UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) June 19, 2017

|

| | |

| | |

Winnebago Industries, Inc. |

(Exact Name of Registrant as Specified in its Charter) |

|

| | |

Iowa | 001-06403 | 42-0802678 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

P.O. Box 152, Forest City, Iowa | | 50436 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code 641-585-3535

______________________________________________________________________

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Items under Sections 1 through 4 and 6 through 8 are not applicable and are therefore omitted.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On June 19, 2017, Winnebago Industries, Inc., (the “Company”) and Sarah N. Nielsen, the Company’s former Vice President and Chief Financial Officer, entered into a Separation Agreement (the “Separation Agreement”) pursuant to which Ms. Nielsen separated from employment with the Company effective June 2, 2017.

Separation Agreement

Under the terms of the Separation Agreement Ms. Nielsen will receive thirty-one weeks of pay in equal weekly installments at her base salary at the time of her separation beginning once the Agreement becomes irrevocable and totaling $205,700. The Company will also pay Ms. Nielsen a pro rata share based on Ms. Nielsen’s actual time worked in Fiscal 2017 of any bonus under the Company’s Fiscal 2017 Annual Incentive Compensation Plan, which payment shall be determined in October and paid no later than November 1, 2017. Ms. Nielsen will also receive a lump sum of $8,400 which is approximately equivalent to the premium cost of COBRA coverage during the 31 weeks of separation pay. All other Company benefits such as life insurance, disability insurance, 401(k) plan, and vacation accruals ceased effective with Ms. Nielsen’s separation. In addition, 9,166 unvested shares of stock from stock awards granted in October of 2014 and 2015 and December of 2016, will vest on June 27, 2017, unless this Agreement is rescinded by Ms. Nielsen. The Human Resources Committee agreed to waive the vesting requirements and permit the foregoing shares to vest upon the agreement becoming enforceable.

Under the Separation Agreement, Ms. Nielsen agrees that she will not solicit Company employees or compete against the Company for a period of one year. Ms. Nielsen also agreed to a general release of claims against the Company arising under various employment laws. Under the terms of the Separation Agreement, Ms. Nielsen is entitled to rescind the Agreement for seven days following execution of the Separation Agreement.

The Human Resources Committee approved the compensation payable to Ms. Nielsen under the Separation Agreement.

The foregoing summary of the Separation Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the Separation Agreement, which is attached hereto as Exhibit 10.1 to this Form 8-K, and is incorporated by reference into this Item 5.02.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits |

| | |

| Exhibit Number | Description |

| 10.1 | Separation Agreement dated June 19, 2017, by Winnebago Industries, Inc. and Sarah Nielsen |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | WINNEBAGO INDUSTRIES, INC. | |

| | | | |

Date: | June 22, 2017 | By: | /s/ Scott C. Folkers | |

| | Name: | Scott C. Folkers | |

| | Title: | Vice President, General Counsel and Secretary | |

SEPARATION AGREEMENT AND GENERAL RELEASE

This is a Separation Agreement and General Release (hereinafter “Agreement” or “Separation Agreement”) entered into by and between Sarah Nielsen, her heirs, legal representatives, legatees, successors and assigns (hereinafter referred to as “Employee”) and Winnebago Industries, Inc (hereinafter referred to as “Company”).

In consideration of the mutual promises contained in this Agreement, Company and Employee agree as follows:

1.Employee and Company agree that Employee’s employment with Company ended effective June 2, 2017 (the “Separation Date”).

