UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

| |

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| Check the appropriate box: |

|

Preliminary Proxy Statement |

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

Brown-Forman Corporation

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) Title of each class of securities to which transaction applies: |

| |

(2) Aggregate number of securities to which transaction applies: |

| |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) Proposed maximum aggregate value of transaction: |

| |

(5) Total fee paid: |

|

Fee paid previously with preliminary materials. |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

| |

(1) Amount Previously Paid: |

| |

(2) Form, Schedule or Registration Statement No.: |

| |

(3) Filing Party: |

| |

(4) Date Filed: |

2017 PROXY

STATEMENT

& NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS

June 27, 2017

DEAR BROWN-FORMAN STOCKHOLDER:

It is our pleasure to invite you to attend Brown-Forman Corporation’s

2017 Annual Meeting of Stockholders, which will be held at the Brown-Forman Conference Center in Louisville, Kentucky, on Thursday,

July 27, 2017, at 9:30 A.M. (Eastern Daylight Time). Please see the Notice of Annual Meeting on the next page for more information

about this location and our admission procedures.

Your vote is important to us. We urge you to complete and

return your proxy card or to vote by telephone or online as soon as possible, even if you plan to attend the Annual Meeting.

We hope to see you on July 27. On behalf of the Board of Directors,

thank you for your continued support.

Very truly yours,

Paul C. Varga,

Chairman and Chief Executive Officer

Geo. Garvin Brown IV,

Chairman of the Board of Directors

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| DATE: |

Thursday, July 27, 2017 |

| |

|

| TIME: |

9:30 A.M. (Eastern Daylight Time) |

| |

|

| LOCATION: |

Brown-Forman Conference Center |

| |

850 Dixie Highway |

| |

Louisville, Kentucky 40210 |

We are holding this meeting for the following purposes:

| • |

To elect the thirteen directors named in this Proxy Statement; |

| • |

To vote, on a nonbinding advisory basis, to approve our executive compensation; |

| • |

To vote, on a nonbinding advisory basis, on the frequency of future advisory votes on executive compensation; and |

| • |

To transact any other business that may properly come before the meeting. |

Class A stockholders of record at the close of business on

June 19, 2017, are entitled to vote at the meeting, either in person or by proxy.

There are several ways to vote. You may complete, sign, and date

the enclosed proxy card and return it in the enclosed envelope, or you may vote by telephone (1-800-652-8683) or online (www.investorvote.com/BFB).

Whatever method you choose, please vote in advance of the meeting to ensure that your shares will be voted as you direct. Instructions

on telephone and online voting are on the proxy card enclosed with this Proxy Statement.

Louisville, Kentucky

June 27, 2017

By order of the Board of Directors

Matthew E. Hamel, Secretary

ADMISSION PROCEDURES

We are committed to providing a safe, secure environment for

our stockholders, employees, and guests. To that end, please observe the following procedures if you plan to attend the Annual

Meeting:

| • |

Before the meeting: Please register on or before July 25, 2017, by contacting Linda Gering, our Stockholder Services Manager, at (502) 774-7690 or Linda_Gering@b-f.com. |

| • |

When you arrive: Brown-Forman representatives will direct you to the Forester Center garden area, where you can check in at the registration table beginning at 8:30 A.M. (Eastern Daylight Time). In case of inclement weather, registration will take place inside the Forester Center Annex. |

| • |

What to bring: Everyone attending the meeting should bring a photo ID. If your shares are registered in the name of a bank, broker, or other holder of record, please also bring documentation of your stock ownership (such as a brokerage statement) as of June 19, 2017. |

If you do not register in advance, you may still be admitted

if you present a photo ID along with your proxy card, brokerage statement, or other documentation of stock ownership.

IMPORTANT NOTICE REGARDING AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 27, 2017:

The Notice of Annual Meeting, Proxy Statement, and Annual Report

to Stockholders, which includes our Form 10-K for fiscal 2017, are available at www.brown-forman.com/ investors/annual-report/.

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

1 |

In this section we highlight certain information

about matters discussed in this Proxy Statement. As it is only a summary, we encourage you to read the entire Proxy Statement before

voting.

ANNUAL MEETING OF STOCKHOLDERS

| Date: |

Thursday, July 27, 2017 |

Location: |

Brown-Forman Conference Center |

| |

|

|

850 Dixie Highway |

| Time: |

9:30 A.M. (Eastern Daylight Time) |

|

Louisville, Kentucky 40210 |

PROPOSALS FOR STOCKHOLDER VOTING

| Proposal |

|

Our Board’s voting recommendation |

|

Where to find details |

| Election of 13 directors |

|

FOR all nominees |

|

Pages 16–20 |

| Advisory vote to approve our executive compensation |

|

FOR the proposal |

|

Page 51 |

| Advisory

vote on the frequency of future advisory votes on executive compensation |

|

For EVERY THREE YEARS as the frequency of future advisory votes on executive compensation |

|

Page 52 |

PERFORMANCE AND COMPENSATION HIGHLIGHTS

We believe our executive compensation program continues to attract,

motivate, reward, and retain a talented and diverse team of executives. These individuals lead our efforts to be the best brand

builder in the spirits industry, and enable us to deliver superior and sustainable value for our stockholders. The incentive payouts

to our executives described in this Proxy Statement reflect our performance during fiscal 2017.

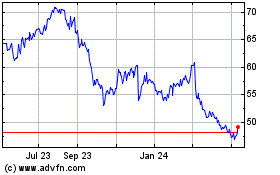

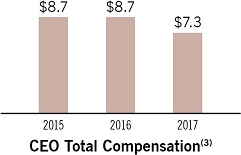

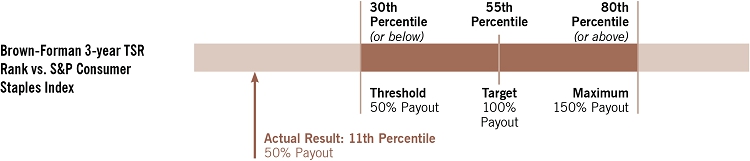

The following charts compare trends in Brown-Forman’s performance

with respect to total shareholder return, diluted earnings per share, and underlying operating income growth with trends in the

compensation of our Chief Executive Officer, Paul Varga. These metrics reflect exceptional long-term value generated for our stockholders,

and the charts show how our compensation strategy aligns with that performance.

OUR PERFORMANCE IN FISCAL 2017:

|

|

|

|

|

(compound annual growth rate;

Class B common stock) |

|

(compound annual growth rate) |

|

(in $ millions) |

| (1) |

EPS was adjusted to exclude the effect of acquired and divested brands in fiscal 2016 and fiscal 2017.

These measures remove the effects of (a) the gain on the sale of Southern Comfort and Tuaca, (b) those transaction-related

costs not included in the gain on the sale of Southern Comfort and Tuaca, (c) financing-related costs for the acquisition

of BenRiach, and (d) operating activity for the acquired and divested businesses in the non-comparable periods. (With respect

to the comparison of fiscal 2017 to fiscal 2016, the non-comparable period comprised all months of both years.) EPS used for

fiscal 2016 was $1.63, compared to the reported GAAP value of $2.61, and EPS used for fiscal 2017 was $1.72, compared to the

reported GAAP value of $1.71. Both measures are adjusted in Part II, Item 7, “Management’s Discussion and Analysis

of Financial Condition and Results of Operations,” under the heading “Fiscal 2017 Highlights — Adjusted

Measures for Acquired and Divested Brands.” |

| (2) |

Reflects growth in “underlying operating income” over the past fiscal years. “Underlying operating income”

is not derived in accordance with GAAP. We explain why the Company uses this measure in Part II, Item 7, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” under the heading “Non-GAAP Financial

Measures,” in our Annual Report on Form 10-K for fiscal 2017. |

| (3) |

Mr. Varga’s total compensation includes base salary, stock appreciation rights, non-equity compensation, and all

other compensation as reported in the Fiscal 2017 Summary Compensation Table on page 40. It also includes performance-adjusted

restricted stock award values as reported at the end of the applicable three-year performance period. Changes in pension value

are excluded. |

| 2 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

OUR DIRECTOR NOMINEES TO THE BOARD

Class A stockholders are being asked to vote on the election

of the thirteen directors named below. More details about each director’s background, skills, and expertise can be found

below under “Proposal 1: Election of Directors” beginning on page 16. One new director, Kathleen M. Gutmann, joined

the Board on May 24, 2017.

