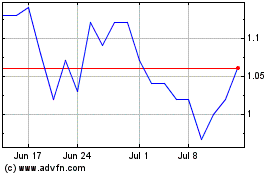

Our share price has been volatile and your investment in

our common shares could decrease in value.

The

market price for securities of technology companies, including ours,

historically has been highly volatile, and the market from time to time has

experienced significant price and volume fluctuations that are unrelated to the

operating performance of such companies. For example, during the 12-month period

ended February 28, 2017, our closing stock price has ranged from a low of $0.20

to a high of $1.97. Fluctuations in the market price or liquidity of our common

shares may harm the value of your investment in our common shares. You may not

be able to resell your common shares at or above the price you pay for those

shares due to fluctuations in the market price caused by changes in our

operating performance or prospects and other factors, including, among

others:

|

|

•

|

actual or anticipated fluctuations in our operating

results or future prospects;

|

|

|

|

|

|

|

•

|

our announcements or our competitors’ announcements of

new products;

|

|

|

|

|

|

|

•

|

public reaction to our press releases, our other public

announcements and our filings with the SEC;

|

|

|

|

|

|

|

•

|

strategic actions by us or our competitors;

|

|

|

|

|

|

|

•

|

changes in financial markets or general economic

conditions;

|

|

|

|

|

|

|

•

|

our ability to raise additional capital as needed;

|

|

|

|

|

|

|

•

|

developments regarding our patents or proprietary rights

or those of our competitors; and

|

|

|

|

|

|

|

•

|

changes in stock market analyst recommendations or

earnings estimates regarding our common shares, other comparable companies

or our industry generally.

|

Future sales of our common shares could adversely affect

the market price and our future capital-raising activities could involve the

issuance of equity securities, which would dilute your investment and could

result in a decline in the trading price of our common shares.

We

will likely sell securities in the public or private equity markets if and when

conditions are favorable, even if we do not have an immediate need for

additional capital at that time. Sales of substantial amounts of common shares,

or the perception that such sales could occur, could adversely affect the

prevailing market price of our common shares and our ability to raise capital.

We may issue additional common shares in future financing transactions or as

incentive compensation for our executive management and other key personnel,

consultants and advisors. Issuing any equity securities would be dilutive to the

equity interests represented by our then-outstanding common shares. The market

price for our common shares could decrease as the market takes into account the

dilutive effect of any of these issuances.

Sales of shares issuable upon exercise or exchange of

outstanding warrants, the conversion of outstanding convertible debt, or the

effectiveness of our registration statement may cause the market price of our

shares to decline.

Excluding

the warrants issued pursuant to the Securities Purchase Agreement and the

warrants issued to Opus Bank, as of June 7, 2017, we have warrants outstanding

for the purchase of up to 46,522,919 common shares having a weighted-average exercise price of $0.74 per share. Our 8%

Senior Secured Convertible Debenture is currently convertible into common shares

at a conversion price of $3.00 per common share. The sale of our common shares

upon exercise of our outstanding warrants, the conversion of the debenture into

common shares, or the sale of a significant amount of the common shares issued

or issuable upon exercise of the warrants in the open market, or the perception

that these sales may occur, could cause the market price of our common shares to

decline or become highly volatile.

- 8 -

If our common shares are delisted from the NASDAQ Capital

Market, our business, financial condition, results of operations and share price

could be adversely affected, and the liquidity of our common shares and our

ability to obtain financing could be impaired.

In

August 2016, we received a letter from the NASDAQ Stock Market LLC (“NASDAQ”)

notifying us that we were not in compliance with the requirement of NASDAQ

Listing Rule 5450(a)(1) (“Listing Rule”) for continued listing on the NASDAQ

Global Market as a result of the closing bid price for our common shares being

below $1.00 for 30 consecutive business days. This notification has had no

effect on the listing of our common shares at this time. In accordance with the

Listing Rule, we had 180 calendar days, or until January 30, 2017, to regain

compliance with such rule. On February 1, 2017, we were granted an additional

180 calendar day period to regain compliance with the Listing Rule in connection

with the transfer of the listing of our common shares to the NASDAQ Capital

Market. To regain compliance, we must effectuate a reverse stock split in order

for our common shares to have a closing bid price above $1.00 for a minimum of

10 consecutive business days. No assurance can be given that we will regain

compliance during that period.

