Filed Pursuant to Rule 424(b)5

Registration No. 333-211436

The information in this preliminary prospectus supplement is not

complete and may be changed. A registration statement relating to the shares has become effective under the Securities Act of 1933, as amended. This preliminary prospectus supplement and the accompanying prospectus do not constitute an offer to sell

the shares and it is not soliciting an offer to buy the shares in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 26, 2017

Prospectus Supplement

(to Prospectus Dated May 18,

2016)

$100,000,000

REPLIGEN CORPORATION

Common Stock

We are offering up to

$100,000,000 of our common stock in this offering.

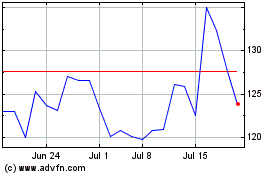

Our common stock is listed on the NASDAQ Global Select Market under the symbol “RGEN.” The

last reported sale price of our common stock on the NASDAQ Global Select Market on June 23, 2017 was $44.20 per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions (1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to Repligen Corporation, before expenses

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.”

|

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-18 of this prospectus supplement and in our Annual Report on Form 10-K for the year ended December 31, 2016, which is incorporated herein by

reference.

We have granted the underwriters an option to purchase up to $15,000,000 of additional shares from us at the public offering price, less

underwriting discounts and commissions, within 30 days of the date of this prospectus supplement.

Neither the Securities and Exchange Commission (the

“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

The underwriters are offering the shares of our common stock as set forth under “Underwriting.” Delivery of the shares of common

stock will be made on or about June , 2017.

|

|

|

|

|

|

|

|

J.P. Morgan

|

|

Stephens Inc.

|

The date of this prospectus supplement is June , 2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of the registration statement that we filed with the SEC using a “shelf” registration process and consists of two parts. The

first part is this prospectus supplement, including the documents incorporated by reference, which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference, gives

more general information, some of which may not apply to this offering. Generally, when we refer to the “prospectus,” we are referring to both parts combined. This prospectus supplement and any free writing prospectus we authorize for use

in connection with this offering may add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

If information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference that was filed

with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus supplement, the accompanying prospectus, the documents incorporated by reference into each and any free writing prospectus we

authorize for use in connection with this offering include important information about us, the common stock and other information should you consider before investing in the common stock. See “Incorporation of Certain Information by

Reference.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a

representation, warranty or covenant to you. Moreover, such representations, warranties and covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

We take no responsibility for, and can provide no assurances as to the reliability of, any information

that is in addition to or different from that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We are not offering to sell these securities in any jurisdiction where the offer or sale is not

permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate as of any date other than as of the date of this prospectus supplement or the

accompanying prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our

securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

All references in this

prospectus supplement or the accompanying prospectus to “Repligen,” the “Company,” “we,” “us,” or “our” mean Repligen Corporation and our subsidiaries, unless we state otherwise or the context

otherwise requires. References to “Spectrum” refers to Spectrum, Inc., a California corporation, and its subsidiaries on a consolidated basis, which we have entered into a contract to acquire, as more thoroughly described in

“Prospectus Summary—Recent Developments—Proposed Acquisition of Spectrum” and “The Acquisition.”

This prospectus

supplement, the accompanying prospectus and the information incorporated herein and therein by reference contain references to trademarks, service marks and trade names owned by us or other companies. Solely for convenience, trademarks, service

marks and trade names referred to in this prospectus supplement, the accompanying prospectus and the information incorporated herein and therein, including logos, artwork, and other visual displays, may appear without the

®

or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable

licensor to these trademarks, service marks and trade names. We do not intend our use or display of other companies’ trade names, service marks or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other

companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement, the accompanying prospectus or any related free writing prospectus are the property of their respective owners.

S-1

PRESENTATION OF NON-GAAP FINANCIAL INFORMATION

Non-GAAP Adjusted Income From Operations, Non-GAAP Adjusted Net Income, Non-GAAP Adjusted EBITDA, and Non-GAAP Adjusted Net Income Per Share (Diluted) which

are presented in this prospectus supplement, are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). We include this non-GAAP financial information because we believe

these measures provide a useful comparison of our financial results between periods and reflect how management reviews its financial results. These financial measures exclude the impact of certain acquisition-related items because we believe that

the resulting charges do not accurately reflect the performance of our ongoing operations for the period in which such charges were incurred.

We define

Non-GAAP Adjusted Income from Operations as income from operations as reported in accordance with GAAP and excluding acquisition costs, amortization of intangible assets and contingent consideration expense booked through our condensed consolidated

statements of comprehensive income. Similarly, we define Non-GAAP Adjusted Net Income as net income as reported in accordance with GAAP excluding acquisition costs, amortization of intangible assets and related tax effects, contingent consideration

expense and non-cash interest expense booked through our condensed consolidated statements of comprehensive income. We define Non-GAAP Adjusted EBITDA as net income as reported in accordance with GAAP, excluding investment income, interest expense,

taxes, depreciation and amortization, and excluding acquisition costs and contingent consideration expenses booked through our condensed consolidated statements of comprehensive income. Finally, we define Non-GAAP Adjusted Net Income Per Share

(Diluted) as net income per share, excluding acquisition costs, amortization of intangible assets and related tax effects, contingent consideration expense and non-cash interest expense booked through our condensed consolidated statements of

comprehensive income.

Non-GAAP Adjusted Income from Operations, Adjusted Net Income, Adjusted EBITDA, and Non-GAAP Adjusted Net Income Per Share

(Diluted) are not recognized terms under GAAP. Because certain companies do not calculate Non-GAAP Adjusted Income From Operations, Adjusted Net Income, Non-GAAP Adjusted EBITDA, and Non-GAAP Adjusted Net Income Per Share (Diluted) in the same way

and certain other companies may not perform such calculations, those measures as used by other companies may not be consistent with the way we calculate such measures and should not be considered as alternative measures of operating profit or net

income. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP.

