___________________________________________________________________

___________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE,

SAVINGS AND SIMILAR PLANS PURSUANT TO SECTION

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

Commission file number 001-13836

Full title of the plan and the address of the plan, if different from the issuer named below:

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

Tyco International Management Company LLC

9 Roszel Road

Princeton, NJ 08540

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

JOHNSON CONTROLS INTERNATIONAL PLC

One Albert Quay,

Cork, Ireland

TYCO INTERNATIONAL PLC

(Former name, if changed since last report)

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

YEARS ENDED DECEMBER 31, 2016 AND 2015

|

|

|

|

|

|

|

|

|

Contents

|

Page

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2016 and 2015

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits for the year ended

December 31, 2016

|

|

|

|

|

|

Notes to the Financial Statements

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

Schedule H, Line 4i* - Schedule of Assets (Held at End of Year)

as of December 31, 2016**

|

|

|

|

|

|

Signature

|

|

|

|

|

|

Index to Exhibits

|

|

*Note: Refers to item number Form 5500 ("Annual Return/Report of Employee Benefit Plan") filed with the Department of Labor for the plan year ended December 31, 2016.

**Note: Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income and Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Administrator, Participants and Beneficiaries

of the Tyco International Retirement Savings and Investment Plan

We have audited the accompanying statements of net assets available for benefits of Tyco International Retirement Savings and Investment Plan (the "Plan") as of December 31, 2016 and 2015, and the related statement of changes in net assets available for benefits for the year ended December 31, 2016. The financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the year ended December 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

The supplemental schedule of assets (held at end of year) as of December 31, 2016 has been subjected to audit procedures performed in conjunction with the audits of the Plan's financial statements. The supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with U.S. Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule of assets (held at end of year) as of December 31, 2016, is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/

EisnerAmper LLP

Iselin, New Jersey

June 21, 2017

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

Interest in investments of the Tyco International Management

Company Defined Contribution Plans Master Trust

|

$

|

2,163,609,028

|

|

|

$

|

2,060,984,443

|

|

|

Interest in notes receivable of the Tyco International Management

Company Defined Contribution Plans Master Trust

|

62,127,240

|

|

|

63,611,664

|

|

|

Total interest in the net assets of the Tyco International

Management Company Defined Contribution Plans Master Trust

|

2,225,736,268

|

|

|

2,124,596,107

|

|

|

|

|

|

|

|

Employer contributions receivable

|

6,104,972

|

|

|

4,317,297

|

|

|

Participants' contributions receivable

|

2,208,543

|

|

|

1,517,895

|

|

|

Total receivables

|

8,313,515

|

|

|

5,835,192

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

2,234,049,783

|

|

|

$

|

2,130,431,299

|

|

See the notes to the financial statements

2

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

December 31, 2016

|

|

|

|

|

Additions

|

|

|

|

|

|

Investment income from the Tyco International Management Company Defined

Contribution Plans Master Trust

|

$

|

175,487,132

|

|

|

|

|

|

Participants' contributions

|

93,195,031

|

|

|

Employer contributions

|

55,368,431

|

|

|

|

148,563,462

|

|

|

|

|

|

Total additions

|

324,050,594

|

|

|

|

|

|

Deductions

|

|

|

|

|

|

Distributions and withdrawals

|

218,989,944

|

|

|

Administrative expenses

|

1,442,166

|

|

|

|

|

|

Total deductions

|

220,432,110

|

|

|

|

|

|

Net increase in net assets available for benefits

|

103,618,484

|

|

|

|

|

|

Net assets available for benefits, beginning of year

|

2,130,431,299

|

|

|

Net assets available for benefits, end of year

|

$

|

2,234,049,783

|

|

See the notes to the financial statements

3

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

NOTE 1 - DESCRIPTION OF THE PLAN

The Tyco International Retirement Savings and Investment Plan (the “Plan”) was established December 31, 1996 as a result of a spin-off of the hourly portion of the Kendall Employees’ Savings and Investment Plan (the “Kendall Plan”) and the merging of the Kendall Plan into a prior existing plan (prior to January 1, 2009, the Plan was known as Tyco International (US) Inc. Retirement Savings and Investment Plan III and for the period of January 1, 2009 through October 1, 2010, the Plan was known as Tyco International Retirement Savings and Investment Plan III). Effective October 1, 2010, the Plan name was changed to the Tyco International Retirement Savings and Investment Plan.