Board Nominees

| |

|

|

|

|

|

Committee Membership |

| Nominee Name, Age & Occupation |

|

Director

Since |

|

Director

Category |

|

Audit |

|

Comp |

|

Corp Gov

& Nom |

|

Exec |

Patrick Bousquet-Chavanne, AGE 59

Executive Director of Customer, Marketing and M&S.com, Marks and Spencer Group PLC |

|

2005 |

|

I |

|

|

|

• |

|

• |

|

|

Campbell P. Brown, AGE 49

President and Managing Director of Old Forester, Brown-Forman Corporation |

|

2016 |

|

B, M |

|

|

|

|

|

|

|

|

Geo. Garvin Brown IV, AGE 48

Chairman of the Board, Brown-Forman Corporation |

|

2006 |

|

B |

|

|

|

|

|

• |

|

C |

Stuart R. Brown, AGE 52

Managing Partner, Typha Partners, LLC |

|

2015 |

|

B |

|

|

|

|

|

|

|

|

Bruce L. Byrnes, AGE 69

Retired Vice Chairman of the Board, The Procter & Gamble Company |

|

2010 |

|

I |

|

• |

|

|

|

• |

|

|

John D. Cook, AGE 64

Lead Independent Director; Director Emeritus of McKinsey & Company |

|

2008 |

|

I |

|

• |

|

• |

|

C |

|

• |

Marshall B. Farrer, AGE 46

Vice President and Managing Director of Global Travel Retail, Brown-Forman Corporation |

|

2016 |

|

B, M |

|

|

|

|

|

|

|

|

Laura L. Frazier, AGE 59

Owner and Chairman, Bittners LLC |

|

2016 |

|

B |

|

|

|

|

|

|

|

|

Kathleen M. Gutmann, AGE 48

Chief Sales and Solutions Officer, United Parcel Service, Inc. |

|

2017 |

|

I |

|

|

|

|

|

|

|

|

Augusta Brown Holland, AGE 41

Founding Partner, Haystack Partners LLC |

|

2015 |

|

B |

|

|

|

|

|

|

|

|

Michael J. Roney, AGE 63

Retired Chief Executive, Bunzl plc |

|

2014 |

|

I |

|

|

|

C |

|

|

|

|

Michael A. Todman, AGE 59

Retired Vice Chairman, Whirlpool Corporation |

|

2014 |

|

I |

|

C |

|

|

|

|

|

|

Paul C. Varga, AGE 53

Chairman & CEO, Brown-Forman Corporation |

|

2003 |

|

M |

|

|

|

|

|

|

|

• |

B=Brown Family Director M=Management Director I=Independent Director C=Chair

“In building our brands and creating new opportunities,

we are writing the next chapter in our story of innovation, perseverance, and success.”

Paul Varga, Chairman and CEO

| FISCAL 2017 |

|

|

| |

| 19% |

$561M |

$274M |

RETURN ON

INVESTED

CAPITAL(1) |

SHARE

REPURCHASES |

DIVIDENDS |

| (1) |

Return on Invested Capital is not derived in accordance with GAAP. We explain why the Company uses this measure in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” under the heading “Non-GAAP Financial Measures,” in our Annual Report on Form 10-K for fiscal 2017. |

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

3 |

| |

ANNUAL MEETING INFORMATION |

ABOUT YOUR PROXY MATERIALS

Our Board of Directors is soliciting proxies for our upcoming

Annual Meeting of Stockholders to be held on July 27, 2017 (the Annual Meeting). This means that you can vote “by proxy”

at the Annual Meeting —that is, you can instruct us how you would like your shares to be voted at the meeting whether or

not you personally attend.

We are providing this Proxy Statement and accompanying materials

to help you make an informed decision on the matters to be considered at the Annual Meeting. We will begin mailing this Proxy Statement

and accompanying materials, and also make them available online, on or about June 27, 2017, to holders of record of our Class A

and Class B common stock at the close of business on June 19, 2017, which is the “record date” for the Annual Meeting.

This Proxy Statement and our Annual Report to Stockholders, which

includes our Form 10-K for fiscal 2017, are available at www.brown-forman.com/investors/annual-report/. You may request

additional printed copies at any time using the contact information below.

Please let us know as soon as possible how you would like

your shares voted. To do this, you may complete, sign, date, and return the enclosed proxy card or voting instruction card, or

you may instruct us by telephone or online. See “Voting” below for details.

Contact Information

For information about your stock ownership or other stockholder

services, please contact Linda Gering, our Stockholder Services Manager, by telephone at (502) 774-7690, by e-mail at Linda_Gering@b-f.com,

or by mail at Brown-Forman Corporation, 850 Dixie Highway, Louisville, Kentucky 40210.

Reducing Duplicate Mailings

The Securities and Exchange Commission (SEC) permits us to deliver

a single Proxy Statement and Annual Report to stockholders who share the same address and last name, unless we receive contrary

instructions from any stockholder in the household. Even if your household receives only one Proxy Statement and Annual Report,

each stockholder will receive an individual proxy card. We participate in this “householding” process to reduce our

printing costs, postage fees, and to better facilitate voting. If you would like to enroll in “householding,” or if

your household is already enrolled but you prefer to opt out of “householding” for next year, please inform us using

the contact information above and we will promptly fulfill your request.

ATTENDING THE ANNUAL MEETING

Although only Class A stockholders may vote at the Annual Meeting,

Class A and Class B stockholders who owned their shares as of June 19, 2017, are welcome to attend.

If you plan to attend, please register by July 25, 2017, by contacting

Linda Gering using the contact information above. Please bring a photo ID and, if your shares are registered in the name of a bank,

broker, or other holder of record, documentation of your stock ownership as of the record date. Please see “Admission

Procedures” outlined in the Notice of Annual Meeting for full details.

VOTING

Who May Vote

If you held shares of Class A common stock at the close of

business on the record date (June 19, 2017), you, or your legal proxies, may vote at the Annual Meeting on all three

proposals. At the close of business on the record date, there were 169,062,117 shares of Class A common stock outstanding and

entitled to vote at the Annual Meeting. At the close of business on the record date, there were 215,189,294 shares of Class B

common stock outstanding, however those shares are not entitled to vote.

If you purchased Class A common stock after the record date,

you may vote those shares only if you receive a proxy to do so from the person who held the shares on the record date. Each share

of Class A common stock is entitled to one vote. If you receive more than one proxy card or voting instruction card, you should

complete, sign, date, and return each one (or follow the telephone or online voting instructions) because the cards represent different

shares.

| 4 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

ANNUAL MEETING

INFORMATION • VOTING

How to Vote

Stockholders of record. If your shares are registered

directly in your name with our stock transfer agent, Computershare, you are considered the “stockholder of record”

of those shares. If you are a stockholder of record of Class A shares, you can give a proxy to be voted at the meeting:

• over the telephone by calling a toll-free number

(1-800-652-8683);

• online (www.investorvote.com/BFB); or

• by completing, signing, and mailing the enclosed

proxy card in the envelope provided.

