Property/Casualty Insurance Industry's Net Income Drops 42.2 Percent in First-Quarter 2017

June 26 2017 - 10:00AM

Property/Casualty Insurance

Industry's Net Income Drops 42.2 Percent in First-Quarter

2017

JERSEY CITY, N.J., June 26, 2017 - The private

U.S. property/casualty insurance industry saw its net income after

taxes drop to $7.7 billion in first-quarter 2017 from $13.4 billion

in first-quarter 2016-a 42.2 percent decline-and its overall

profitability as measured by its annualized rate of return on

average policyholders' surplus fall to 4.4 percent from 7.9

percent, according to ISO, a Verisk Analytics (Nasdaq:VRSK)

business, and the Property Casualty Insurers Association of America

(PCI).

The industry experienced $7.3 billion in direct

catastrophe losses-the highest first-quarter catastrophe losses

since the 1994 Northridge earthquake and $2.3 billion above the

direct catastrophe losses for first-quarter 2016. Insurers'

combined ratio deteriorated to 99.6 percent for first-quarter 2017

from 97.4 percent for first-quarter 2016.

Insurers also saw some improvement from a year

earlier. Net written premium growth accelerated to 4.0 percent for

first-quarter 2017 from 3.2 percent for first-quarter 2016. Net

investment gains[1] increased

by $1.2 billion to $14.4 billion in first-quarter 2017 from $13.2

billion for first-quarter 2016. The industry's surplus[2] reached a

new all-time high value of $709.0 billion as of March 31, 2017,

increasing $8.1 billion from $700.9 billion as of December 31,

2016.

"Three major wind and thunderstorm events

each resulted in more than $1 billion in damages in first-quarter

2017. That's the first time we've seen three events of that

magnitude in the first quarter in more than 60 years. Fortunately,

insurers are well capitalized, and short-term volatility in

catastrophe losses is not affecting their ability to provide

coverage and pay claims. They're also seeing some acceleration

in premiums and investment income. However, to remain profitable

and provide appropriate returns on their capital, insurers need to

plan for the long term and continue to engage in disciplined

underwriting based on robust data and analytics."

|

"Industry operating results continued to deteriorate in the

first quarter of 2017. The combined ratio worsened to just better

than break-even, underwriting gains shifted to net losses, and

pretax operating income plummeted 60 percent as compared with the

first quarter of 2016. Additional industry data shows personal auto

loss ratio improvement in first-quarter 2017, although the rolling

four-quarter average is still worse than the rolling average at the

first quarter of last year. Unlike first-quarter personal auto

improvement, personal property lines losses increased, impacted by

an almost 50 percent increase in catastrophe losses in

first-quarter 2017 compared with the same period in 2016,

compounding the 2015-2016 increase of similar proportion.

Policyholder surplus increased slightly in real terms, and the

overall deterioration in results in first-quarter 2017 is far less

remarkable excluding a special reinsurance transaction that reduced

other income and pretax operating income by $6.3

billion."

|

| Beth Fitzgerald, Senior Vice President,

Industry Engagement, ISO |

Robert Gordon, PCI's Senior Vice President for Policy

Development and Research |

View the full report from ISO and PCI here.

About ISO

Since 1971, ISO has been a leading source of information about

property/casualty insurance risk. For a broad spectrum of

commercial and personal lines of insurance, ISO provides

statistical, actuarial, underwriting, and claims information and

analytics; compliance and fraud identification tools; policy

language; information about specific locations; and technical

services. ISO serves insurers, reinsurers, agents and brokers,

insurance regulators, risk managers, and other participants in the

property/casualty insurance marketplace. ISO is a Verisk Analytics

(Nasdaq:VRSK) business. For more information, please

visit www.verisk.com/iso.

About PCI

PCI is composed of nearly 1,000 member companies, representing the

broadest cross section of insurers of any national trade

association. PCI members write more than $183 billion in annual

premium,

35 percent of the nation's property/casualty insurance. Member

companies write 42 percent of the U.S. automobile insurance market,

27 percent of the homeowners market, 32 percent of the commercial

property and liability market, and 34 percent of the private

workers' compensation market. For more information,

visit www.pciaa.net.

Contact:

Giuseppe Barone/Erin Bzymek

MWW Group (for ISO)

201-507-9500

gbarone@mww.com

ebzymek@mww.com

Jeffrey Brewer for PCI

(847) 553-3763

Loretta Worters for I.I.I.

(212) 346-5500

[1] Net

investment gains equal the sum of net investment income and

realized capital gains (or losses) on investments.

[2]

Policyholders' surplus is insurers' net worth measured according to

Statutory Accounting Principles.

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Verisk Analytics Inc. via Globenewswire

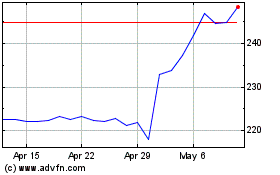

Verisk Analytics (NASDAQ:VRSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

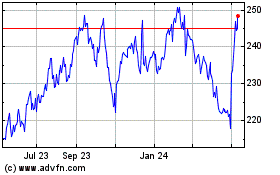

Verisk Analytics (NASDAQ:VRSK)

Historical Stock Chart

From Apr 2023 to Apr 2024