2.Subject to the other conditions set forth herein, Company agrees to provide Employee with the following:

a.Severance Payments. Employee will be eligible to receive an amount equal to 31 weeks of Employee’s current annual base salary ($345,045/52 wks * 31 wks = $205,700.00), less legally required deductions, in 31 weekly installment(s). The thirty one (31) week Severance Period represents twenty nine (29) weeks of payments over and above what the Company in its discretion would award Employee if she did not sign this Agreement. In addition, Employee will receive a one time payment for a pro rata share of the fiscal 2017 Officers Incentive Compensation Plan, Group A Officers based on actual time worked during fiscal 2017. The exact amount of the payment for the pro rata bonus shall be determined following the close of the fiscal year 2017. Estimated payment date will be October 2017, but the payment date will be no later than November 1, 2017. Company will provide with the payment an accounting of the calculation of the payment sufficient enough to allow Employee to determine how pro rata share/bonus was calculated.

b.Health and Welfare Benefits. Employee’s health insurance shall terminate at the end of the month in which the separation date occurs, and thereafter Employee will be eligible for COBRA continuation coverage, provided she timely elects such coverage and meets the other conditions, including timely payment of monthly premiums. The Company shall pay Employee, in addition to the other payments described herein, a lump sum of $8,400.00, which is approximately equivalent to the premium cost of COBRA coverage during the Severance Period. This payment shall have no effect on the length of time COBRA coverage is available to Employee and is not intended to extend that time period. The payment shall be made within 30 days from the Separation Date, provided Employee has not rescinded the Agreement. All other benefits such as life insurance, disability insurance, 401(k) deferrals and match, and vacation accrual will cease as of Employee’s Separation Date.

c.Other Benefits. Employee had stock awards granted in October 2014, October 2015, and December 2016, which have unvested shares remaining. Upon this Agreement becoming enforceable, Company will take appropriate actions to have 9166 shares of the unvested shares vest (1,666 shares from the October 2014 grant, 5000 shares from the October 2015 grant,

and 2500 shares from the December 2016 grant). Employee shall not be entitled to any of the other unvested shares or stock options that are currently not vested. The balance of the stock award agreements provisions shall remain enforceable and appropriate taxes will be withheld from either the proceeds of shares sold, share withholding, other compensation payable hereunder, or as otherwise paid by Employee. Any earned, but unused vacation shall be paid in a lump sum within 30 days of the Separation Date. During her employment, Employee may have participated in other benefit plans at Winnebago. Employee will be eligible to continue participation in those plans to the extent permitted under the terms of the plan documents or agreements and her rights to benefits shall be and remain subject to the terms and conditions set forth in the plan documents or agreements.

d.Non-Disparagement By Company. Company agrees not to libel, slander or disparage the Employee to any individuals or groups.

3.The parties agree that the items identified in Paragraph 2 above are consideration in addition to any payments or other benefits to which Employee would otherwise be entitled, and include consideration of the waiver and release of claims set forth in paragraph 5 below.

4.Employee agrees:

a.She will not be entitled to, nor have any claim to, any compensation under (i) any other incentive compensation plan and/or (ii) any other compensation plan;

b.To cooperate with Company to complete or transfer all pending projects and employment matters as determined by the Company prior to the Separation Date;

c.To provide Company with reasonable cooperation and assistance, including accurate and truthful testimony at trial if deemed necessary, for all lawsuits or proceedings for which Employee’s testimony or cooperation may be warranted after the Separation Date. Company shall reimburse Employee for any reasonable and necessary expense incurred as a result of Employee’s cooperation and assistance;

d.To promptly return to Company no later than the Separation Date all Company materials and property, including but not limited to draft books, credit cards, cash advances, price books and customer lists, computers, and to file Employee’s final expense report;

e.Not to use, copy or disclose, directly or indirectly, to anyone not connected with Company any confidential information or trade secrets obtained during the term of Employee’s employment with Company including any memoranda, books, records, documents, or client lists for use outside of Company. In addition, the Confidentiality and Intellectual Property Rights Agreement signed by the Employee, shall continue in force indefinitely according to its terms and conditions;

f.Not to solicit current Company employees to leave such employment for a period of one year from the Separation Date;

g.Not to libel, slander or disparage the Company or its policies or practices to any individua or groups; and