Even if you plan to attend the meeting, we encourage you to submit

a proxy in advance. We must receive your proxy by 1:00 a.m., Eastern Daylight Time, on Thursday, July 27, 2017, to ensure your

vote is recorded. You may override a proxy by following the applicable procedure outlined below in “Changing Your Vote.”

The telephone and online voting procedures have been set up for your convenience and are designed to authenticate your identity,

enable you to give voting instructions, and confirm that those instructions are recorded properly. If you are a stockholder of

record and wish to vote by telephone or online, please refer to the instructions on the enclosed proxy card.

Your proxy will authorize the individuals named on the proxy

card to vote your shares in accordance with your instructions. These individuals will also have the obligation and authority to

vote your shares as they see fit on any other matter properly presented for a vote at the Annual Meeting. If for any reason a director

nominee is not available to serve, the individuals named as proxy holders may vote your shares at the Annual Meeting for another

nominee. The proxy holders for this year’s Annual Meeting are Geo. Garvin Brown IV, Paul C. Varga, and Matthew E. Hamel.

If you are a stockholder of record and you sign and return

your proxy card (or give your proxy by telephone or online) without specifying how you want your shares to be voted, our proxy

holders will vote your shares “FOR” the election of each of the nominees to the Board (Proposal 1), “FOR”

the advisory resolution to approve our executive compensation (Proposal 2), and for “EVERY THREE YEARS” as the frequency

of future advisory votes on executive compensation (Proposal 3). With respect to any other matter that properly comes before the

Annual Meeting, the proxy holders will vote your shares as recommended by the Board or, if no recommendation is given, using their

own discretion.

“Street name” stockholders. If your shares

are held in a stock brokerage account or by a bank (known as holding shares in “street name”), you have the

right to instruct your broker or bank how to vote your shares, and the broker or bank is required to vote in accordance with your

instructions. To provide those instructions by mail, please complete, sign, date, and return your voting instruction card in the

postage-paid envelope provided by your broker or bank. Alternatively, if the broker or bank that holds your shares offers online

or telephone voting, you will receive information from your broker or bank about how to submit your voting instructions by those

methods. You may vote in person at the meeting, but only if you obtain a “legal proxy” from the broker or bank that

holds your shares.

If you are a street name stockholder and you do not instruct

your broker how to vote, your broker is not permitted to vote your shares on any of the proposals we will address at the Annual

Meeting. This is known as a “broker non-vote.”

Changing Your Vote

If you are a stockholder of record, you may change your

vote by submitting another proxy by telephone or online, by mailing another properly signed proxy card bearing a later date than

your original one, or by attending the Annual Meeting and casting your vote in person. You also may revoke a proxy that you previously

provided by delivering timely written notice of revocation to our Secretary, Matthew E. Hamel, at Brown-Forman Corporation, 850

Dixie Highway, Louisville, Kentucky 40210, or at Secretary@b-f.com.

If you hold your shares in street name and you wish to

change or revoke your voting instructions, please refer to the materials your broker or bank provided to you for instructions.

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

5 |

ANNUAL MEETING INFORMATION •

ANNOUNCEMENT OF VOTING RESULTS

Quorum Requirements

Business can be conducted at the Annual Meeting only if a quorum

consisting of a majority of the outstanding shares of Class A common stock is present in person or represented by proxy. Abstentions

and broker non-votes, if any, will be counted as present for purposes of establishing a quorum.

Votes Needed For Approval

| Proposal |

|

Vote required to pass |

|

Effect of abstentions and broker non-votes |

| Election

of directors |

|

Nominees

who receive a majority of the Class A votes cast (the number

of shares voted “for” the nominee exceeds the number of shares

voted “against” that nominee) will be elected. |

|

No

effect. |

| Advisory

resolution to approve executive

compensation |

|

Approval

requires an affirmative vote of the majority of the Class A shares

present (in person or represented by proxy) and entitled to vote. |

|

Abstentions

are equivalent to votes against the

proposal.

Broker non-votes will have

no effect. |

| Advisory

resolution on the frequency

of future advisory votes on executive compensation |

|

The

frequency receiving the greatest number of votes (every one, two,

or three years) will be considered the recommendation of the stockholders. |

|

No

effect. |

| Any

other matter |

|

Approval

requires an affirmative vote of the majority of the Class A shares

present (in person or represented by proxy) and entitled to vote. |

|

Abstentions

are equivalent to votes against the

proposal.

Broker non-votes will have

no effect. |

Dividend Reinvestment and Employee Stock Purchase Plan Shares

Shares of Class A common stock held in Brown-Forman’s dividend

reinvestment and employee stock purchase plans are included in your holdings and reflected on your proxy card. These shares will

be voted as you direct.

ANNOUNCEMENT OF VOTING RESULTS

We intend to announce the preliminary voting results at the Annual

Meeting and to issue a press release later that day. In addition, we will report the voting results by filing a Form 8-K with the

SEC within four business days following the Annual Meeting.

PROXY SOLICITATION EXPENSES

Brown-Forman bears the cost of soliciting proxies. Beginning

on June 27, 2017, which is the mailing date for these proxy materials, our directors, officers, and other employees may solicit

proxies in person or by regular or electronic mail, phone, fax, or online. These individuals will not receive additional compensation

for soliciting proxies. We will reimburse banks, brokers, nominees, and other fiduciaries for their reasonable charges and expenses

incurred in forwarding our proxy materials to the beneficial owners of our stock held in street name. In addition, we have retained

Proxy Express, Inc. to assist with the distribution of proxy materials for a fee of approximately $15,000, plus expenses.

| 6 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

|

OUR BOARD OF DIRECTORS

Our Board is the policy-making body that is ultimately responsible

for Brown-Forman’s business success and ethical climate. The Board oversees the performance of our senior management team,

which is responsible for leading and operating Brown-Forman’s business. The Board’s primary responsibilities include

retention, evaluation, and succession planning for the Chief Executive Officer and the Chairman of the Board, as well as oversight

of our corporate strategy, financial condition, executive compensation policies and practices, and enterprise risk management.

The Board may retain independent advisors to help it perform its duties.

SELECTION OF DIRECTORS

In evaluating candidates for Board membership, the Corporate

Governance and Nominating Committee seeks directors who will represent the long-term best interests of all stockholders. As articulated

in our Corporate Governance Guidelines, all Brown-Forman directors should possess the highest personal and professional ethics,

integrity, and values. The Board believes the best directors have the following additional qualities: good judgment, candor, independence,

civility, business courage, experience with businesses and other organizations of comparable character and comparable or larger

size, and a lack of conflicts of interest.

The Corporate Governance and Nominating Committee and the Board

consider diversity in evaluating candidates for Board membership, though neither has adopted a formal policy to that effect. The

Board’s goal is to maintain a well-balanced composition that combines a variety of experiences, backgrounds, skills, and

perspectives to enable the Board, as a whole, to guide Brown-Forman effectively in the pursuit of its strategic objectives. In

evaluating potential Board candidates, the Corporate Governance and Nominating Committee considers an individual’s independence;

business, professional, or public service experience; relevant industry knowledge, experience, and relationships; business judgment;

financial expertise; international experience; leadership skills; age, gender, race, and other personal characteristics; time availability;

and familial relation to our controlling family stockholders.

