Brutal price competition is rippling through profits, inflation

and antitrust

By Ryan Knutson

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the US print

edition of The Wall Street Journal (June 24, 2017).

Customers are used to cellphone bill shock, but not like

this.

The cost of U.S. cellular service is rapidly plunging, reversing

years of increases that have squeezed consumers' budgets and

generated huge profits for wireless companies.

Americans are using their smartphones more than ever to stream

videos, surf the web and browse Facebook. But telecommunications

companies are losing their power to raise prices for using their

networks, in part because the U.S. cellphone market is nearing

saturation. That has kicked off a vicious price war among the four

national wireless carriers.

The consumer-price index for wireless phone service, an

indicator of current offers from cellphone service providers,

dropped 12.5% in May from a year ago, according to the Labor

Department. The index earlier fell 13% in April, the largest

decline in the history of the category, prompting Federal Reserve

Chairwoman Janet Yellen to say earlier this month it was a factor

in the country's low inflation.

Beyond the consumer impact, the rapid collapse in the industry's

pricing power will ripple through its profit margins, federal

regulations and antitrust law.

T-Mobile US Inc. and Sprint Corp., the third and fourth largest

carriers, recently rekindled talks about a merger, according to

people familiar with the matter. The two previously discussed

combining in 2014 but backed down in the face of regulatory

opposition.

The rout could continue when the many consumers who haven't felt

the effects of price drops, unaware they can lower their monthly

bills, call their carriers to demand better deals.

Selina Sosa, who runs a nonprofit near Dallas, cut her monthly

bill by about a third in less than six months. Last December, she

switched carriers from AT&T Inc. to Verizon Communications

Inc., reducing her payment for three phones from $330 to $279.

In April, Ms. Sosa called Verizon with a billing question and an

agent offered to switch her into an unlimited-data plan and lower

her monthly bill by another $57. "I didn't even ask to reduce my

payment," she said, adding she was relieved to save the extra

cash.

Six years ago, the number of active cellphones surpassed the

U.S. population. About 80% of Americans currently own a smartphone,

according to CTIA, an industry trade group. Many have multiple

devices. Consumers are also keeping their smartphones for longer

periods, which means fewer customers are up for grabs.

Offers from wireless providers are becoming increasingly

extreme. Sprint this month launched a short-term promotion to give

away a free year of wireless service to new customers who supply

their own mobile phones. The move comes months before Apple Inc. is

expected to introduce its newest iPhone, which is when carriers

typically roll out discounts.

The competition grew so intense during the first three months of

this year that Verizon, the largest national carrier, suffered its

first-ever quarterly subscriber loss. AT&T Inc. and Sprint also

lost customers, and the industry's total revenue growth slowed to

1% from a year ago, its lowest-ever rate, according to research

from investment bank UBS. The quarter's big winner was T-Mobile,

which has been offering plans with favorable features.

A major reason for the steep decline in the wireless

consumer-price index is companies' return to unlimited-data plans.

Back in 2010 and 2011, AT&T and Verizon ended their

all-you-can-eat plans for smartphone customers and imposed monthly

caps on usage. Executives for years said unlimited plans made

little economic sense.

In February, Verizon brought back unlimited plans to counter a

wave of customer defections to T-Mobile and Sprint, which had both

rolled out aggressive unlimited offers. Days later, AT&T

responded with a new unlimited plan of its own. With the new plans,

making calls and texting are essentially free. Expensive overage

fees that carriers impose when users exceed their monthly usage

limit are also going away.

Verizon now charges $80 a month for an unlimited talk, text and

data plan for a single line. Sprint charges $50 for a similar plan

in the first year. In 2011, an unlimited Verizon plan cost $120 and

one from Sprint cost $110.

Verizon Chief Executive Lowell McAdam said at a conference in

May that adopters of its current unlimited plan are mostly people

who used to have pricier subscriptions. He also predicts many

customers with lower-price, capped-data plans will soon start

paying more for unlimited service to avoid having to keep track of

their monthly data usage.

"There are ebbs and flows for sure," said Jeffrey Moore, head of

Wave7 Research, which tracks wireless competition, "but I think

that the past year has been the most aggressive time in wireless

history."

Cellphones are a major expense for many families. The average

American household spent $1,074 for cellular service in the year to

June 2016, up 77% from a decade earlier. Total household

expenditures rose just 13% over that same period, according to

Labor Department data.

If many people wind up paying less for their cellphone bills, it

could free up consumer spending in other areas, similar to how a

decline in gasoline prices can boost other parts of the

economy.

For much of the past year, Niya Case, a human-resources

specialist who lives near Tampa, Fla., was paying about $400 a

month for four smartphones and two tablets, which belonged to her

and family members.