The Plan is a defined contribution plan sponsored by Tyco International Management Company, LLC (“TIMCO” or “Plan Sponsor”), and is available to certain salaried, union and non-union hourly employees of TIMCO and TIMCO affiliated companies. On September 2, 2016, Johnson Controls, Inc. ("JCI Inc.") and Tyco International plc (“Tyco”), TIMCO's parent company, completed a merger, with JCI Inc. being the surviving corporation in the merger and a wholly owned indirect subsidiary of Tyco. Following the merger, Tyco changed its name to "Johnson Controls International plc." The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”) and the Internal Revenue Code of 1986, as amended (the “Code”). Selected Plan provisions are described below. Participants should refer to the Plan document and summary plan description for more complete information regarding the terms of the Plan.

ELIGIBILITY

Plan participants must be at least eighteen years old. Union employees may have different eligibility requirements. Refer to the Plan document for more details.

CONTRIBUTIONS

Contributions are subject to Code limitations. Contributions to the Plan are funded on a per pay period basis.

Participants’ contributions

- Participants may contribute a percentage of their eligible compensation up to a specified amount. During 2016, the following contribution limits applied: (i) non-highly compensated employees may contribute up to 35% of eligible compensation on a combined before-tax and/or after-tax basis; (ii) highly-compensated employees may contribute up to 16% of eligible compensation on a before-tax basis and up to an additional 10% on an after-tax basis; and (iii) highly-compensated employees who are eligible to participate in the Tyco Supplemental Savings and Retirement Plan, a non-qualified deferred compensation plan, may contribute up to 16% on a before-tax basis not to exceed $17,000 and such employees are not eligible to make after-tax contributions. Union employees may have different contribution limits. Refer to the Plan document for more details.

Employer contributions

- Certain participant contributions are eligible to receive matching contributions. Additionally, up until May 1, 2015 certain employees were eligible to receive “supplemental” matching contributions based on their years of service with Tyco and its affiliated companies. As of May 1, 2015, the "supplemental" matching contributions were discontinued, and employees who previously received this matching contribution were to receive a service-related transition benefit for the remainder of 2015, as well as for the 2016 calendar year, which would be credited to their account in the first quarter of the following plan year. To receive the transition benefit, an employee must have been employed by Tyco on the last day of the plan year. The level of matching contributions and supplemental matching contributions varies for each participating employer in the Plan. Union employees may have different contribution limits. Refer to the Plan document for more details.

PARTICIPANT ACCOUNTS

Each participant’s account is credited with the participant’s deferral contributions, employer contributions, and an allocation of earnings or losses, and is charged with participant fees and his or her withdrawals, as applicable. Participants are entitled to the benefit in their respective accounts, to the extent vested.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

VESTING

Participants are immediately vested in any contributions they make to the Plan, plus actual earnings thereon. Vesting with respect to any matching contributions, and any associated earnings, is based on a participant’s years of “vesting service.” Effective January 1, 2002, participants who perform an hour of service on or after that date are fully vested in all employer contributions following completion of three years of vesting service. Any participant who performs an hour of service after January 1, 2002 and is covered under a former employer’s graded vesting schedule will become 100% vested after three years of vesting service, regardless of the prior employer’s graded vesting schedule. Prior to January 1, 2002, a participant was generally 100% vested after five years of vesting service. However, participants from a former employer’s plan that was merged into the Plan could continue to vest in accordance with the former plan’s vesting schedule.

FORFEITURES

Upon termination of employment for reasons other than a distributable event, nonvested contributions are forfeited on the earlier of the date the participant receives a total distribution of his vested account balance or the date the participant incurs five consecutive breaks in service. Nonvested forfeitures may be used to reduce employer contributions or to pay Plan expenses. During the year ended December 31, 2016, forfeitures of approximately $3,104,997 were used to reduce employer contributions and pay Plan expenses. As of December 31, 2016 and 2015, forfeited nonvested accounts totaled $177,393 and $275,365, respectively.