Future sales of our securities under certain

circumstances may trigger price-protection provisions in outstanding warrants,

which would dilute your investment and could result in a decline in the trading

price of our common shares.

In

connection with our registered direct offering in December 2015, we issued a

warrant exercisable to purchase up to 1,500,000 common shares that contains

certain price protection provisions. If we, at any time while these warrants are

outstanding, effect certain variable rate transactions and the issue price,

conversion price or exercise price per share applicable thereto is less than the

exercise price then in effect for the warrants, then the exercise price of the

warrants will be reduced to equal such price. Additionally, if at any time while

the warrants issued pursuant to the Securities Purchase Agreement entered into

in March 2017 are outstanding, the Company sells or grants options to purchase,

reprices or otherwise issues any common shares or securities convertible into

common shares at a price less than $0.30, then the exercise price for the

Warrants will be reduced to such price, provided that the exercise price will

not be lower than $0.10, and the number of common shares issuable under the

Warrants will be increased such that, after taking into account the decrease in

the exercise price, the aggregate exercise price under the Warrants will remain

the same. Any reverse stock split made in order to regain compliance with the

Listing Rule will not adjust the minimum exercise price of the warrants. The

triggering of these price protection provisions, together with the exercise of

these warrants, could cause the market price of our common shares to decline or

become highly volatile, and/or cause additional dilution to our

shareholders.

We may have to pay liquidated damages to our investors,

which will increase our negative cash flows.

Under

the terms of our registration rights agreements entered into with certain

investors in connection with private placements of our securities in May, June,

and August 2015, in connection with the warrant exchange agreement we entered

into in March 2016 and in connection with the private placement in March 2017,

if we fail to comply with certain provisions set forth in these agreements,

including covenants requiring that we maintain the effectiveness of the

registration statements registering these securities, then we will be required

to pay liquidated damages to our investors. There can be no assurance that the

registration statements will remain effective for the time periods necessary to

avoid payment of liquidated damages. If we are required to pay our investors

liquidated damages, this could materially harm our business and future

prospects.

The terms of our March 2017 private placements may

materially and adversely impact our ability to obtain additional financing in

the future.

We

are subject to certain restrictions and obligations in connection with our

private placement of warrants that was consummated in March 2017 which may

materially and adversely affect our ability to obtain additional financing in

the future. These restrictions and obligations include participation rights

whereby certain investors are entitled to purchase up to 50% in the aggregate of

the securities sold in any subsequent issuance for 15 months following the

closing of the private placement (the “Closing”), prohibitions on issuing common

shares or common share equivalents in a variable rate transaction for 90 days

following the Closing and prohibitions on issuing common shares or common share

equivalents through an equity line of credit, at-the-market offering, or similar

transaction for six months following the Closing. Additionally, if at any time

while the warrants are outstanding the Company sells or grants options to

purchase, reprices or otherwise issues any common shares or securities convertible into common shares at a price less than

$0.30, then the exercise price for the Warrants will be reduced to such price,

provided that the exercise price will not be lower than $0.10, and the number of

common shares issuable under the Warrants will be increased such that, after

taking into account the decrease in the exercise price, the aggregate exercise

price under the Warrants will remain the same. Any reverse stock split made in

order to regain compliance with the Listing Rule will not adjust the minimum

exercise price of the warrants. The triggering of these price protection

provisions, together with the exercise of these warrants, could materially and

adversely affect our ability to obtain additional financing in the future.

- 9 -

We do not expect to pay cash dividends on our common

shares for the foreseeable future.