The Corporate Governance and Nominating Committee occasionally

engages independent search firms to assist in identifying potential Board candidates. The Board has not adopted a formal policy

regarding stockholder-nominated director candidates because the committee believes the process it follows to identify and select

Board members has been appropriate and effective.

|

|

BROWN-FORMAN IS A “CONTROLLED COMPANY.”

As a publicly traded, family-controlled company, Brown-Forman

enjoys a rare governance opportunity in that members of our controlling stockholder family, the Brown family, participate directly

on our Board. We believe this governance structure gives us a distinct competitive advantage because Brown family members bring

a long-term ownership perspective to our Board. This advantage is sustained by a careful balancing of the roles of our Board, management,

and our stockholders — including the Brown family.

|

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

7 |

CORPORATE GOVERNANCE • BOARD

COMPOSITION

BOARD COMPOSITION

How Our Controlled-Company Status Affects Our Board

Our Board has determined that Brown-Forman is a “controlled

company” under New York Stock Exchange (NYSE) rules because more than 50% of our Class A voting stock is held by members

of the Brown family.

As a controlled company, we are exempt from NYSE listing standards

that require boards to have a majority of independent directors, a fully independent nominating/corporate governance committee,

and a fully independent compensation committee. As a matter of good corporate governance, the Board has voluntarily chosen to have

a Compensation Committee that is composed entirely of directors who meet the NYSE’s heightened independence standards for

compensation committee members. Our Board does not have a majority of independent directors or a fully independent nominating/corporate

governance committee.

Our Independent Directors

Under NYSE listing rules, a director qualifies as “independent”

if the board of directors affirmatively determines the director has no material relationship with the company. Material relationships

can include commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships. While the focus

is on independence from management, our Board considers all relevant facts and circumstances in making an independence determination.

Our Board recognizes the value of having independent directors, and has determined that six directors are independent under NYSE

standards: Patrick Bousquet-Chavanne, Bruce L. Byrnes, John D. Cook, Kathleen M. Gutmann, Michael J. Roney, and Michael A. Todman.

The Board has determined that Geo. Garvin Brown IV, Campbell

P. Brown, Marshall B. Farrer, and Paul C. Varga are not independent because they are, or recently have been, members of Brown-Forman

management. The Board elected not to make a determination with respect to the independence of Stuart R. Brown, Laura L. Frazier,

and Augusta Brown Holland.

Our Brown Family Directors

We believe it is strategically important for Brown family members

to be actively engaged in the oversight of Brown-Forman. Through participation on the Board, the Brown family’s long-term

perspective is brought to bear, in some measure, upon each and every matter the Board considers. Brown family directors also serve

as an effective link between the Board and the controlling family stockholders.

In addition, Board service allows the Brown family to actively

oversee its investment in the Company. Currently, the Brown family directors are: Campbell P. Brown, Geo. Garvin Brown IV, Stuart

R. Brown, Marshall B. Farrer, Laura L. Frazier, and Augusta Brown Holland.

| 8 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE GOVERNANCE • BOARD

COMPOSITION

Our Management Directors

We also believe it is important, from a corporate governance

standpoint, for management to be represented on the Board. Currently, Campbell P. Brown, Marshall B. Farrer, and Paul C. Varga

serve in dual roles as Board members and Brown-Forman executives.

BROWN-FORMAN BOARD OF DIRECTORS

| PATRICK BOUSQUET-CHAVANNE |

|

CAMPBELL P. BROWN |

|

GEO. GARVIN BROWN

IV |

| |

|

|

|

|

|

Executive Director of Customer, Marketing and M&S.com, Marks and Spencer Group PLC |

|

|

President and Managing Director of Old Forester, Brown-Forman Corporation |

|

|

Chairman of the Board, Brown-Forman Corporation |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| STUART R. BROWN |

|

BRUCE L. BYRNES |

|

JOHN D. COOK |

| |

|

|

|

|

|

|

|

|

Managing Partner, Typha Partners, LLC |

|

|

Retired Vice Chairman of the Board, The Procter & Gamble Company |

|

|

Lead Independent Director; Director Emeritus of McKinsey & Company |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| MARSHALL B. FARRER |

|

LAURA L. FRAZIER |

|

KATHLEEN M. GUTMANN |

| |

|

|

|

|

|

|

|

|

Vice President and Managing Director of Global Travel Retail, Brown-Forman Corporation |

|

|

Owner and Chairman, Bittners LLC |

|

|

Chief Sales and Solutions Officer, United Parcel Service, Inc. and Senior Vice President, The UPS Store and UPS Capital |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| AUGUSTA BROWN HOLLAND |

|

MICHAEL J. RONEY |

|

MICHAEL A. TODMAN |

| |

|

|

|

|

|

|

|

|

Founding Partner, Haystack Partners LLC |

|

|

Retired Chief Executive, Bunzl plc |

|

|

Retired Vice Chairman, Whirlpool Corporation |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| PAUL C. VARGA |

|

INDEPENDENT |

|

RECENT CHANGES TO OUR BOARD

As previously disclosed, Kathleen M. Gutmann joined the Board

on May 24, 2017, as an independent director.

|

| |

|

|

|

|

|

|

Chairman & CEO, Brown-Forman Corporation |

|

BROWN FAMILY |

|

| |

|

|

|

| |

MANAGEMENT |

|

| |

|

|

|

|

| |

|

BROWN FAMILY &

MANAGEMENT |

|

| |

|

|

|

|

|

|

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

9 |

CORPORATE GOVERNANCE •

LEADERSHIP STRUCTURE

LEADERSHIP STRUCTURE

Chairman of the Board

Our Board believes that the determination of whether to separate

or combine the roles of Chairman of the Board and Chief Executive Officer should depend largely upon the identity of the Chief

Executive Officer and the composition of the Board at the time. For this reason, it does not have a policy on separation of these

roles, but rather evaluates the situation on a case-by-case basis. Currently, these roles are separate, although they have been

combined in the past. Geo. Garvin Brown IV, a Brown family member, serves as Chairman of the Board.

Company Chairman and CEO

Paul C. Varga serves as the Chairman and Chief Executive Officer

of Brown-Forman. Mr. Varga is our highest ranking executive officer and is responsible for Brown-Forman’s strategy, operations,

and performance.

Lead Independent Director

When a non-independent director holds the office of Chairman

of the Board or Presiding Chairman of the Board, as is currently the case, the Board may select one independent director (after

considering the recommendation of the Corporate Governance and Nominating Committee) to serve as Lead Independent Director. The

Lead Independent Director, if any, will be elected annually. John D. Cook has served in this role since 2012.

As Lead Independent Director, Mr. Cook’s responsibilities

are to:

| • |

call meetings of the independent or non-management directors, when necessary or advisable; |

| • |

chair executive sessions attended solely by independent directors; |

| • |

facilitate open communications among directors and with management between Board meetings and help directors reach consensus on important matters; |

| • |

serve as liaison, when necessary or advisable, between the Chairman of the Board or Presiding Chairman of the Board and the independent and non-management directors; |

| • |

be available for consultation and direct communication upon the reasonable request of major and/or long-term stockholders; |

| • |

play a leadership role in contingency and succession planning, if and as needed; and |

| • |

perform such other duties as the Board may from time to time delegate to assist the Board in the fulfillment of its responsibilities. |

Mr. Cook chaired one executive session of non-management directors

in fiscal 2017. Also, because our non-management director group includes directors who are not “independent” under

NYSE listing standards, Mr. Cook called and presided over one executive session in fiscal 2017 that was attended solely by our

independent directors.