INVESTMENT OPTIONS

Plan participants are able to direct the investment of their Plan holdings (employer and employee contributions) into various investment options offered under the Plan on a daily basis.

NOTES RECEIVABLE FROM PARTICIPANTS

Participants are allowed to borrow from their Plan accounts. The minimum amount that a participant may borrow is $1,000. The maximum amount that a participant may borrow is the lesser of: (i) 50% of the participant’s vested account balance; or (ii) $50,000 less the highest loan balance outstanding in the previous twelve months. Participants are allowed to have two loans outstanding at a time. Loans are adequately secured by the participant’s account balance and bear a reasonable interest rate. Loans must be repaid through payroll deductions. Upon termination of service, all loans must be repaid in full. As of December 31, 2016, interest rates on notes receivable from participants ranged from 3.25% to 9.50%. As of December 31, 2016 and 2015, notes receivable from participants totaled $62,127,240 and $63,611,664, respectively.

PAYMENT OF BENEFITS

Upon termination of service, death, disability or retirement, a participant may elect to receive either a lump sum distribution equal to the participant’s vested interest in his or her account, or to have an annuity purchased by the Plan with the vested interest in the participant’s account, in accordance with the terms of the Plan document.

ADMINISTRATIVE EXPENSES

At the present time, some of the expenses of administering the Plan, including the fees of the Plan trustee, consultants and auditor expenses, but excluding certain loan fees, hardship withdrawal fees and Qualified Domestic Relations Order processing fees, are paid by the Company and its affiliated employers and/or from Plan forfeitures. The costs associated with certain investment options such as management fees, brokerage fees and transfer taxes are deducted from the assets of the investment options and are generally assessed as a percentage of assets invested. Additionally, plan participants with account balances are assessed recordkeeping and administration fees. Fidelity Management Trust Company ("Fidelity"), the trustee for the Tyco International Management Company Defined Contribution Plans Master Trust (the "Master Trust"), automatically deducts these fees from participant accounts on a quarterly basis. The quarterly fees are subject to change and were $7.50 per account during 2016.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

PLAN ADMINISTRATION

The Plan is administered by the Retirement Plans Investment Committee of Johnson Controls International plc. Fidelity Workplace Services LLC maintains the participant accounts as record keeper of the Plan.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying financial statements of the Plan are prepared on the accrual basis of accounting in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP").

USE OF ESTIMATES

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

NOTES RECEIVABLE FROM PARTICIPANTS

Notes receivable from participants are reported at their unpaid principal balance plus any accrued but unpaid interest, with no allowance for credit losses, as repayments of principal and interest are received through payroll deductions and the notes are collateralized by the participants’ account balances. Amounts are presented as other receivables in the Master Trust.

INVESTMENT VALUATION AND INCOME RECOGNITION

The Plan participates in the Master Trust, which consisted of only the Tyco International Retirement Savings and Investment Plan as of December 31, 2016 and 2015 and for the year ended December 31, 2016.

The Plan’s interest in the investments of the Master Trust is reported at fair value based on the fair values of the underlying investments held in the Master Trust. Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The Plan records its interest in the investments and notes receivable from participants held in the Master Trust and investment income or loss from the Master Trust (including interest, dividends, net unrealized and realized gains and losses) based upon each plan participants’ ownership in the underlying participant-directed investments and notes receivable comprising the Master Trust. Expenses for participant loans and hardship withdrawals are allocated on a participant basis. Other expenses that are offset against forfeitures are specifically charged to the Plan, as applicable. Certain investment management fees are offset against investment income.

Accounting Standards Codification ("ASC") 820, "Fair Value Measurement," defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a three-level fair value hierarchy that prioritizes information used in developing assumptions when pricing an asset or liability as follows:

|

|

|

|

|

|

Level 1:

|

Observable inputs such as quoted prices in active markets;

|

|

Level 2:

|

Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

|

|

Level 3:

|

Unobservable inputs where there is little or no market data, which requires the reporting entity to develop its own assumptions.

|

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

The fair values of the underlying investments of the Master Trust are determined as follows:

Interest-bearing Cash:

Interest-bearing cash is composed of various money market funds. The fair values have been determined based upon their quoted redemption prices and recent transaction prices of $1.00 per share (level 2 inputs), with no discounts for credit quality or liquidity restrictions.

