WPP's Martin Sorrell Says Whole Foods Deal Could Up Amazon's Ad Game

June 21 2017 - 1:07PM

Dow Jones News

By Jack Marshall

Google and Facebook continue to strengthen their grip on the

online advertising market, but there's another "gorilla in the

room" that troubles WPP Chief Executive Martin Sorrell more:

Amazon.

The online retail giant has for years been described by ad

executives as a "sleeping giant" in the digital advertising world,

but its $13.4 billion acquisition of grocery chain Whole Foods

could further strengthen Amazon's ability to influence how and

where WPP's clients choose to spend their money, Mr. Sorrell

said.

The deal could extend Amazon's already powerful data about

consumers' online behaviors and consumption habits to real-world

stores.

The Whole Foods deal "is going to change the way clients control

their budgets and think about their budgets in a meaningful way,"

Mr. Sorrell said in an interview hosted by the Financial Times at

the Cannes Lions advertising festival on Wednesday.

Amazon still isn't a big digital ad player -- eMarketer predicts

it will generate $1.81 billion in ad revenue worldwide this year,

for a 0.8% market share.

Beyond Amazon, Mr. Sorrell once again expressed concern about

the growing power of the online ad "duopoly" of Google and

Facebook, and their changing role in the digital media

landscape.

The two companies currently control 75% of digital advertising,

he estimated, but WPP questions the transparency they provide given

their surging revenues, margins and market caps. (Emarketer

estimates that the tech titans earned 77 cents of each new dollar

spent on digital advertising in the U.S. last year.)

"Who knows how their algorithms work? Their algorithms change

and there's no explanation," Mr. Sorrell said.

He said the duo should take more responsibility for the content

that's hosted on their platforms and behave like media

companies.

"In my view Google and Facebook are media companies, they are

not technology companies. They are responsible for the content they

distribute and they can't walk away from that," he said.

Representatives for Google and Facebook had no immediate

comment.

Some advertisers pulled their spending from Google and YouTube

earlier this year after revelations their ads ran alongside

objectionable content. Google has made efforts to win them back,

including improving the technology that screens videos and giving

marketers more control. Those efforts have won over many marketers,

though other notable ones still remain on the sidelines.

Write to Jack Marshall at Jack.Marshall@wsj.com

(END) Dow Jones Newswires

June 21, 2017 12:52 ET (16:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

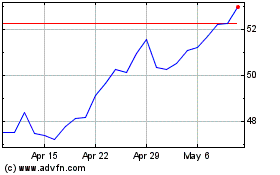

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024