We

have never paid cash dividends on our common shares and do not anticipate that

any cash dividends will be paid on the common shares for the foreseeable future.

The payment of any cash dividend by us will be at the discretion of our board of

directors and will depend on, among other things, our earnings, capital,

regulatory requirements and financial condition.

- 10 -

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

The following table sets forth information with respect to each

of the directors and officers of the Company, who share a business address at

9112 Spectrum Center Blvd, San Diego, CA 92123 USA.

|

Name

|

|

Position with Sphere 3D

|

|

Peter Ashkin

(1)(2)(3)

|

|

Director

|

|

Dr. Cheemin Bo-Linn

(1)(2)(3)

|

|

Director

|

|

Eric L. Kelly

|

|

Chief Executive Officer, Chairman and Director

|

|

Vivekanand Mahadevan

(1)(2)(3)

|

|

Director

|

|

Duncan McEwan

|

|

Director

|

|

Peter Tassiopoulos

|

|

President, Vice Chairman and Director

|

|

Kurt L. Kalbfleisch

|

|

Senior Vice President and Chief Financial

Officer

|

|

Jenny C. Yeh

|

|

Vice President, Legal and General Counsel

|

_____________________

|

|

(1)

|

Member of Audit Committee.

|

|

|

(2)

|

Member of Compensation Committee.

|

|

|

(3)

|

Member of the Nominating and Governance

Committee.

|

Peter Ashkin, Director

Mr.

Ashkin

member of the Board and also serves as the Chairman of its

Compensation Committee. Mr. Ashkin has been a Managing Partner of Baker, Cook

and Constable LLC, a venture capital firm that focuses on investing in, and

operating high-tech start-up companies since March 2012 and President of Peter

Ashkin Consulting, a consulting agency that focuses on high-tech startup

companies since 2006. Previously, Mr. Ashkin served as President of the

Technology Group for CanWest Mediaworks (2004 -2006), at that time, Canada’s

largest media company, with multiple locations across Canada consisting of

newspapers, broadcast television and cable. Prior to CanWest, Mr. Ashkin served

as President of Product Strategy for AOL (America Online) (2001 -2004), at that

time, the world’s largest internet provider. Mr. Ashkin also served as Senior

Vice President and Chief Technology Officer of Gateway Computer (1998 - 2001)

and prior thereto a number of senior and executive management positions at both

Toshiba Corporation and Apple.

Dr. Cheemin Bo-Linn, Director

Dr.

Bo-Linn has served as a member of our Board since April 2017 and also serves as

the Chairman of its Audit Committee. Dr. Bo-Linn is the CEO and President of

Peritus Partners Inc., an international consulting group focused on leading

companies to the next level growth and increasing business valuation, and has

held this position since January 2013. From September 2010 to November 2012, she

was Chief Marketing Officer, Chief Revenue Officer and consultant at NetLine

Corporation, a global online multi-channel digital media network, mobile

applications and content marketing services company. From July 2006 to August

2010, she was President of Peritus Partners Inc./BL Group. From June 1980 to

June 2006, she held a number of executive business management roles including

IBM Vice-President of Electronics, and other roles with responsibility ranging

from strategy, marketing, sales, operations and investments across storage and

software products and consulting services. She presently serves on the Advisory

Board of SpeedTrack, a business analytics software company, and Women in

Technology International, an online marketplace for research, publications,

media and career services. She previously served as a member of the Boards of

Directors of Violin Memory, Inc., NetLine Corporation, Association of Corporate

Growth-SV, American Electronics Association and several private companies. She

holds a Doctorate of Education focused on “Computer-based Management Information

Systems and Organizational Change” from the University of Houston.

