Filed

pursuant to Rule 424(b)(5)

Registration No. 333-213100

Prospectus

Supplement

(To

Prospectus dated December 23, 2016)

$25,000,000

Workhorse

Group Inc.

Common

Stock

We

have entered into a certain sales agreement, or the sales agreement, with Cowen and Company, LLC, or Cowen, relating

to shares of our common stock offered by this prospectus supplement. In accordance with the terms of the sales agreement,

we may offer and sell shares of our common stock having an aggregate offering price of up to $25.0 million from time

to time through Cowen.

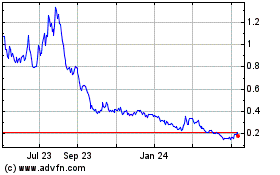

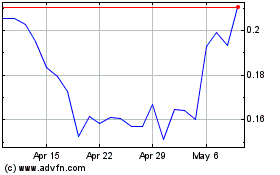

Our

common stock is listed on the Nasdaq Capital Market under the symbol “WKHS.” On June 21, 2017, the

last reported sale price of our common stock on the Nasdaq Capital Market was $4.64 per share.

Sales

of our common stock, if any, under this prospectus supplement may be made in sales deemed to be “at the market

offerings” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act,

including sales made directly on or through the Nasdaq Capital Market, the existing trading market for our common stock,

or any other existing trading market for our common stock. Cowen is not required to sell any specific number or dollar amount

of securities, but will act as a sales agent, or the sales agent, using commercially reasonable efforts consistent with its normal

trading and sales practices, on mutually agreed terms between Cowen and us. There is no arrangement for funds to be received in

any escrow, trust or similar arrangement.

The compensation to Cowen for sales of common stock sold

pursuant to the sales agreement will be an amount equal to 3.0% of the gross proceeds of any shares of common

stock sold under the sales agreement. In connection with the sale of the common stock on our behalf, Cowen will be deemed to be

an “underwriter” within the meaning of the Securities Act and the compensation of Cowen will be deemed to be underwriting

commissions or discounts. We have also agreed to provide indemnification and contribution to Cowen with respect to certain liabilities,

including liabilities under the Securities Act or the Exchange Act of 1934, as amended, or the Exchange Act.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” on page S-6 of this prospectus supplement and under similar headings in

the other documents that are incorporated by reference into this prospectus supplement.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

DETERMINED IF THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS ARE TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO

THE CONTRARY IS A CRIMINAL OFFENSE.

Cowen

June

22, 2017

TABLE

OF CONTENTS

Prospectus Supplement

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part

of a registration statement that we have filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf”

registration process. Under the shelf registration process, we may offer shares of our common stock having a total aggregate offering

price of up to $150,000,000. Under this prospectus supplement, we may offer shares of our common stock having a total aggregate

offering price of up to $25,000,000 from time to time at prices and on terms to be determined by market conditions at the time

of offering.

Before

buying any of the common stock that we are offering, we urge you to carefully read this prospectus supplement and the

accompanying prospectus, together with the information incorporated by reference in this prospectus supplement and the

accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering

when making your investment decision. You should also read and consider the information in the documents we have referred you

to under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by

Reference.” These documents contain important information that you should consider when making your investment

decision.

This

prospectus supplement describes the terms of this offering of common stock and also adds to and updates information

contained in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. To

the extent there is a conflict between the information contained in this prospectus supplement and the information contained

in any document incorporated by reference into this prospectus supplement and the accompanying prospectus that was filed

with the SEC before the date of this prospectus, you should rely on the information in this prospectus supplement. If any

statement in one of these documents is inconsistent with a statement in another document having a later date — for example,

a document incorporated by reference into this prospectus supplement — the statement in the document having the

later date modifies or supersedes the earlier statement.

You

should rely only on the information contained in or incorporated by reference in this prospectus supplement and the accompanying

prospectus, and any free writing prospectus that we have authorized for use in connection with this offering. We have not, and

the sales agent has not, authorized anyone to provide you with different information. If anyone provides you with different or

inconsistent information, you should not rely on it. We are not, and the sales agent is not, making an offer to sell these securities

in any jurisdiction where the offer or sale is not permitted.

You

should assume that the information appearing in this prospectus supplement, the documents incorporated by reference in this prospectus

supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with

this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations

and prospects may have changed since those dates. You should read this prospectus supplement, the documents incorporated

by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have

authorized for use in connection with this offering, in their entirety before making an investment decision.

Unless

otherwise stated or unless the context requires otherwise, all references in this

prospectus supplement to “Workhorse,” “company,” “we,” “us”

and “our” or similar references refer to Workhorse Group Inc.

This

prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein include

trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included

or incorporated by reference into this prospectus supplement and the accompanying prospectus are the property of their respective

owners.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated

by reference into this prospectus supplement. This summary is not complete and does not contain all of the information that

you should consider before deciding whether to invest in our common stock. For a more complete understanding of our company and

this offering, we encourage you to read and consider carefully the more detailed information in this prospectus supplement

and the accompanying prospectus, including the information incorporated by reference in this prospectus supplement and the accompanying

prospectus, and the information included in any free writing prospectus that we have authorized for use in connection with this

offering, including the information under the heading “Risk Factors” in this prospectus supplement on page S-6 and under

similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

Overview

We

are a technology company focused on providing sustainable and cost-effective solutions to the commercial transportation sector.

As an American manufacturer we design and build high performance battery-electric electric vehicles and aircraft that make movement

of people and goods more efficient and less harmful to the environment. As part of our solution, we also develop cloud-based,

real-time telematics performance monitoring systems that enable fleet operators to optimize energy and route efficiency. Although

we operate as a single unit through our subsidiaries, we approach our development through two divisions, Automotive and Aviation.

Automotive

Medium-Duty

Delivery Vehicles

Medium-duty

electric delivery vans are currently in production and are in use by our customers on U.S. roads. Our delivery customers include

companies such as UPS, FedEx Express and Alpha Baking. Data from our in-house developed telematics system demonstrates our vehicles

on the road are averaging approximately a 500% increase in fuel economy as compared to conventional gasoline-based trucks of the

same size and duty cycle. In addition to improved fuel economy, we are anticipating that the performance of our vehicles on-route

will reduce long-term vehicle maintenance expense by approximately 50% as compared to fossil-fueled trucks.