Mutual Funds:

The fair value for Mutual Funds is determined by direct quoted market prices. Mutual funds are open-ended investments that obtained proper registration from the Securities and Exchange Commission. The funds publish daily their Net Asset Value ("NAV") after the close of trading on regulated financial exchanges. The NAV represents the current market value of the fund's holdings after deducting the fund's liabilities. The Plan’s Mutual Funds include investment in equity, bond, balanced (equities and bonds) and money market funds.

Common Stock:

The fair value for the Johnson Controls International plc Stock Fund ("JCI plc Stock Fund"), formerly known as the Tyco International Stock Fund ("Tyco Stock Fund"), and the Adient Stock Fund is determined by indirect quoted market prices. The value of the funds are not published, but the investment manager reports daily the underlying holdings. The underlying holdings are direct quoted market prices on liquid and regulated financial exchanges. The fair value of the investments in the JCI plc Stock Fund and Adient Stock Fund reflect a unit value computed daily based on the share price and the value of the fund's short-term investments. At December 31, 2016, the Plan held 5,588,635 units of the JCI plc Stock Fund at a unit value of $8.43. At December 31, 2016, the Plan held 537,834 units of the Adient Stock Fund at a unit value of $12.48. At December 31, 2015, the Plan held 5,001,626 units of the Tyco Common Stock Fund at a unit value of $7.48.

Separately Managed Accounts:

Separately managed accounts are valued based on the underlying net assets, which are primarily valued using quoted market prices (level 1 inputs). As of December 31, 2016 and 2015, the Master Trust held one separately managed account, the T. Rowe Price Large Cap Value Fund. The separately managed account is a portfolio tailored and maintained by a portfolio manager. Participants receive units in the fund valued daily, representing a mix of the underlying assets. The fund seeks to provide long-term capital appreciation with income as a secondary objective by investing in attractively priced stocks of companies with market values greater than $10 billion with promising financial outlooks and the potential for improved investor perceptions. The common stock invested in by the fund are in various different market sectors, with the most predominant being financial services, industrials, healthcare, consumer cyclical, and energy.

Collective Trusts:

Collective trusts are valued based on their net asset values, as reported by custodians as of the financial statement dates and prices of recent transactions (level 2 inputs). The NAV is used as a practical expedient to estimate fair value. The investment objectives and underlying investments of the collective trusts vary. One of the collective trusts holds an interest in an underlying U.S. debt index fund and a money market fund which seeks investment results that correspond to the price and yield performance, before fees and expenses, of the Barclays U.S. Aggregate Bond Index. Another collective trust holds a portfolio of equity investments that seek to approximate the performance of the S&P Mid-Cap 400 Index, and another invests primarily in common stocks of domestic and foreign issuers which the collective trust manager believes offer the potential for above-average growth. A number of collective trusts seek to achieve a high total return through investments in a combination of domestic and international equity and debt based on the fund’s target retirement date. The target retirement date funds automatically reduce the equity allocation as the participant approaches the targeted retirement year and beyond. Each collective trust held through the Plan’s interest in the Master Trust provides for daily redemptions by the Plan at reported net asset values per share but retains the right to require up to 15 days of advance notice.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

BENEFIT PAYMENTS

Benefit payments to participants are recorded when distributed.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

NEW ACCOUNTING PRONOUNCEMENTS

Recently Adopted Accounting Pronouncements

In July 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-12 "Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient." Only Part II of ASU 2015-12 is applicable to the Plan. Part II of ASU 2015-12 eliminates the requirements to disclose individual investments that represent 5 percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. It also simplifies the level of disaggregation of investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investments by nature, characteristics, and risks. ASU 2015-12 was effective retrospectively for fiscal years beginning after December 15, 2015. The Plan adopted Part II of this guidance for the plan year ended December 31, 2016 and applied the change retrospectively to all periods presented. The adoption of this guidance did impact disclosures in the notes to the financial statements, but did not impact the net assets available for benefits.