For reconciliations of our

income and net income, as applicable, to Non-GAAP Adjusted Income from Operations, Non-GAAP Adjusted Net Income, Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted Net Income Per Share (Diluted), see “Summary Consolidated Financial

Data—Reconciliation of Non-GAAP Financial Measures.”

S-2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein contain and any free writing

prospects we authorize for use in connection with this offering may contain statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act), including those related to our recently announced acquisition of Spectrum. These forward-looking statements contain

projections of our future results of operations or of our financial position or state other forward-looking information. In some cases you can identify these statements by forward-looking words such as “anticipate,” “believe,”

“could,” “continue,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” “plan,” “projected” or the negative of such words or

other similar words or phrases. We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual

results to differ materially from the expectations we describe in our forward-looking statements.

Investors are cautioned not to unduly rely on

forward-looking statements because they involve risks and uncertainties, and statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual

results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements

include, but are not limited to, statements about:

|

|

•

|

|

the acceptance by the market of our products;

|

|

|

•

|

|

the implementation of our business model, strategic plans for our business, products and technology;

|

|

|

•

|

|

the timing of and our ability to complete and successfully integrate acquisitions, including the acquisition of Spectrum;

|

|

|

•

|

|

our expectations relating to the synergies, cost savings and other benefits of our acquisition of Spectrum;

|

|

|

•

|

|

our ability to maintain and establish key customer relationships;

|

|

|

•

|

|

estimates of our expenses, future revenues and capital requirements;

|

|

|

•

|

|

our financial performance;

|

|

|

•

|

|

the scope of protection we are able to establish and maintain for intellectual property rights covering our products and technology;

|

|

|

•

|

|

developments relating to our competitors and our industry; and

|

|

|

•

|

|

other risks and uncertainties, including those listed under the caption “Risk Factors” below, including those related to the acquisition of Spectrum and the risks related to the business of Spectrum and in any

documents incorporated by reference herein.

|

Given these uncertainties, readers should not place undue reliance on our forward-looking

statements. These forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Except as may be required by applicable law, we do not undertake or intend to update any

forward-looking statements after the date of this prospectus supplement or the accompanying prospectus or the respective dates of documents incorporated by reference herein or therein that include forward-looking statements.

S-3

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying

prospectus. This summary may not contain all the information that you should consider before making your investment decision. You should read this entire prospectus supplement and the accompanying prospectus carefully, especially the risks of

investing in our securities discussed under “Risk Factors” beginning on page S-18 of this prospectus supplement, along with our consolidated financial statements and notes to those consolidated financial statements, the unaudited pro forma

condensed combined financial statements of included herein and the other information incorporated by reference in this prospectus supplement and the accompanying prospectus and any free writing prospectus we authorize for use in connection with this

offering, before making an investment decision. This prospectus supplement may add to, update or change information in the accompanying prospectus.

Overview

Repligen (“Repligen,” the

“Company,” “we” or “our”) is a bioprocessing-focused, global life sciences company bringing over 30 years of expertise and innovation to our customers. We develop and market a broad range of high-value products and

flexible solutions that address critical steps in the production of biologic drugs while ensuring that the highest drug quality and safety standards are upheld. Our mission is to inspire advances in bioprocessing as a trusted partner in the

production of biologic drugs that improve human health worldwide. Focused on cost and process efficiencies, we deliver innovative technologies that help set new standards in the way biologic drugs are manufactured.

Since our strategic decision in 2012 to focus fully on building our bioprocessing business, we have expanded and diversified our portfolio beyond our legacy

Protein A affinity ligands business to include a number of technology leading bioprocessing products that we sell direct to biopharmaceutical companies and CDMOs (contract development and manufacturing organizations) worldwide. Our dedicated team of

professionals has substantial experience in biomanufacturing and works proactively with industry leaders and customers to develop innovative solutions that address pressure points in the bioproduction process.

Our bioprocessing products drive process efficiency, cost and yield improvements. In upstream processes, our XCell ATF filtration devices and protein cell

culture supplements are used in clinical and commercial-stage manufacturing to improve biologic drug yields. In downstream processes, our Protein A ligands are a critical component of Protein A resins used to purify over 70 antibody-based drugs

on the market and more than 300 in clinical development. Also in downstream processes, our OPUS pre-packed chromatography columns are used in the purification of clinical-stage biologics, and our Sius tangential flow filtration, or TFF, cassettes

are used to concentrate clinical and commercial-stage biologic drugs.

We manufacture and supply Protein A ligands through long-term agreements with major

life sciences companies such as GE Healthcare and MilliporeSigma, who in turn produce and sell Protein A resins to end users (biopharmaceutical companies and CDMOs). We manufacture and supply our cell culture supplements through a distribution

agreement with MilliporeSigma.

We market our chromatography and filtration products globally through a direct commercial organization in the United

States and Europe with a combination of direct sales and distributors in Asia. Since 2014, we have invested in expanding our global commercial organization adding 30 sales, marketing, product management, service and applications personnel to form a

40-person commercial team. Our commercial and R&D teams have a track record of successfully launching new products and applications, as well as building new markets for acquired technologies. For example, since acquiring the XCell ATF business

in 2014, we have rapidly expanded its market penetration through increased customer interaction, new products and expanded applications that increase flexibility and convenience while streamlining biomanufacturing workflow for our customers.