We

estimate that our E-GEN Range-Extended Electric delivery vans will save over $150,000 in fuel and maintenance savings over the

20-year life of the vehicle. Due to the positive return-on-investment we are able to command a premium price for our vehicles

from major fleet buyers. Fleet buyers are able to achieve a four-year or better return-on-investment (without government incentives),

which justifies the higher acquisition cost of our vehicles.

The

Workhorse Custom Chassis acquisition includes other important assets including the Workhorse brand and logo, intellectual property,

schematics, logistical support from Up-Time Parts (a Navistar subsidiary) and access to a network of 400-plus sales and service

outlets across North America. We believe the combination of our assembly capability, coupled with our battery-electric product

development expertise gives Workhorse a unique opportunity to manufacture at scale in the U.S.

W-15

Pickup Truck

The

success of our value selling equation to fleet buyers of medium-duty vehicles encouraged us to bring this same philosophy to the

much higher volume segment of light-duty trucks. Our first product offering in the light-duty truck environment is our W-15 Range-Extended

Electric Pickup Truck, which is presently under development. To date, we have received letters of intent for 5,050 W-15 pickup

trucks from fleets. We formally unveiled a working concept version of the W-15 at the Advanced Clean Transportation conference

in Long Beach, CA on May 1,

,

2017.

To

capture further efficiencies and economies-of-scale we are designing our light-duty vehicles to take advantage of our existing

supply chain repurposing the use of the critical components such as Panasonic Li-ion cells, the BMW engines as our range extender,

our in-house developed vehicle control system software and our Metron Telematics performance monitoring system. In addition, we

are also using composite carbon fiber body panels on the W-15 which dramatically reduce our tooling costs, reduce vehicle weight

and eliminate rust.

To

realize further efficiencies, we intend to assemble the W-15 at our existing 250,000 square foot facility in Union City, Indiana.

This plant has the capability to produce 60,000 vehicles per year. The battery packs will be built in our Loveland, Ohio battery

pack plant which also serves as our corporate headquarters.

Post

Office Replenishment Program

Workhorse,

with our partner VT Hackney, is one of five awardees that the United States Postal Service selected to build prototype vehicles

for USPS Next Generation Delivery Vehicle project. The Post Office has stated the number of vehicles to be replaced in the project

is approximately 180,000. We are on track to deliver our prototypes to the USPS by the September 2017 deadline. The Post Office

has stated they intend to test the prototypes for six months and select a winning bid(s) following the testing process. We have

designed our Post Office truck so it can be built on the same line as the W-15 in Union City, Indiana.

Aviation

Delivery

Drones

Our

HorseFly Delivery Drone is a custom designed, purpose-built drone that is fully integrated in our electric trucks. We have a patent

pending on this architecture and we believe we are the only company in the world with a working drone/truck system. The HorseFly

delivery drone and truck system is designed to work within the FAA Rule 107 that permits the use of commercial drones in U.S.

airspace under certain conditions. UPS conducted a successful real world test with us in February 2017 and it received worldwide

news coverage. The knowledge we have gained in building electric delivery trucks for last-mile delivery has led us to believe

that a drone/truck delivery system can provide significant cost savings in the parcel delivery ecosphere.

As

stated in UPS’s press release issued on February 21, 2017, a reduction of just one mile per driver per day over one year

can save UPS up to $50 million. Rural delivery routes are the most expensive to serve due to the time and vehicle expenses required

to complete each delivery. In this test, the drone made one delivery while the driver continued down the road to make another,

which is a possible role UPS envisions for drones in the future.

Manned

Multicopter

We

are leveraging our knowledge of high-voltage battery packs, electric motor controls and range extending generators to design a

multi-copter that can carry a pilot and passenger. Several companies are now developing similar aircraft; however, we believe

that our range-extended truck experience combined with our technical aviation development experience will give us competitive

advantages and speed-to-market with such an aircraft.

Risks

Associated with our Business

Our

business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors”

immediately following this prospectus supplement summary and those described under similar headings in the

documents incorporated by reference into this prospectus supplement and the accompanying prospectus. These risks include:

|

|

●

|

Our

results of operations have not resulted in profitability and we may not be able to achieve

profitability going forward.

|

|

|

|

|

|

|

●

|

We

have yet to achieve positive cash flow and, given our projected funding needs, our ability

to generate positive cash flow is uncertain.

|

|

|

|

|

|

|

●

|

We

need access to additional financing in 2017 and beyond, which may not be available to

us on acceptable terms or at all. If we cannot access additional financing when we need

it and on acceptable terms, our business may fail.

|

|

|

|

|

|

|

●

|

The

development of our business in the near future is contingent upon the implementation

of orders from UPS and other key customers for the purchase of E-GENs. If we are unable

to perform under these orders, our business may fail.

|

|

|

|

|

|

|

●

|

Our

limited operating history makes it difficult for us to evaluate our future business prospects

and make decisions based on those estimates of our future performance.

|

|

|

|

|

|

|

●

|

Our

business, prospects, financial condition and operating results will be adversely affected

if we cannot reduce and adequately control the costs and expenses associated with operating

our business, including our material and production costs.

|

|

|

|

|

|

|

●

|

Increases

in costs, disruption of supply or shortage of lithium-ion cells could harm our business.

|

|

|

|

|

|

|

●

|

The

demand for commercial electric vehicles depends, in part, on the continuation of current

trends resulting from dependence on fossil fuels. Extended periods of low diesel or other

petroleum-based fuel prices could adversely affect demand for our vehicles, which would

adversely affect our business, prospects, financial condition and operating results.

|

|

|

|

|

|

|

●

|

Our

future growth is dependent upon the willingness of operators of commercial vehicle fleets

to adopt electric vehicles and on our ability to produce, sell and service vehicles that

meet their needs. This often depends upon the initial purchase price and related adoption

costs for an operator adopting electric vehicle technology as compared to the purchase

price of traditional internal combustion technology. When the price of oil is low, as

it recently has been, it is difficult to convince commercial fleet operations to change

to more expensive electric vehicles.

|

Corporate

Information

We

were incorporated in the State of Nevada in 2007 under the name Title Starts Online Inc. On December 28, 2009, we entered into

and closed a Share Exchange Agreement with the shareholders of Advanced Mechanical Products, Inc. (n/k/a AMP Electric Vehicles,

Inc.) (“AMP”) pursuant to which we acquired 100% of the outstanding securities of AMP in exchange for shares of common

stock. We were a shell company immediately prior to the acquisition of AMP. We formally changed our name to AMP Holding

Inc. on May 24, 2010 and then to Workhorse Group Inc. on April 16, 2016.

