REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

Plan

Administrator and Audit Committee of the Board of

Directors

Community

Bancorp & Designated Subsidiaries Retirement Savings

Plan

We have

audited the accompanying statements of net assets available for

benefits of Community Bancorp & Designated Subsidiaries

Retirement Savings Plan (the Plan) as of December 31, 2016 and

2015, and the related statement of changes in net assets available

for benefits for the year ended December 31, 2016. These financial

statements are the responsibility of the Plan’s management.

Our responsibility is to express an opinion on these financial

statements based on our audits.

We

conducted our audits in accordance with the standards of the Public

Company Accounting Oversight Board (United States). Those standards

require that we plan and perform the audit to obtain reasonable

assurance about whether the financial statements are free of

material misstatement. An audit includes examining, on a test

basis, evidence supporting the amounts and disclosures in the

financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis

for our opinion.

In our

opinion, the financial statements referred to above present fairly,

in all material respects, the net assets available for benefits of

the Plan as of December 31, 2016 and 2015, and the changes in net

assets available for benefits for the year ended December 31, 2016,

in conformity with accounting principles generally accepted in the

United States of America.

The

supplemental information in the accompanying schedule of assets

(held at end of year) as of December 31, 2016 has been subjected to

audit procedures performed in conjunction with the audit of the

Plan's financial statements. The supplemental information is

presented for the purpose of additional analysis and is not a

required part of the financial statements but includes supplemental

information required by the Department of Labor's Rules and

Regulations for Reporting and Disclosure under the Employee

Retirement Income Security Act of 1974. The supplemental

information is the responsibility of the Plan's management. Our

audit procedures included determining whether the supplemental

information reconciles to the financial statements or the

underlying accounting and other records, as applicable, and

performing procedures to test the completeness and accuracy of the

information presented in the supplemental information. In forming

our opinion on the supplemental information in the accompanying

schedule, we evaluated whether the supplemental information,

including its form and content, is presented in conformity with the

Department of Labor's Rules and Regulations for Reporting and

Disclosure under the Employee Retirement Income Security Act of

1974. In our opinion, the supplemental information in the

accompanying schedule is fairly stated in all material respects in

relation to the financial statements as a whole.

Portland,

Maine

June

27, 2017

VT Reg.

No. 92-0000278

COMMUNITY

BANCORP & DESIGNATED

|

SUBSIDIARIES

RETIREMENT SAVINGS PLAN

|

|

|

|

|

Statements

of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

December

31,

|

|

|

|

|

|

|

|

Assets

|

|

|

|

Investments,

at fair value

|

|

|

|

Money

market assets

|

$

1,813,136

|

$

762,244

|

|

Marketable

equity securities

|

7,109,000

|

6,209,295

|

|

Mutual

funds

|

11,541,376

|

11,091,514

|

|

|

|

|

|

Total

investments

|

20,463,512

|

18,063,053

|

|

|

|

|

|

Receivables

|

|

|

|

Employer

contributions

|

447,486

|

455,957

|

|

Participant

contributions

|

18,347

|

17,681

|

|

Participant

loans

|

487,401

|

467,208

|

|

Accrued

interest and dividends

|

258

|

300

|

|

|

|

|

|

Total

receivables

|

953,492

|

941,146

|

|

|

|

|

|

Net

assets available for benefits

|

$

21,417,004

|

$

19,004,199

|

The accompanying notes are an integral part of these financial

statements.

COMMUNITY

BANCORP & DESIGNATED

|

SUBSIDIARIES

RETIREMENT SAVINGS PLAN

|

|

|

|

Statement

of Changes in Net Assets Available for Benefits

|

|

|

|

|

Year

Ended December 31, 2016

|

|

|

|

|

|

|

|

|

Additions to net

assets attributed to:

|

|

|

Investment

and participant loan income

|

|

|

Net

appreciation in fair value of investments

|

$

1,203,152

|

|

Interest

and dividends from investments and participant loans

|

848,835

|

|

|

|

|

|

2,051,987

|

|

|

|

|

Contributions

|

|

|

Employer’s

|

591,045

|

|

Participants’

|

444,583

|

|

Rollovers

|

19,048

|

|

|

|

|

|

1,054,676

|

|

|

|

|

Total

additions

|

3,106,663

|

|

|

|

|

Deductions from net

assets attributed to:

|

|

|

Benefits

paid to participants

|

647,293

|

|

Administrative

expenses

|

46,565

|

|

|

|

|

Total

deductions

|

693,858

|

|

|

|

|

Increase

in net assets available for benefits

|

2,412,805

|

|

|

|

|

Net assets

available for benefits

|

|

|

|

|

|

Beginning

of year

|

19,004,199

|

|

|

|

|

End

of year

|

$

21,417,004

|

The accompanying notes are an integral part of these financial

statements.

COMMUNITY BANCORP & DESIGNATED

SUBSIDIARIES RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2016 and 2015

Note

1. Description of Plan

The

following description of the Community Bancorp & Designated

Subsidiaries Retirement Savings Plan (the Plan) provides only

general information. Participants should refer to the Plan

agreement for a more complete description of the Plan's

provisions.

