Amended Current Report Filing (8-k/a)

June 22 2017 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K/A

(Amendment No. 1)

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 15, 2017

ALPHATEC HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-52024

|

|

20-2463898

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5818 El Camino Real

Carlsbad, California 92008

(Address of Principal Executive Offices)

(760)

431-9286

(Registrant’s telephone number, including area code)

Not applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14.a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note:

This Current Report on Form 8-K/A is being filed to amend the Current Report on Form 8-K filed by Alphatec Holdings, Inc. (the “Company”) with the

Securities and Exchange Commission on June 21, 2017 (the “Original Form 8-K”). The Company is filing this Current Report on Form 8-K/A solely to include in Item 5.02 additional information regarding the amendment and restatement

of the Company’s 2016 Equity Incentive Award Plan and the amendment and restatement of the 2007 Employee Stock Purchase Plan, which, as reported in the Original Form 8-K, were approved by the Company’s stockholders at the Company’s

Annual Meeting of Stockholders held June 15, 2017. Stockholder approval of the Equity Plan and the ESPP was previously disclosed in Item 5.07 of the Original Filing. This Current Report on Form 8-K/A amends and restates in its entirety the

Original Form 8-K. Except as indicated above, no other changes were made to the Original Form 8-K.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On May 5, 2017, Alphatec Holdings, Inc. (the “Company”) filed a Current Report on Form 8-K announcing that Leslie H. Cross, whose term as a

director on the Board of Directors expired at the annual meeting of stockholders held on June 15, 2017, had chosen not to stand for re-election at the annual meeting. In connection with his departure from the Company’s Board of

Directors, Mr. Cross and the Company entered into a Vesting Acceleration Agreement (the “Vesting Agreement”). Pursuant to the Vesting Agreement, as of June 15, 2017, all outstanding options to purchase the Company’s common

stock and any restricted common stock held by Mr. Cross as of June 15, 2017, became vested and exercisable. In addition, the term during which Mr. Cross may exercise any stock option was extended until the earlier of:

(i) June 15, 2019 (or the following business day if such day is not a business day of the Company), or (ii) the expiration date that would apply to such stock option. This summary of the Vesting Agreement is qualified in its entirety

by reference to the full text of the Vesting Agreement, which shall be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2017.

As described in Item 5.07 below, at the Company’s Annual Meeting of Stockholders, the stockholders of the Company approved an amendment and

restatement of the Company’s 2016 Equity Incentive Award Plan (the “Restated Plan”) and an amendment and restatement of the 2007 Employee Stock Purchase Plan (the “Restated ESPP”).

The Restated Plan modifies the Company’s original 2016 Equity Incentive Award Plan to (1) increase the shares available for grant under the Restated

Plan by 2,000,000, (2) extend the expiration date of the Restated Plan to 2027, (3) increase the maximum number of shares of Common Stock that may be granted to any one participant during a one-year period to 500,000, and (4) provide

that the total aggregate value of cash compensation, or other compensation, and the value (determined as of the grant date in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, or any successor thereto)

of awards granted to a non-employee director as compensation for services as a non-employee director during any fiscal year of the Company may not exceed $300,000 (which limit shall be increased to $500,000 in the first fiscal year of a non-employee

director’s service on the Company’s Board of Directors).

The Restated ESPP modifies the Company’s original 2007 Employee Stock Purchase

Plan, as amended, to (1) increase the shares available for issuance under the Restated ESPP by 500,000 and (2) remove the evergreen provision that allowed for an annual increase in the number of shares available for issuance thereunder.

Copies of the Restated Plan and the Restated ESPP are attached hereto as Exhibits 10.1 and 10.2, respectively, and are incorporated into this

Item 5.02 by reference. The foregoing summary is qualified in its entirety by the complete terms and conditions of the Restated Plan and the Restated ESPP. Descriptions of the material terms of the Restated Plan and the Restated ESPP are

included in the Company’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on May 5, 2017.

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders

|

On June 15, 2017, the Company held its Annual

Meeting of Stockholders (the “Annual Meeting”). The Company’s definitive proxy statement for the Annual Meeting was filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 5, 2017 and describes in

detail each of the seven proposed voting matters (the “Proposals”) submitted to the Company’s stockholders at the Annual Meeting. As of April 24, 2017, the record date of the Annual Meeting, there were 10,857,773 outstanding

shares of the Company’s common stock. At the Annual Meeting, a quorum of 7,091,091 shares of the Company’s common stock were represented in person or by proxy. The final results for the votes cast with respect to each Proposal are set

forth below.