Our

corporate headquarters are located at 100 Commerce Drive, Loveland, Ohio 45140, and our telephone number is (513) 360-4704.

Our truck assembly facility is located in Union City, Indiana. This facility consists of three buildings with 270,000 square feet

of manufacturing and office space on 46 acres. We maintain a website at www.workhorse.com. We do not incorporate by reference

into this prospectus supplement the information on, or accessible through, our website, and you should not consider

it as part of this prospectus supplement.

THE

OFFERING

|

Common Stock Offered By Us

|

Shares of our common stock having an aggregate offering price of up to $25,000,000.

|

|

Manner

of Offering

|

“At

the market offering” that may be made from time to time through our sales agent, Cowen. See “Plan of Distribution”

on page S-12 of this prospectus supplement.

|

|

Use

of Proceeds

|

We

currently intend to use the net proceeds from this offering primarily for purchase of inventory for orders, continued

research and development, and for working capital and general corporate purposes. See “Use of Proceeds” on page S-8 of

this prospectus supplement.

|

|

Risk

Factors

|

Investing

in our common stock involves significant risks. See “Risk Factors” on page S-6 of this prospectus supplement,

and under similar headings in other documents incorporated by reference into this prospectus supplement and the accompanying

prospectus.

|

|

Nasdaq

Capital Market Symbol

|

“WKHS”.

|

RISK FACTORS

Investing

in our securities involves a high degree of risk. You should carefully review the risks and uncertainties described below and

under the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015,

as updated by our annual, quarterly and other reports and documents that are incorporated by reference into this prospectus

supplement and the accompanying prospectus and any free writing prospectus that we have authorized for use

in connection with this offering, before deciding whether to invest in our common stock. Each of the risk factors could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our

securities, and the occurrence of any of these risks might cause you to lose all or part of your investment. There may be

additional risks that we do not presently know of or that we currently believe are immaterial which could also impair our

business and financial position. Please also read carefully the following section titled “Special Note Regarding Forward-Looking

Statements.”

Additional Risks

Related to This Offering

You may experience

dilution

.

The

offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior

to this offering. Assuming that an aggregate of 5,387,931 shares of our common stock are sold at a price of $4.64 per

share, the last reported sale price of our common stock on the Nasdaq Capital Market on June 21, 2017, for aggregate gross

proceeds of $25.0 million, and after deducting commissions and estimated offering expenses payable by us, you would experience

immediate dilution of $3.60 per share, representing the difference between our as adjusted net tangible book value per share

as of March 31, 2017, after giving effect to this offering, and the assumed offering price. The exercise of outstanding

stock options and warrants would result in further dilution of your investment. See the section entitled “Dilution”

below for a more detailed illustration of the dilution you would incur if you participate in this offering. Because the sales

of the shares offered hereby will be made directly into the market or in negotiated transactions, the prices at which we sell

these shares will vary and these variations may be significant. Purchasers of the shares we sell, as well as our existing shareholders,

will experience significant dilution if we sell shares at prices significantly below the price at which they invested.

You

may experience future dilution as a result of future equity offerings

.

To

raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares

or other securities in any other offering at a price per share that is less than the price per share paid by investors in this

offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common

stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

Our

management might apply the net proceeds from this offering in ways with which you do not agree and in ways that may impair the

value of your investment

.

We

currently intend to use the net proceeds from this offering primarily to for purchase of inventory for orders, continued

research and development and for working capital and general corporate purposes. Pending these uses, we expect to invest the net

proceeds primarily in a money market mutual fund with a large financial institution. Our management has broad discretion as to

the use of such proceeds and you will be relying on the judgment of our management regarding the application of these proceeds.

Our management might apply these proceeds in ways with which you do not agree, or in ways that ultimately do not yield a favorable

return. If our management applies such proceeds in a manner that does not yield a significant return, if any, on our investment

of such net proceeds, it could compromise our ability to pursue our growth strategy and adversely affect the market price of our

common stock.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus, the documents we file with the SEC that are incorporated by reference in

this prospectus supplement and the accompanying prospectus and any free writing prospectus that we have authorized for use in

connection with this offering, contain “forward-looking statements” within the meaning of Section 27A of the

Securities Act and Section 21E of the Exchange Act. These are based on our management’s current beliefs, expectations

and assumptions about future events, conditions and results and on information currently available to us. Discussions containing

these forward-looking statements may be found, among other places, in the Sections entitled “Business,” “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated

by reference from our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q, as well as any

amendments thereto, filed with the SEC.

Any

statements in this prospectus supplement and the accompanying prospectus, or incorporated herein or therein, about our

expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking

statements. These forward-looking statements include statements regarding:

|

|

●

|

market

acceptance for our products,

|

|

|

●

|

our

ability to attract and retain customers for existing and new products,

|

|

|

●

|

our

ability to control our expenses,

|

|

|

●

|

our

ability to recruit and retain employees,

|

|

|

●

|

legislation

and government regulation,

|

|

|

●

|

global

and local business conditions,

|

|

|

●

|

our

ability to effectively maintain and update our product and service portfolio,

|

|

|

●

|

the

strength of competitive offerings,

|

|

|

●

|

the

prices being charged by those competitors,

|

|

|

●

|

our

ability to raise capital under acceptable terms, and

|

|

|

●

|

the

risks discussed elsewhere herein.

|

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“could,” “would,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “project,” “predict,” “potential” and similar expressions intended

to identify forward-looking statements. These statements reflect our current views with respect to future events and are based

on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. We discuss in greater detail many of these risks under the heading “Risk Factors” contained

in this prospectus supplement and the accompanying prospectus and in our most recent Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated

by reference into this prospectus supplement and the accompanying prospectus in their entirety. Also, these forward-looking

statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless

required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future

events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed

or implied in such forward-looking statements. You should read this prospectus supplement and the accompanying prospectus,

together with the documents we have filed with the SEC that are incorporated by reference and any free writing prospectus that

we may authorize for use in connection with this offering, completely and with the understanding that our actual future results

may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by

these cautionary statements.

USE OF

PROCEEDS

We may issue and sell shares of our

common stock having aggregate sales proceeds of up to $25,000,000 from time to time. Because there is no minimum offering

amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us,

if any, are not determinable at this time. There can be no assurance that we will sell any shares under or fully utilize the

sales agreement with Cowen as a source of financing.