General

The

Plan is a defined contribution plan covering all employees of the

sponsor, Community National Bank (the Bank), a subsidiary of

Community Bancorp. (the Company or Community Bancorp), who have

attained age 21 and have completed one year of service. Effective

January 1, 2008, the Plan recognized years of service with

LyndonBank and affiliated employers for purposes of eligibility and

computing vesting. Under the provisions of the Plan, investment

activity is directed by individual participants. The Plan is

subject to the provisions of the Employee Retirement Income

Security Act of 1974 (ERISA).

Contributions

Participants

may contribute up to the maximum amount allowed by the Internal

Revenue Code (IRC). The Bank makes matching contributions equal to

50% of the participant’s contributions, with such

contributions limited to 5% of annual eligible compensation. The

Bank may also make additional discretionary contributions.

Contributions are subject to certain limitations. After tax or ROTH

contributions are accepted by the Plan.

Forfeiture Accounts

There

were no unallocated forfeitures as of December 31, 2016 and 2015.

Forfeitures may be used to reduce future employer contributions.

During 2016 and 2015, $19,220 and $10,439, respectively, of

forfeitures was used to reduce the Bank’s

contribution.

Note 2. Summary of Accounting Policies

Participant Loans

Loans

to participants are reported at their unpaid principal balances

plus any accrued but unpaid interest. Delinquent participant loans

are reclassified as distributions based upon the terms of the plan

documents.

Effective

January 1, 2016, all new loans made after January 1, 2016 will come

due upon termination of the participant.

Investment Valuation

Investments

are reported at fair value. Fair value is the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement

date. See Note 3 for discussion of fair value

measurement.

Use of Estimates

The

preparation of financial statements in conformity with U.S.

generally accepted accounting principles requires management to

make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements. Actual results

could differ from those estimates.

COMMUNITY BANCORP & DESIGNATED

SUBSIDIARIES RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2016 and 2015

Payment of Benefits

Benefits

are recorded when paid.

Administrative Expenses

All

reasonable expenses of administration may be paid out of Plan

assets unless paid by the Bank.

Note 3. Fair Value Measurement

Fair

value measurement accounting literature establishes a fair value

hierarchy that prioritizes the inputs to valuation techniques used

to measure fair value. This hierarchy consists of three broad

levels: Level 1 inputs consist of unadjusted quoted prices in

active markets for identical assets and have the highest priority,

and Level 3 inputs have the lowest priority. The Plan uses

appropriate valuation techniques based on the available inputs to

measure the fair value of its investments. When available, the Plan

measures fair value using Level 1 inputs because they generally

provide the most reliable evidence of fair value. No Level 2 or

Level 3 inputs were used at December 31, 2016 and

2015.

Level 1 Fair Value Measurement

Money

market assets are valued at the net asset value of shares held by

the Plan at year end. The fair value of marketable equity

securities is based on the closing price reported on the active

market where the individual securities are traded. The fair value

of mutual funds is based on quoted net asset values of the shares

held by the Plan at year end.

The

Plan’s investments are reported at fair value on a recurring

basis in the accompanying statements of net assets available for

benefits. The methods used to measure fair value may produce an

amount that may not be indicative of net realizable value or

reflective of future fair values. Furthermore, although the Plan

believes its valuation methods are appropriate and consistent with

other market participants, the use of different methodologies or

assumptions to determine the fair value of certain financial

instruments could result in a different fair value measurement at

the reporting date.

COMMUNITY BANCORP & DESIGNATED

SUBSIDIARIES RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2016 and 2015

|

|

Fair

Value Measurement at

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31, 2016

|

|

|

|

|

|

|

|

Money market

assets

|

$

1,813,136

|

$

1,813,136

|

|

|

|

|

|

Marketable equity

securities

|

7,109,000

|

7,109,000

|

|

|

|

|

|

Mutual

funds

|

11,541,376

|

11,541,376

|

|

|

|

|

|

Total assets at

fair value

|

$

20,463,512

|

$

20,463,512

|

|

|

|

|

|

December

31, 2015

|

|

|

|

|

|

|

|

Money market

assets

|

$

762,244

|

$

762,244

|

|

|

|

|

|

Marketable equity

securities

|

6,209,295

|

6,209,295

|

|

|

|

|

|

Mutual

funds

|

11,091,514

|

11,091,514

|

|

|

|

|

|

Total assets at

fair value

|

$

18,063,053

|

$

18,063,053

|

COMMUNITY BANCORP AND DESIGNATED

SUBSIDIARIES’ RETIREMENT SAVINGS PLAN

Notes to Financial Statements

December 31, 2016 and 2015

Note 4. Tax Status

The

Plan is part of a prototype plan designated by Future Planning

Associates, Inc., the record keeper of the Plan. The Internal

Revenue Service has determined and informed the record keeper by a

letter dated March 31, 2014 that the prototype plan is designed in

accordance with the applicable sections of the IRC. The Plan has

been amended since receiving the determination letter. However, the

plan administrator and the Plan’s tax counsel believe that

the Plan is currently designed and being operated in compliance

with the applicable requirements of the IRC.

