UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE TO

Tender Offer Statement under Section

14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

_____________________

LIFEWAY FOODS, INC.

(Name of Subject Company (Issuer) and

Filing Person (Offeror))

_____________________

Common Stock, no par value

(Title of Class of Securities)

531914109

(CUSIP Number of Class of Securities)

Douglas A. Hass

General Counsel and Assistant Corporate

Secretary

Lifeway Foods, Inc.

6431 Oakton Street

Morton Grove, IL 60053

(847) 967-1010

(Name, address and telephone number of

person authorized to receive

notices and communications on behalf

of filing person)

Copy to:

Timothy Lavender, Esq.

Kelley Drye & Warren LLP

333 West Wacker Drive, Suite 2600

Chicago, IL 60606

(312) 857-7070

CALCULATION OF FILING FEE

|

Transaction valuation

(1)

|

|

Amount of filing fee

(2)

|

|

$6,000,000

|

|

$695.40

|

|

|

(1)

|

The transaction valuation is estimated only for purposes of calculating the filing fee. This amount is based on the offer to purchase for not more than $6,000,000 in aggregate of up to 705,882 shares of Common Stock, no par value, at the minimum tender offer price of $8.50 per share.

|

|

|

(2)

|

The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, equals $115.90 per $1,000,000 of the value of the transaction.

|

|

|

o

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

Amount Previously Paid: N/A

|

|

Filing Party: N/A

|

|

|

Form or Registration No.: N/A

|

|

Date Filed: N/A

|

|

|

o

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions

to which the statement relates:

|

|

o

|

third-party tender offer subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

o

|

going-private transaction subject to Rule 13e-3.

|

|

|

o

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting

the results of the tender offer:

o

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

|

|

o

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

o

|

Rule 14d-1(d) (Cross-Border Third Party Tender Offer)

|

Table of Contents

|

PART I – FINANCIAL INFORMATION

|

|

|

|

|

|

Item 1.

|

Summary Term Sheet.

|

|

|

|

|

|

|

Item 2.

|

Subject Company Information.

|

|

|

|

|

|

|

Item 3.

|

Identity and Background of Filing Person.

|

|

|

|

|

|

|

Item 4.

|

Terms of the Transaction.

|

|

|

|

|

|

|

Item 5.

|

Past Contacts, Transactions, Negotiations, and Agreements.

|

|

|

|

|

|

|

Item 6.

|

Purposes of the Transaction and Plans or Proposals.

|

|

|

|

|

|

|

Item 7.

|

Source and Amount of Funds or Other Consideration.

|

|

|

|

|

|

|

Item 8.

|

Interest in Securities of the Subject Company.

|

|

|

|

|

|

|

Item 9.

|

Persons/Assets, Retained, Employed, Compensated or Used.

|

|

|

|

|

|

|

Item 10.

|

Financial Statements.

|

|

|

|

|

|

|

Item 11.

|

Additional Information.

|

|

|

|

|

|

|

Item 12.

|

Exhibits.

|

|

|

|

|

|

|

Item 13.

|

Information Required by Schedule 13E-3

|

|

|

|

|

|

|

|

Signatures.

|

|

|

|

|

|

|

|

Index of Exhibits.

|

|

This Tender Offer Statement on Schedule TO (this “Schedule

TO”) relates to the offer by Lifeway Foods, Inc., an Illinois corporation (“Lifeway” or the “Company”),

to purchase for cash up to $6,000,000 of shares of its common stock, no par value (the “shares”), pursuant to (i) auction

tenders at prices specified by the tendering shareholders of not less than $8.50 and not more than $9.50 per share, or (ii) purchase

price tenders, in either case, net to the seller in cash, less any applicable withholding taxes and without interest, upon the

terms and subject to the conditions described in the Offer to Purchase, dated June 26, 2017 (the “Offer to Purchase”),

a copy of which is filed herewith as Exhibit (a)(1)(A), and in the related Letter of Transmittal (the “Letter of Transmittal”

and, together with the Offer to Purchase, as they may be amended or supplemented from time to time, the “Tender Offer”),

a copy of which is attached hereto as Exhibit (a)(1)(B). This Schedule TO is being filed in accordance with Rule 13e-4(c)(2) promulgated

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The information contained in the Offer to Purchase and the Letter

of Transmittal is hereby incorporated by reference in response to all the items of this Schedule TO, and as more particularly set

forth below.

ITEM 1. SUMMARY TERM SHEET.

The information under the heading “Summary

Term Sheet,” included in the Offer to Purchase, is incorporated herein by reference.

ITEM 2. SUBJECT COMPANY INFORMATION.

Lifeway Foods, Inc. is the name of the subject company and issuer

of the securities to which this Schedule TO relates. The address and telephone number of its principal executive office are 6431

Oakton Street, Morton Grove, Illinois 60053, (847) 967-1010.

(b)

Securities.