"Oh my God, people pay less than that for a brand-new car," the

38-year-old said she used to think when she looked at her bill from

Sprint.

Ms. Case said she asked friends about less expensive offers and

decided to switch providers a few weeks ago. She is now paying

about $155 a month for four phone lines at T-Mobile and plans to

put the savings toward school clothes for her children and a family

cruise in the fall.

The changes have been punishing for wireless companies. After

rising every quarter for 17 years, revenue from wireless data plans

fell 0.33% in the first quarter of this year, according to industry

consultant Chetan Sharma.

The slowdown is making companies look outside the industry for

growth. AT&T plans to buy Time Warner Inc. for $85 billion,

while Verizon has scooped up Yahoo and AOL to build a digital media

business.

Some economists believe consolidation among the four national

carriers could end the price war, because three competitors with

roughly equal market share would behave less aggressively to

maintain the status quo.

During a call with analysts last month, Sprint Chairman

Masayoshi Son said he was looking to merge Sprint with another

company and that T-Mobile was "the first priority."

Sprint CEO Marcelo Claure said consolidation will make the

industry even more competitive. "Sprint has been working hard to

invest in its network and bring increased value to consumers, but

as we look to the future, scale will be critical to sustaining

competition," he said in a written statement to The Wall Street

Journal.

T-Mobile CEO John Legere spoke about consolidation in an April

call with analysts. "I'm very comfortable that we could make a case

that it is in the best interest of customers, of the country, of

the industry versus the alternatives of the status quo," Mr. Legere

said.

If a deal does materialize, regulators recently appointed by

President Donald Trump will need to revisit the state of

competition in the market. The U.S. wireless market is already one

of the nation's most concentrated industries.

The big wireless carriers have acquired a host of national and

regional cellular providers since 2000. In recent years, regulators

have twice prevented the remaining four national players from

consolidating to three. The government in 2011 blocked a proposed

merger between AT&T and T-Mobile and signaled three years later

it would do the same for a Sprint and T-Mobile combination.

"This is one of the best examples of the benefits of antitrust,"

said Gene Kimmelman, president of the consumer-focused group Public

Knowledge and a former Justice Department antitrust official under

President Barack Obama.

Berin Szoka, president of TechFreedom, a libertarian policy

group, said nationwide high-speed networks that benefit many

consumers couldn't have been built without the economies of scale

that large companies have.

"The market is supposed to drive that balancing act," Mr. Szoka

said. "The more that we have the government making those decisions

instead and second guessing the market, the greater risk that we

get that wrong."

Former FCC Chairman Tom Wheeler didn't buy that argument when

Mr. Son, Sprint's chairman, was laying the groundwork for a deal

with T-Mobile less than a year after Japan's SoftBank Group Corp.

acquired Sprint.

During a 2014 meeting at Mr. Wheeler's office in Washington, the

Japanese billionaire said he could help the U.S. fix what he called

its terrible wireless networks if he was allowed to get bigger,

according to a person familiar with the meeting.

"We have two big guys punching back with two hands, and two

smaller guys fighting with one hand each," Mr. Son said, according

to the person's recollection. "We want to unite the two hands so we

can punch back."

Mr. Wheeler said Mr. Son should first try competing as a

stand-alone company. "The merger made no sense before, and it makes

no sense today," Mr. Wheeler wrote in an op-ed on CNBC's website

last month.

Since 2014, Sprint has gone from hemorrhaging monthly

subscribers to adding nearly one million last year, while T-Mobile

added more than four million last year. Verizon alone still has far

more customers than Sprint and T-Mobile combined, and Sprint hasn't

had a profitable year since 2006.

Describing his approach to merger reviews, Ajit Pai, a

Republican who took over as chair of the Federal Communications

Commission earlier this year, said the agency will examine the

marketplace to see if prices are coming down and innovation is

increasing.

"I don't claim to know in a vacuum what the optimal market

structure of any particular marketplace is, what the 'right' number

of competitors should be," Mr. Pai said last month at the American

Enterprise Institute in Washington.

Write to Ryan Knutson at ryan.knutson@wsj.com

(END) Dow Jones Newswires

June 24, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

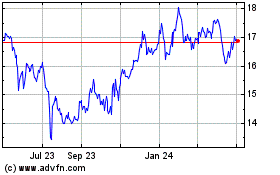

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to Apr 2024

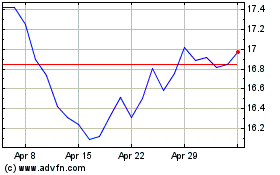

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2023 to Apr 2024