Note 5. Plan Termination

Although

it has not expressed any intention to do so, the Bank has the right

under the Plan to discontinue its contributions at any time and to

terminate the Plan subject to the provisions set forth in ERISA. In

the event of Plan termination, participants would become 100%

vested in their employer contributions.

Note

6. Party-In-Interest Transactions

Community

Financial Services Group, LLC is the Plan’s custodian. The

Bank has a one-third ownership interest in Community Financial

Services Group, LLC. Fees paid to the custodian by the Plan for

investment management services amounted to $44,065 for the year

ended December 31, 2016.

The

Plan allows for participant contributions to be invested in common

stock of the Company. At December 31, 2016 and 2015, the Plan held

462,374 and 435,740 shares, respectively, valued at $7,109,000 and

$6,209,295, respectively.

There

were no party-in-interest transactions which are prohibited by

ERISA Section 406 and for which there is no statutory or

administrative exemption.

Note

7. Risks and Uncertainties

The

Plan invests in various investment securities. Investment

securities are exposed to various risks such as interest rate,

market, and credit risks. Due to the level of risk associated with

certain investment securities, it is at least reasonably possible

that changes in the values of investment securities will occur in

the near term and that such changes could materially affect

participants’ account balances and the amounts reported in

the statement of net assets available for benefits.

Note 8

.

Subsequent Events

For

purposes of accrual or disclosure in these financial statements,

the Company has evaluated subsequent events through the date of

issuance of these financial statements.

Schedule

COMMUNITY BANCORP & DESIGNATED

SUBSIDIARIES RETIREMENT SAVINGS PLAN

Schedule H, Line 4i – Schedule of Assets (Held at End of

Year)

Required for IRS Form 5500

EIN #03-0288082

Plan #002

December 31, 2016

|

|

|

(c)

|

|

|

|

|

(b)

|

Description of

Investment

|

|

|

|

|

Identity of

Issue,

|

Including Maturity

Date,

|

|

|

|

|

Borrower,

Lessor,

|

Rate of Interest,

Collateral,

|

|

|

|

|

or Similar

Party

|

Par or Maturity

Value

|

|

|

|

|

|

|

|

|

|

|

Fidelity Money

Market Fund

|

Money

Market

|

**

|

$

1,807,476

|

|

|

Federated

Government Obligations Fund

|

Money

Market

|

**

|

5,660

|

|

|

American Balanced

Fund

|

Mutual

Fund

|

**

|

2,284,282

|

|

|

Dodge & Cox

Balanced Fund

|

Mutual

Fund

|

**

|

520,137

|

|

|

Growth Fund of

America, Inc.

|

Mutual

Fund

|

**

|

2,369,103

|

|

|

T. Rowe Price

Equity Income Fund

|

Mutual

Fund

|

**

|

1,100,638

|

|

|

Royce Premier

Investment Fund

|

Mutual

Fund

|

**

|

1,027,978

|

|

|

Vanguard Total

Stock Market Index Fund

|

Mutual

Fund

|

**

|

3,074,877

|

|

|

Vanguard Short Term

Bond Index Fund

|

Mutual

Fund

|

**

|

207,848

|

|

|

EuroPacific Growth

Fund

|

Mutual

Fund

|

**

|

956,513

|

|

*

|

Community

Bancorp.

|

Common

Stock

|

**

|

7,109,000

|

|

|

|

|

|

|

Investments

at fair value

|

|

|

20,463,512

|

|

|

|

|

|

*

|

Participant

loans

|

2.88% -

4.81%,

|

|

|

|

|

|

various

maturities

|

-

|

487,401

|

|

|

|

|

|

|

|

$

20,950,913

|

|

|

|

|

|

*

|

Indicates a

party-in-interest to the Plan.

|

|

|

|

|

**

|

Participant

directed investments, information not required.

|

|

|

|

SIGNATURES

The Plan.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Plan Administrators have duly caused this

annual report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

COMMUNITY

BANCORP & DESIGNATED SUBSIDIARIES

|

|

RETIREMENT

SAVINGS PLAN

|

|

DATE: June

27, 2017

|

/s/

Kathryn M.

Austin

|

|

|

|

Kathryn

M. Austin, President & Chief

|

|

|

|

Executive

Officer, Community Bancorp.

|

|

|

|

(Plan

Administrator)

|

|

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 11-K

[ X ]

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

COMMUNITY BANCORP.

EXHIBITS

EXHIBIT

INDEX

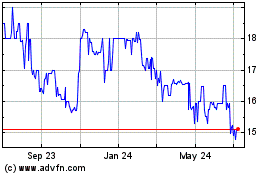

Community Bancorp (QX) (USOTC:CMTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

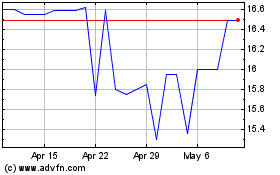

Community Bancorp (QX) (USOTC:CMTV)

Historical Stock Chart

From Apr 2023 to Apr 2024