Current Report Filing (8-k)

June 20 2017 - 4:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 8-K

_______________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 14, 2017

_______________________________________________

Perrigo Company plc

(Exact name of registrant as specified in its charter)

_______________________________________________

Commission file number 001-36353

|

|

|

|

|

|

|

Ireland

|

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland

|

|

-

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

+353 1 7094000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On June 14, 2017, the Remuneration Committee recommended to the Board of Directors, and the Board of Directors approved, changes to payments and the treatment of outstanding equity awards upon certain termination events for certain executive officers of the Company.

Under a new executive severance plan (the “Plan”), in the event of termination without “cause” or resignation for “good reason” (each as defined in the Plan) during the period from the approval date of the Plan until 12 months after the date on which a successor to John T. Hendrickson commences employment as the Company’s Chief Executive Officer (the “Transition Period”), participating executives will be entitled to 1.5 times the sum of base salary and target bonus payable over an 18-month severance period, and during the severance period, the Company will continue to pay the employer portion of COBRA premiums. Consistent with the Company’s prior severance plan already in effect, participating executives will also be entitled to a pro rata bonus payment based on actual performance for the year of termination and up to $25,000 of career transition assistance. The Plan will terminate at the end of the Transition Period. During the term of the Plan, to the extent more favorable, executive officers who are U.S. or Belgian employees (other than Mr. Hendrickson) will receive payments and benefits under the Plan instead of those that would have been provided under the Company’s other severance arrangements.

If any executive officer of the Company (other than Mr. Hendrickson) is terminated without “cause” or resigns for “good reason” during the Transition Period, his or her unvested equity awards outstanding under the Company’s Long-Term Incentive Plan will continue to vest per their original vesting schedules and will remain outstanding for their original terms. Performance-based restricted stock units will vest based on actual performance at the end of the original performance periods. These amended provisions are applicable only during the Transition Period, and only apply to the extent these provisions are more favorable than the terms of the original award agreement.

The above-described payments, benefits and equity award treatment are subject to a release of claims as well as confidentiality, invention, non-disparagement, non-compete and non-solicitation provisions.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

PERRIGO COMPANY PLC

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Todd W. Kingma

|

|

Dated:

|

June 20, 2017

|

|

|

Todd W. Kingma

|

|

|

|

|

|

Executive Vice President,

General Counsel and Secretary

|

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

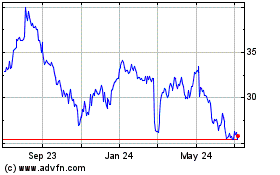

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Apr 2023 to Apr 2024