INDEX

|

|

|

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule:

|

|

|

|

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

Benefits Committee

GATX Corporation

We have audited the accompanying statements of net assets available for benefits of the GATX Corporation Salaried Employees Retirement Savings Plan as of December 31, 2016 and 2015, and the related statements of changes in net assets available for benefits for the years ended December 31, 2016 and 2015. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the GATX Corporation Salaried Employees Retirement Savings Plan at December 31, 2016 and 2015, and the changes in its net assets available for benefits for the years ended December 31, 2016 and 2015, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2016 has been subjected to audit procedures performed in conjunction with the audit of the GATX Corporation Salaried Employees Retirement Savings Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young, LLP

Chicago, Illinois

June 26, 2017

GATX Corporation Salaried Employees Retirement Savings Plan

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

Investments in mutual funds

|

$

|

55,236,824

|

|

|

$

|

56,798,381

|

|

|

Interest in collective trusts

|

78,609,229

|

|

|

77,423,835

|

|

|

Interest in GATX common stock fund

|

26,613,440

|

|

|

22,585,037

|

|

|

Total investments at fair value

|

160,459,493

|

|

|

156,807,253

|

|

|

Notes receivable from participants

|

1,293,919

|

|

|

1,529,176

|

|

|

Employer contribution receivable

|

101,851

|

|

|

74,967

|

|

|

Net assets available for benefits

|

$

|

161,855,263

|

|

|

$

|

158,411,396

|

|

The accompanying notes are an integral part of these statements.

GATX Corporation Salaried Employees Retirement Savings Plan

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31

|

|

|

2016

|

|

2015

|

|

Additions

|

|

|

|

|

Investment (loss) income:

|

|

|

|

|

Net investment gain (loss) from mutual funds

|

$

|

624,287

|

|

|

$

|

(1,245,838

|

)

|

|

Net investment gain from collective trusts

|

7,285,009

|

|

|

175,179

|

|

|

Net investment gain (loss) from GATX common stock fund

|

9,555,218

|

|

|

(7,097,416

|

)

|

|

Interest and dividend income

|

1,689,927

|

|

|

3,097,748

|

|

|

Total investment income (loss)

|

19,154,441

|

|

|

(5,070,327

|

)

|

|

Contributions

|

|

|

|

|

Employer contributions

|

1,596,041

|

|

|

1,618,915

|

|

|

Participant contributions

|

5,475,163

|

|

|

5,737,488

|

|

|

Rollover contributions

|

285,566

|

|

|

200,079

|

|

|

Total contributions

|

7,356,770

|

|

|

7,556,482

|

|

|

Interest income on notes receivable from participants

|

60,403

|

|

|

65,410

|

|

|

Total additions

|

26,571,614

|

|

|

2,551,565

|

|

|

Deductions

|

|

|

|

|

Benefit payments

|

23,119,107

|

|

|

21,121,310

|

|

|

Administrative fees

|

8,640

|

|

|

8,659

|

|

|

Transfer to GATX Corporation Hourly Employees Retirement Savings Plan

|

—

|

|

|

13,286

|

|

|

Total deductions

|

23,127,747

|

|

|

21,143,255

|

|

|

Net increase (decrease)

|

3,443,867

|

|

|

(18,591,690

|

)

|

|

Net assets available for benefits at beginning of year

|

158,411,396

|

|

|

177,003,086

|

|

|

Net assets available for benefits at end of year

|

$

|

161,855,263

|

|

|

$

|

158,411,396

|

|

The accompanying notes are an integral part of these statements.

GATX Corporation Salaried Employees Retirement Savings Plan

Notes to Financial Statements

1. Description of the Plan

The following description of the GATX Corporation (GATX or the Company) Salaried Employees Retirement Savings Plan (the Plan) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan's provisions.

General

The Plan is a defined-contribution plan established on July 1, 1965, for salaried employees of GATX and each of its domestic subsidiaries. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). Fidelity Management Trust Company has been appointed trustee of the Plan and also serves as the record keeper to maintain the individual accounts of each Plan participant.