S-4

Our portfolio of bioprocessing products has expanded from our legacy Protein A line since 2011 through

strategic acquisitions and internal product development. We have focused on building a portfolio of technology-leading products that we sell directly to end users. In 2016, we added the Sius TFF filtration line through our purchase of TangenX

Technology Corporation, or TangenX, and we added a lab-scale pre-packed chromatography column line through our purchase of Atoll GmbH. In 2014, we acquired the XCell ATF filtration line from Refine Technologies LLC. In 2011, we added to our Protein

A ligands business and added cell culture growth factors through our acquisition of Novozymes Biopharma Sweden AG. Internally, we develop and market our process-scale OPUS pre-packed chromatography columns. Also through internal innovation, we have

extended both our OPUS and XCell ATF product lines, to include more size options and technology features to benefit our customers. For example, in 2016 we introduced a resin recovery feature on our largest OPUS columns and we launched a single-use

(disposable) alternative to our stainless steel XCell ATF Systems.

Many of our products are early in their adoption cycle, and together with the

expansion of our commercial organization and strategic acquisitions, have contributed to product revenue expansion from $41.8 million in 2012, to $104.4 million in 2016. While all product franchises have grown, our diversification strategy has

resulted in our direct product sales accounting for approximately 48% of our bioprocessing revenue in 2016, compared to approximately 17% in 2012. To meet increased demand for our products, we have increased and continue to increase the volume and

scale of manufacturing at our two manufacturing facilities in the United States and Sweden and plan to expand manufacturing capacity at our newly acquired manufacturing facilities in the United States and Germany.

Customers use our products to produce initial quantities of drug for clinical studies, then scale-up to larger volumes as the drug progresses to commercial

production following regulatory approval. Detailed specifications for a drug’s manufacturing process are included in applications that must be approved by regulators, such as the U.S. Food and Drug Administration, or the FDA, and the European

Medicines Agency, throughout the clinical trial process and prior to final commercial approval. As a result, products that become part of the manufacturing specifications of a late-stage clinical or commercial process can be very “sticky”

due to the costs and uncertainties associated with displacing them.

The Biologics Manufacturing Process

Manufacturing biologic drugs requires three fundamental steps. First, upstream manufacturing involves the production of the biologic by living cells that are

grown in a bioreactor under controlled conditions. These cells, or factories, are highly sensitive to the conditions under which they grow, including the composition of the cell culture media and the growth factors used to stimulate increased cell

growth and protein production, or titre. In the second, downstream step, the biologic must be separated and purified, typically through various filtration and chromatography steps. In the third stage of the process, the purified biologic drug is

formulated, quality controlled and packaged into its final injectable form.

Biologics are generally high value therapies. Given the inherent complexities

of the process and drug product, we have observed that manufacturers are seeking and investing in innovative technologies that address pressure points in the production process in order to improve yields. We see that manufacturers are also seeking

technologies that reduce costs as the biologic drug moves through clinical stages and into commercial processes by adopting single-use technologies as well as other products that confer more flexibility and efficiency.

Our Strategy

We are focused on the development,

production and commercialization of differentiated, technology-leading solutions or products that address pressure points in the biologics manufacturing process and deliver substantial value to our customers. Our products are designed to increase

our customers’ yield, and we are committed to supporting our customers with strong customer service and applications expertise. We intend to build on our

S-5

recent history of developing market leading solutions and delivering strong financial performance through the following strategies:

|

|

•

|

|

Continued innovation

. We plan to capitalize on our internal technological expertise to develop products that address unmet needs in upstream and downstream bioprocessing. We intend to invest further in our core

proteins business (ligands and growth factors) while developing platform and derivative products to support our expanding chromatography (OPUS) and filtration (ATF – Alternating Tangential Flow – and TangenX SIUS products) franchises.

|

|

|

•

|

|

Platforming our products

. A key strategy for accelerating market adoption of our products is delivery of enabling technologies that become the standard, or “platform,” technology in markets where we

compete. We focus our efforts on winning early-stage technology evaluations through direct interaction with the key biomanufacturing decision makers in process development labs. Further, as the molecule advances in development and through to

commercialization, we believe purchase volumes of our products may increase. This strategy is designed to establish both early adoption of our enabling technologies at key accounts and accelerate the implementation of our products as platform

products, thereby strengthening our competitive advantage and contributing to long-term growth.

|

|

|

•

|

|

Targeted acquisitions

. We intend to continue to selectively pursue acquisitions of innovative technologies and products. We intend to leverage our balance sheet to acquire technologies and products that improve

our overall financial performance by improving our competitiveness in filtration or chromatography or moving us into adjacent markets with common commercial call points.

|

|

|

•

|

|

Geographical expansion

. We intend to expand our commercial presence by continuing to build out our global sales, marketing, field applications and services infrastructure.

|

|

|

•

|

|

Operational efficiency

. We seek to expand operating margins through capacity utilization and process optimization strategies designed to increase our manufacturing yields. We plan to invest in systems to support

our global operations, optimizing resources across our global footprint to maximize productivity.

|

Recent Developments

Proposed Acquisition of Spectrum

On June 22,

2017, we entered into an agreement and plan of merger and reorganization to acquire all of the outstanding capital stock of Spectrum, Inc., a privately held filtration company that recognized approximately $40 million in revenue for the year ended

December 31, 2016. Spectrum products have utility in not only monoclonal antibody manufacturing but also in the production of vaccines, recombinant proteins, diagnostic products and the growing cell therapy markets. Spectrum focuses on

customer-tailored solutions, which are subsequently standardized for the broader filtration market. Today, the hollow fiber filters used in our ATF product line are manufactured by Spectrum. The acquisition of Spectrum, if consummated, provides us

with a Repligen-owned filter consumable for our ATF products and further provides us access to the broader markets of vaccines, recombinant proteins and cell therapy where hollow fiber technology is used throughout the manufacturing workflow.

