Report of Foreign Issuer (6-k)

June 21 2017 - 8:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

21 June

2017

LLOYDS BANKING GROUP

plc

(Translation of registrant's name into

English)

5th Floor

25 Gresham Street

London

EC2V 7HN

United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

________

Index

to Exhibits

Item

No.1

Regulatory News

Service Announcement, dated 21 June 2017

re: Results of tender offer for certain USD notes

21 June

2017

LLOYDS BANK PLC - RESULTS OF TENDER OFFER FOR CERTAIN OF ITS

OUTSTANDING USD NOTES

Lloyds

Bank plc ("Lloyds Bank" or the "Offeror") is today announcing the

final results of its previously announced cash tender offer (the

"Offer") for any and all of certain series of outstanding U.S.

dollar denominated notes issued by Lloyds Bank plc and guaranteed

by Lloyds Banking Group plc (the "Notes"). The Offer was made on

the terms and subject to the conditions set out in the Offer to

Purchase dated 12 June 2017 (the "Offer to Purchase") and the

related notice of guaranteed delivery.

Capitalised

terms not otherwise defined in this announcement have the same

meaning as in the Offer to Purchase.

Based

on information provided by the Tender Agent, $257,235,000 in

aggregate principal amount of the Notes listed in the table below

were validly tendered and not validly withdrawn by 5:00 p.m., New

York City time, on 20 June 2017 (the "Expiration Deadline"), as

more fully set forth below. The Offeror has accepted all Notes that

were validly tendered and not validly withdrawn prior to the

Expiration Deadline. The Settlement Date is expected to be 23 June

2017. In addition, $1,175,000 in aggregate principal amount of the

Notes were tendered using the guaranteed delivery

procedures.

The

table below sets forth, among other things, the principal amount of

each series of Notes validly tendered and not validly withdrawn at

or prior to the Expiration Deadline:

|

Notes

|

ISIN/CUSIP

|

Principal Amount Outstanding

|

Aggregate Principal Amount Tendered Excluding Notes Tendered Using

Guaranteed Delivery Procedures

|

Aggregate Principal Amount Tendered Using Guaranteed Delivery

Procedures

|

Purchase Price Per $1,000 Principal Amount of Notes

|

|

2.350%

Senior Notes due 2019 (Series 1)

|

US53944VAB53

53944VAB5

|

$466,152,000

|

$112,051,000

|

$1,175,000

|

$1,008.34

|

|

2.400%

Senior Notes due 2020 (Series 2)

|

US53944VAE92

53944VAE9

|

$466,899,000

|

$70,425,000

|

$0

|

$1,009.03

|

|

3.500%

Senior Notes due 2025 (Series 3)

|

US53944VAH24

53944VAH2

|

$515,222,000

|

$74,759,000

|

$0

|

$1,043.90

|

FURTHER INFORMATION

Lucid

Issuer Services Limited acted as tender agent for the Offer. Lloyds

Securities Inc. acted as Dealer Manager. Questions regarding the

Offer should be directed to Lloyds Securities Inc. at +1 (855)

400-6511 (U.S. Toll-Free) or +1 (212) 827-3105 (U.S.

Collect).

CONCURRENT NON-U.S. OFFER

On 12

June 2017, the Offeror also launched a capped tender offer (the

"Non-U.S. Offer") in respect of certain of Lloyds Bank's

outstanding euro and pound sterling denominated debt securities.

This announcement does not relate to the Non-U.S.

Offer.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

LLOYDS

BANKING GROUP plc

(Registrant)

By: Douglas

Radcliffe

Name: Douglas

Radcliffe

Title: Group

Investor Relations Director

Date: 21

June 2017

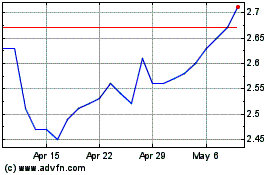

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

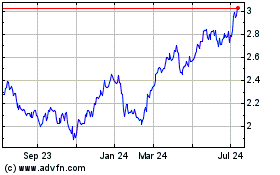

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024