In May 2015, the FASB issued ASU No. 2015-07, "Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent)." ASU No. 2015-07 removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. Such investments should be disclosed separate from the fair value hierarchy. The Plan adopted this guidance for the plan year ended December 31, 2016 and applied the change retrospectively to all periods presented. The adoption of this guidance only impacts disclosures in the notes to the financial statements.

Recently Issued Accounting Pronouncements

In February 2017, the FASB issued Accounting Standards Update ASU No. 2017-06, "Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting." ASU No. 2017-06 clarifies the presentation requirements by a plan's interest in a master trust and requires disclosure of the dollar amount of the plan's interest in each investment type held by a master trust, as well as disclosure of the master trust's other assets and liabilities, and the dollar amount of the plan's interest in each of those balances. ASU No. 2017-06 is effective for fiscal years beginning after December 15, 2018 with early adoption permitted, and will be applied retrospectively to all periods presented. The Company is currently evaluating the impact the adoption of the guidance will have on the Plan’s financial statements.

NOTE 3 - INCOME TAX STATUS

The Plan was amended and restated effective January 1, 2016. On May 17, 2017, the Internal Revenue Service stated that the Plan, as then designed, was in compliance with the applicable requirements of the Code. Although the Plan has been amended since it was restated, Plan management believes that the Plan is designed and being operated in compliance with the applicable requirements of the Code. Therefore Plan management believes that the Plan was qualified and the related trust was tax-exempt as of the financial statement date.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2016 and 2015, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by the Department of Labor or Internal Revenue Service. There are currently no audits in progress.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

NOTE 4 - PLAN TERMINATION

Although it has not expressed any intent to do so, the Plan Sponsor has the right under the Plan to discontinue its contributions at any time and to amend or terminate the Plan subject to the provisions of the Plan and ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

NOTE 5 - RELATED PARTIES AND PARTIES-IN-INTEREST TRANSACTIONS

As discussed in Note 1, "Description of the Plan," of the notes to the financial statements, JCI Inc. and Tyco completed a Merger on September 2, 2016. Prior to the Merger, the underlying investments of the Master Trust included a unitized stock fund, the Tyco Stock Fund, which was comprised of a short-term investment fund component and ordinary shares of Tyco. As of the Merger Date, each Tyco share held within the Tyco Stock Fund was consolidated into 0.955 shares, Tyco International plc changed its name to Johnson Controls International plc and started trading on New York Stock Exchange under JCI Inc.’s existing ticker symbol “JCI”. The units held in the Tyco Stock Fund were exchanged to the new JCI plc Stock Fund, which is also a unitized stock fund.

The total value of the Plan’s investment in the Tyco Stock Fund was approximately $37.4 million at December 31, 2015. For the period from January 1, 2016 to September 2, 2016, the Plan purchased units in the Tyco Stock Fund of approximately $7.4 million, sold units of approximately $6.1 million and had net appreciation in the fair value of investments of approximately $18.4 million. On the Merger Date, the units of the Tyco Stock Fund of approximately $57.1 million were exchanged into the JCI plc Stock Fund as described above, and the Tyco Stock Fund ceased to exist.

On October 31, 2016, Johnson Controls International plc completed the spin-off of its Automotive Experience business by way of transfer to Adient plc and the issuance of ordinary shares of Adient directly to holders of Johnson Controls ordinary shares on a pro rata basis. Each participant received one share of the new Adient Stock Fund for every ten shares of JCI plc Stock fund that they held in the Plan immediately preceding the spin-off. A new Adient Stock Fund was established in the Plan in order to hold distributed shares. The Adient Stock Fund is a closed investment in the Plan, which means balances can be taken out of the Adient Stock Fund but no new contributions or exchanges can be made into this Fund.

The units of JCI plc Stock Fund of approximately $5.6 million were distributed into the Adient Stock Fund units at the date of the spin-off. For the period from October 31, 2016 to December 31, 2016, the Plan sold units in the Adient Stock Fund of approximately $0.4 million and had net appreciation in the fair value of investments of approximately $1.5 million. The total value of the Plan’s investment in the Adient Stock Fund was approximately $6.7 million at December 31, 2016.