In addition to expanding our filtration product line, our acquisition of Spectrum, if consummated, will add further depth to our growing portfolio of

single-use disposable products. Both Repligen and Spectrum have increasingly focused on developing single-use, disposable solution to the bioprocessing customer base. We have introduced OPUS, SIUS TFF filters and single-use ATF and Spectrum has

introduced its single-use hollow fiber cartridges portfolio, single-use flow paths and associated systems.

S-6

We believe the combination of Spectrum’s hollow fiber technology and systems with our ATF and TangenX

SIUS TFF solutions will give our customers a portfolio of leading technologies and a robust commercial support organization.

Specifically, we believe

that the proposed acquisition, if consummated will:

|

|

•

|

|

Position us as a market leader in both hollow fiber (Spectrum) and flat sheet (TangenX) filtration technology with manufacturing capabilities in both areas.

|

|

|

•

|

|

Add breadth and depth to our filtration portfolio with a direct consumable for our market leading ATF technology while expanding TFF (tangential flow filtration) applications with upstream and downstream (TangenX)

solutions.

|

|

|

•

|

|

Expand market applications beyond our historical focus on monoclonal antibodies to vaccines, recombinant proteins, diagnostics and cell therapies.

|

|

|

•

|

|

Add market leading TFF filtration systems to our portfolio.

|

|

|

•

|

|

Strengthen our single-use portfolio with hollow fiber cartridges and single-use disposable flow path solutions from lab to pilot to production scale.

|

|

|

•

|

|

Expand our commercial organization from 15 to over 30 direct sales representatives, with experience in hollow fiber and TFF filter sales.

|

|

|

•

|

|

Provide us with a platform to drive growth in Asia with a combination of direct sales personnel and a network of distributors.

|

We believe that coupling Repligen and Spectrum’s portfolio with the broader market presence of the combined companies, presents an opportunity to

accelerate our market position as a leading innovator in single-use and continuous manufacturing technologies with strong franchises in filtration, chromatography and proteins (Protein A ligands and growth factors).

Spectrum Overview

Spectrum develops disposable

hollow fiber filtration modules, systems and dialysis membranes. Spectrum offers a differentiated portfolio of hollow fiber cartridges, disposable flow path solutions for single-use manufacturing and a family of fully integrated filtration systems

that span production volumes from bench top to commercial scale. Spectrum’s products are used for the filtration, isolation, purification and concentration of monoclonal antibodies, vaccines, recombinant proteins, diagnostic products and cell

therapies with the substantial majority of its 2016 revenue coming from these markets. The remaining 2016 revenue was derived from sales of lab chromatography products and hospital operating room disposables.

Spectrum was founded in 1970, is headquartered in Rancho Dominguez, California and has more than 220 employees worldwide. Spectrum has multiple

manufacturing sites in North America, a distribution center in the Netherlands and a strong commercial team with a direct sales presence in North America, Europe and Asia.

Merger Agreement with Spectrum

On June 22,

2017, we entered into an into an agreement and plan of merger and reorganization, or Acquisition Agreement, with two of our newly formed subsidiaries, Spectrum and Roy T. Eddleman, as representative of Spectrum’s security holders, pursuant

to which, through a series of mergers, Spectrum will become a direct, wholly owned subsidiary of Repligen. The aggregate acquisition consideration payable in exchange for all of the outstanding equity securities of Spectrum consists of approximately

$120 million in cash and 6,154,000 shares of our common stock (the “Acquisition Consideration”). The Acquisition Consideration is subject to adjustment

S-7

based on (i) cash and working capital adjustment provisions, (ii) the amount of Spectrum’s transaction expenses and indebtedness that remain unpaid as of the closing of the

Acquisition and (iii) indemnification obligations of holders of equity securities of Spectrum receiving Acquisition Consideration. Approximately $27 million of the Acquisition Consideration will be placed into a third party escrow account

against which we may make claims for indemnification and purchase price adjustments until the fifteen month anniversary of the closing of the Acquisition.

The Acquisition is conditioned upon, among other things, the expiration of the applicable waiting period (and any extension thereof) under the

Hart-Scott-Rodino Antitrust Improvements Act of 1976 laws and other customary closing conditions. The Acquisition Agreement provides for limited termination rights, including, among others, by the mutual consent of Repligen and Spectrum, upon

certain breaches of representations, warranties, covenants or agreements, and in the event the Acquisition has not been consummated before September 20, 2017, subject to the ability to extend under certain circumstances.

Risks Related to Our Business and the Acquisition of Spectrum

Our ability to execute our business strategy, and our acquisition of Spectrum, is subject to a number of risks of which you should be aware before you decide

to invest in our common stock. In particular, you should consider the following risks, which are discussed more fully in the section entitled “Risk Factors” in this prospectus supplement and in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2016, which is incorporated herein by reference:

|

|

•

|

|

Although we generate revenue from product sales, our product revenue may be negatively impacted by a number of factors, including without limitation, competition in the bioprocessing market, our reliance on a limited

number of customers, our ability to develop or acquire additional bioprocessing products in the future, our ability to manufacture our bioprocessing products sufficiently and timely, and our ability to effectively penetrate the bioprocessing

products market.

|

|

|

•

|

|

We may not be able to achieve sufficient market acceptance for our bioprocessing products, and our results of operations and competitive positions could suffer.

|

|

|

•

|

|

If our products do not perform as expected, we could experience lost revenue, delayed or reduced market acceptance, increased cost and damage to our reputation.