Why the Board Chose this Leadership Structure

The Board has determined that this leadership structure currently

serves the best interests of Brown-Forman and its stockholders. Having a Brown family member serve as Chairman of the Board promotes

the Brown family’s active oversight of, and engagement and participation in, the Company and its business and reflects the

fact that Brown-Forman is controlled by the Brown family. In addition, because Mr. Brown handles the responsibilities associated

with the position of Chairman of the Board, Mr. Varga can concentrate on strategy and operations, while the Board still has access

to his comprehensive knowledge of the Company’s business. The Lead Independent Director position provides leadership to,

and fosters coordination among, our independent directors, enabling them to fulfill their role of bringing outside perspectives

to the Board.

| 10 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE GOVERNANCE •

BOARD GUIDELINES AND PROCEDURES

BOARD GUIDELINES AND PROCEDURES

Corporate Governance Guidelines

The Board believes transparency is a hallmark of good corporate

governance. To that end, the Board has adopted Corporate Governance Guidelines that provide a framework for the Board to exercise

its duties. Among other things, these guidelines contain policies and requirements regarding: director qualifications; director

responsibilities, including the Lead Independent Director’s role; meetings and attendance; committee composition and responsibilities;

director compensation; and director access to management and independent advisors. The Corporate Governance Guidelines are published

on our website at www.brown-forman.com/about/corporate-governance/guidelines/.

Board and Committee Self-Assessment

The Corporate Governance Guidelines require the Board to conduct

an annual self-assessment. Each Board committee (except the Executive Committee) also annually assesses how it performed during

the preceding twelve-month period. These assessment procedures vary, from requiring members to complete questionnaires that call

for both quantitative responses and free-ranging comments, to having an independent third party interview each member and then

synthesize themes that emerge.

Director Service

The Board is authorized to fix the size of the Board at a number

between three and seventeen members. Directors are elected each year at the Annual Meeting by a majority of the votes cast by our

Class A stockholders. Once elected, a director holds office until the next Annual Meeting or until a successor is elected and qualified,

unless the director first resigns, retires, or is removed. Directors are not subject to term limits but a director may not stand

for re-election to the Board after reaching the age of 71. In exceptional circumstances, the Board may ask a director to remain

on the Board until a given date if the director’s continued service would significantly benefit Brown-Forman. Service of

a director beyond the age of 71 requires a recommendation by the Corporate Governance and Nominating Committee and the approval

of two-thirds of the Board (not including the director under consideration).

Board Meetings

The Board held six regular meetings and no special meetings during

fiscal 2017. Absent an appropriate reason, all directors are expected to attend the Annual Meeting, all Board meetings, and all

meetings of each committee on which they serve. All directors attended 90% or more of the aggregate meetings of the Board and committees

on which they served during fiscal 2017. All directors then serving attended the 2016 Annual Meeting of Stockholders.

Board Committees

Our Board has four standing committees: Audit Committee, Compensation

Committee, Corporate Governance and Nominating Committee, and Executive Committee. Each Board committee operates under a written

charter that is posted on our website at www.brown-forman.com/about/corporate-governance/committee-composition/.

| AUDIT COMMITTEE |

|

|

|

| |

|

|

|

| The Board

has delegated to the Audit Committee responsibility for overseeing Brown-Forman’s financial statements; audit process;

system of internal controls; enterprise risk assessment and risk management policies and processes; compliance with legal

and regulatory requirements; and internal audit functions. In addition, the Audit Committee oversees the independent auditor’s

qualifications, independence, and performance. The Audit Committee’s responsibilities include preparing the Audit Committee

Report that appears in this Proxy Statement on page 56. |

|

MET 10 TIMES IN FISCAL 2017 |

| |

|

|

| |

Committee Members: |

| |

|

|

| |

• |

Michael A. Todman (Chair) |

| |

• |

Bruce L. Byrnes |

| |

• |

John D. Cook |

Audit Committee members must satisfy director independence standards

prescribed by the NYSE and mandated by the Sarbanes-Oxley Act. Each member of our Audit Committee satisfies all of these heightened

independence standards. The Board has determined that each member of our Audit Committee is also “financially literate”

within the meaning of the NYSE rules, and that Mr. Todman is an “audit committee financial expert” under SEC rules.

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

11 |

CORPORATE GOVERNANCE •

BOARD GUIDELINES AND PROCEDURES

| COMPENSATION COMMITTEE |

|

|

|

| |

|

|

|

| The Compensation Committee’s

responsibilities include determining the compensation of the Chief Executive Officer; recommending market-competitive compensation

for the Board; approving incentive compensation plan design and changes thereto for the Chief Executive Officer and other

senior executive officers; assisting the Board in its oversight of risk related to compensation policies and practices; overseeing

the preparation of the Compensation Discussion and Analysis section of this Proxy Statement; preparing the Compensation Committee

Report that appears in this Proxy Statement on page 39; and leading the evaluation of the performance of the Chief Executive

Officer. |

|

MET 6 TIMES IN FISCAL 2017 |

| |

|

|

| |

Committee Members: |

| |

|

|

| |

• |

Michael J. Roney (Chair) |

| |

• |

Patrick Bousquet-Chavanne |

| |

• |

John D. Cook |

| |

|

|

|

| The Compensation Committee has retained Frederic W. Cook

& Co. (FWC) to provide independent advice on executive and director compensation matters. For additional information on

the services provided by FWC, as well as the Compensation Committee’s processes and procedures for considering and determining

executive compensation, please see the Compensation Discussion and Analysis section of this Proxy Statement, which begins

on page 24. |

| |

| Each member of the Compensation Committee qualifies as

an independent director under NYSE listing standards (including the heightened independence standards for compensation committee

members of non-controlled companies), as a “non-employee director” under SEC rules, and as an “outside director”

under regulations adopted pursuant to Section 162 of the Internal Revenue Code. The Board specifically considered factors

relevant to the ability of these directors to be independent from management in connection with Compensation Committee service. |

| |

| CORPORATE GOVERNANCE AND NOMINATING COMMITTEE |

|

|

|

| |

|

|

|

| The Corporate Governance

and Nominating Committee’s responsibilities include helping the Board identify, recruit, and recommend appropriate candidates

to serve as directors; reviewing periodically our corporate governance principles in light of developments in corporate governance

and best practices, taking into account our controlled-company status; coordinating and overseeing Chief Executive Officer

and Chairman of the Board succession planning; and assisting the Board with its annual self-assessment. All of the Corporate

Governance and Nominating Committee members are independent under NYSE listing standards, except Geo. Garvin Brown IV. |

|

MET 8 TIMES IN FISCAL 2017 |

| |

|

|

| |

Committee Members: |

| |

|

|

| |

• |

John D. Cook (Chair) |

| |

• |

Patrick Bousquet-Chavanne |

| |

• |

Geo. Garvin Brown IV |

| |

• |

Bruce L. Byrnes |

| |

|

|

|

| EXECUTIVE COMMITTEE |

|

|

|

| |

|

|

|

| The Executive Committee

consists of the Chief Executive Officer, the Chairman of the Board (if separate from the Chief Executive Officer), and one

or more other directors as determined by the Board from time to time. The Board can change the Executive Committee membership,

fill vacancies, and dissolve the committee at any time. The Executive Committee may exercise all of the powers of the Board,

subject to certain exceptions specified in our By-laws or Delaware law. However, traditionally, the Executive Committee acts

only when exercising a power the Board has specifically delegated, when there is an emergency, or when the issue does not

warrant the full Board’s attention. |

|

MET ONCE IN FISCAL 2017 |

| |

|

|

| |

Committee Members: |

| |

|

|

| |

• |

Geo. Garvin Brown IV (Chair) |

| |

• |

John D. Cook |

| |

• |

Paul C. Varga |

| 12 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE

GOVERNANCE • BOARD GUIDELINES AND PROCEDURES

Board’s Role in Risk Oversight

The Board believes its current leadership structure best enables

it to fulfill its risk oversight function. Our Corporate Governance Guidelines require the Board to ensure we implement appropriate

processes for managing enterprise risk, and our Board considers risk oversight an integral part of its role in the strategic planning

process. The Board regularly and actively considers how strategic decisions affect Brown-Forman’s risk profile.

