Current Report Filing (8-k)

June 23 2017 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report:

June 22, 2017

(Date of earliest event reported)

THE KROGER CO.

(Exact name of registrant as specified in its charter)

|

Ohio

|

|

No. 1-303

|

|

31-0345740

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1014 Vine Street

Cincinnati, OH 45202

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(513) 762-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.07

Submission of Matters to a Vote of Security Holders.

(a) June 22, 2017 — Annual Meeting

(b) The shareholders elected eleven directors to serve until the annual meeting in 2018, or until their successors have been elected and qualified; approved executive compensation on an advisory basis; selected one year as the frequency for future advisory votes on executive compensation on an advisory basis; and ratified the selection of PricewaterhouseCoopers LLP as the Company’s independent public accounting firm for fiscal year 2017. The shareholders defeated a shareholder proposal regarding a report assessing the environmental impacts of using unrecyclable packaging for private label brands; a shareholder proposal regarding a report assessing the climate benefits and feasibility of adopting enterprise wide, quantitative, time bound targets for increasing renewable energy sourcing; a shareholder proposal regarding a report providing quantitative metrics on supply chain impacts on deforestation, including progress on time bound goals for reducing such impacts; and a shareholder proposal recommending adoption of a policy and amendment of the bylaws as necessary to require the chair of the Board to be independent. The final results are as follows:

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON-VOTE

|

|

|

|

|

|

|

|

|

|

|

|

Nora A. Aufreiter

|

|

709,186,521

|

|

9,315,681

|

|

1,477,580

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Robert D. Beyer

|

|

688,310,896

|

|

29,809,026

|

|

1,859,860

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Anne Gates

|

|

710,596,213

|

|

7,617,381

|

|

1,766,188

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Susan J. Kropf

|

|

705,537,509

|

|

12,944,176

|

|

1,498,097

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

W. Rodney McMullen

|

|

666,397,617

|

|

47,187,962

|

|

6,394,203

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Jorge P. Montoya

|

|

706,905,873

|

|

10,920,395

|

|

2,153,514

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Clyde R. Moore

|

|

691,558,229

|

|

26,120,643

|

|

2,300,910

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

James A. Runde

|

|

705,233,986

|

|

12,816,873

|

|

1,928,923

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Ronald L. Sargent

|

|

707,167,689

|

|

10,874,037

|

|

1,938,056

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Bobby S. Shackouls

|

|

696,775,247

|

|

21,067,120

|

|

2,137,415

|

|

98,676,114

|

|

|

|

|

|

|

|

|

|

|

|

Mark S. Sutton

|

|

709,680,025

|

|

8,478,819

|

|

1,820,938

|

|

98,676,114

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON VOTE

|

|

Advisory vote approving executive compensation

|

|

667,610,536

|

|

49,543,218

|

|

2,826,028

|

|

98,676,114

|

2

|

|

|

ONE YEAR

|

|

TWO

YEARS

|

|

THREE

YEARS

|

|

ABSTAIN

|

|

BROKER

NON VOTE

|

|

Advisory vote regarding frequency of future advisory votes on executive compensation

|

|

638,164,571

|

|

5,542,623

|

|

73,672,163

|

|

2,600,425

|

|

98,676,114

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

Ratification of PricewaterhouseCoopers LLP as auditors for 2017

|

|

802,376,384

|

|

14,472,028

|

|

1,807,484

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON VOTE

|

|

Shareholder proposal (regarding a report assessing the environmental impacts of using unrecyclable packaging for private label brands)

|

|

168,279,514

|

|

534,286,039

|

|

17,414,229

|

|

98,676,114

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON VOTE

|

|

Shareholder proposal (regarding a report assessing the climate benefits and feasibility of adopting enterprise wide, quantitative, time bound targets for increasing renewable energy sourcing)

|

|

174,814,258

|

|

529,138,947

|

|

16,026,550

|

|

98,676,114

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON VOTE

|

|

Shareholder proposal (regarding a report providing quantitative metrics on supply chain impacts on deforestation, including progress on time bound goals for reducing such impacts)

|

|

160,777,257

|

|

542,764,963

|

|

16,437,562

|

|

98,676,114

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON VOTE

|

|

Shareholder proposal (recommending adoption of a policy and amend the bylaws as necessary to require the Chair of the Board to be independent)

|

|

256,405,394

|

|

455,993,399

|

|

7,580,989

|

|

98,676,114

|

3

(d) Upon consideration of the results of the shareholder advisory vote on the frequency of future advisory votes on executive compensation, the Board of Directors determined to follow the shareholder recommendation of every “one year” for holding an advisory vote on executive compensation until the next required advisory vote on the frequency of future advisory votes on executive compensation.

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THE KROGER CO.

|

|

|

|

|

|

|

|

|

June 23, 2017

|

By:

|

/s/ Christine S. Wheatley

|

|

|

|

Christine S. Wheatley

|

|

|

|

Group Vice President, Secretary and General Counsel

|

5

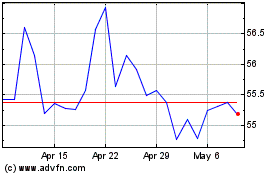

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

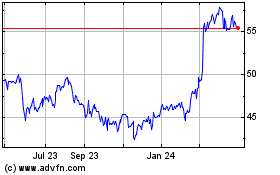

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024