The subject securities to which this Schedule TO relates are

shares of common stock, no par value, of Lifeway Foods, Inc. As of June 23, 2017, there were 16,154,095 shares of the Company’s

common stock issued and outstanding. The information set forth in the Offer to Purchase under the heading “Introduction”

is incorporated herein by reference.

|

|

(b)

|

Trading Market and Price

|

Information about the trading market and price of the shares

of the Company’s common stock set forth in the Offer to Purchase under the heading “Section 8 — Price

Range of Shares; Dividends” is incorporated herein by reference.

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSON.

The filing person to which this Schedule TO relates is Lifeway

Foods, Inc. The business address and telephone number of Lifeway is set forth under Item 2(a) above and incorporated herein by

reference. The names and business addresses of the directors and executive officers of Lifeway are as set forth in the Offer to

Purchase under the heading “Section 12 — Interests of Directors and Executive Officers; Transactions and Arrangements

Concerning the Shares,” and such information is incorporated herein by reference.

ITEM 4. TERMS OF THE TRANSACTION.

The material terms of the transaction set forth in the Offer

to Purchase under the headings “Summary Term Sheet,” “Section 1 — Number of Shares; Purchase

Price; Proration,” “Section 2 — Purpose of the Offer; Certain Effects of the Offer,” “Section

3 — Procedures for Tendering Shares,” “Section 4 — Withdrawal Rights,” “Section

5 — Purchase of Shares and Payment of Purchase Price,” “Section 6 — Conditional Tender

of Shares,” “Section 7 — Conditions of the Offer,” “Section 9 — Source

and Amount of Funds,” “Section 10 — Certain Financial Information,” “Section 11 — Certain

Information Concerning the Company,” “Section 12 — Interests of Directors and Executive Officers; Transactions

and Arrangements Concerning the Shares,” “Section 15 — Material U.S. Federal Income Tax Consequences”

and “Section 16 — Extension of the Offer; Termination; Amendment” are incorporated herein by reference.

Information regarding purchases from officers, directors and

affiliates of Lifeway set forth in the Offer to Purchase under the heading “Section 12 — Interests of Directors

and Executive Officers; Transactions and Arrangements Concerning the Shares” is incorporated herein by reference.

Item 5. Past ContRacts,

Transactions, Negotiations and Agreements.

(a)

Agreements Involving the Subject

Company’s Securities.

The information set forth in the Offer to Purchase under the

headings “Section 8 — Price Range of Shares; Dividends” and “Section 12 — Interests

of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares” is incorporated herein by reference.

Item 6. Purposes

of the Transaction and Plans or Proposals.

Information regarding the purpose of the transaction set forth

in the Offer to Purchase under the headings “Summary Term Sheet” and “Section 2 — Purpose of

the Offer; Certain Effects of the Offer” is incorporated herein by reference.

|

|

(b)

|

Use of Securities Acquired.

|

Information regarding the treatment of shares acquired pursuant

to the Tender Offer set forth in the Offer to Purchase under the heading “Section 2 — Purpose of the Offer;

Certain Effects of the Offer” is incorporated herein by reference.

Information about any plans or proposals set forth in the Offer

to Purchase under the headings “Section 2 — Purpose of the Offer; Certain Effects of the Offer” and

“Section 12 — Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the

Shares” is incorporated herein by reference.

Item 7. Source and

Amount of Funds or Other Consideration.

Information regarding the source of funds set forth in the Offer

to Purchase under the heading “Section 9 — Source and Amount of Funds” is incorporated herein by reference.

Information regarding the conditions of the offer set forth

in the Offer to Purchase under the heading “Section 7 — Conditions of the Offer” is incorporated herein

by reference. There are no alternative financing arrangements or financing plans for the Tender Offer.

(d)

Borrowed Funds.

Information regarding the borrowing of funds set forth in the

Offer to Purchase under the heading “Section 9 — Source and Amount of Funds” is incorporated herein

by reference.

Item 8. Interest

in Securities of the Subject Company.

(a)

Securities Ownership.

The information set forth under the heading “Section 12 — Interests

of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares” in the Offer to Purchase is incorporated

herein by reference.

|

|

(c)

|

Securities Transactions.

|

The information set forth under the heading “Section 12 — Interests

of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares” in the Offer to Purchase is incorporated

herein by reference.

Item 9. Persons/Assets,

Retained, Employed, Compensated or Used.

|

|

(a)

|

Solicitations or Recommendations.

|

The information set forth under the headings “Summary

Term Sheet” and “Section 17 — Fees and Expenses” in the Offer to Purchase is incorporated herein

by reference.

Item 10. Financial

Statements.

|

|

(a)

|

Financial Information.

|

The information set forth under the heading “Section 10 — Certain

Financial Information” in the Offer to Purchase is incorporated herein by reference.

|

|

(b)

|

Pro Forma Information.

|

The information set forth under the heading “Section 10 — Certain

Financial Information” in the Offer to Purchase is incorporated herein by reference.

Item 11. Additional

Information.

|

|

(a)

|

Agreements, Regulatory Requirements and Legal Proceedings.

|

(a)(1) The information set forth under the

heading “Section 12 — Interests of Directors and Executive Officers; Transactions and Arrangements Concerning

the Shares” in the Offer to Purchase is incorporated herein by reference.

(a)(2) The information set forth under the

heading “Section 14 — Legal Matters; Regulatory Approvals” in the Offer to Purchase is incorporated

herein by reference.