While the Board has ultimate oversight responsibility for the

risk management process, certain committees have important supplementary roles in that process. During fiscal 2017, the Board tasked

its committees to assist with the responsibilities outlined below:

| • |

Audit Committee —

overseeing our most significant financial reporting and accounting control risks and management’s monitoring and

management of those risks. |

| • |

Compensation Committee —

overseeing risks related to compensation policies and practices. |

| • |

Corporate Governance and

Nominating Committee — overseeing risks related to corporate governance, board composition, and succession planning

for the Chief Executive Officer and the Chairman of the Board. |

These committees met regularly with members of management and

outside advisors, as necessary, and reported to the Board regularly on their risk oversight and mitigation activities. In addition,

management’s Disclosure Controls Committee and Enterprise Risk Management Committee both play an integral role in making

sure that relevant risk-related information is reported to senior management and the Board as directly and quickly as possible.

Further, our management Ethics, Compliance and Risk Team, comprising a number of senior executives and subject matter experts,

meets throughout the year to address issues related to risk, ethics, and compliance; to coordinate the work of those areas; and

to oversee the formulation and promulgation of company policies and the training of employees in compliance with them.

Communication with Our Board

Stockholders and other interested parties may communicate with

our directors, including the non-management directors or the independent directors as a group, by writing to our Secretary, Matthew

E. Hamel, at 850 Dixie Highway, Louisville, Kentucky 40210, or at Secretary@b-f.com. The Secretary’s office will forward

written communications to the individual director or group of directors to whom they are addressed, with copies to all other directors.

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

13 |

CORPORATE GOVERNANCE •

BEST PRACTICES

BEST PRACTICES

Brown-Forman has long believed that good corporate governance

is essential to long-term success. We continually evaluate our corporate governance practices in the context of our controlled-company

status to address the changing regulatory environment, and adopt those practices that we believe are in the best interests of Brown-Forman

and all of our stockholders.

Code of Conduct

The Brown-Forman Code of Conduct expresses its expectations of

ethical behavior for all of our employees and directors. The Code of Conduct includes our Code of Ethics for Senior Financial Officers,

which reflects the expectation that all of our financial, accounting, reporting, and auditing activities will be conducted in strict

compliance with all applicable rules and regulations and will conform to the highest ethical standards. Brown-Forman encourages

its employees to “speak up” when aware of a potential code of conduct violation and provides multiple channels for

doing so, including anonymously. The Code of Conduct, including reporting channels, and the Code of Ethics for Senior Financial

Officers can be found on our website at www.brown-forman.com/about/corporate-governance/code-of-ethics/ and www.brown-forman.com/about/corporate-governance/code-of-ethics-for-senior-financial-officers/.

Disclosure Controls Committee

The Disclosure Controls Committee is composed of members

of management. This committee has established controls and procedures designed to ensure that information Brown-Forman may be

required to disclose is gathered and communicated to the committee and that all required disclosures are made in a timely and

accurate manner. The committee has implemented a financial review process that enables our Chief Executive Officer and Chief

Financial Officer to certify our quarterly and annual reports, as well as procedures designed to ensure our compliance with

SEC Regulation FD (Fair Disclosure).

Risk Committee

The mission of the Enterprise Risk Management (ERM) Committee,

which is composed of members of management, is to ensure that all of Brown-Forman’s major risks are identified and evaluated.

The ERM Committee also identifies the individuals and teams who are responsible for mitigating risks, and ensures that mitigation

plans are in place to mitigate the Company’s significant risks. The ERM Committee reports to the Audit Committee regarding

its policies and processes. In addition, the ERM Committee reports to the Board at least annually regarding the top risks facing

Brown-Forman, and periodically updates the Board on the mitigation plans related to those risks.

| 14 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

CORPORATE GOVERNANCE •

OUR CONTROLLING FAMILY STOCKHOLDERS

OUR CONTROLLING FAMILY STOCKHOLDERS

Brown-Forman has an engaged family stockholder base with a

long-term ownership perspective. We view our status as a publicly traded, family-controlled company as a distinct competitive

advantage, and we believe a strong relationship with the Brown family is essential to our growth, independence, and ability

to create long-term value for all stockholders. Management interacts with Brown family members in a manner consistent with

all applicable laws and regulations. We actively cultivate our relationship with the Brown family through a variety of

channels, as detailed below.

Brown-Forman/Brown Family Shareholders Committee

In 2007, Geo. Garvin Brown IV and Paul C. Varga organized the

Brown-Forman/Brown Family Shareholders Committee, which they continue to co-chair. This committee provides a forum for frequent,

open, and constructive dialogue between Brown-Forman and its controlling family stockholders. The Brown Family Shareholders Committee

engages the Brown family on topics of mutual interest such as the Company and industry, governance, ownership, and philanthropy.

Director of Family Shareholder Relations

The Director of Family Shareholder Relations, a Brown-Forman

employee, works with other employees and Brown family members to develop and implement policies and practices designed to further

strengthen the relationship between Brown-Forman and the Brown family.

Brown Family Member Employees

Brown-Forman employs ten Brown family members, some of whom participate

on management teams that oversee strategic and operational matters. Participation on these committees enables our Brown family

employees to contribute their perspectives on the important issues we confront. In addition to their management contributions,

the Brown family employees play a critical role in upholding the Brown-Forman corporate culture.

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

15 |

| |

PROPOSAL 1: |

| |

ELECTION OF DIRECTORS |

This section provides information about our thirteen

director nominees, including the experience, qualifications, attributes, and skills that enable them to make valuable contributions

to our Board.

All of our director nominees are current directors of Brown-Forman.

Each director was elected by the stockholders at our 2016 Annual Meeting except for Kathleen M. Gutmann, who was appointed to the

Board in May 2017. Kathleen M. Gutmann was recommended for appointment to the Board by the Corporate Governance and Nominating

Committee following a process conducted with the assistance of a third-party executive search firm.

The Board unanimously recommends a vote “FOR” the

election of each director nominee.

Your shares will be voted “FOR” the election

of all director nominees listed below unless you instruct the proxy holders to vote against, or to abstain from voting for, one

or more nominees. If any nominee becomes unable to serve before the meeting, the proxy holders may vote for a substitute nominee

if the Board has designated one. As of the date of this Proxy Statement, the Board believes each nominee is prepared to serve if

elected.

NOMINEES

| PATRICK BOUSQUET-CHAVANNE |

|

|

| |

|

|

|

|

|

Director since 2005

Age 59

Committees:

- Compensation

- Corporate Governance and

Nominating

|

|

CURRENT AND PAST POSITIONS

Positions at Marks and Spencer Group PLC:

- Executive Director of Customer, Marketing and M&S.com since

2016

- Executive Director of Marketing and International from 2014 to 2016

- Executive Director, Marketing and Business Development

from 2013 to 2014

- Corporate Director of Strategy and Business Development from 2012 to 2013

Positions at Yoostar Entertainment Group:

- Co-Chairman from 2010 to 2012

- President and Chief Executive Officer from 2009 to 2012

|

|

QUALIFICATIONS AND SKILLS

- Senior management and board experience at one of the world’s

leading manufacturers and marketers of branded consumer goods, including experience with implementing strategy, branding, licensing,

distribution, digital, and international expansion

- Experience dealing with governance issues relevant to family-controlled public

companies

OTHER DIRECTORSHIPS

- Marks and Spencer Group PLC since 2013

- HSNi Corporation from

2008 to 2013

|

| CAMPBELL P. BROWN |

|

|

| |

|

|

|

|

|

Director since 2016

Age 49

|

|

CURRENT AND PAST POSITIONS

Positions with Brown-Forman and affiliates:

- President and Managing Director of Old Forester, our founding

bourbon brand, since 2015

- Led the wine and spirits portfolio in Canada and the Midwest region of the U.S.