|

|

|

•

|

|

If we are unable to manufacture our products in sufficient quantities and in a timely manner, our operating results will be harmed, our ability to generate revenue could be diminished and our gross margin may be

negatively impacted.

|

|

|

•

|

|

The Acquisition, if consummated, will create numerous risks and uncertainties which could adversely affect our financial condition and operating results.

|

|

|

•

|

|

We will incur significant transaction, integration and other costs in connection with the Acquisition and these costs may exceed the realized benefits, if any, of the synergies and efficiencies from the Acquisition,

including likely resulting in a loss per share on a GAAP basis for Repligen in fiscal 2017.

|

|

|

•

|

|

We may encounter difficulties in integrating Spectrum’s business and retaining Spectrum’s key personnel and sales force.

|

|

|

•

|

|

We will be subject to business uncertainties while the Acquisition is pending, which could adversely affect our business.

|

|

|

•

|

|

The Acquisition, which is subject to a number of closing conditions, some of which are out of our control, may not close when we expect, or at all.

|

|

|

•

|

|

Other acquisitions we have completed or may in the future complete expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or

technologies.

|

S-8

|

|

•

|

|

Our results of operations could be negatively affected by potential fluctuations in foreign currency exchange rates.

|

|

|

•

|

|

We have limited sales and marketing capabilities, and such capabilities are becoming increasingly important for our business as we began to sell directly to more end-users, so the buildout of such capabilities is

critical to our anticipated revenue growth.

|

|

|

•

|

|

If we are unable to hire and retain skilled personnel, including sales and marketing personnel, then we will have trouble developing and marketing our products.

|

|

|

•

|

|

If we are unable to obtain or maintain our intellectual property rights related to our products, we may not be able to compete effectively or succeed commercially.

|

Company Information

We were incorporated in May 1981

under the laws of the State of Delaware. Our mailing address and executive offices are located at 41 Seyon Street, Waltham, MA 02453 and our telephone number at that address is (781) 250-0111. We maintain an Internet website at the following

address:

www.repligen.com

. The information on, or that can be accessed through, our website does not constitute part of this prospectus supplement, and the reference to our website address is included in this prospectus supplement as an

inactive textual reference only. You should not rely on any such information in making the decision whether to invest in our common stock. Our common stock trades on the NASDAQ Global Select Market under the symbol “RGEN.”

S-9

THE OFFERING

|

Common stock offered by us

|

$100,000,000 of shares.

|

|

Option to purchase additional shares of common stock

|

We have granted the underwriters an option exercisable for 30 days after the date of this prospectus supplement to purchase up to $15,000,000 of additional shares from us.

|

|

Common stock to be outstanding immediately after this offering

|

36,338,987 shares (or 36,678,353 shares if the underwriters exercise in full their option to purchase additional shares), assuming sales of $100,000,000 of shares of our common stock in this offering at an offering price of $44.20 per share (the

last reported sale price of our common stock on the NASDAQ Global Select Market on June 23, 2017). The actual number of shares issued will vary depending on the sales price under this offering.

|

|

Use of proceeds

|

We estimate that the net proceeds to us from this offering, after deducting the estimated underwriting discount and estimated offering expenses payable by us, will be approximately $93.5 million (or approximately $107.6 million if the

underwriters exercise their option to purchase additional shares of common stock in full). The estimated net proceeds are based on the assumed public offering price of $44.20 per share, which was the last reported sale price of our common stock on

the NASDAQ Global Select Market on June 23, 2017. We intend to use the net proceeds from this offering for working capital and other general corporate purposes, including to fund possible acquisitions of, or investments in, complementary

businesses, products, services and technologies. See “Use of Proceeds.”

|

|

Risk factors

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-18 of this prospectus supplement and in our Annual Report on Form 10-K for the year ended December 31, 2016, which is incorporated

by reference herein, for a discussion of factors that you should read and consider before investing in our securities.

|

|

NASDAQ Global Select Market symbol

|

“RGEN”

|

The number of shares of our common stock to be outstanding immediately after this offering as shown above is based on

34,076,544 shares outstanding as of March 31, 2017. This number of shares excludes the following:

|

|

•

|

|

805,903 shares of our common stock issuable upon the exercise of stock options outstanding under the Second Amended and Restated 2001 Repligen Corporation Stock Plan (the “2001 Plan”) and the Repligen

Corporation Amended and Restated 2012 Stock Option and Incentive Plan (the “2012 Plan,” and collectively with the 2001 Plan and the 1992 Repligen Corporation Stock Option Plan, the “Plans”);

|

S-10

|

|

•

|

|

404,781 shares of our common stock issuable upon the vesting of outstanding restricted stock units issued under the Plans;

|

|

|

•

|

|

1,531,010 shares of our common stock reserved for future issuance under the 2012 Plan; and

|

|

|

•

|

|

3,585,850 shares of our common stock issuable upon the conversion of our 2.125% Convertible Senior Notes due 2021 (the “Notes”), at the conversion price in effect as of the date of this prospectus supplement.

|

To the extent that any of these options are exercised, restricted stock units vest, new options are issued under our equity incentive plans

and subsequently exercised, we issue additional shares of common stock in the future, or the outstanding Notes convert to common stock, there will be further dilution to the investors participating in this offering.

