Current Report Filing (8-k)

June 23 2017 - 3:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

June 23, 2017 (June 21, 2017)

Date of Report (date of Earliest Event Reported)

NEWTEK BUSINESS SERVICES CORP.

(Exact Name of Company as Specified in its Charter)

|

|

|

|

|

|

|

MARYLAND

|

814-01035

|

46-3755188

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification No.)

|

1981 Marcus Avenue, Suite 130, Lake Success, NY 11042

(Address of principal executive offices and zip code)

(212) 356-9500

(Company’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Forward-Looking Statements

Statements in this Current Report on Form 8-K (including the exhibits), including statements regarding Newtek Business Services Corp.’s (“Newtek” or the “Company”) beliefs, expectations, intentions or strategies for the future, may be forward-looking statements. All forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the plans, intentions and expectations reflected in or suggested by the forward-looking statements. Such risks and uncertainties include, among others, intensified competition, operating problems and their impact on revenues and profit margins, anticipated future business strategies and financial performance, anticipated future number of customers, business prospects, legislative developments and similar matters. Risk factors, cautionary statements and other conditions which could cause Newtek’s actual results to differ from management's current expectations are contained in Newtek’s filings with the Securities and Exchange Commission. Newtek undertakes no obligation to update any forward-looking statement to reflect events or circumstances that may arise after the date of this filing.

Item 1.01.

Entry Into a Material Definitive Agreement.

On June 21, 2017, Universal Processing Services of Wisconsin LLC (“NMS”), CrystalTech Web Hosting, Inc. (“NTS”), Premier Payments LLC (“Premier”), Small Business Lending, LLC (“SBL”) and ADR Partners, LLC d/b/a banc-serv (“BSP” and together with NMS, NTS, Premier and SBL, the “Borrowers”), each a portfolio company of Newtek Business Services Corp. (the “Company”), entered into an Amended and Restated Credit and Guaranty Agreement (the “Agreement”), dated June 21, 2017, with the “Lenders” party thereto from time to time and Goldman Sachs Bank USA (“GS Bank”), as Administrative Agent and Collateral Agent, and Goldman Sachs Specialty Lending Group, L.P., as Lead Arranger, pursuant to which the Lenders agreed to increase the aggregate principal amount of the term loan facility available to the Borrowers from $38,000,000 to $50,000,000 (the “Amended Facility”) and to add SBL and BSP as Borrowers under the Amended Facility. The Company, together with The Whitestone Group, LLC, Wilshire Holdings I, Inc., Newtek Business Services Holdco 1, Inc. (“Holdco 1”) and Banc-Serv Acquisition, Inc. (“BSA”), each wholly-owned subsidiaries, whether directly or indirectly, of the Company, and certain subsidiaries of Intermediate Holdings and BSA party to the Agreement from time to time, including Newtek LSP Holdco, LLC, UPSWI Sales, LLC and CRY Sales, LLC, have agreed to guarantee the repayment of the Amended Facility and are parties to the Agreement as “Guarantors” thereunder.

The proceeds of the Amended Facility will be used to finance future growth as well as for general corporate purposes.

Concurrent with the increase in the aggregate principal amount of the Amended Facility, the Borrowers received a reduction in the interest rate of between 1.0% and 2.0% from the rates in effect immediately prior to the Agreement. The term of the Amended Facility has been extended through June 21, 2021.

The Agreement specifies certain events of default, pursuant to which GS Bank could require immediate repayment by the Borrowers of all outstanding amounts under the Amended Facility.

The above description is a summary and is qualified in its entirety by the terms of the Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

A press release announcing the Amended Facility is filed as Exhibit 99.1 to this Current Report on Form 8-K.

Item 2.03.

Creation of a Direct Financial Obligation or an Obligation under an Off-

Balance Sheet Arrangement of a Registrant.

The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Amended and Restated Credit and Guaranty Agreement, dated June 21, 2017, by and among Universal Processing Services of Wisconsin LLC, CrystalTech Web Hosting, Inc., Small Business Lending, LLC, ADR Partners, LLC, Premier Payments LLC, Newtek Business Services Corp., Wilshire Holdings I, Inc., The Whitestone Group, LLC, Newtek Business Services Holdco 1, Inc., Banc-Serv Acquisition, Inc., certain subsidiaries of Newtek Business Services Holdco 1, Inc. and Banc-Serv Acquisition, Inc., including Newtek LSP Holdco, LLC, CRY Sales, LLC and UPSWI Sales, LLC, the Lenders party thereto from time to time, Goldman Sachs Bank USA, as Administrative Agent and Collateral Agent, and Goldman Sachs Specialty Lending Group, L.P., as Lead Arranger.

|

|

99.1

|

|

Press Release, dated June 22, 2017, announcing the Amended Facility.

|

SIGNATURES

In accordance with the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

NEWTEK BUSINESS SERVICES CORP.

|

|

|

|

|

|

Date: June 23, 2017

|

By:

|

/

S

/ B

ARRY

S

LOANE

|

|

|

|

Barry Sloane

|

|

|

|

Chairman of the Board and Chief Executive Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Amended and Restated Credit and Guaranty Agreement, dated June 21, 2017, by and among Universal Processing Services of Wisconsin LLC, CrystalTech Web Hosting, Inc., Small Business Lending, LLC, ADR Partners, LLC, Premier Payments LLC, Newtek Business Services Corp., Wilshire Holdings I, Inc., The Whitestone Group, LLC, Newtek Business Services Holdco 1, Inc., Banc-Serv Acquisition, Inc., certain subsidiaries of Newtek Business Services Holdco 1, Inc. and Banc-Serv Acquisition, Inc., including Newtek LSP Holdco, LLC, CRY Sales, LLC and UPSWI Sales, LLC, the Lenders party thereto from time to time, Goldman Sachs Bank USA, as Administrative Agent and Collateral Agent, and Goldman Sachs Specialty Lending Group, L.P., as Lead Arranger.

|

|

99.1

|

|

Press Release, dated June 22, 2017, announcing the Amended Facility.

|

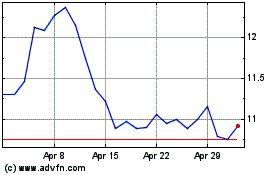

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

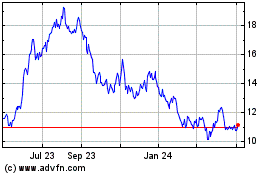

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024