(a)(3) The information set forth under the

heading “Section 14 — Legal Matters; Regulatory Approvals” in the Offer to Purchase is incorporated

herein by reference.

(a)(4) The information set forth under the

heading “Section 2 — Purpose of the Offer; Certain Effects of the Offer” in the Offer to Purchase is

incorporated herein by reference.

(a)(5) In a letter dated May 19, 2016, the

Company received a request to voluntarily produce documents in connection with a confidential, informal inquiry by the Division

of Enforcement of the SEC concerning the Company’s internal controls, disclosure controls procedures, and internal control

over financial reporting for fiscal years 2013 through the date of the letter. The SEC has informed the Company that the inquiry

should not be construed as an indication that any violation of any federal securities law has occurred or as a reflection upon

the merits of any person, company, or securities involved. Since receiving the letter, the Company has been cooperating with the

SEC and will continue to do so. The remaining information set forth under the heading “Section 14 — Legal

Matters; Regulatory Approvals” in the Offer to Purchase is incorporated herein by reference.

|

|

(b)

|

Other Material Information.

|

Not applicable.

The Company will amend this Schedule TO

to include documents that the Company may file with the Securities and Exchange Commission after the date of the Offer to Purchase

pursuant to Section 13(a), 13(c) or 14 of the Exchange Act and prior to the expiration of the Tender Offer to the extent required

by Rule 13e-4(d)(2) of the Exchange Act.

ITEM 12. EXHIBITS.

The Index of Exhibits immediately following

the signature page of this Schedule TO is incorporated herein by reference.

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3.

(a) Not applicable.

SIGNATURES

After due inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this Schedule TO is true, complete and correct

|

|

LIFEWAY FOODS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 26, 2017

|

By:

|

/s/ Douglas A. Hass

|

|

|

|

|

Douglas A. Hass

|

|

|

|

|

General Counsel and Assistant Corporate Secretary

|

|

INDEX OF EXHIBITS

|

(a)(1)(A)

|

Offer to Purchase, dated June 26, 2017.

|

|

|

|

|

(a)(1)(B)

|

Letter of Transmittal.

|

|

|

|

|

(a)(1)(C)

|

Notice of Guaranteed Delivery.

|

|

|

|

|

(a)(1)(D)

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated June 26, 2017.

|

|

|

|

|

(a)(1)(E)

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated June 26, 2017.

|

|

|

|

|

(a)(2)

|

None.

|

|

|

|

|

(a)(3)

|

Not Applicable.

|

|

|

|

|

(a)(4)

|

Not Applicable.

|

|

|

|

|

(a)(5)

|

Press release, dated June 26, 2017 announcing the Company’s commencement of the tender offer.

|

|

|

|

|

(b)

|

Not applicable.

|

|

|

|

|

(c)

|

None

|

|

|

|

|

(d)(1)

|

Stock Purchase Agreement dated October 1, 1999 by and among Danone Foods, Inc., Lifeway Foods, Inc., Michael Smolyansky and certain other parties (incorporated by reference to Exhibit 10.10 to Lifeway's Current Report on Form 8-K dated October 1, 1999, and filed October 12, 1999 (File No. 000-17363)).

|

|

|

|

|

(d)(2)

|

Stockholders' Agreement dated October 1, 1999 by and among Danone Foods, Inc., Lifeway Foods, Inc., Michael Smolyansky and certain other parties (incorporated by reference to Exhibit 10.11 to Lifeway's Current Report on Form 8-K dated October 1, 1999, and filed October 12, 1999 (File No. 000-17363)).

|

|

|

|

|

(d)(3)

|

Letter Agreement dated December 24, 1999 (amending original Stockholders' Agreement with Danone Foods, Inc.) (incorporated by reference to Exhibit 10.12 to Lifeway's Current Report on Form 8-K dated December 24, 1999, and filed January 12, 2000 (File No. 000-17363)).

|

|

|

|

|

(d)(4)

|

Employment Agreement, dated September 12, 2002, between Lifeway Foods, Inc. and Julie Smolyansky (incorporated by reference to Exhibit 10.14 to Amendment No. 2 filed April 30, 2003 to Lifeway's Quarterly Report on Form 10-QSB/A for the quarter ended September 30, 2002 (File No. 000-17363)).

|

|

|

|

|

(d)(5)

|

Employment Agreement by and between the Company and John Waldron, dated as of April 21, 2017 (incorporated by reference to Exhibit 10.3 to Lifeway's Current Report on Form 8-K dated April 26, 2017 and filed on April 26, 2017 (File No. 000-17363)).

|

|

|

|

|

(g)

|

None.

|

|

|

|

|

(h)

|

None.

|

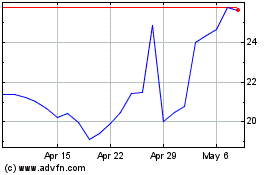

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

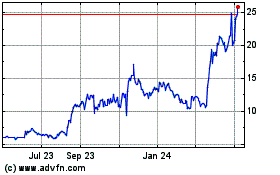

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Apr 2023 to Apr 2024