Unless otherwise indicated, all information in this prospectus supplement assumes:

|

|

•

|

|

that the underwriters do not exercise their option to purchase up to $15,000,000 of additional shares of our common stock; and

|

|

|

•

|

|

no options, restricted stock units, warrants, or shares of common stock were issued or converted after March 31, 2017.

|

S-11

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table sets forth summary consolidated financial data and other operating information of the Company. The summary consolidated financial data as

of December 31, 2016 and for the years ended December 31, 2016 and 2015 are derived from our audited consolidated financial statements, which are incorporated by reference herein. The summary consolidated financial data as of

March 31, 2017 and for the three months ended March 31, 2017 and 2016 are derived from our unaudited condensed consolidated financial statements, which are incorporated by reference herein. These unaudited condensed consolidated financial

statements have been prepared on a basis consistent with our audited consolidated financial statements. The unaudited consolidated financial statements include all adjustments, consisting of normal recurring accruals, that we consider necessary for

a fair presentation of the financial position and the results of operations for these periods. Our historical results are not necessarily indicative of the results that may be expected in the future. The following summary consolidated financial data

should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto, all of which is incorporated by

reference herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31,

|

|

|

Year ended December 31,

|

|

|

Consolidated Statements of Operations Data:

(in thousands, except share and per share data)

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue

|

|

$

|

30,569

|

|

|

$

|

25,094

|

|

|

$

|

104,441

|

|

|

$

|

83,537

|

|

|

Royalty and other revenue

|

|

|

21

|

|

|

|

—

|

|

|

|

100

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue

|

|

|

30,590

|

|

|

|

25,094

|

|

|

|

104,541

|

|

|

|

83,537

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product revenue

|

|

|

13,990

|

|

|

|

11,069

|

|

|

|

47,117

|

|

|

|

35,251

|

|

|

Research and development

|

|

|

1,742

|

|

|

|

1,539

|

|

|

|

7,355

|

|

|

|

5,740

|

|

|

Selling, general and administrative

|

|

|

9,182

|

|

|

|

7,018

|

|

|

|

30,853

|

|

|

|

24,699

|

|

|

Contingent consideration — fair value adjustments

|

|

|

—

|

|

|

|

2,005

|

|

|

|

3,242

|

|

|

|

4,083

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,914

|

|

|

|

21,631

|

|

|

|

88,567

|

|

|

|

69,773

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

5,676

|

|

|

|

3,463

|

|

|

|

15,974

|

|

|

|

13,764

|

|

|

Investment income

|

|

|

96

|

|

|

|

61

|

|

|

|

346

|

|

|

|

136

|

|

|

Interest expense

|

|

|

(1,585

|

)

|

|

|

(5

|

)

|

|

|

(3,768

|

)

|

|

|

(32

|

)

|

|

Other (expense) income

|

|

|

(120

|

)

|

|

|

(979

|

)

|

|

|

(860

|

)

|

|

|

(445

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

4,067

|

|

|

|

2,540

|

|

|

|

11,692

|

|

|

|

13,423

|

|

|

Income tax (benefit) provision

|

|

|

999

|

|

|

|

915

|

|

|

|

11

|

|

|

|

4,078

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

3,068

|

|

|

$

|

1,625

|

|

|

$

|

11,681

|

|

|

$

|

9,345

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.09

|

|

|

$

|

0.05

|

|

|

$

|

0.35

|

|

|

$

|

0.28

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

$

|

0.09

|

|

|

$

|

0.05

|

|

|

$

|

0.34

|

|

|

$

|

0.28

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

33,891,702

|

|

|

|

33,024,681

|

|

|

|

33,572,883

|

|

|

|

32,881,940

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

34,382,322

|

|

|

|

33,493,575

|

|

|

|

34,098,898

|

|

|

|

33,577,091

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-12

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data:

(in

thousands)

|

|

March 31, 2017

|

|

|

December 31, 2016

|

|

|

Cash, cash equivalents and marketable securities*

|

|

$

|

141,843

|

|

|

$

|

141,780

|

|

|

Working capital

|

|

|

172,048

|

|

|

|

163,078

|

|

|

Total assets

|

|

|

290,628

|

|

|

|

288,913

|

|

|

Long-term obligations

|

|

|

100,086

|

|

|

|

99,074

|

|

|

Accumulated deficit

|

|

|

(56,793

|

)

|

|

|

(59,861

|

)

|

|

Stockholders’ equity

|

|

|

176,791

|

|

|

|

168,764

|

|

|

*

|

does not include restricted cash

|

|

(1)

|

For a discussion of and definitions for Non-GAAP Adjusted Income From Operations, Non-GAAP Adjusted Net Income, and Non-GAAP Adjusted EBITDA and Non-GAAP Adjusted Net Income Per Share (Diluted), see “Presentation

of Non-GAAP Financial Information.” See “Reconciliation of Non-GAAP Financial Measures” for GAAP reconciliation of these measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

March 31,

|

|

|

Year ended

December 31,

|

|

|

Other Operating Data(1)

(in

thousands, except per share data)

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

Non-GAAP Adjusted Income From Operations

|

|

$

|

6,793

|

|

|

$

|

6,260

|

|

|

$

|

23,482

|

|

|

$

|

19,447

|

|

|

Non-GAAP Adjusted Net Income

|

|

$

|

5,054

|

|

|

$

|

4,318

|

|

|

$

|

16,779

|

|

|

$

|

14,615

|

|

|

Non-GAAP Adjusted EBITDA

|

|

$

|

7,601

|

|

|

$

|

6,032

|

|

|

$

|

25,891

|

|

|

$

|

21,998

|

|

|

Non-GAAP Adjusted Net Income Per Share (Diluted)

|

|

$

|

0.15

|

|

|

$

|

0.13

|

|

|

$

|

0.49

|

|

|

$

|

0.44

|

|

Reconciliation of Non-GAAP Financial Measures

This prospectus supplement contains certain financial measures that have been prepared other than in accordance with GAAP. These measures include Non-GAAP

Adjusted Income From Operations, Adjusted Net Income, Adjusted EBITDA and Non-GAAP Adjusted Net Income Per Share (Diluted). We include this financial information because we believe these measures provide a more accurate comparison of our financial

results between periods and more accurately reflect how management reviews its financial results. We excluded the impact of certain acquisition related items because we believe that the resulting charges do not accurately reflect the performance of

our ongoing operations for the period in which such charges are incurred. The following tables present a reconciliation of such financial measures to the most comparable measures calculated in accordance with GAAP.