Eric L. Kelly, Chief Executive Officer and Chairman

Eric

Kelly has served as CEO and chairman of Sphere 3D since the company's merger

with Overland Storage in December 2014. Mr. Kelly served as Overland Storage's

CEO since January 2009, its President & CEO since January 2010 and as a

board member since November 2007. Prior to joining Overland Storage, Mr. Kelly

was President of Silicon Valley Management Partners Inc., a management

consulting and M&A advisory firm which he co-founded in 2007. He is a

seasoned executive with over 35 years of experience in the technology industry.

Mr. Kelly served two terms, from 2013 to 2016, on the U.S. Department of

Commerce’s Manufacturing Council, where he offered advice and counsel to the

Obama administration on strategies and policy recommendations on ways to promote

and advance U.S. manufacturing globally, and from 2013-2014 he was appointed to

President Obama’s White House Advanced Manufacturing Steering Committee. He is

also serving on the Board of Directors-San Jose State University, is a member of

the Global Leadership Council for San Jose State University’s Lucas College and

Graduate School of Business and serves on the Advisory Board for San Francisco

State University Graduate School of Business. He earned an MBA from San

Francisco State University and a B.S. in Business Management from San Jose State

University

- 11 -

Vivekanand Mahadevan, Director

Mr.

Mahadevan has been the Chief Executive Officer of Dev Solutions, Inc., a

consulting firm that helps technology startups build next-generation market

leaders in data analytics, security, storage and cloud markets since March 2012.

Mr. Mahadevan was the Chief Strategy Officer for NetApp, Inc., a supplier of

enterprise storage and data management software and hardware products and

services, from November 2010 until February 2012. Prior to that time served as

Vice President of Marketing for LSI Corporation, an electronics company that

designs semiconductors and software that accelerate storage and networking, from

January 2009 to September 2010. Prior to LSI Corporation, he was Chief Executive

Officer for Deeya Energy, Inc., and has also held senior management positions

with leading storage and systems management companies including BMC Software,

Compaq, Ivita, and Maxxan Systems. Mr. Mahadevan is also a current board member

of Violin Memory, Inc. Mr. Mahadevan holds an M.B.A. in Marketing and MS in

Engineering from the University of Iowa as well a degree in Mechanical

Engineering from the Indian Institute of Technology.

Duncan McEwan, Director

Mr.

McEwan is president of Diligent Inc., a consulting company he founded in 1991

specializing in M&A and strategic advice for technology-based clients. Mr.

McEwan was Executive Vice President and Chief Strategy Officer of Call-Net

Enterprises Inc., a provider of long-distance telephone services until it merged

into Rogers Communication Inc. (2004-2005); President and Chief Operating

Officer of Sprint Canada Inc., an integrated, national telecommunications

provider (2001-2004); Chief Executive Officer of Northpoint Canada

Communications, a provider of high-speed data and Internet (DSL) lines

(2000-2001); President and Chief Executive Officer of Canadian Satellite

Communications (Cancom) (1996-2000). Mr. McEwan has been Chairman of the Board

of Geminare, Inc. since 2010, an emerging global leader in business continuity

and cloud-based software systems and has previously served on a number of other

public and private company boards. Mr. McEwan is a graduate of the University of

Toronto.

Peter Tassiopoulos, President, Vice Chairman and

Director

Mr.

Tassiopoulos is a current member of the Board and has served as President of the

Company since December 1, 2014. Mr. Tassiopoulos served as the Chief Executive

Officer of the Company from March 2013 until December 1, 2014. Mr. Tassiopoulos

has extensive experience in information technology business development and

global sales as well as a successful track record leading early-stage technology

companies. He has been actively involved as a business consultant over the past

10 years, including acting as Chief Operating Officer and then Chief Executive

Officer of BioSign Technologies Inc. from September 2009 to April 2011 and Chief

Executive Officer of IgeaCare Systems Inc. from February 2003 to December 2008.

Mr. Tassiopoulos is also a current board member of Northern Sphere Mining Corp.,

formerly Argentium Resources Inc.

Kurt L. Kalbfleisch, Senior Vice President and Chief

Financial Officer

Mr.