Upon hire, new employees are automatically enrolled in the plan at a 3% contribution rate unless they choose otherwise. Deductions begin after 60 days of employment.

Contributions

Each year, participants may make basic contributions of 1% to 50% of eligible pretax compensation, as defined in the Plan, and participants who have attained the age of 50 before the close of the plan year may make additional catch-up contributions of 1% to 25% of eligible pretax compensation. Participants may also contribute amounts representing distributions from other qualified defined-benefit or defined-contribution plans. Participant contributions are made through payroll deductions and are recorded in the period the deductions are made.

After a participant completes six months of service, the Company may contribute on behalf of the participant a matching contribution of $0.50 for each $1.00 contributed by the participant, up to 6% of the participant's eligible compensation contributed to the Plan.

For 2016 and 2015

, the Company made matching contributions at this level. At its discretion, the Company may suspend matching contributions or make additional matching contributions for eligible participants. All contributions are made in cash and deposited semimonthly. All contributions are subject to certain limitations of the Internal Revenue Code of 1986, as amended (the Code).

Participant Accounts

Each participant's account is credited with the participant's contributions, the Company's contributions, and an allocation of the Plan's earnings or losses. Allocations are based on account balances (as defined). The benefit to which a participant is entitled is that which can be provided from the participant's account. All participant and Company contributions are participant-directed into various investment options and investment allocations may be changed on any business day.

Effective April 1, 2016, participants are no longer able to make new investments in the GATX common stock fund.

A participant may divest any portion of his or her existing account balance in the GATX common stock fund and reinvest such amounts in any other plan investment option. Restrictions may apply to a participant’s ability to transfer account balances from the GATX stock fund pursuant to the Company’s insider trading policy.

Vesting

Participants are immediately 100% vested in their account balances.

GATX Corporation Salaried Employees Retirement Savings Plan

Notes to Financial Statements (continued)

Payment of Benefits

In the event of retirement (as defined), death, permanent disability, or termination of employment, the balance in the participant's account, less any outstanding loan balances, will be distributed to the participant or the participant's beneficiary in a single lump-sum cash payment or installment payments. In-service withdrawals are available to participants in the case of financial hardship (as defined). The Plan also allows for age 59 1/2 withdrawals (as defined).

Administrative Expenses

It is the intent of the Company to pay the administrative expenses of the Plan, but if the Company fails to make the payments, or so directs, there may be a charge against the Plan for these expenses.

Participant Loans

A participant may borrow an amount up to the lesser of $50,000 or 50% of the participant's account balance. Such loans, which are payable over a term specified by the Plan, bear interest at a reasonable rate and are secured by the participant's account balance in the Plan.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants remain 100% vested in their account balances.

2. Significant Accounting Policies

Basis of Accounting

The accompanying financial statements were prepared on the accrual basis in accordance with U.S. Generally Accepted Accounting Principles ("GAAP").

The Plan, along with the GATX Corporation Hourly Employees Retirement Savings Plan, participate in the GATX Corporation Master Trust (the "Master Trust"). Individual accounts are maintained for participants of each participating plan, including Plan and participant level specific accounting of activity (primarily contributions, benefit payments and expenses). The accompanying financial statements and supplemental schedule present the Plan’s net assets available for benefits and changes in net assets available for benefits on a stand-alone basis. The Plan's interest in the Master Trust was 93.5% and 94.2% at December 31, 2016 and 2015.

Accounting Changes

In May 2015, the Financial Accounting Standards Board (the FASB) issued Accounting Standards Update 2015-07, F

air Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) (ASU 2015-07)

. ASU 2015-07 eliminates the requirement to categorize within the fair value hierarchy investments for which the fair values are estimated using the net asset value practical expedient. In addition, the requirement to make specific disclosures for all investments eligible to be assessed at fair value with the net asset value per share practical expedient has been removed. Instead, such disclosures are restricted only to investments that the entity has decided to measure using the practical expedient. The new guidance was effective in 2016. The amendment impacts the disclosure in the notes to the financial statements but does not have an effect on the Plan's financial statements.