In the first quarter of 2017, we began deducting intangible amortization in our presentation of Non-GAAP financial metrics. The Non-GAAP financial metrics

included in our Annual Report on Form 10-K for the year ended December 31, 2016 and incorporated by reference in this prospectus supplement do not deduct intangible amortization. However, we have included a deduction for the Non-GAAP financial

metrics below for fiscal year 2016 and 2015 results for comparability and because this is our intended presentation going forward. As a result, the 2016 and 2015 Non-GAAP financial metrics below differ from those included in our Annual Report on

Form 10-K for the year ended December 31, 2016.

S-13

Reconciliation of GAAP Income from Operations to Non-GAAP Adjusted Income from Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

Three months ended

March 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

GAAP Income from Operations

|

|

$

|

15,974

|

|

|

$

|

13,764

|

|

|

$

|

5,676

|

|

|

$

|

3,643

|

|

|

Non-GAAP Income from Operations Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition costs

|

|

|

2,214

|

|

|

|

—

|

|

|

|

402

|

|

|

|

393

|

|

|

Intangible amortization

|

|

|

2,052

|

|

|

|

1,600

|

|

|

|

715

|

|

|

|

399

|

|

|

Contingent consideration—fair value adjustments

|

|

|

3,242

|

|

|

|

4,083

|

|

|

|

—

|

|

|

|

2,005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjusted Income from Operations

|

|

$

|

23,482

|

|

|

$

|

19,447

|

|

|

$

|

6,793

|

|

|

$

|

6,260

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP Income to Non-GAAP Adjusted Net Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

Three months ended

March 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

GAAP Net Income

|

|

$

|

11,681

|

|

|

$

|

9,345

|

|

|

$

|

3,068

|

|

|

$

|

1,625

|

|

|

Non-GAAP Net Income Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition costs

|

|

|

2,214

|

|

|

|

—

|

|

|

|

402

|

|

|

|

393

|

|

|

Intangible amortization

|

|

|

2,052

|

|

|

|

1,600

|

|

|

|

715

|

|

|

|

399

|

|

|

Contingent consideration—fair value adjustments

|

|

|

3,242

|

|

|

|

4,083

|

|

|

|

—

|

|

|

|

2,005

|

|

|

Non-cash interest expense

|

|

|

2,274

|

|

|

|

—

|

|

|

|

970

|

|

|

|

—

|

|

|

Tax effect of intangible amortization

|

|

|

(415

|

)

|

|

|

(413

|

)

|

|

|

(101

|

)

|

|

|

(104

|

)

|

|

Net tax benefit from Atoll and TangenX acquisitions

|

|

|

(4,269

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjusted Net Income

|

|

$

|

16,779

|

|

|

$

|

14,615

|

|

|

$

|

5,054

|

|

|

$

|

4,318

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

Three months ended

March 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

GAAP Net Income

|

|

$

|

11,681

|

|

|

$

|

9,345

|

|

|

$

|

3,068

|

|

|

$

|

1,625

|

|

|

Non-GAAP EBITDA Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income

|

|

|

(346

|

)

|

|

|

(136

|

)

|

|

|

(96

|

)

|

|

|

(61

|

)

|

|

Interest expense

|

|

|

3,768

|

|

|

|

32

|

|

|

|

1,585

|

|

|

|

5

|

|

|

Tax provision

|

|

|

11

|

|

|

|

4,078

|

|

|

|

999

|

|

|

|

915

|

|

|

Depreciation

|

|

|

3,269

|

|

|

|

2,996

|

|

|

|

928

|

|

|

|

751

|

|

|

Amortization

|

|

|

2,052

|

|

|

|

1,600

|

|

|

|

715

|

|

|

|

399

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP EBITDA

|

|

|

20,435

|

|

|

|

17,915

|

|

|

|

7,199

|

|

|

|

3,634

|

|

|

Other Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition costs

|

|

|

2,214

|

|

|

|

—

|

|

|

|

402

|

|

|

|

393

|

|

|

Contingent consideration—fair value adjustments

|

|

|

3,242

|

|

|

|

4,083

|

|

|

|

—

|

|

|

|

2,005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjusted EBITDA

|

|

$

|

25,891

|

|

|

$

|

21,998

|

|

|

$

|

7,601

|

|

|

$

|

6,032

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-14

Reconciliation of GAAP Net Income (Loss) Per Share to Non-GAAP Adjusted Net Income Per Share (Diluted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