Kalbfleisch has served as Senior Vice President and Chief Financial Officer of

the Company since December 1, 2014. Mr. Kalbfleisch had 20 years of service with

Overland and served as Overland's Senior Vice President since June 2012, Chief

Financial Officer since February 2008, and Secretary since October 2009. Prior

to that, he served as Overland's Vice President of Finance from July 2007 to

June 2012.

Jenny C. Yeh, Vice President, Legal and General

Counsel

Ms.

Yeh has served as Vice President, Legal and General Counsel of the Company since

October 5, 2015. Prior to joining the Company, Ms. Yeh served as Executive

Counsel, Transactions and Finance, at General Electric Company where she was a

senior legal advisor to GE Corporate’s business development group, supporting

global corporate strategy and transactions across all GE industrial businesses

worldwide. From 2007 to 2011, Ms. Yeh was a corporate partner at Baker &

McKenzie LLP, where she advised clients in general corporate and securities

matters, with a specialization in complex cross-border transactions. Ms. Yeh

holds a Juris Doctorate from Georgetown University Law Center, and Bachelor of

Arts degrees from the University of California at Berkeley.

- 12 -

The

Company’s independent auditor is Moss Adams LLP, located at 4747 Executive

Drive, Suite 1300, San Diego, CA 92121.

RELATED PARTY TRANSACTIONS

Related

parties of the Company include the Company’s directors, key management personnel

and persons that beneficially own, control or direct, directly or indirectly,

more than 10% of the voting securities of the Company. Key management personnel

are those persons having authority and responsibility for planning, directing,

and controlling the activities of the Company, directly or indirectly. There

were no transactions between the Company and such related parties for the

preceding three financial years up to June 23, 2017 that were material to the

Company or such related party, except for the following:

Registered

Direct Offering and Concurrent Private Placement.

On March 24, 2017,

the Company entered into a Securities Purchase Agreement with certain investors,

pursuant to which the Company issued to the investors, in the aggregate,

20,454,546 of the Company’s common shares for gross proceeds of $4.5 million.

The purchase price for one common share was $0.22. The Securities Purchase

Agreement also provided for the concurrent private placement of warrants

exercisable to purchase up to 20,454,546 common shares.

MF

Ventures, LLC, which beneficially owns, directly or indirectly, securities of

the Company carrying more than 10% of the voting rights attached to the

outstanding voting securities of the Company (on a partially-diluted basis),

participated in the private placements by acquiring 4,545,454 common shares and

warrants to purchase 4,545,454 common shares, for an aggregate purchase price of

$1.0 million.

Private

Placement.

Between December 30, 2016 and March 16, 2017, the Company

completed a private placement and issued a total of 18,139,998 “Units” at a

purchase price of $0.30 per Unit. Each Unit consisted of one common share and

one warrant from each of two series of warrants. The Company received gross

proceeds of $5.4 million in connection with the sale of the Units. The first

series of warrants is exercisable to purchase 18,139,998 common shares in the

aggregate and has an exercise price of $0.40 per share, a one-year term, and is

exercisable in whole or in part at any time prior to expiration. The second

series of warrants is exercisable for 18,139,998 common shares in the aggregate

and has an exercise price of $0.55 per share, a five-year term, and is

exercisable in whole or in part at any time prior to expiration.

MF

Ventures, LLC, participated in the private placements by acquiring 8,333,333

common shares and warrants to purchase 16,666,666 shares.

Lynn

Factor and Sheldon Inwentash, a married couple who beneficially owns, directly

or indirectly, securities of the Company carrying more than 10% of the voting

rights attached to the outstanding voting securities of the Company (on a

partially-diluted basis), participated in the private placements by acquiring

5,325,000 common shares and warrants to purchase 10,650,000 shares. An

additional 700,000 common shares and warrants to purchase 1,400,000 shares were

acquired by ThreeD Capital Inc. Mr. Inwentash is the Chief Executive Officer of

ThreeD Capital Inc.

