Current Report Filing (8-k)

June 23 2017 - 5:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 23, 2017 (June 16, 2017)

SeaWorld Entertainment, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

001-35883

|

27-1220297

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

9205 South Park Center Loop, Suite 400 Orlando, Florida

|

32819

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (407) 226-5011

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) As previously disclosed in a Current Report on Form 8-K filed with the Securities and Exchange Commission on June 16, 2017, David F. D’Alessandro did not receive a majority of the votes cast at the 2017 Annual Meeting of Stockholders (the “

Annual Meeting

”) of SeaWorld Entertainment, Inc. (the “

Company

”) and, pursuant to the terms of the Company’s Bylaws (the “

Bylaws

”), offered to tender his immediate resignation to the Board following the Annual Meeting. The Bylaws provide that the Nominating and Corporate Governance Committee (the “

Committee

”) of the Company’s Board of Directors (the “

Board

”) must make a recommendation to the Board on whether to accept or reject such resignation, or whether other action should be taken, following which the Board must take action after considering the Committee’s recommendation.

In their deliberations with respect to Mr. D’Alessandro’s offer to resign, the Committee and the Board considered a number of factors, including the background, experience (including his seven year tenure on the Board) and the perspective that Mr. D’Alessandro brings to the Board and to the Company more generally. In that context, the Committee and the Board took into account the potential impact of Mr. D’Alessandro’s immediate departure on the Board’s and the Company’s ability to successfully address certain challenges that the Company now faces, including, without limitation, the matters set forth under Item 8.01 below.

After consideration of all of these factors, on June 22, 2017, the Committee determined that it was in the best interest of the Company for Mr. D’Alessandro to continue to serve on the Board as its non-executive chairman through December 31, 2017 at which time he will step down from the Board. As a result, the Committee unanimously recommended that the Board reject Mr. D’Alessandro’s offered immediate resignation. The disinterested members of the Board thereafter unanimously resolved to reject Mr. D’Alessandro’s immediate resignation and agreed with him that he will step down on December 31, 2017.

Mr. D’Alessandro did not participate in the deliberations of the Committee or of the Board, although Mr. D’Alessandro’s views were solicited and taken into account by the Committee and the Board.

Item 8.01 Other Events.

In June 2017, the Company received a subpoena in connection with an investigation by the U.S. Department of Justice concerning disclosures and public statements made by the Company and certain executives and/or individuals on or before August 2014, including those regarding the impact of the “Blackfish” documentary, and trading in the Company’s securities. The Company also has received subpoenas from the staff of the U.S. Securities and Exchange Commission in connection with these matters. On June 16, 2017, the Company’s Board of Directors formed a Special Committee comprised of independent directors with respect to these inquiries. The Special Committee has engaged counsel to advise and assist the Committee. The Company has cooperated with these government inquiries and intends to continue to cooperate with any government requests or inquiries.

Forward-Looking Statements

This Current Report on Form 8-K contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act which are subject to the “safe harbor” created by those sections. These statements include, but are not limited to, statements related to the Company’s plans, objectives, goals, expectations, beliefs, business strategies, future events, business conditions, business trends. These forward-looking statements, which are identified by words such as “might,” “will,” “may,” “should,” “estimates,” “expects,” “continues,” “contemplates,” “anticipates,” “projects,” “plans,” “potential,” “predicts,” “intends,” “believes,” “forecasts,” “future,” “guidance,” “targeted,” “scheduled” are subject to a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements contained in this Current Report on Form 8-K, including the risks, uncertainties and factors set forth in the section entitled “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in subsequent reports, including Current Reports on Form 8-K, that the Company files or furnishes with the Securities and Exchange Commission (“SEC”). The Company’s filings with the SEC are available from the SEC’s EDGAR database at

www.sec.gov

and via the Company’s website at

www.seaworldentertainment.com

. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Current Report on Form 8-K and in the Company’s filings with the SEC. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

SEAWORLD ENTERTAINMENT, INC.

|

|

|

|

|

|

|

|

Date: June 23, 2017

|

|

By:

|

|

/s/ G. Anthony (Tony) Taylor

|

|

|

|

Name:

|

|

G. Anthony (Tony) Taylor

|

|

|

|

Title:

|

|

Chief Legal Officer, General Counsel and Corporate Secretary

|

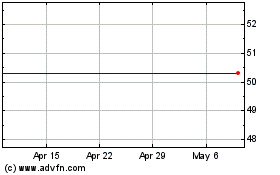

SeaWorld Entertainment (NYSE:SEAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

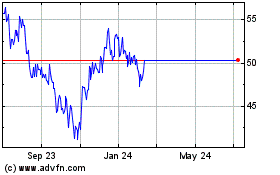

SeaWorld Entertainment (NYSE:SEAS)

Historical Stock Chart

From Apr 2023 to Apr 2024