h.For a period of one (1) year (any separation of my employment with Company for any reason (the “Non-competitive Period”), I agree not to accept employment with another company that competes, directly or indirectly, with Company or is a Material Supplier to Company within the United States or Canada. For purposes of this paragraph, “employment” includes, but is not limited to, any of the following roles: employee, advisor, consultant, independent contractor, principal, agent, partner, officer, director, shareholder (at all if the company is not publicly traded or owner of more than 5% of the outstanding shares if the company is publicly traded) or otherwise. Competing indirectly, for purposes of this Agreement, shall mean any activity that has a negative financial impact on Company. Material Supplier shall mean any supplier that sells goods to Winnebago, in the aggregate, of more than $10,000,000 annually as of the date of this Agreement which the parties have identified. I acknowledge that the geographic territory identified above represents a reasonable and appropriate geographic area for purposes of this Agreement. I will inform any new employer, prior to accepting employment, of the existence of this non-competition obligation and provide such employer with a copy of this Agreement. If my employment with Company ends, regardless of the reason, I acknowledge I will not be paid any additional compensation for this non-competition obligation. I agree that the foregoing restrictions are reasonable and necessary for the protection of the business and interests of Company and will not deprive me of the means or opportunity for suitably supporting and maintaining myself or my family, or for obtaining employment after my employment with Company ends.

5. Subject to Paragraph 5(b) below and as a material inducement to Company to enter into the Agreement, Employee, on Employee’s own behalf and on behalf of Employee’s heirs, executors, agents, administrators, successors, assigns and representatives, covenants not to sue and fully and forever releases, acquits and discharges Company, its shareholders, partners, officers, directors, employees, agents, attorneys, representatives, parents, subsidiaries, divisions, affiliated companies, joint venture companies, insurers, customers, suppliers, and successors (collectively the “Releasees”), of and from any and all actions, causes of action, claims and demands whatsoever (collectively “claims”) that Employee may have had, may now have, or may hereafter have against Releasees, including without limitation any and all claims in any way related to or based upon Employee’s employment with and/or Employee’s severance from employment with Company, including without limitation any claims for unpaid wages, breach of contract, implied contract, promissory estoppel, tortious conduct or claims arising under any federal or state statute or law or local ordinance, including but not limited to: the Age Discrimination in Employment Act (“ADEA”); the Older Workers Benefit Protection Act (“OWBPA”); the Americans with Disabilities Act as Amended (“ADAA”); the Family and Medical Leave Act (“FMLA”); Title VII of the Civil Rights Act of 1964; the Civil Rights Acts of 1991; the Employee Retirement Income Security Act (“ERISA”); the Worker Adjustment and Retraining Notification Act (“WARN”); Iowa’s or any other state’s fair employment practices laws; any other federal, state or local law, including without limitation, any other federal, state or local employment discrimination law; or claims arising under any public policy, contract or covenant (express or implied) or common law. Provided, however, that if the Company were to breach the Agreement, this release would not bar an action by Employee against the Company to enforce its term(s).

a.On Employee’s own behalf and on behalf of Employee’s heirs, executors, agents, administrators, successors, assigns and representatives, Employee specifically waives any right or claim under the Age Discrimination in Employment Act of 1967 as amended and the Older Workers Benefit Protection Act (collectively referred to as the “Act”). Employee acknowledges and agrees that this waiver of any right or claim under the Act (hereinafter “Waiver”) is knowing and voluntary, and specifically agrees as follows: (i) that this Waiver is part of a written agreement between Employee and the Company; (ii) that this Agreement and this Waiver are written in a manner which Employee understands; (iii) that this Waiver specifically relates to rights or claims arising under the Act; (iv) that Employee does not waive any rights or claims under the Act that may arise after the date of execution of this Agreement and Waiver as set forth below; (v) that Employee waives rights or claims under the Act arising on or before the execution date of this Agreement in exchange for consideration in addition to anything of value to which Employee is already entitled to receive; (vi) that Employee is hereby advised in writing to consult with an attorney prior to executing this Agreement and Waiver; (vii) that Employee has a period of twenty-one (21) days within which to consider this Agreement and Waiver; (viii) Employee’s execution of this Agreement during such 21 day period constitutes a waiver of the remainder of the period; and (ix) that for a period of seven (7) days following the execution of this Agreement and Waiver, Employee may revoke the Agreement and Waiver, and the Agreement and Waiver will not become effective or enforceable until the revocation period expires.