We

currently intend to use the net proceeds from this offering primarily to purchase of inventory for orders, continued research

and development, and for working capital and general corporate purposes. We may also use a portion of the net proceeds to acquire

or invest in businesses, products and technologies that are complementary to our own, although we have no current plans, commitments

or agreements with respect to any acquisitions as of the date of this prospectus supplement. Pending these uses, we expect to

invest the net proceeds primarily in a money market mutual fund with a large financial institution.

DILUTION

Our

historical net tangible book value as of March 31, 2017 was approximately $19.2 million, or $0.53 per share. Historical

net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of

shares of our common stock outstanding as of March 31, 2017. Dilution with respect to net tangible book value per share represents

the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible

book value per share of our common stock immediately after this offering.

After

giving effect to the assumed sale of 5,387,931 shares of our common stock in this offering at an assumed offering price

of $4.64 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on June 21, 2017,

and after deducting estimated offering commissions and offering expenses payable by us, our as adjusted net tangible book value

as of March 31, 2017 would have been approximately $43.1 million, or $1.04 per share. This represents an immediate

increase in net tangible book value of $0.50 per share to existing stockholders and immediate dilution of $3.60 per

share to investors purchasing our common stock in this offering at the assumed offering price. The following table illustrates

this dilution on a per share basis:

|

Assumed

public offering price per share

|

|

|

|

|

|

$

|

4.64

|

|

|

Net

tangible book value per share as of March 31, 2017

|

|

$

|

0.53

|

|

|

|

|

|

|

Increase

in net tangible book value per share attributable to this offering

|

|

$

|

0.51

|

|

|

|

|

|

|

As

adjusted net tangible book value per share as of March 31, 2017, after giving effect to this offering

|

|

|

|

|

|

$

|

1.04

|

|

|

Dilution

per share to investors purchasing our common stock in this offering

|

|

|

|

|

|

$

|

3.60

|

|

The

above discussion and table are based on 35,956,800 shares of our common stock outstanding as of March 31, 2017,

and exclude:

|

|

●

|

3,273,891 shares

of common stock issuable upon the exercise of stock options outstanding as of March

31, 2017, having a weighted average exercise price of $3.93 per share; and

|

|

|

●

|

4,646,967 shares

of common stock issuable upon the exercise of warrants outstanding as of March 31,

2017, each at an exercise price of $6.90 per share.

|

The

table above assumes for illustrative purposes that an aggregate of 5,387,931 shares of our common stock are sold

during the term of the sales agreement with Cowen at a price of $4.64 per share, the last reported sale price of our

common stock on the Nasdaq Capital Market on June 21, 2017, for aggregate gross proceeds of $25.0 million. The

shares subject to the sales agreement with Cowen are being sold from time to time at various prices. An increase of

$1.00 per share in the price at which the shares are sold from the assumed offering price of $4.64 per share shown

in the table above, assuming all of our common stock in the aggregate amount of $25.0 million during the term of the

sales agreement with Cowen is sold at that price, would increase our adjusted net tangible book value per share after the

offering to $1.07 per share and would increase the dilution in net tangible book value per share to new investors in

this offering to $4.60 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A

decrease of $1.00 per share in the price at which the shares are sold from the assumed offering price of $4.64 per share

shown in the table above, assuming all of our common stock in the aggregate amount of $25 million during the term of the

sales agreement with Cowen is sold at that price, would decrease our adjusted net tangible book value per share after the

offering to $1.01 per share and would decrease the dilution in net tangible book value per share to new investors in

this offering to $2.63 per share, after deducting commissions and estimated aggregate offering expenses payable by us. This

information is supplied for illustrative purposes only.

To

the extent that outstanding options or warrants outstanding as of March 31, 2017 have been or may be exercised or other

shares issued, investors purchasing our common stock in this offering may experience further dilution. In addition, we may choose

to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for

our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible

debt securities, the issuance of these securities could result in further dilution to our stockholders.

DESCRIPTION

OF CAPITAL STOCK

As

of the date of this prospectus supplement, our articles of incorporation, as amended, authorizes us to issue 50,000,000 shares

of common stock, par value $0.001 per share, and 75,000,000 shares of preferred stock, par value $0.001 per share. As of March

31, 2017, 35,956,800 shares of common stock were outstanding.

The

following summary describes the material terms of our capital stock and the registration rights under our registration rights

agreement. The descriptions of capital stock and the registration rights under our registration rights agreement are qualified

by reference to our amended and restated certificate of incorporation, as amended, our amended and restated bylaws and our registration

rights agreement, which are incorporated by reference as exhibits into the registration statement of which this prospectus supplement

and the accompanying prospectus are a part.

Common

Stock

Voting

Rights

The

holders of our common stock are entitled to one vote per share on all matters to be voted upon by our shareholders, including

the election of directors. Cumulative voting is not permitted in the election of directors.

Dividend

Rights

Subject

to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our common

stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines

to issue dividends and then only at the times and in the amounts that our board may determine.

Liquidation

Rights

In

the event of our liquidation, dissolution, or winding up, our common shareholders will receive ratably any net assets that remain

after the payment of all of our debts and other liabilities, subject to the senior rights of any outstanding preferred stock.

Other

Our

shares of common stock are not convertible into any other security and do not have any preemptive rights, conversion rights, redemption

rights or sinking fund provisions. The rights, preferences and privileges, including voting rights, of holders of our common stock

are subject to, and may be adversely affected by, the rights of the holders of shares of preferred stock that the board may designate

and issue in the future. There are currently no preferred shares outstanding.

Preferred

Stock

We

are authorized to issue up to 75,000,000 shares of preferred stock, in one or more series with such designations, relative rights,

preferences, voting rights, limitations, dividend rates, redemption prices, liquidation prices, conversion rights, sinking or

purchase fund rights, and other provisions as the board may fix or determine. Any series of preferred stock may have rights and

privileges superior to those of common stock.

No

shares of preferred stock have been issued to date, nor do we have any currently designated shares of preferred stock. We currently

have no plans to issue any shares of preferred stock.

Stock

Purchase Warrants

On

November 9, 2015 and December 4, 2015, Workhorse entered into Securities Purchase Agreements with several accredited investors

(the “Investors”) providing for the sale by Workhorse to the Investors of 6% Convertible Promissory Notes in the aggregate

amount of $13,534,426 (the "Notes"). In addition to the Notes, the Investors also received stock purchase warrants (the

“Warrants”) to acquire an aggregate of 1,366,979 shares of common stock of our company. The Warrants are exercisable

for five years at an exercise price of $5.28.