In July 2015, the FASB issued ASU 2015-12,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient

. Part I of the ASU eliminates the requirements to measure the fair value of fully benefit-responsive investment contracts and provide certain disclosures. Contract

GATX Corporation Salaried Employees Retirement Savings Plan

Notes to Financial Statements (continued)

value is the only required measure for fully benefit-responsive investment contracts. Part II of the ASU eliminates the requirements to disclose individual investments that represent 5 percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. It also simplifies the level of disaggregation of investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investments by nature, characteristics, and risks. Further, the disclosure of information about fair value measurements shall be provided by general type of plan asset. Part III of the ASU is not applicable to the Plan. The new guidance was effective beginning in 2016, and Management has adopted Parts I and II retrospectively. As a result of this new guidance, the Statements of Net Assets Available for Benefits were revised to reflect the fair value of our fully benefit-responsive investment at its contract value and to remove the reconciliation from fair value to contract value. The related disclosures in the fair value footnote have also been revised to reflect this change.

In February 2017, the FASB issued ASU 2017-06,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting

(ASU 2017-06). ASU 2017-06 requires a plan to present its interest in a master trust and the change in that interest as separate line items in the statement of net assets available for benefits and in the statement of changes in net assets available for benefits, respectively. It also requires a plan to disclose the master trust’s investments and other assets and liabilities, as well as the dollar amount of its interest in these balances. ASU 2017-06 is effective for entities for fiscal years beginning after December 15, 2018, with retrospective application to all periods presented. Early application is permitted. Management is currently evaluating the effect that the provisions of ASU 2017-06 will have on the Plan’s financial statements.

Use of Estimates

The preparation of financial statements in accordance with GAAP necessitates management to make estimates and assumptions that affect the amounts reported in the financial statements, accompanying notes and supplemental schedule. The Company regularly evaluates its estimates and judgments based on historical experience and other relevant facts and circumstances. Actual results could differ from these estimates.

Benefit Payments

Benefits are recorded when paid.

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. No allowance for credit losses has been recorded as of

December 31, 2016

or

2015

. If a participant ceases to make loan repayments and the Plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Investment Valuation and Income Recognition

Investments held by the Plan are stated at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See "Note

4. Fair Value of Financial Instruments

" for further discussion and disclosures related to fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded as earned. Dividends are recorded on the ex-dividend date. Investment gains and losses include those that are realized and unrealized.

3. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market volatility and credit risk. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that

GATX Corporation Salaried Employees Retirement Savings Plan

Notes to Financial Statements (continued)

changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported on the statement of net assets available for benefits.

4. Fair Value of Financial Instruments

As defined by GAAP, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value measurements are classified according to a three-level hierarchy based on management's judgment about the reliability of the inputs used in the fair value measurement. Level 1 inputs are quoted prices available in active markets for identical assets or liabilities. Level 2 inputs are observable, either directly or indirectly, and include quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 inputs are unobservable, meaning they are supported by little or no market activity.

The level in the fair value hierarchy within which a fair value measurement is classified is determined based on the lowest level input that is significant to the fair value measure in its entirety.

The following tables set forth the fair value of the Plan's assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2016

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds

|

$

|

55,236,824

|

|

|

$

|

55,236,824

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

GATX common stock fund

|

26,613,440

|

|

|

26,613,440

|

|

|

—

|

|

|

—

|

|

|

Collective trusts measured at net asset value (1):

|

|

|

|

|

|

|

|

|

|

U.S. equities

|

53,888,413

|

|

|

|

|

|

|

|

|

International equities

|

2,377,307

|

|

|

|

|

|

|

|

|

Fixed income

|

1,716,091

|

|

|

|

|

|

|

|

|

Fixed income (Fidelity MIP II)

|

20,627,418

|

|

|

|

|

|

|

|

|

Total assets at fair value

|

$

|

160,459,493

|

|

|

$

|

81,850,264

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2015

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds

|

$

|

56,798,381

|

|

|

$

|

56,798,381

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

GATX common stock fund

|

22,585,037

|

|

|

22,585,037

|

|

|

—

|

|

|

—

|

|

|

Collective trusts measured at net asset value (1):

