Current Report Filing (8-k)

June 20 2017 - 5:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June

20, 2017

Akoustis

Technologies, Inc.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

001-38029

|

33-1229046

|

|

(State or Other Jurisdiction

|

(Commission File

|

(I.R.S. Employer

|

|

of Incorporation)

|

Number)

|

Identification Number)

|

9805 Northcross Center Court, Suite H

Huntersville, NC 28078

(Address of principal executive offices, including

zip code)

704-997-5735

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(

see

General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

þ

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item

1.01 Entry into a Material Definitive Agreement.

On June 20, 2017, Akoustis Technologies, Inc. (the “Company”) executed a purchase order (the “Purchase

Order”) to purchase a thin film material deposition tool, which will be used to grow thin film materials for the

Company’s RF Filter applications (the “Deposition Tool”), from AIXTRON, Inc. (“AIXTRON”) for an aggregate

purchase price of $2.1 million, exclusive of materials necessary for the installation and completion of commissioning the

Deposition Tool’s use. The Company will also be responsible for the costs of international shipment, import, and onsite

preparation for installation and delivery.

The Company has

remitted a $630,000 deposit on the Deposition Tool, as required by the terms and conditions of the Purchase Order, and the

Company expects to satisfy the remainder of the purchase price with either cash on hand and/or through debt financing. The

final payment will be due upon signed final acceptance of the Deposition Tool at our New York facility, but no later than 90

days after the scheduled shipment, which is scheduled to occur in the late third quarter or early fourth quarter of 2017.

Failure to satisfy the Company’s obligations under the Purchase Order could subject the Company to liquidated damages

in the amount of 8% of the purchase price.

Performance

of the Deposition Tool is required to be demonstrated to mutually agreed and defined performance specifications. The

Deposition Tool will be subject to three acceptance tests to prove that it meets the agreed specifications related to system

hardware, software, and basic functionality. If the installation and acceptance tests cannot be completed within six months

from the scheduled shipment date, unless such delay is agreed to in writing or caused by AIXTRON or certain other events, the

Company must reimburse AIXTRON for the additional costs for the installation and commissioning of the Deposition Tool. In

addition, the Company is required to indemnify AIXTRON and its agents, employees, or subcontractors for certain injuries and

damages, if any, incurred by them during the performance of their duties under the sales terms and conditions attached to the

Purchase Order.

The purchase of the

Deposition Tool is governed by the laws of the Federal Republic of Germany, excluding its conflicts of laws rules and excluding

the United Nations Convention on Contracts for the International Sale of Goods.

The foregoing description

of the Purchase Order is qualified in its entirety by reference to the Purchase Order, attached hereto as Exhibit 10.1 and incorporated

herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits:

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Purchase

Order for Deposition Tool

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AKOUSTIS TECHNOLOGIES, INC.

|

|

|

|

|

|

By:

|

/s/ Jeffrey B. Shealy

|

|

|

|

Name: Jeffrey B. Shealy

|

|

|

|

Title: Chief Executive Officer

|

Date: June 20, 2017

EXHIBIT INDEX

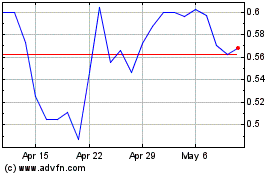

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

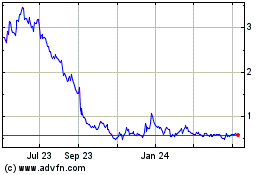

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Apr 2023 to Apr 2024