In

May 2014, we entered into subscription agreement with accredited investors (“May 2014 Investors”) pursuant to which

the May 2014 Investors purchased 1,428,000 shares of common stock for a purchase price of $1,428,000, together with a common stock

purchase warrants to acquire 714,000 shares of common stock at $1.50 per share for a period of three years.

In

May 2014, we entered into conversion agreements with debt holders that were accredited investors (“May 2014 Conversion Investors”)

pursuant to which the May 2014 Conversion Investors converted $1,169,300 into 1,169,300 shares of common stock together with a

common stock purchase warrants to acquire 584,650 shares of common stock at $1.50 per share for a period of three years.

We

entered into Subscription Agreements with five accredited investors (the “December 2014 Investors”) between November

24, 2014 and December 29, 2014 providing for the sale to the December 2014 Investors of 14% Unsecured Convertible Promissory Notes

in the aggregate amount of $1,243,000 (the "December 2014 Notes"). In addition to the December 2014 Notes, the December

2014 Investors also received common stock purchase warrants (the “December 2014 Warrants”) to acquire 443,929 shares

of common stock. The December 2014 Warrants are exercisable for five years at an exercise price of $1.40. The initial closing

of $200,000 was on November 24, 2014, the second closing of $700,000 was on December 8, 2014 and the third closing of $343,000

was on December 30, 2014.

Anti-Takeover

Provisions Under Nevada Law.

Combinations

with Interested Stockholder. Sections 78.411-78.444, inclusive, of the Nevada Revised Statutes (“NRS”) contain

provisions governing combinations with an interested stockholder. For purposes of the NRS, “combinations” include:

(i) any merger or consolidation with any interested stockholder, (ii) any sale, lease, exchange, mortgage, pledge, transfer

or other disposition to any interested stockholder of corporate assets with an aggregate market value equal to 5% or more of the

aggregate market value of the corporation’s consolidated assets, 5% or more of the outstanding shares of the corporation

or 10% or more of the earning power or net income of the corporation, (iii) the issuance to any interested stockholder of

voting shares (except pursuant to a share dividend or similar proportionate distribution) with an aggregate market value equal

to 5% or more of the aggregate market value of all the outstanding shares of the corporation, (iv) the dissolution of the

corporation if proposed by or on behalf of any interested stockholder, (v) any reclassification of securities, recapitalization

or corporate reorganization that will have the effect of increasing the proportionate share of the corporation’s outstanding

voting shares held by any interested stockholder and (vi) any receipt by the interested stockholder of the benefit (except

proportionately as a stockholder) of any loan, advance, guarantee, pledge or other financial assistance. For purposes of the NRS,

an “interested stockholder” is defined to include any beneficial owner of more than 10% of any class of the voting

securities of a Nevada corporation and any person who is an affiliate or associate of the corporation and was at any time during

the preceding three years the beneficial owner or more than 10% of any class of the voting securities of the Nevada corporation.

Subject

to certain exceptions, the provisions of the NRS governing combinations with interested stockholders provide that a Nevada corporation

may not engage in a combination with an interested stockholder for two years after the date the person first became an interested

stockholder unless the combination or the transaction by which the person first became an interested stockholder is approved by

the board of directors before the person first became an interested stockholder.

Control

Share Acquisitions. The NRS also contains a “control share acquisitions statute.” If applicable to a Nevada corporation

this statute restricts the voting rights of certain stockholders referred to as “acquiring persons,” that acquire

or offer to acquire ownership of a “controlling interest” in the outstanding voting stock of an “issuing corporation.”

For purposes of these provisions a “controlling interest” means with certain exceptions the ownership of outstanding

voting stock sufficient to enable the acquiring person to exercise one-fifth or more but less than one-third, one-third or more

but less than a majority, or a majority or more of all voting power in the election of directors and “issuing corporation”

means a Nevada corporation that has 200 or more stockholders of record, at least 100 of whom have addresses in Nevada appearing

on the stock ledger of the corporation, and which does business in Nevada directly or through an affiliated corporation. The voting

rights of an acquiring person in the affected shares will be restored only if such restoration is approved by the holders of a

majority of the voting power of the corporation. The NRS allows a corporation to “opt-out” of the control share acquisitions

statute by providing in such corporation’s articles of incorporation or bylaws that the control share acquisitions statute

does not apply to the corporation or to an acquisition of a controlling interest specifically by types of existing or future stockholders,

whether or not identified.

Articles

of Incorporation and Bylaws

No

Cumulative Voting.

Where cumulative voting is permitted in the election of directors, each share is entitled to as many

votes as there are directors to be elected and each shareholder may cast all of its votes for a single director nominee or distribute

them among two or more director nominees. Thus, cumulative voting makes it easier for a minority shareholder to elect a director.

Our articles of incorporation deny shareholders the right to vote cumulatively.

Authorized

But Unissued Shares.

Our articles of incorporation permit the board to authorize the issuance of preferred stock,

and to designate the rights and preferences of our preferred stock, without obtaining shareholder approval. One of the

effects of undesignated preferred stock may be to enable the board to render more difficult or to discourage a third

party’s attempt to obtain control of Workhorse Group by means of a tender offer, proxy contest, merger, or otherwise.

The issuance of shares of preferred stock also may discourage a party from making a bid for the common stock because the

issuance may adversely affect the rights of the holders of common stock. For example, preferred stock that we issue may rank

prior to the common stock as to dividend rights, liquidation preference, or both, may have special voting rights and may be

convertible into shares of common stock. Accordingly, the issuance of shares of preferred stock may discourage bids for our

common stock or may otherwise adversely affect the market price of our common stock.

Transfer

Agent or Registrar

Empire

Stock Transfer, Inc. is the transfer agent and registrar of our common stock.

Listing

on the Nasdaq Capital Market

Our

common stock is listed on the Nasdaq Capital Market under the symbol “WKHS”.

PLAN

OF DISTRIBUTION

We

have entered into a sales agreement with Cowen under which we may issue and sell shares of our common stock having an aggregate

gross sales price of up to $25,000,000 from time to time through Cowen acting as agent. The sales agreement is filed as an exhibit

to our Current Report on Form 8-K dated June 22, 2017 and is incorporated by reference to this prospectus supplement.