For the period from September 2, 2016 to December 31, 2016, the Plan purchased units in the JCI plc Stock Fund of approximately $8.1 million, sold units of approximately $3.9 million and had net depreciation in the fair value of investments of approximately $8.6 million. The total value of the Plan’s investment in the JCI Plc Stock Fund was approximately $47.1 million at December 31, 2016.

The unit values of the Tyco Stock Fund, JCI plc Stock Fund and Adient Stock Fund are recorded and maintained by Fidelity and the Plan. Plan participants may direct up to 25% of their employee and employer contributions to the JCI plc Stock Fund. In addition, participants may exchange a portion of their account balance into the JCI plc Stock Fund, provided the transaction does not cause the portion of their account balance invested in the JCI plc Stock Fund to exceed 25%.

Certain of the assets of the Master Trust are invested in registered investment companies managed by Fidelity Investments, for which Fidelity Management & Research Company (“FMR Co.”) provides investment advisory services. FMR Co. is an affiliate of both Fidelity, and Fidelity Workplace Services, LLC, record keeper of the Plan. Expenses paid to FMR Co. and/or its affiliates by the Plan during the year ended December 31, 2016 were $1,207,419. These transactions and investments, as well as participant loans, qualify as exempt “party-in-interest” transactions, as “party-in-interest” is defined under Department of Labor regulations as any fiduciary of the Plan, any party rendering services to the Plan, the Company and certain others.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

NOTE 6 - RISK AND UNCERTAINTIES

The Master Trust, in which the Plan holds an interest, invests in various investments. Investments are exposed to various risks such as interest rate, market, liquidity, and credit risks. Due to the level of risk associated with certain investments and the sensitivity of certain fair value estimates to changes in valuation assumptions, it is at least reasonably possible that changes in the values of investments will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits.

Plan participants direct the investment of their Plan holdings into various investment options offered under the Plan and solely bear the risk of loss associated with the investment securities in which they are invested.

NOTE 7 - INVESTMENTS IN THE MASTER TRUST

As explained in Note 2, the Plan participates in the Master Trust, which consisted of only the Tyco International Retirement Savings and Investment Plan as of December 31, 2016 and 2015 and for the year December 31, 2016. Fidelity holds the Master Trust’s investment assets, provides administrative functions for the Plan and executes investment transactions as directed by participants.

The Plan’s relative share of ownership of the total net assets of the Master Trust was 100% as of both December 31, 2016 and 2015. The following table presents net assets held in the Master Trust, including fair value of investments held in the Master Trust, as of December 31, 2016 and 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

Investments at fair value as determined by quoted market price (direct):

|

|

|

|

|

|

Interest-bearing Cash

|

|

$

|

3,850,617

|

|

|

$

|

2,282,149

|

|

|

Mutual Funds

|

|

724,106,003

|

|

|

706,618,971

|

|

|

|

|

|

|

|

|

Investments at fair value as determined by quoted market price (indirect):

|

|

|

|

|

|

Common Stock Funds

|

|

53,166,055

|

|

|

37,158,484

|

|

|

Separately Managed Accounts

|

|

142,556,388

|

|

|

125,962,107

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

62,127,240

|

|

|

63,611,664

|

|

|

Net assets available for benefits at fair value

|

|

985,806,303

|

|

|

935,633,375

|

|

|

|

|

|

|

|

|

Investments measured at net asset value, as practical expedient:

|

|

|

|

|

|

Collective Trusts

|

|

1,239,929,965

|

|

|

1,188,962,732

|

|

|

Net assets available for benefits

|

|

$

|

2,225,736,268

|

|

|

$

|

2,124,596,107

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

Investment income for the Master Trust for the year ended December 31, 2016 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