Proposal 1

The stockholders elected each of Mortimer Berkowitz III, R. Ian Molson, David H. Mowry, Stephen E. O’Neil, Terry M. Rich, Jeffrey P. Rydin

and Donald A. Williams to serve on the Company’s Board of Directors for a term of one year until the 2018 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified, or until their earlier death or

resignation, by the following vote:

|

|

|

|

|

|

|

|

|

Nominee

|

|

Votes For

|

|

Votes Withheld

|

|

Broker Non-Votes

|

|

Mortimer Berkowitz III

|

|

4,016,656

|

|

91,248

|

|

2,983,187

|

|

R. Ian Molson

|

|

3,923,119

|

|

184,785

|

|

2,983,187

|

|

David H. Mowry

|

|

4,045,616

|

|

62,288

|

|

2,983,187

|

|

Stephen E. O’Neil

|

|

3,953,167

|

|

154,737

|

|

2,983,187

|

|

Terry M. Rich

|

|

4,044,826

|

|

63,078

|

|

2,983,187

|

|

Jeffrey P. Rydin

|

|

4,035,152

|

|

72,752

|

|

2,983,187

|

|

Donald A. Williams

|

|

4,040,700

|

|

67,204

|

|

2,983,187

|

Proposal 2

The stockholders ratified the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending

December 31, 2017 by the following vote:

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

6,979,516

|

|

33,887

|

|

77,688

|

|

0

|

Proposal 3

The

stockholders approved the amendment and restatement of the Company’s 2016 Equity Incentive Plan by the following vote:

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

3,718,715

|

|

371,305

|

|

17,884

|

|

2,983,187

|

Proposal 4

The

stockholders approved the amendment and restatement of the Company’s 2007 Employee Stock Purchase Plan by the following vote:

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

4,056,960

|

|

47,744

|

|

3,200

|

|

2,983,187

|

Proposal 5

The

stockholders approved, on a non-binding advisory basis, the compensation of the Company’s named executed officers by the following vote:

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

4,020,934

|

|

67,344

|

|

19,626

|

|

2,983,187

|

Proposal 6

The

stockholders approved, on a non-binding advisory basis, holding the non-binding advisory vote on the compensation of the Company’s named executive officers on an annual basis by the following vote:

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

2 Years

|

|

3 years

|

|

Abstentions

|

|

Broker Non-Votes

|

|

4,014,506

|

|

19,515

|

|

68,925

|

|

4,958

|

|

2,983,187

|

Proposal 7

The

stockholders approved the issuance of up to an aggregate of 17,525,972 shares of common stock issuable upon the conversion of outstanding shares of our Series A Convertible Preferred Stock and the exercise of outstanding warrants by the following

vote:

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

4,036,072

|

|

68,813

|

|

3,019

|

|

2,983,187

|

No other items were presented for stockholder approval at the Annual Meeting.

In light of the results of the stockholder vote on the frequency of future non-binding advisory votes on the compensation of the Company’s named

executive officers, and consistent with the Company’s recommendation, the Company’s Board of Directors has determined that the Company will hold a non-binding advisory vote on executive compensation annually until the next required vote on

the frequency of future non-binding advisory votes on the compensation of the Company’s named executive officers.

|

Item 9.01.

|

Financial Statements and Exhibits

|

The following are filed as Exhibits to this Current Report on Form 8-K.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Amended and Restated 2016 Equity Incentive Award Plan

|

|

|

|

|

10.2

|

|

Amended and Restated 2007 Employee Stock Purchase Plan

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: June 22, 2017

|

|

|

|

ALPHATEC HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jeffrey G. Black

|

|

|

|

|

|

Name:

|

|

Jeffrey G. Black

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

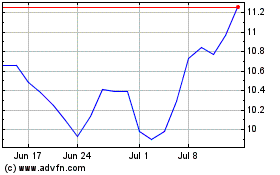

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

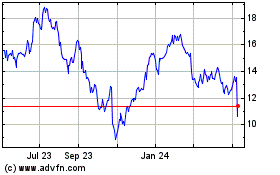

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024