Upon

delivery of a placement notice and subject to the terms and conditions of the sales agreement, Cowen may sell our common stock

by any method permitted by law deemed to be an “at-the-market” offering as defined in Rule 415 promulgated under

the Securities Act, including sales made directly on the Nasdaq Capital Market, on any other existing trading market for our common

stock or to or through a market maker. Cowen may also sell our common stock by any other method permitted by law, including in

privately negotiated transactions. We may instruct Cowen not to sell common stock if the sales cannot be effected at or above

the price designated by us from time to time. We or Cowen may suspend the offering of common stock upon notice and subject to

other conditions.

Each

time we wish to issue and sell common stock under the sales agreement, we will notify Cowen of the number of shares to be issued,

the dates on which such sales are anticipated to be made, any minimum price below which sales may not be made and other sales

parameters as we deem appropriate. Once we have so instructed Cowen, unless Cowen declines to accept the terms of the notice,

Cowen has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such

shares up to the amount specified on such terms. The obligations of Cowen under the sales agreement to sell our common stock are

subject to a number of conditions that we must meet.

We

will pay Cowen commissions, in cash, for its services in acting as agent in the sale of our common stock. Cowen will be entitled

to compensation at a fixed commission rate equal to 3% of the gross sales price per share sold. Because there is no minimum offering

amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us,

if any, are not determinable at this time. We have also agreed to reimburse Cowen for certain specified expenses, including the

fees and disbursements of its legal counsel, in an amount not to exceed $50,000. We estimate that the total expenses for the offering,

excluding discounts and commissions payable to Cowen under the terms of the sales agreement, will be approximately $300,000.

Settlement

for sales of common stock will generally occur on the third business day following the date on which any sales are made, or on

some other date that is agreed upon by us and Cowen in connection with a particular transaction, in return for payment of the

net proceeds to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities

of The Depository Trust Company or by such other means as we and Cowen may agree upon. There is no arrangement for funds to be

received in an escrow, trust or similar arrangement.

Cowen

will use its commercially reasonable efforts, consistent with its sales and trading practices, to solicit offers to purchase the

common stock under the terms and subject to the conditions set forth in the sales agreement. In connection with the sale of the

common stock on our behalf, Cowen may be deemed to be an “underwriter” within the meaning of the Securities Act and

the compensation of Cowen will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to Cowen against certain civil liabilities, including liabilities under the Securities Act.

The

offering of our common stock pursuant to the sales agreement will terminate upon the earlier of (1) the sale of all shares

of our common stock subject to the sales agreement, or (2) termination of the sales agreement as permitted therein. We and

Cowen may each terminate the sales agreement at any time upon 10 days’ prior notice.

Cowen

and its affiliates may in the future provide various investment banking, commercial banking and other financial services for us

and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M,

Cowen will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus

supplement.

Our

common stock is listed on the Nasdaq Capital Market and trades under the symbol “WKHS”. The transfer agent of our

common stock is Empire Stock Transfer Inc.

LEGAL

MATTERS

The

validity of the common stock offered by this prospectus supplement will be passed upon by Fleming PLLC, Rockville

Centre, New York. Proskauer Rose LLP, New York, New York, will act as counsel to Cowen and Company, LLC in connection with

this offering.

EXPERTS

Clark

Schaefer Hackett & Company, an independent registered public accounting firm, has audited our financial statements included

in our Annual Report on Form 10-K for the year ended December 31, 2016, as set forth in their report, which is incorporated

by reference in this prospectus supplement and elsewhere in the registration statement. Our financial statements are incorporated

by reference in reliance on Clark Schaefer Hackett & Company’s report, given on their authority as experts in accounting

and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus supplement and the accompanying prospectus are part of a registration statement we filed with the SEC.

This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the

registration statement and the exhibits to the registration statement. For further information with respect to us and

the securities we are offering under this prospectus supplement, we refer you to the registration statement and the

exhibits and schedules filed as a part of the registration statement. Neither we nor any agent, underwriter or dealer

has authorized any person to provide you with different information. We are not making an offer of these securities in any

state where the offer is not permitted. You should not assume that the information in this prospectus supplement is

accurate as of any date other than the date on the front page of this prospectus supplement, regardless of the time of

delivery of this prospectus supplement or any sale of the securities offered by this

prospectus supplement.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy the registration

statement, as well as any other document filed by us with the SEC, at the SEC’s Public Reference Room at 100 F Street NE,

Washington, D.C. 20549. You can also request copies of these documents by writing to the SEC and paying a fee for the copying

cost. You may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330.

The SEC maintains a website that contains reports, proxy statements and other information regarding issuers that file electronically

with the SEC, including Workhorse Group Inc. The address of the SEC website is www.sec.gov.

We

maintain a website at www.workhorse.com. Information contained in or accessible through our website does not constitute a part

of this prospectus supplement or the accompanying prospectus and is not incorporated by reference into this prospectus supplement.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information into this prospectus supplement, which means that we

can disclose important information to you by referring you to another document filed separately with the SEC. The SEC file number

for the documents incorporated by reference in this prospectus supplement is 001-37673. The documents incorporated by

reference into this prospectus supplement contain important information about us that you should read.

The

following documents are incorporated by reference into this document:

|

|

●

|

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2016 filed with the SEC on March 17, 2017;

|

|

|

●

|

our

Quarterly Report on Form 10-Q filed with the SEC on May 10, 2017; and

|

|

|

●

|

our

Current Report on Form 8-K filed with the SEC on May 19, 2017; and

|

|

|

●

|

the

description of our common stock, which is registered under Section 12 of the Exchange Act, in our registration statement on

Form 8-A, filed with the SEC on January 5, 2016, including any amendments or reports filed for the purpose of updating such

description.

|

We

also incorporate by reference into this prospectus supplement all documents (other than current reports furnished under

Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) that are filed by

us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement but

prior to the termination of the offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

We

will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or

oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus supplement but

not delivered with this prospectus supplement, including exhibits which are specifically incorporated by reference into

such documents. You should direct any requests for documents by writing us at 100 Commerce Drive, Loveland, Ohio 45140 Attn: Secretary

or by telephoning us at 513-297-3640.

Any

statement contained herein or in a document incorporated or deemed to be incorporated by reference into this document will be

deemed to be modified or superseded for purposes of the document to the extent that a statement contained in this document or

any other subsequently filed document that is deemed to be incorporated by reference into this document modifies or supersedes

the statement.

PROSPECTUS

$150,000,000

Common

Stock

Preferred

Stock

Warrants

Debt Securities

Units

and

up to 1,033,717 Shares of Common Stock and 1,833,193 Shares of Common

Stock

Underlying Stock Purchase Warrants held by Selling Shareholders

We

may offer and sell, from time to time in one or more offerings, up to $150,000,000 in the aggregate of common stock, preferred

stock, warrants to purchase our common stock, debt securities or units, at prices and on terms that we will determine at the time

of the offering. Preferred stock, warrants and debt securities may also be convertible into preferred stock or common stock.