December 31, 2016

|

|

|

|

|

Investment income

|

|

|

Net appreciation in fair value of investments:

|

|

|

Mutual Funds

|

$

|

31,254,029

|

|

|

Common Stock Funds

|

4,059,573

|

|

|

Collective Trusts

|

91,740,946

|

|

|

Separately Managed Accounts

|

16,829,140

|

|

|

Total net appreciation in fair value of investments

|

143,883,688

|

|

|

|

|

|

Other investment income

|

29,642,114

|

|

|

Interest on notes receivable from participants

|

1,961,330

|

|

|

Total investment income

|

$

|

175,487,132

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

The following table sets forth by level, within the fair value hierarchy, the Master Trust’s investments measured at fair value on a recurring basis as of December 31, 2016 and 2015;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of

|

|

|

|

December 31, 2016

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Interest-bearing Cash

|

|

$

|

—

|

|

|

$

|

3,850,617

|

|

|

$

|

—

|

|

|

$

|

3,850,617

|

|

|

Mutual Funds

|

|

724,106,003

|

|

|

—

|

|

|

—

|

|

|

724,106,003

|

|

|

Common Stock Funds

|

|

53,166,055

|

|

|

—

|

|

|

—

|

|

|

53,166,055

|

|

|

Separately Managed Accounts

|

|

142,556,388

|

|

|

—

|

|

|

—

|

|

|

142,556,388

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments in the Fair Value Hierarchy

|

|

919,828,446

|

|

|

3,850,617

|

|

|

—

|

|

|

923,679,063

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments Measured at Net Asset Value, as Practical Expedient:

|

|

|

|

|

|

|

|

|

|

Collective Trusts *

|

|

|

|

|

|

|

|

1,239,929,965

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments

|

|

|

|

|

|

|

|

$

|

2,163,609,028

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of

|

|

|

|

December 31, 2015

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Interest-bearing Cash

|

|

$

|

—

|

|

|

$

|

2,282,149

|

|

|

$

|

—

|

|

|

$

|

2,282,149

|

|

|

Mutual Funds

|

|

706,618,971

|

|

|

—

|

|

|

—

|

|

|

706,618,971

|

|

|

Common Stock Funds

|

|

37,158,484

|

|

|

—

|

|

|

—

|

|

|

37,158,484

|

|

|

Separately Managed Accounts

|

|

125,962,107

|

|

|

—

|

|

|

—

|

|

|

125,962,107

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments in the Fair Value Hierarchy

|

|

869,739,562

|

|

|

2,282,149

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments Measured at Net Asset Value, as Practical Expedient:

|

|

|

|

|

|

|

|

|

|

Collective Trusts *

|

|

|

|

|

|

|

|

1,188,962,732

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments

|

|

|

|

|

|

|

|

$

|

2,060,984,443

|

|

* As discussed in Note 2, "Summary of Significant Accounting Policies" of the notes to the financial statements, ASU No. 2015-07 allows investments measured at NAV as a practical expedient to be excluded from the fair value hierarchy. The fair value amounts presented herein are intended to permit reconciliation of total investments to the statement of net assets available for benefits.

For the year ended December 31, 2016 there were no transfers of investments between Level 1 and Level 2.

NOTE 8 - RECLASSIFICATIONS

Certain prior period reclassifications have been made to conform to the current period presentation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

|

|

SCHEDULE H, 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

PLAN #032, EIN: 20-5073412

|

|

DECEMBER 31, 2016

|

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Cost

|

|

Current Value

|

|

*

|

|

Notes receivable from participants

|

|

3.25% - 9.50%

|

|

|

|

$

|

62,127,240

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Represents a party-in-interest

|

|

|

|

|

|

|

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the members of the Johnson Controls International PLC Employee Benefit Policy Committee have duly caused this annual report to be signed by the undersigned thereunto duly authorized.

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

By:

/s/

Brian J. Stief

Brian J. Stief

Executive Vice President and Chief Financial Officer

JOHNSON CONTROLS INTERNATIONAL PLC

June 21, 2017

TYCO INTERNATIONAL RETIREMENT SAVINGS AND INVESTMENT PLAN

INDEX TO EXHIBITS

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

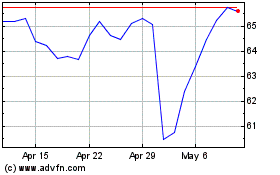

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024