Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 27 2017 - 6:04AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-212372

Pricing Term Sheet

FIDELITY NATIONAL INFORMATION SERVICES, INC.

Pricing Term Sheet

€500,000,000 0.400% Senior Notes due 2021 (“2021 Euro Notes”)

£300,000,000 1.700% Senior Notes due 2022 (“Sterling Notes”)

€500,000,000 1.100% Senior Notes due 2024 (“2024 Euro Notes”)

The information in this pricing term sheet supplements the Issuer’s Preliminary Prospectus Supplement, dated June 26, 2017, and supersedes the

information in the Preliminary Prospectus Supplement to the extent it is inconsistent with the information contained therein. The pricing term sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. Financial

information presented in the Preliminary Prospectus Supplement or incorporated by reference therein is deemed to have changed to the extent affected by the changes described herein. This pricing term sheet should be read together with the

Preliminary Prospectus Supplement, including the documents incorporated by reference therein, and the accompanying Prospectus dated July 1, 2016 before making a decision in connection with an investment in the securities. Capitalized terms used

in this pricing term sheet but not defined have the meanings given to them in the Preliminary Prospectus Supplement.

|

|

|

|

|

|

|

|

Issuer:

|

|

Fidelity National Information Services, Inc.

|

|

|

|

|

Expected Ratings (Moody’s/S&P/Fitch)*:

|

|

[Reserved]

|

|

|

|

|

Principal Amount:

|

|

2021 Euro Notes: €500,000,000

Sterling

Notes: £300,000,000

2024 Euro Notes: €500,000,000

|

|

|

|

|

Coupon:

|

|

2021 Euro Notes: 0.400%

Sterling Notes:

1.700%

2024 Euro Notes: 1.100%

|

|

|

|

|

Trade Date:

|

|

June 26, 2017

|

|

|

|

|

Settlement Date:

|

|

T+10; July 10, 2017

|

|

|

|

|

Maturity Date:

|

|

2021 Euro Notes: January 15, 2021

Sterling

Notes: June 30, 2022

2024 Euro Notes: July 15, 2024

|

|

|

|

|

|

|

|

|

Price to Public:

|

|

2021 Euro Notes: 99.917% of principal amount

Sterling Notes: 99.643% of principal amount

2024 Euro Notes:

99.772% of principal amount

|

|

|

|

|

Re-offer Yield (annual):

|

|

2021 Euro Notes: 0.424%

Sterling Notes:

1.776%

2024 Euro Notes: 1.134%

|

|

|

|

|

Spread to Bund/Gilt:

|

|

2021 Euro Notes: +96.8 basis points

Sterling

Notes: +140.0 basis points

2024 Euro Notes: +127.1 basis points

|

|

|

|

|

Benchmark Bund/Gilt:

|

|

2021 Euro Notes: DBR 2.500% due January 2021

Sterling Notes: UKT 4.000% due March 2022

2024 Euro Notes: DBR

1.500% due May 2024

|

|

|

|

|

Benchmark Bund/Gilt Price and Yield:

|

|

2021 Euro Notes: 110.85; -0.544%

Sterling

Notes: 116.89; 0.368%

2024 Euro Notes: 111.32; -0.137%

|

|

|

|

|

Pricing Benchmark:

|

|

2021 Euro Notes: Interpolated EUR mid-swap

Sterling Notes: UKT 4.000% due March 2022

2024 Euro Notes:

Interpolated EUR mid-swap

|

|

|

|

|

Reference EUR Mid-swap Rate:

|

|

2021 Euro Notes: -0.026%

2024 Euro Notes:

0.384%

|

|

|

|

|

Re-offer Spread to EUR Mid-swap Rate:

|

|

2021 Euro Notes: +45 basis points

2024 Euro

Notes: +75 basis points

|

|

|

|

|

Interest Payment Dates:

|

|

2021 Euro Notes: January 15, commencing January 15, 2018

Sterling Notes: June 30, commencing June 30, 2018

2024 Euro

Notes: July 15, commencing July 15, 2018

|

|

|

|

|

Denominations:

|

|

€100,000 and integral multiples of €1,000 in excess thereof as to the 2021 Euro Notes and the 2024 Euro Notes

