Regional Management Corp. Enters into Warehouse Facility and Increases Availability Under Senior Revolving Credit Facility

June 20 2017 - 4:37PM

Business Wire

- Warehouse Facility Initial Committed Line of

$125 Million; Expandable to $150 Million -

- Senior Revolver Commitment Increased to $638

Million and Maturity Extended to June 2020 -

Regional Management Corp. (NYSE:RM), a diversified consumer

finance company, announced today that it and its wholly-owned

subsidiary, Regional Management Receivables II, LLC, have entered

into a revolving $125 million warehouse facility, which is

expandable to $150 million and will be funded by large loan

receivables. The warehouse facility has an initial term of 18

months, to be followed by a 12-month amortization period. Credit

Suisse is acting as the structuring and syndication agent and Wells

Fargo is acting as the administrative agent.

In addition, Regional Management announced that it has amended

and restated its senior revolving credit facility agreement. The

committed line under the senior revolver has increased to $638

million from its previous amount of $585 million, and the maturity

date has been extended to June 2020. The upper limit of the

accordion feature has also been increased to $700 million from its

previous amount of $650 million. Other borrowing terms under the

facility, including the cost of funds, remain largely

unchanged.

The amended and restated senior revolving credit facility allows

for both the new warehouse facility and for subsequent

securitizations using warehouse collateral, subject to the

satisfaction of certain limited conditions.

“The establishment of our new warehouse facility, along with the

increase in our senior revolving credit facility, is a testament to

the strength of our business and will provide us with significant

additional capability to fund our strategic growth initiatives,”

said Peter R. Knitzer, President and Chief Executive Officer of

Regional Management. “We look forward to our new relationship with

our warehouse facility lenders and very much appreciate the ongoing

long-term support of our senior revolver bank group, including the

group’s newest members, BankUnited and Synovus.”

Forward-Looking Statements

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, which represent Regional Management Corp.’s

expectations or beliefs concerning future events. Words such as

“may,” “will,” “should,” “likely,” “anticipates,” “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,”

and similar expressions may be used to identify these

forward-looking statements. Such forward-looking statements are

about matters that are inherently subject to risks and

uncertainties, many of which are outside of the control of Regional

Management. Factors that could cause actual results or performance

to differ from the expectations expressed or implied in such

forward-looking statements include, but are not limited to, the

following: changes in general economic conditions, including levels

of unemployment and bankruptcies; risks associated with Regional

Management’s transition to a new loan origination and servicing

software system; risks related to opening new branches, including

the ability or inability to open new branches as planned; risks

inherent in making loans, including repayment risks and value of

collateral, which risks may increase in light of adverse or

recessionary economic conditions; changes in interest rates; the

risk that Regional Management’s existing sources of liquidity

become insufficient to satisfy its needs or that its access to

these sources becomes unexpectedly restricted; changes in federal,

state, or local laws, regulations, or regulatory policies and

practices, and risks associated with the manner in which laws and

regulations are interpreted, implemented, and enforced; the timing

and amount of revenues that may be recognized by Regional

Management; changes in current revenue and expense trends

(including trends affecting delinquencies and credit losses);

changes in Regional Management’s markets and general changes in the

economy (particularly in the markets served by Regional

Management); changes in the competitive environment in which

Regional Management operates or in the demand for its products;

risks related to acquisitions; changes in operating and

administrative expenses; and the departure, transition, or

replacement of key personnel. Such factors and others are discussed

in greater detail in Regional Management’s filings with the

Securities and Exchange Commission. Regional Management will not

update the information contained in this press release beyond the

publication date, except to the extent required by law, and is not

responsible for changes made to this document by wire services or

Internet services.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer

finance company providing a broad array of loan products primarily

to customers with limited access to consumer credit from banks,

thrifts, credit card companies, and other traditional lenders.

Regional Management began operations in 1987 with four branches in

South Carolina and has since expanded its branch network across

South Carolina, Texas, North Carolina, Tennessee, Alabama,

Oklahoma, New Mexico, Georgia, and Virginia. Each of its loan

products is structured on a fixed rate, fixed term basis with fully

amortizing equal monthly installment payments and is repayable at

any time without penalty. Regional Management’s loans are sourced

through its multiple channel platform, including in its branches,

through direct mail campaigns, independent and franchise automobile

dealerships, online credit application networks, retailers, and its

consumer website. For more information, please visit

www.RegionalManagement.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170620006487/en/

For Regional Management Corp.Investor RelationsGarrett Edson,

203-682-8331

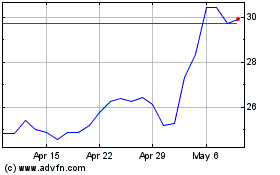

Regional Management (NYSE:RM)

Historical Stock Chart

From Mar 2024 to Apr 2024

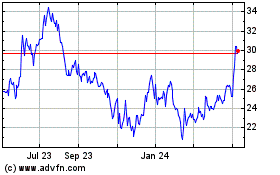

Regional Management (NYSE:RM)

Historical Stock Chart

From Apr 2023 to Apr 2024