|

|

|

|

|

|

|

|

|

U.S. equities

|

49,853,496

|

|

|

|

|

|

|

|

|

International equities

|

2,544,096

|

|

|

|

|

|

|

|

|

Fixed income

|

1,290,694

|

|

|

|

|

|

|

|

|

Fixed income (Fidelity MIP II)

|

23,735,549

|

|

|

|

|

|

|

|

|

Total assets at fair value

|

$

|

156,807,253

|

|

|

$

|

79,383,418

|

|

|

$

|

—

|

|

|

$

|

—

|

|

________

|

|

|

|

(1)

|

In accordance with the relevant accounting standards, investments measured at fair value using the net asset values (NAV) per share (or its equivalent) practical expedient are not specifically recorded in any category of the fair value hierarchy.

|

GATX Corporation Salaried Employees Retirement Savings Plan

Notes to Financial Statements (continued)

The following is a description of the valuation techniques and inputs used as of December 31,

2016 and 2015

:

Mutual funds

:

Valued at quoted market prices, which represent the NAV of shares held at year-end.

GATX common stock fund

: Tracked on a unitized basis and consists of shares of GATX common stock and cash sufficient to meet the fund's daily cash needs. Unitizing the GATX common stock fund allows for daily trades into and out of the fund. The value of a unit reflects the combined quoted market price of GATX common stock, which is traded on an active exchange, and the cash investments, which are held in a money market fund and valued at quoted market prices, which represent the NAV's of shares held at year-end.

Collective trusts (excluding the Fidelity MIP II)

: Valued based on the closing NAV prices provided by the administrator of the funds. There are no unfunded commitments, restrictions on redemption frequency, or advance notice periods required for redemption for any of the collective trusts. The funds are designed to deliver safety and stability by preserving principal and accumulated earnings.

Fidelity Managed Income Portfolio II (Fidelity MIP II)

:

Participant-directed redemptions have no restrictions; however, the Plan is required to provide a one year redemption notice to liquidate its entire share in the fund. The Fidelity MIP II is valued at NAV, which is determined by the fund manager using a pricing model with inputs (such as yield curves and credit spreads) that are observable or can be corroborated by observable market data for substantially the full term of the assets. The fund is designed to deliver safety and stability by preserving principal and accumulated earnings.

5. Reconciliation of Financial Statements to the Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31

|

|

|

2016

|

|

2015

|

|

Net assets available for benefits per the financial statements

|

$

|

161,855,263

|

|

|

$

|

158,411,396

|

|

|

Net adjustment from fair value to contract value for fully benefit-responsive contracts

|

—

|

|

|

170,407

|

|

|

Employer contribution receivable

|

—

|

|

|

(74,967

|

)

|

|

Net assets available for benefits per Form 5500

|

$

|

161,855,263

|

|

|

$

|

158,506,836

|

|

The following is a reconciliation of net increase in plan assets per the financial statements to the Form 5500 for the year ended

December 31, 2016

:

|

|

|

|

|

|

|

|

Net increase in plan assets per the financial statements

|

$

|

3,443,867

|

|

|

Adjustment from fair value to contract value for fully benefit-responsive investment contracts at December 31, 2015

|

(170,407

|

)

|

|

Employer contribution receivable at December 31, 2015

|

74,967

|

|

|

Net increase in plan assets per the Form 5500

|

$

|

3,348,427

|

|

GATX Corporation Salaried Employees Retirement Savings Plan

Notes to Financial Statements

6. Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service (IRS) dated November 21, 2011, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the Code), and therefore, the related trust is tax-exempt. Subsequent to this determination, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The plan administrator believes that the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan, as amended, is qualified and the related trust is tax-exempt.

GAAP requires Plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31,

2016

, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

7. Related Party and Party-in-Interest Transactions

The Plan holds units of collective trusts and shares of a money market fund, which are managed by Fidelity Management Trust Company, the trustee of the Plan. The Plan also invests in the common stock of the Company and provides participant loans. These transactions qualify as party-in-interest transactions; however, they are exempt from the prohibited transactions rules under ERISA.