£100,000 and integral multiples of £1,000 in excess thereof as to the Sterling

Notes

|

2

|

|

|

|

|

|

|

|

Optional Redemption:

|

|

2021 Euro Notes: At any time prior to the Par Call Date at a discount rate of the Comparable Government Bond Rate plus 15 basis points

Sterling Notes: At any time prior to the Par Call Date at a discount rate of the

Comparable Government Bond Rate plus 20 basis points

2024 Euro Notes: At any time

prior to the Par Call Date at a discount rate of the Comparable Government Bond Rate plus 20 basis points

Notwithstanding the foregoing, if the 2021 Euro Notes are redeemed on or after December 15, 2020 (the date that is one month prior to their maturity date)

or the Sterling Notes are redeemed on or after May 31, 2022 (the date that is one month prior to their maturity date) or the 2024 Euro Notes are redeemed on or after April 15, 2024 (the date that is three months prior to their maturity

date), the 2021 Euro Notes, the Sterling Notes and the 2024 Euro Notes, respectively, will be redeemed at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding, the

date of redemption. December 15, 2020, May 31, 2022 and April 15, 2024 are the Par Call Dates in respect of the 2021 Euro Notes, the Sterling Notes and the 2024 Euro Notes, respectively.

|

|

|

|

|

Use of Proceeds

|

|

We expect the net proceeds from this offering to be approximately €993,945,000 from the Euro Notes and £297,579,000 from the Sterling Notes after deducting the underwriting discounts but before deducting our estimated

offering expenses. We intend to use the net proceeds from this offering, together with borrowings under our revolving credit facility, to pay for the Tender Offer Notes purchased in the Tender Offers, including accrued and unpaid interest. Any net

proceeds remaining will be used for general corporate purposes, which may include repurchase or repayment of certain of our outstanding debt securities, which we may accomplish through other tender offers, open market purchases or calls for

redemption, or our other outstanding indebtedness. For more information on the Tender Offers, see our Current Report on Form 8-K, filed with the SEC on June 26, 2017. Nothing herein shall be construed as an offer to purchase any series of the Tender

Offer Notes, as the Tender Offers are being made only to the recipients of, and upon the terms and conditions set forth in, the related offer to purchase.

|

|

|

|

|

CUSIP:

|

|

2021 Euro Notes: 31620M AV8

Sterling Notes:

31620M AX4

2024 Euro Notes: 31620M AW6

|

3

|

|

|

|

|

|

|

|

ISIN:

|

|

2021 Euro Notes: XS1640492648

Sterling

Notes: XS1640493299

2024 Euro Notes: XS1640492994

|

|

|

|

|

Common Code:

|

|

2021 Euro Notes: 164049264

Sterling Notes:

164049329

2024 Euro Notes: 164049299

|

|

|

|

|

Joint Book-Running Managers:

|

|

Barclays Bank PLC

J.P. Morgan Securities

plc

Citigroup Global Markets Limited

Crédit Agricole

Corporate and Investment Bank

HSBC Bank plc

Lloyds Bank

plc

Merrill Lynch International

MUFG Securities EMEA plc

U.S. Bancorp Investments, Inc.

Wells Fargo Securities

International Limited

|

|

|

|

|

Senior Co-Managers:

|

|

PNC Capital Markets LLC

SunTrust Robinson

Humphrey, Inc.

|

|

|

|

|

Co-Manager:

|

|

SMBC Nikko Capital Markets Limited

|

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be revised or withdrawn at any

time.

The issuer has filed a registration statement (including a prospectus and a preliminary prospectus supplement) with the SEC for the offering

to which this communication relates. Before you invest, you should read the prospectus and the preliminary prospectus supplement in that registration statement and other documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus

and preliminary prospectus supplement if you request it by contacting Barclays Bank PLC collect at 1-888-603-5847 and J.P. Morgan Securities plc collect at 44-207-134-2468.

4

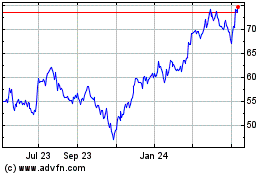

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

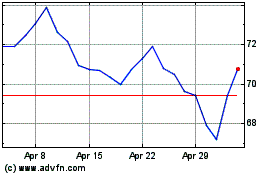

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Apr 2023 to Apr 2024