Related

Party Term Loan.

In September 2016, the Company entered into a $2.5

million term loan agreement with FBC Holdings (an affiliate of Cyrus Capital

Partners, a related party). The term loan has a maturity date of January 31,

2018 and bears interest at a 20.0% simple annual interest rate, payable monthly

in arrears. Monthly payments of principal on the term loan begin on January 31,

2017, in 13 equal installments. The Company has the option to pre-pay the

outstanding balance of the term loan, plus any accrued interest, at any

time.

Related

Party Warrant Exchange Agreement.

The Company entered into a warrant

exchange agreement (the “Warrant Exchange Agreement”), dated March 25, 2016,

with MF Ventures, LLC (the “Holder”) pursuant to which the Company agreed to

issue a warrant (the “New Warrant”) for the purchase of up to 7,199,216 common

shares (the “Warrant Shares”), no par value, in a privately negotiated exchange

under Section 3(a)(9) of the Securities Act of 1933, as amended, in exchange for

the surrender and cancellation of previously outstanding warrants for the

purchase of up to, in aggregate, 3,031,249 common shares (the “Previously

Outstanding Warrants”). The Previously Outstanding Warrants were issued pursuant

to: (i) that certain Purchase Agreement, dated as of May 13, 2015, by and

between the Company and the Holder (the “May Purchase Agreement”); (ii) that

certain Purchase Agreement, dated as of August 10, 2015, by and between the

Company and the Holder (the “August Purchase Agreement”); and (iii) that certain

Subscription Agreement, dated as of September 22, 2015, by and between the

Company and the Holder (the “2015 Subscription Agreement”). The terms of the New

Warrant are substantially similar to the Previously Outstanding Warrants except:

(i) in the case of the Previously Outstanding Warrants issued pursuant to the

May Purchase Agreement, the exercise price changed from $4.00 per common share

to $1.22 per common share; (ii) in the case of the Previously Outstanding

Warrants issued pursuant to the August Purchase Agreement and the 2015

Subscription Agreement, the exercise price changed from $2.33 per common share

to $1.22 per common share; and (iii) the expiry date changed from various dates between May

18, 2020 and September 22, 2020 to April 14, 2016. However, if the holder

exercises the New Warrant for the purchase of at least 3,031,249 common shares

before April 14, 2016, then the expiry date for the balance of any unexercised

portion of the New Warrant shall become March 25, 2021. On March 25, 2016, the

Holder exercised 3,031,249 of the Warrant Shares for 3,031,249 common shares

pursuant to which the Company received $3.7 million in proceeds. The expiration

date for the remaining balance of the New Warrant is March 25, 2021. The Company

also entered into a Registration Rights Agreement (the “Registration Rights

Agreement”), dated as of March 25, 2016, with the Holder. Pursuant to the

Registration Rights Agreement, the Company filed a registration statement with

the SEC to register the resale of the Warrant Shares.

- 13 -

Related

Party Convertible Notes.

On December 1, 2014, in connection with the

acquisition of Overland, the existing debt of Overland and the remaining debt of

the Company were amended and restated into a $19.5 million convertible note with

FBC Holdings. In April 2016, the Company modified its convertible note with FBC

Holdings, pursuant to which the holder made an additional advance of $5.0

million to the Company. The convertible note was originally convertible into

common shares at a price equal to $7.50 per share with respect to $10 million of

the convertible note and $8.50 per share with respect to $9.5 million of the

convertible note. In November 2015, the convertible note was modified and the

conversion prices of $7.50 per share and $8.50 per share were adjusted to $3.00

per share. The convertible note is scheduled to mature March 31, 2018 and bears

interest at an 8.0% simple annual interest rate, payable semi-annually. The

obligations under the convertible note are secured by substantially all assets

of the Company. At December 31, 2016, the Company had $24.2 million, net of

unamortized debt costs of $0.3 million, outstanding on the convertible note.