- Served in the emerging

markets of India, the Philippines, and Turkey

- Various other positions over a 23-year career

- Founding member of Brown-Forman/Brown

Family Shareholders Committee since 2007

|

|

QUALIFICATIONS AND SKILLS

- Business and industry experience gained by serving in operational,

management, and executive positions within the Company

- Deep knowledge of family corporate governance

- Perspective as a fifth

generation Brown family stockholder

- A history of service on the Brown-Forman/ Brown Family Shareholders Committee, which demonstrates

his ability to represent the long-term interests of shareholders

OTHER DIRECTORSHIPS

- Republic Bank and Trust Company since 2008

|

| 16 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

ELECTION OF

DIRECTORS • NOMINEES

| GEO. GARVIN BROWN IV |

|

|

| |

|

|

|

|

|

Director since 2006

Age 48

Committees:

- Corporate Governance and

Nominating

- Executive (Chair)

|

|

CURRENT AND PAST POSITIONS

Positions with Brown-Forman and affiliates:

- Chairman of the Board since 2007

- Executive Vice President from 2011 to 2015

- Senior Vice President and Managing Director of Western Europe

and Africa from 2009 to 2011

- Vice President and Jack Daniel’s Brand Director in Europe and Africa from 2004 to 2008

- Director

of the Office of the Chairman and Chief Executive Officer from 2002 to 2004

- Founding member and Co-Chairman of Brown-Forman/Brown

Family Shareholders Committee since 2007

|

|

QUALIFICATIONS AND SKILLS

- Business and industry experience gained by serving in operational,

management, and executive positions within the Company

- Deep knowledge of family corporate governance

- Perspective as a fifth

generation Brown family stockholder

- A history of service on the Brown-Forman/ Brown Family Shareholders Committee, which demonstrates

his ability to represent the long-term interests of shareholders

|

| STUART R. BROWN |

|

|

| |

|

|

|

|

|

Director since 2015

Age 52

|

|

CURRENT AND PAST POSITIONS

Typha Partners, LLC (an early-stage private equity investment

company), Managing Partner since 2010

DendriFund, Inc. (a charitable foundation established by Brown-Forman), President

since 2011

Between the Covers Bookstore, Owner from 1998 to 2010

Positions

with Brown-Forman and affiliates:

- Sales and Marketing Management from 1995 to 1998

- Founding member of Brown-Forman/Brown Family Shareholders Committee

since 2007

|

|

QUALIFICATIONS AND SKILLS

- Extensive experience in family governance, entrepreneurial management,

finance, and board leadership

- Perspective as a fifth generation Brown family stockholder

- A history of service on the Brown-Forman/

Brown Family Shareholders Committee, which demonstrates his ability to represent the long-term interests of shareholders

|

| BRUCE L. BYRNES |

|

|

| |

|

|

|

|

|

Director since 2010

Age 69

Committees:

- Audit

- Corporate Governance and

Nominating

|

|

CURRENT AND PAST POSITIONS

Positions with The Procter & Gamble Company:

- Vice Chairman of the Board from 2002 to 2008

- Vice Chairman, Global Brand Building Training, from 2007 to

2008

- Vice Chairman, Global Household Care Division, from 2004 to 2007

|

|

QUALIFICATIONS AND SKILLS

- Executive leadership of a global consumer goods company

- Expertise

in brand building, brand management, and finance

- Experience with international marketing and operations and corporate strategy

OTHER DIRECTORSHIPS

- Boston Scientific Corporation from 2009 to 2015

- Diebold, Incorporated

from 2010 to 2015

- Cincinnati Bell, Inc. from 2003 to 2013

|

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

17 |

ELECTION OF DIRECTORS • NOMINEES

| JOHN D. COOK |

|

|

| |

|

|

|

|

|

Director since 2008;

Lead Independent

Director since 2012

Age

64

Committees:

-Compensation

-Corporate Governance and Nominating (Chair)

-Audit

-Executive

|

|

CURRENT AND PAST POSITIONS

Positions with McKinsey & Company:

- Director Emeritus

- Director from 2003 to 2008

|

|

QUALIFICATIONS AND SKILLS

- Skills gained during a 40-year career advising and managing

consumer products companies and creating shareholder value

- Leadership and senior management experience

- Financial and international

expertise

- Marketing skills

- Experience with strategic acquisitions and integrations

OTHER DIRECTORSHIPS

- Winona Capital Management since 2007

|

| |

|

|

|

|

| MARSHALL B. FARRER |

|

|

| |

|

|

|

|

|

Director since 2016

Age 46

|

|

CURRENT AND PAST POSITIONS

Positions with Brown-Forman and affiliates:

- Vice President, Managing Director of Global Travel Retail, which

includes Duty Free, Military, Cruise, and Transportation sales globally since 2015

- Led the global Jack Daniel’s Tennessee

Honey brand team from 2014 to 2015

- Managing director of the Australia/Pacific region from 2010 to 2014

- Led the Latin America

& Caribbean region from 2006 to 2009

- Various other positions over a 19-year career

- Founding member of Brown-Forman/Brown

Family Shareholders Committee since 2007

- Member of the Brown-Forman Management Executive Committee from 2007 to 2009

|

|

QUALIFICATIONS AND SKILLS

- Business and industry experience gained from serving in operational,

management, and executive positions within the Company

- Deep knowledge of family corporate governance

- Perspective as a fifth

generation Brown family stockholder

- A history of service on the Brown-Forman Executive Committee and Brown-Forman/ Brown Family

Shareholders Committee, which demonstrates his ability to represent the long-term interests of shareholders

|

| |

|

|

|

|

| LAURA L. FRAZIER |

|

|

| |

|

|

|

|

|

Director since 2016

Age 59

|

|

CURRENT AND PAST POSITIONS

Bittners (a more than 160-year-old interior and commercial

design firm), Owner, Chairman, and past-CEO

Positions with Brown-Forman and affiliates:

- Member of the board of directors of Lenox, Inc., a former subsidiary,

from 1999 to 2005

- Founding member of Brown-Forman/Brown Family Shareholders Committee since 2007

|

|

QUALIFICATIONS AND SKILLS

- Executive leadership and entrepreneurial management skills

-

Perspective as a fifth generation Brown family stockholder

- A history of service on the Brown-Forman/ Brown Family Shareholders

Committee, which demonstrates her ability to represent the long-term interests of shareholders

|

| 18 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

ELECTION OF DIRECTORS • NOMINEES

| KATHLEEN M. GUTMANN |

|

|

| |

|

|

|

|

|

Director since May 2017

Age 48

|

|

CURRENT AND PAST POSITIONS

Positions with United Parcel Service:

- Chief Sales and Solutions Officer and Senior Vice President

of The UPS Store and UPS Capital since 2015

- Senior Vice President of Worldwide Sales and Solutions from 2014 to 2015

- President

of Worldwide Sales from 2011 to 2014

|

|

QUALIFICATIONS AND SKILLS

- Experience with directing long-term strategy as a member

of the UPS Management Committee

- Oversight of P&L for UPS Capital, a UPS subsidiary that

provides supply chain, financial, insurance, and payment solutions, and The UPS Store, a franchise system of retail shipping, mailbox,

print, and business service centers

|

| |

|

|

|

|

| AUGUSTA BROWN HOLLAND |

|

|

| |

|

|

|

|

|

Director since 2015

Age 41

|

|

CURRENT AND PAST POSITIONS

- Haystack Partners LLC (environmentally conscious real

estate development), Founding Partner since 2006

- Founding member of Brown-Forman/Brown Family Shareholders Committee since 2007

|

|

QUALIFICATIONS AND SKILLS

- Extensive knowledge of urban planning and revitalization and

environmentally friendly development

- Experience serving on numerous

civic boards

- Perspective

as a fifth generation Brown family stockholder

- A history of service on the Brown-Forman/ Brown

Family Shareholders Committee, which demonstrates her ability to represent the long-term interests

of shareholders

|

| |

|

|

|

|

| MICHAEL J. RONEY |

|

|

| |

|

|

|

|

Director since 2014

Age 63

Committees:

- Compensation (Chair)

|

|

CURRENT AND PAST POSITIONS

Bunzl plc, Chief Executive Officer from 2005 to 2016

|

|

QUALIFICATIONS AND SKILLS

- Extensive senior management and executive leadership experience

- Deep expertise in multinational production, distribution, and operations

- Financial expertise

- International mergers and acquisitions

experience

OTHER DIRECTORSHIPS

- Next plc since February 2017, Deputy Chairman and Chairman Designate

- Grafton Group plc since May 2016, Non-Executive Chairman since January 1, 2017

- Johnson Matthey plc from 2007 to 2014, Senior

Independent Director

- Bunzl plc from 2003 to 2005, Non-Executive Director

|

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

19 |

ELECTION OF DIRECTORS • NOMINEES

| MICHAEL A. TODMAN |

|

|

| |

|

|

|

|

|

Director since 2014

Age 59

Committees:

- Audit (Chair)

|

|

CURRENT AND PAST POSITIONS

Positions with Whirlpool and affiliates:

- Vice Chairman, Whirlpool Corporation from 2014 to 2015

- President,

Whirlpool International from 2009 to 2014

- President, Whirlpool North America from 2007 to 2009

|

|

QUALIFICATIONS AND SKILLS

- Extensive knowledge and experience in multinational operations,

sales and distribution, and manufacturing

- Executive leadership of large multinational organizations

- Financial expertise

OTHER DIRECTORSHIPS

- Newell Rubbermaid, Inc. since 2007

- Prudential Financial, Inc.

since 2016

- Whirlpool Corporation from 2006 to 2015

|

| |

|

|

|

|

| PAUL C. VARGA |

|

|

| |

|

|

|

|

|

Director since 2003

Age 53

Committees:

- Executive

|

|

CURRENT AND PAST POSITIONS

Positions with Brown-Forman and affiliates:

- Chief Executive Officer since 2005

- Chairman since 2007

- President and Chief Executive Officer of Brown-Forman Beverages

from 2003 to 2005

- Global Chief Marketing Officer for Brown-Forman Spirits from 2000 to 2003

|

|

QUALIFICATIONS AND SKILLS

- In-depth knowledge of the Company’s business, operations,

and strategy gained during his 30-year career

- Extensive knowledge of the beverage alcohol industry

- Sales and marketing and

financial expertise

- Strategic thinking, leadership, management, consensus-building, and communication skills

OTHER DIRECTORSHIPS

- Macy’s, Inc. since 2012

|

Family relationships. No family relationship — first

cousin or closer — exists between any two directors, executive officers, or individuals nominated or chosen to become a director

or executive officer, except for the following relationships between Brown family directors: Geo. Garvin Brown IV and Campbell

P. Brown are brothers, and Marshall B. Farrer is their first cousin; and Stuart R. Brown and Augusta Brown Holland are first cousins.

| 20 |

|

BROWN-FORMAN 2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

OVERVIEW

Our directors serve one-year terms that begin with their election

at an Annual Meeting and end immediately upon the election of directors at the next Annual Meeting. We refer to this period as

a “Board Year” for director compensation purposes.

Our non-employee director compensation consists of an annual Board

retainer, a Chair of the Board retainer, a Lead Independent Director retainer, committee member retainers, committee chair retainers,

and meeting fees. To align the interests of our non-employee directors with those of our stockholders, non-employee directors receive

their Board retainers in a combination of cash and equity. Non-employee directors receive meeting fees only if they attend more

than eight meetings (Board), ten meetings (Audit Committee), or six meetings (Compensation Committee and Corporate Governance &

Nominating Committee). The Compensation Committee believes this compensation structure appropriately reflects the importance of

directors’ active participation at Board and committee meetings.

The Compensation Committee reviews, with the assistance of its independent

consultant Frederic W. Cook & Co. (FWC) information each year related to the competitiveness of non-employee Director compensation

and, from time to time, recommends adjustments to its compensation structure to ensure both continued competitiveness and the appropriate

compensation. Based upon the review of this information in fiscal 2017, FWC recommended, and the Board confirmed and approved, no

changes to the existing retainers and fees listed below.

| DIRECTOR COMPENSATION STRUCTURE |

|

|

| |

|

|

| Pay Element |

|

Amount |

Lead Independent Director Retainer

Paid in six installments over the Board Year. |

|

$30,000 |

Board Retainer

Directors may elect to receive their cash retainer in equity. Directors who have satisfied our stock ownership guidelines may elect to receive up to 100% of the retainer in cash, including the equity retainer. The cash retainer is paid in six installments over the Board Year. |

$185,000 total

• $70,000 cash

• $115,000 equity

(deferred stock units) |

Meeting Fees

No fee is paid unless the director attends more than eight meetings (Board). |

Board |

$5,000 per meeting |

| No fee is paid unless the director attends more than ten meetings (Audit)

or six meetings (Compensation and Corporate Governance & Nominating) |

Audit, Compensation, and Corporate Governance & Nominating |

$2,500 per meeting

$1,250 per telephonic meeting |

| Committee Member Retainers |

Audit |

$25,000 |

| Paid in six installments over the Board Year. |

Compensation |

$20,000 |

| |

Corporate Governance & Nominating |

$20,000 |

Committee Chair Retainers

(Audit, Compensation, and Corporate Governance & Nominating)

Paid in six installments over the Board Year. If a director chairs more than one committee, he or she will receive multiple

chair retainers. |

|

$20,000 |

Non-Employee Chair of the Board Retainer

Paid in six installments over the Board Year. |

|

$625,000 |

2017

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS BROWN-FORMAN |

|

21 |

DIRECTOR COMPENSATION • OVERVIEW

Deferred Stock Units

Our Deferred Stock Unit (DSU) program for non-employee directors

allows us to issue both Class A common DSUs and Class B common DSUs. Each DSU represents the right to receive one share of Brown-Forman’s

Class A or Class B common stock, based on the closing price of the shares on the date the award is made. After a non-employee director’s

Board service ends, his or her DSUs are paid out in shares of Class A or Class B common stock following a six-month waiting period.

Directors may elect to receive this distribution either in a single lump sum or in ten equal annual installments.

On each dividend payment date, non-employee directors are credited

with the cash dividends on the number of shares represented by the DSUs they held on the record date for that dividend. These dividend

credits are converted to additional DSUs based on the market value of the Class A or Class B common stock as of the dividend payment