In

addition, the selling shareholders may offer to sell up to up to 1,033,717 shares of common stock presently outstanding and up

to 1,833,193 shares of common stock issuable upon exercise of Stock Purchase Warrants. We will not receive any of the proceeds

from the sale of shares of common stock by the selling shareholders.

This

prospectus describes some of the general terms that may apply to these securities. Each time we or a selling shareholder sell

securities, to the extent required by applicable law, we will provide a supplement to this prospectus that contains specific information

about the offering and the terms of the securities being offered. The supplement may also add, update or change information contained

in this prospectus.

You

should carefully read this prospectus, all prospectus supplements and all other documents incorporated by reference in this prospectus

before you invest in our securities.

We

and the selling shareholders will offer the securities in amounts, at prices and on terms to be determined by market conditions

at the time of the offerings. The securities may be offered separately or together in any combination.

The

securities may be offered and sold on a delayed or continuous basis directly by us and the selling shareholders or through underwriters,

agents or dealers as designated from time to time, through a combination of these methods or any other method as provided in the

applicable prospectus supplement. The supplements to this prospectus will designate the terms of our plan of distribution. See

the discussion under the heading “Plan of Distribution” for more information on the topic.

Our

common stock is listed on The NASDAQ Capital Market under the symbol “WKHS.”

Investing

in our securities involves risks. You should carefully review the section captioned “

Risk Factors

”

beginning on page 1 of this prospectus regarding information included and incorporated by reference in this prospectus and the

applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is December 23, 2016.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission using a “shelf”

registration process. Using this process, we may sell any combination of the securities described in this prospectus in one or

more offerings up to a total dollar amount of $150,000,000 and the selling shareholders referred to in this prospectus and identified

in supplements to the prospectus may also offer and sell our shares of common stock under this prospectus.

This

prospectus provides you with a general description of the securities that we may offer. Each time we use this prospectus to offer

securities, we will provide a prospectus supplement that will describe the specific terms of the offering. The prospectus supplement

may also add to or update other information contained in this prospectus.

In

making your investment decision, you should rely only on the information contained or incorporated by reference in this prospectus

and any prospectus supplement we may authorize to be delivered to you. This prospectus incorporates important business and financial

information about us that is not included in or delivered with this prospectus. You may obtain a copy of this information, without

charge, as described in the “Where You Can Find More Information” section. We have not authorized anyone to provide

you with any other information. If you receive any other information, you should not rely on it.

You

should not assume that the information appearing in this prospectus is accurate as of any date other than the date on the front

cover of this prospectus. You should not assume that the information contained in the documents incorporated by reference in this

prospectus is accurate as of any date other than the respective dates of those documents. Our business, financial condition, results

of operations, reserves and prospects may have changed since that date.

We

encourage you to read this entire prospectus together with the documents incorporated by reference into this prospectus before

making a decision whether to invest in our securities.

ABOUT

WORKHORSE GROUP INC.

We

are a last mile delivery technology company headquartered in the United States. We have broad capabilities beginning with the

development and production of American made battery-electric medium-duty truck chassis helping delivery fleets achieve efficiencies

and strengthening their sustainability initiatives. To the best of our knowledge, we are the only medium-duty battery-electric

original equipment manufacturer (OEM) in the United States. We have also recently commenced the development of an electric pickup

work truck with range extender for fleet usage With a focus on last mile delivery and expanding on fleets' operational efficiencies,

Workhorse also develops and integrates unmanned aerial vehicle (UAV) platforms. Our drone delivery platform, HorseFly

TM

is FAA compliant and fully integrated with our medium duty truck chassis. Workhorse also develops and integrates cloud-based,

real-time proof-of-performance telematics monitoring software, that provides fleet operators with advanced vehicle diagnostics,

energy and route efficiency.

We

are a Nevada corporation. Our executive offices are located at 100 Commerce Drive, Loveland, Ohio 45140, and our

telephone number is 513-360-4704.

Unless

otherwise stated or the context requires otherwise, references to “we,” “us,” the “Company”

and “Workhorse Group” refer to Workhorse Group Inc. and unless otherwise differentiated, its wholly-owned subsidiaries,

Workhorse Technologies Inc. and Workhorse Motor Works Inc.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider the risk factors and all other information

contained in our most recent Annual Report on Form 10-K, in our Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K before investing in our securities. You should also consider similar information contained in any Annual Report

on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K or other document filed by us with the

SEC after the date of this prospectus before deciding to invest in our securities. If any of these risks were to occur, our business,

financial condition or results of operations could be adversely affected. In that case, the trading price of our common stock

or other securities could decline and you could lose all or part of your investment. When we offer and sell any securities pursuant

to a prospectus supplement, we may include additional risk factors relevant to such securities in the prospectus supplement.

FORWARD

LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve risks and uncertainties. You should not place undue reliance on these

forward-looking statements. Our actual results could differ materially from those anticipated in the forward-looking statements

for many reasons, including the reasons described in our “Prospectus Summary,” “Use of Proceeds,” “Risk

Factors,” “Management Discussion and Analysis of Financial Condition and Result of Operations,” and “Business”

sections. In some cases, you can identify these forward-looking statements by terms such as “anticipate,” “believe,”

“continue,” “could,” “depends,” “estimate,” “expects,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of those terms or other similar expressions, although

not all forward-looking statements contain those words.

We

have based these forward looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These

forward looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, including risks

described in the section titled “Risk Factors” and elsewhere in this prospectus, regarding, among other things:

|

|

●

|

management

and employee operations and execution risks;

|

|

|

|

|

|

|

●

|

a

failure to develop sales and the loss of any key customer that we may develop;

|

|

|

|

|

|

|

●

|

loss

of key personnel;

|

|

|

|

|

|

|

●

|

competition

in the markets we serve;

|

|

|

|

|

|

|

●

|

intellectual

property risks;

|

|

|

|

|

|

|

●

|

our

ability to fund our working capital requirements;

|

|

|

|

|

|

|

●

|

risks

associated with the uncertainty of future financial results;

|

|

|

|

|

|

|

●

|

risks

associated with this offering;

|

|

|

|

|

|

|

●

|

risks

associated with raising additional capital when needed and at reasonable terms; and

|

|

|

|

|

|

|

●

|

risks

associated with our reliance on third party suppliers of raw materials and other organizations that provide goods and services

to us.

|

These

risks are not exhaustive. Other sections of this prospectus may include additional factors that could adversely impact our business

and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge

from time to time, and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in, or implied by, any forward looking statements.