In

February 2016, in connection with the November 2015 modification and certain

specified terms, we issued to the holder of the convertible note a warrant to

purchase 500,000 of common shares of the Company at a price of $1.62.

In

June and December 2015, we issued 157,872 and 510,590 common shares,

respectively, for the payment of interest expense on our convertible note. In

2016, we issued 4,214,849 common shares for the payment of interest expense on

our convertible note.

Terminated

Related Party Credit Facility.

In December 2014, the Company

entered into a revolving credit agreement with FBC Holdings for a revolving

credit facility of $5.0 million. In July 2015, the credit facility was amended

to extend the scheduled maturity date to May 2016 with an automatic extension to

November 2016, and the aggregate borrowing amount was increased from $5.0

million to $10.0 million. In April 2016, the credit facility was terminated upon

repayment of the outstanding balance.

For

the year ended December 31, 2016, interest expense for the credit facility was

$0.9 million, which included $0.7 million of amortization of issuance costs.

Interest expense for the credit facility was $1.2 million, which included $0.7

million of amortization of issuance costs in 2015. At December 31, 2015, there

were $0.1 million in accrued liabilities related to fees.

In

February 2015, we issued warrants to purchase up to 100,000 common shares to FBC

Holdings in connection with draws on our related party credit facility. The

warrants expire in February 2018 and have an exercise price of $4.50 per

share.

In

March 2015, we issued warrants to purchase up to 200,000 common shares to FBC

Holdings in connection with draws on our related party credit facility. The

warrants expire in March 2018 and have an exercise price of: (i) in the case of

100,000 of the warrants, $7.21 per share; and (ii) in the case of 100,000 of the

warrants, $5.02 per share.

In

December 2015, we issued warrants to purchase 500,000 common shares of the

Company to FBC Holdings in connection with draws on our related party credit

facility. The warrants expire in December 2018 and have an exercise price of

$1.54 per share.

Related

Commercial Agreements

. In July 2013, the Company entered into a supply

agreement, and a technology license agreement, with Overland Storage, Inc.. As

payments under the supply agreement, Sphere 3D issued common shares with a value

as of the date of issuance equal to approximately $0.5 million to Overland

during each of the years ended December 31, 2014 and 2013.

In

September 2014, the Company entered into a commercial relationship with a third

party customer to sell a license to its Glassware product. The customer required

that the Glassware product be provided through one of its preapproved

distribution partners. The Company did not have a relationship with such

distribution partner and in order to facilitate such transaction on a timely

basis, the Company and Overland agreed that Overland would purchase the

Glassware product from the Company and resell it to the distribution partner,

with whom Overland had a preexisting relationship.

- 14 -

The

Company recognized $0.8 million and zero in revenue related to these agreements

during the years ended December 31, 2014 and 2013, respectively. The Company

made purchases of $1.4 million from Overland related to the supply agreement

prior to the acquisition of Overland on December 1, 2014. The Company recognized

$0.2 million in interest income from a note receivable from Overland that

existed prior to the acquisition of Overland. No related party expense, other

than debt interest expense, was recognized during the years ended December 31,

2014 and 2013. Amounts included in other current assets and accounts payable

under these agreements was $0.4 million and $0.1 million as of December 31,

2013.

Related

Party Legal Services

. Legal services of $0.4 million and $0.1 million

were provided by a legal firm affiliated with a former director of the Company

during the years ended December 31, 2014 and 2013, respectively. Professional

services of $0.4 million and $0.6 million were provided by a company controlled

by a director of the Company during the years ended December 31, 2014 and 2013,

respectively.