Supplemental Schedule

GATX Corporation Salaried Employees Retirement Savings Plan

EIN 36-1124040

Plan #002

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

Identity of Issuer/Description of Issue

|

|

Shares/Units

|

|

Current Value

|

|

Fidelity Management Trust Company:

|

|

|

|

|

|

GATX Common Stock Fund

|

|

551,113

|

|

|

$

|

26,613,440

|

|

|

NT S&P 500 Index

|

|

68,777

|

|

|

21,506,675

|

|

|

Fidelity Managed Income Portfolio II*

|

|

20,627,418

|

|

|

20,627,418

|

|

|

NT Collective Russell

|

|

849,090

|

|

|

11,754,544

|

|

|

PIMCO Total Return Fund – Institutional Class

|

|

1,111,197

|

|

|

11,145,305

|

|

|

T. Rowe Price Growth Stock Fund – Advisory Class

|

|

208,568

|

|

|

11,106,232

|

|

|

NT S&P 400 Index

|

|

42,909

|

|

|

11,036,071

|

|

|

Fidelity Small Capitalization*

|

|

424,149

|

|

|

9,591,123

|

|

|

Fidelity Diversified International Fund K*

|

|

185,561

|

|

|

6,166,191

|

|

|

Vanguard Target Return 2030

|

|

187,378

|

|

|

5,471,449

|

|

|

Vanguard Target Return 2020

|

|

182,586

|

|

|

5,159,880

|

|

|

Vanguard Target Return 2025

|

|

235,775

|

|

|

3,854,929

|

|

|

Vanguard Target Return 2040

|

|

84,311

|

|

|

2,547,046

|

|

|

Vanguard Target Return 2015

|

|

138,210

|

|

|

2,005,429

|

|

|

Vanguard Target Return 2035

|

|

109,485

|

|

|

1,942,260

|

|

|

Vanguard Target Return 2045

|

|

98,070

|

|

|

1,852,545

|

|

|

Fidelity Select International Small Capitalization*

|

|

121,247

|

|

|

1,788,372

|

|

|

Vanguard Target Return 2050

|

|

56,798

|

|

|

1,726,091

|

|

|

SSgA U.S. Inflation Protected Bond Index Non-Lending Series

|

|

128,460

|

|

|

1,716,091

|

|

|

Vanguard Target Return Inc.

|

|

76,746

|

|

|

983,117

|

|

|

Vanguard Target Return 2010

|

|

30,613

|

|

|

775,742

|

|

|

BlackRock ACWI EX-US

|

|

51,337

|

|

|

588,935

|

|

|

Vanguard Target Return 2055

|

|

10,510

|

|

|

345,896

|

|

|

Vanguard Target Return 2060

|

|

5,328

|

|

|

154,712

|

|

|

Participant loans (4.25% to 9.25% interest rates, various maturities)*

|

|

|

|

1,293,919

|

|

|

|

|

|

|

$

|

161,753,412

|

|

_________________

(*) Party-in-interest to the Plan.

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed by the undersigned thereunto duly authorized.

|

|

|

|

|

GATX CORPORATION SALARIED EMPLOYEES

|

|

RETIREMENT SAVINGS PLAN

|

|

(Name of the Plan)

|

|

|

|

/s/ James M. Conniff

|

|

James M. Conniff

|

|

Senior Vice President, Human Resources

|

June 26, 2017

EXHIBIT INDEX

The following exhibit is filed as part of this annual report:

Exhibit

23.1 Consent of Independent Registered Public Accounting Firm

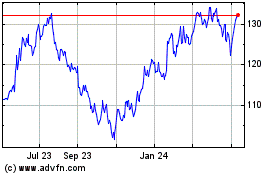

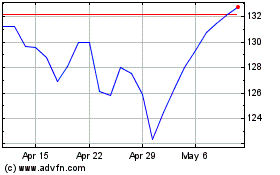

GATX (NYSE:GATX)

Historical Stock Chart

From Mar 2024 to Apr 2024

GATX (NYSE:GATX)

Historical Stock Chart

From Apr 2023 to Apr 2024