b.This Agreement covers both claims that Employee knows about and those Employee may not know about. Employee expressly waives all rights afforded by any statute that limits the effect of a release with respect to unknown claims. Employee understands the significance of Employee’s release of unknown claims and Employee’s waiver of statutory protection against a release of unknown claims.

c.This Agreement shall not affect Employee’s claims arising out of any social security, workers’ compensation or unemployment laws, any right employee may have to recover incentives for reporting misconduct by the Company or its employees, or under the terms of any employee pension or welfare or benefit plans or programs of the Company, which may be payable now or in the future to Employee.

d.Employee warrants and represents that, other than any as referenced in this Agreement, Employee has not filed a law suit or other complaint asserting any claims that are released in this Agreement. Should any person, organization or other entity file, claim, sue or cause or permit to be filed any civil action, suit or legal proceeding against any of the Releasees involving any matter occurring at any time up to the time Employee signs this Agreement, Employee agrees not to seek or accept any personal or monetary relief in such action or proceeding.

6.This Agreement shall not be construed as an admission by Company of any wrong doing or any violation of federal, state or local law, regulation or ordinance, and Company specifically disclaims any wrongdoing whatsoever against Employee on the part of itself, its employees, representatives or agents.

7.Employee represents and warrants that she is the sole owner of the actual or alleged claims, demands, rights, causes of action and other matters which are released herein; that the same

have not been transferred or assigned or caused to be transferred or assigned to any other person, firm, corporation or other legal entity; that they have obtained all approvals necessary to enter into this Agreement; and that she has the full right and power to grant, execute, and deliver the releases, undertakings and agreements contained herein.

8.It is understood and agreed that for purposes of this Agreement the term “Company” as used herein shall include Winnebago Industries, Inc., and any other subsidiaries,or affiliated companies, and all officers, directors and employees of any of the foregoing.

9.To the extent that any provision of this Agreement shall be deemed by any court to be unenforceable, such provision shall be deemed modified or omitted to the extent necessary to make the remaining provisions enforceable; in that event, the parties agree to use their best efforts to substitute a valid, legal and enforceable provision, which insofar as practical, implements the purpose of this Agreement.

10.Employee expressly acknowledges that Employee understands all the provisions of this Separation Agreement and General Release and is voluntarily entering into this Agreement and Release.

11.All disputes arising from this Agreement and otherwise between the Company and Employee as to state laws shall be governed by the laws of the State of Iowa. The venue for any dispute between the parties arising from this Agreement or otherwise shall be in Winnebago County, Iowa.

12.In addition to the other remedies allowed by law and this Agreement, if either party initiates any action or proceedings to enforce this Agreement, the prevailing party in such action or proceeding shall be entitled to recover the costs, including reasonable attorneys’ and expert witness fees.

13.This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof, and supersedes all prior oral or written agreements, commitments or understandings with respect thereto.

|

| | | | |

| | WINNEBAGO INDUSTRIES, INC. | |

| | | | |

/s/ Scott C. Folkers | | By: | /s/ Bret Woodson | 6/19/17 |

Witness | | | Bret Woodson | Date |

| | | Its Vice President, Human Resources | |

| | | | |

| | | | |

/s/ Scott C. Folkers | | | /s/ Sarah Nielsen | 6/15/17 |

Witness | | | Sarah Nielsen | Date |

| | | | |

| | | | |

This regulatory filing also includes additional resources:

wgo8knielsenseparationagreem.pdf

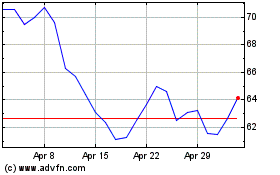

Winnebago Industries (NYSE:WGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

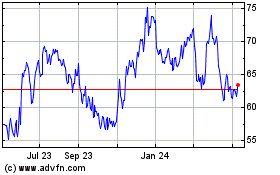

Winnebago Industries (NYSE:WGO)

Historical Stock Chart

From Apr 2023 to Apr 2024