- 15 -

REASONS FOR THE OFFER AND USE OF PROCEEDS

We

are required under the terms of the Registration Rights Agreement entered into

with the investors in the March Private Placement to file a registration

statement on Form F-1, of which this prospectus is a part, to cover the resale

of the common shares issuable upon conversion of the warrants. The common shares

being offered by this prospectus are solely for the account of the selling

shareholders. To the extent that we have received or will receive additional

cash upon exercise of the warrants, we currently expect to use that cash for

general corporate purposes. These purposes may include repayment of debt,

working capital needs, capital expenditures, acquisitions and any other general

corporate purpose.

SELLING SHAREHOLDERS

We

have prepared this prospectus to allow the selling shareholders or their donees,

pledgees, transferees or other successors in interest to sell or otherwise

dispose of, from time to time, up to an aggregate of 22,596,607 common shares

issuable upon the exercise or exchange of (i) 20,454,546 warrants issued to the

selling shareholders in connection with a private placement under a Securities

Purchase Agreement entered into on March 24, 2017 and (ii) 2,142,061 warrants

issued to Opus Bank in connection with our Credit Agreement. The table below

presents information regarding the selling shareholders, the common shares

beneficially owned and the common shares that they may sell or otherwise dispose

of from time to time under this prospectus.

We

do not know when or in what amounts the selling shareholder may sell or

otherwise dispose of the common shares covered hereby. The selling shareholder

might not sell any or all of the shares covered by this prospectus or may sell

or dispose of some or all of the shares other than pursuant to this prospectus.

Because the selling shareholder may not sell or otherwise dispose of some or all

of the shares covered by this prospectus and because there are currently no

agreements, arrangements or understandings with respect to the sale or other

disposition of any of the shares, we cannot estimate the number of the shares

that will be held by the selling shareholder after completion of the offering.

However, for purposes of this table, we have assumed that all of the common

shares covered by this prospectus will be sold by the selling shareholder.

|

|

Beneficial Ownership

(1)

|

|

|

Number of

|

|

Percent

|

|

|

|

Number of

|

|

Percent

|

|

|

Shares

|

|

of

|

|

|

|

Shares

|

|

of

|

|

|

Beneficially

|

|

Class

|

|

Number of

|

|

Beneficially

|

|

Class

|

|

Name of

|

Owned Prior

|

|

Prior

|

|

Shares

|

|

Owned

|

|

After

|

|

Selling

|

to the

|

|

to the

|

|

Offered

|

|

After this

|

|

this

|

|

Shareholder

(2)

|

Offering

|

|

Offering

|

|

Hereby

(3)

|

|

Offering

|

|

Offering

|

|

MF Ventures, LLC

(4)

|

41,913,869

|

(5)

|

33.07%

|

|

4,545,454

|

|

37,368,415

|

|

29.48%

|

|

Anson Investments Master Fund LP

(6)

|

4,210,000

|

|

3.32%

|

|

2,500,000

|

|

1,710,000

|

|

1.35%

|

|

Alto Opportunity Master Fund, SPC -

Segregated Master Portfolio B

(7)

|

2,500,000

|

|

1.97%

|

|

2,500,000

|

|

0

|

|

0%

|

|

CVI Investments, Inc.

(8)

|

2,829,484

|

|

2.23%

|

|

2,272,728

|

|

556,756

|

|

0.44%

|

|

Hudson Bay Master Fund Ltd.

(9)

|

4,545,454

|

|

3.59%

|

|

4,545,454

|

|

0

|

|

0%

|

|

Intracoastal Capital, LLC

(10)

|

3,090,910

|

|

2.44%

|

|

3,090,910

|

|

0

|

|

0%

|

|

Black Mountain Equities, Inc.

(11)

|

500,000

|

|

0.39%

|

|

500,000

|

|

0

|

|

0%

|

- 16 -

|

Gemini Master Fund, Ltd.

(12)

|

500,000

|

|

0.39%

|

|

500,000

|

|

0

|

|

0%

|

|

Opus Bank

(13)

|

2,142,061

|

|

1.69%

|

|

2,142,061

|

|

0

|

|

0%

|

|

*

|

Less than 1.0% .

|

|

(1)

|