You

should not rely upon forward looking statements as predictions of future events. We cannot assure you that the events and circumstances

reflected in the forward looking statements will be achieved or occur. Although we believe that the expectations reflected in

the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Except as required by law, we undertake no obligation to update publicly any forward looking statements for any reason after the

date of this prospectus or to conform these statements to actual results or to changes in our expectations.

You

should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration

statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance

and achievements may be materially different from what we expect. We qualify all of our forward looking statements by these cautionary

statements.

OUR

COMPANY

We

are a last mile delivery technology company headquartered in the United States. We have broad capabilities beginning with the

development and production of American made battery-electric medium-duty truck chassis helping delivery fleets achieve efficiencies

and strengthening their sustainability initiatives. To the best of our knowledge, we are the only medium-duty battery-electric

original equipment manufacturer (OEM) in the United States. We have also recently commenced the development of an electric pickup

work truck with range extender for fleet usage With a focus on last mile delivery and expanding on fleets' operational efficiencies,

Workhorse also develops and integrates unmanned aerial vehicle (UAV) platforms. Our drone delivery platform, HorseFly

TM

is FAA compliant and fully integrated with our medium duty truck chassis. Workhorse also develops and integrates cloud-based,

real-time proof-of-performance telematics monitoring software, that provides fleet operators with advanced vehicle diagnostics,

energy and route efficiency.

On

June 4, 2014, we entered into a Vehicle Purchase Agreement with United Parcel Service Inc. (“UPS”), pursuant to which

we outlined with UPS the relationship by which we would sell vehicles to UPS. On August 7, 2015, we entered into a Prime Order

under the Vehicle Purchase Agreement with UPS, pursuant to which UPS agreed to purchase 125 E-GEN trucks. In connection with each

purchase order, we develop a delivery schedule as well as locations for specific deliveries. However, these deadlines are expected

to evolve as UPS operations personnel from eight states will be involved in the scheduling. On September 7, 2016, we entered into

a purchase order with UPS pursuant to which UPS agreed to purchase from the Company 200 E-GEN electric extended range delivery

trucks.

Workhorse

had previously entered into a purchase agreement with UPS to supply 18 all-electric Workhorse E-100 Walk-In Vans to be deployed

in the Houston-Galveston, Texas area The U.S. Department of Energy selected this project to improve local air quality in the Houston-Galveston

area, which is currently designated as a National Ambient Air Quality Non-Attainment Area. We fulfilled this order in July 2016.

We

have developed and begun delivery of our second generation, full-electric truck, “E-100”, which is a significant improvement

over our first generation E-100 vehicle. The second-generation vehicle includes a single powerful electric motor with no transmission

and lighter, high-density Lithium-ion batteries, giving the vehicle a range of up to 100 miles. We have filed a patent application

for the system that extends the range of electric vehicles while reducing the overall cost of the typical battery-electric power

train. The system, E-GEN

TM

, is designed specifically for the package delivery vehicle market, in which the diesel

and/or gasoline-powered vehicles in use now are required to stop and restart hundreds of times a day. Our E-GEN system incorporates

a small internal combustion engine that powers an integrated electric motor as a generator when the battery pack reaches a pre-determined

depth-of-discharge (DOD). The DOD is calculated based on projected route distance, package loads and electricity efficiency curves.

The gas engine never propels the vehicle, its task is simple, to automatically turn on in the event the battery needs a small

re-charge. We believe that the range-extended battery-electric technology is an ideal fit for urban and suburban delivery routes,

despite the typical fleet owner's concerns about range and cost. Our E-GEN Drive system will enable our customers to keep their

batteries charged to a consistent state of charge throughout the day and, since we are able to use smaller battery packs, we can

reduce the cost of the entire system. Our E-GEN trucks offer a three-year payback, making them price competitive with gasoline-powered

trucks. We recently entered into an agreement with Bayerische Motoren Werke AG (BMW) to supply the new quiet-running 2-cylinder

gasoline generator replacing the current 4-cylinder engine to extend the range of our E-GEN product.

In

March of 2013, we purchased the former Workhorse Custom Chassis assembly plant in Union City, Indiana from Navistar International.

With this acquisition, we acquired the capability to be an Original Equipment Manufacturer (OEM) of Class 3-6 commercial-grade,

medium-duty truck chassis, to be marketed under the Workhorse® brand. Ownership and operation of this plant enables us to

build new chassis with gross vehicle weight capacities of between 10,000 and 26,000 pounds. These chassis are our new 88”-track

(W88) and include either of our two second-generation, battery-electric drive trains, both powered by Panasonic 18650 Li-ion cells.

The W88 truck chassis is currently being offered to fleet purchasing managers at price points that are both attractive and cost

competitive. At the same time, we intend to partner with engine suppliers and body fabricators to offer fleet-specific, custom,

purpose-built chassis that provide total cost of ownership solutions that are superior to the competition.

In

addition to having the ability to build our own chassis, we design and produce battery-electric power trains that can be installed

in new Workhorse chassis or installed as repower packages to convert used Class 3-6 medium-duty vehicles from diesel or gasoline

power to electric power. Our approach is to provide battery-electric power trains utilizing proven, automotive-grade, mass-produced

parts in their architectures, coupled with in-house control software that we have developed over the last five years.

The

Workhorse Custom Chassis acquisition provides other important assets including the Workhorse brand and logo, intellectual property,

schematics, logistical support from Up-Time Parts (a Navistar subsidiary) and a network of 400-plus sales and service outlets

across North America. We believe the combination of our chassis assembly capability, coupled with its ability to offer an array

of fuel choices, gives Workhorse a unique opportunity in the marketplace.

We

are also seeking to re-design the future of parcel delivery aviation: HorseFly™, an Unmanned Aerial Vehicle (UAV) that is

designed for the package delivery market as well as other commercial applications. Our UAV works in tandem with our electric trucks

to bring a practical low cost solution to making the last mile more efficient and cost effective for our parcel customers. HorseFly™

is designed to further improve package delivery efficiencies and has been developed in conjunction with the University of Cincinnati.

In June 2016, the Federal Aviation Administration (or the FAA) announced new rules permitting commercial use of drones weighing