Three months ended

March 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2017

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

GAAP Net Income Per Share

|

|

$

|

0.34

|

|

|

$

|

0.28

|

|

|

$

|

0.09

|

|

|

$

|

0.05

|

|

|

Non-GAAP Net Income Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition costs

|

|

|

0.06

|

|

|

|

—

|

|

|

|

0.01

|

|

|

|

0.01

|

|

|

Contingent consideration—fair value adjustments

|

|

|

0.10

|

|

|

|

0.12

|

|

|

|

—

|

|

|

|

0.01

|

|

|

Intangible amortization

|

|

|

0.06

|

|

|

|

0.05

|

|

|

|

0.02

|

|

|

|

0.06

|

|

|

Non-cash interest expense

|

|

|

0.07

|

|

|

|

—

|

|

|

|

0.03

|

|

|

|

—

|

|

|

Tax effect of intangible amortization

|

|

|

(0.01

|

)

|

|

|

(0.01

|

)

|

|

|

(0.00

|

)

|

|

|

(0.00

|

)

|

|

Net tax benefit from Atoll and TangenX acquisitions

|

|

|

(0.13

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjusted Net Income Per Share (Diluted)

|

|

$

|

0.49

|

|

|

$

|

0.44

|

|

|

$

|

0.15

|

|

|

$

|

0.13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-15

SPECIAL NOTE REGARDING UNAUDITED PRO FORMA CONSOLIDATED

FINANCIAL DATA

On June 22, 2017, we entered into the Acquisition Agreement for the acquisition of Spectrum. See “The Acquisition.” Our

unaudited pro forma financial statements are set forth in this prospectus supplement under the heading “Unaudited Pro Forma Condensed Combined Financial Information.”

The pro forma financial statements are based on our audited and unaudited historical consolidated financial statements and those of Spectrum, which are

incorporated by reference in this prospectus supplement, and those of TangenX Technology Corporation (“TangenX”), which we acquired on December 14, 2016 (the “TangenX Acquisition), after giving effect to (i) the TangenX

Acquisition and (ii) the Acquisition, and were prepared based upon the purchase method of accounting in accordance with GAAP and by applying the assumptions and adjustments described in the notes accompanying the pro forma financial statements.

The unaudited pro forma consolidated financial data presented in this prospectus gives effect to the TangenX Acquisition and the Acquisition as if such acquisitions had happened on January 1, 2016 for the pro forma statement of operations. The

pro forma balance sheet gives effect to the Acquisition as if it occurred as of March 31, 2017.

The pro forma adjustments are preliminary, and the

unaudited pro forma condensed consolidated combined financial statements are not necessarily indicative of the financial position or results of operations that may have actually occurred had the Acquisition taken place on the dates noted, or the

future financial position or operating results of the combined company. The pro forma adjustments are based upon available information and assumptions that we believe are reasonable. We expect to incur additional costs related to employee severance

and other restructuring costs related to the Acquisition. We have not yet completed our assessment and do not have an estimate of these costs.

S-16

SUMMARY CONSOLIDATED FINANCIAL DATA OF SPECTRUM

The following tables set forth summary consolidated financial data of Spectrum as of and for the periods presented. The summary consolidated financial data as

of December 31, 2016 and the years ended December 31, 2016 and January 2, 2016 were derived from Spectrum’s audited consolidated financial statements and related notes incorporated by reference in this prospectus supplement. The

summary consolidated financial data as of April 1, 2017 and for the three months ended April 1, 2017 and April 2, 2016 were derived from Spectrum’s unaudited condensed consolidated financial statements and related notes

incorporated by reference in this prospectus supplement. The unaudited condensed financial statements include all adjustments, consisting of normal recurring accruals, considered necessary for a fair presentation of the financial position and the

results of operations for these periods. These results are not necessarily indicative of, and are not projections for, the results to be expected for any future period, particularly given potential changes following our consummation of the

Acquisition, if successful, including Spectrum no longer recognizing revenue from sales to Repligen.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

Year ended

|

|

|

Consolidated Statements of Operations Data:

(in thousands, except share and per share data)

|

|

April 1,

2017

|

|

|

April 2,

2016

|

|

|

December 31,

2016

|

|

|

January 2,

2016

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue

|

|

$

|

9,735

|

|

|

$

|

9,092

|

|

|

$

|

40,200

|

|

|

$

|

34,482

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product revenue

|

|

|

4,179

|

|

|

|

4,440

|

|

|

|

18,902

|

|

|

|

15,125

|

|

|

Selling, general and administrative

|

|

|

3,258

|

|

|

|

2,490

|

|

|

|

11,835

|

|

|

|

10,384

|

|

|

Research and development

|

|

|

567

|

|

|

|

476

|

|

|

|

1,995

|

|

|

|

1,769

|

|

|

Building expenses

|

|

|

16

|

|

|

|

15

|

|

|

|

57

|

|

|

|

72

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,020

|

|

|

|

7,421

|

|

|

|

32,789

|

|

|

|

27,350

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

1,715

|

|

|

|

1,671

|

|

|

|

7,411

|

|

|

|

7,132

|

|

|

Interest expense, net

|

|

|

(162

|

)

|

|

|

(157

|

)

|

|

|

(654

|

)

|

|

|

(627

|

)

|

|

Other income (expense), net

|

|

|

90

|

|

|

|

201

|

|

|

|

(264

|

)

|

|

|

(323

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

1,643

|

|

|

|

1,715

|

|

|

|

6,493

|

|

|

|

6,182

|

|

|

Income tax provision

|

|

|

606

|

|

|

|

627

|

|

|

|

2,131

|

|

|

|

1,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

1,037

|

|

|

$

|

1,088

|

|

|

$

|

4,362

|

|

|

$

|

4,382

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data:

|

|

April 1,

2017

|

|

|

December 31,

2016

|

|

|

Cash, cash equivalents and marketable securities

|

|

$

|

8,061

|

|

|

$

|

7,937

|

|

|

Working capital

|

|

|

12,099

|

|

|

|

16,885

|

|

|

Total assets

|

|

|

46,975

|

|

|

|

46,509

|

|

|

Long-term obligations

|

|

|

8,071

|

|

|

|

14,026

|

|

|

Retained earnings

|

|

|

17,151

|

|

|

|

16,196

|

|

|

Stockholders’ equity

|

|

|

26,959

|

|

|

|

26,007

|

|

S-17