UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

REPURCHASE, SAVINGS AND SIMILAR PLANS

PURSUANT TO SECTION 15(d) OF THE

SECURITIES ACT OF 1934

(Mark One)

|

|

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended

December 31, 2016

|

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

to

Commission file number: 1-2191

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

CALERES, INC.

401(k) SAVINGS PLAN

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

CALERES, INC.

8300 Maryland Avenue

St. Louis, Missouri 63105

Caleres, Inc. 401(k) Savings Plan

Financial Statements and Schedule

Years Ended December 31, 2016 and 2015

Report of Independent Registered Public Accounting Firm

The Administration Committee

Caleres, Inc. 401(k) Savings Plan

We have audited the accompanying statements of net assets available for benefits of the Caleres, Inc. 401(k) Savings Plan (the Plan) as of December 31, 2016 and 2015, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The supplemental schedule of Schedule of Assets (Held at End of Year) as of December 31, 2016 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ UHY LLP

St. Louis, Missouri

June 20, 2017

Caleres, Inc. 401(k) Savings Plan

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2016

|

|

December 31, 2015

|

|

|

|

Non - Participant - Directed

|

|

Participant - Directed

|

|

Total

|

|

Non - Participant - Directed

|

|

Participant - Directed

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments - at fair value (Note 3):

|

|

$

|

59,601,348

|

|

|

$

|

136,445,158

|

|

|

$

|

196,046,506

|

|

|

$

|

53,447,995

|

|

|

$

|

130,574,426

|

|

|

$

|

184,022,421

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer contributions

|

|

131,386

|

|

|

—

|

|

|

131,386

|

|

|

128,017

|

|

|

—

|

|

|

128,017

|

|

|

Employee contributions

|

|

—

|

|

|

260,015

|

|

|

260,015

|

|

|

—

|

|

|

251,976

|

|

|

251,976

|

|

|

Notes receivable from participants

|

|

—

|

|

|

3,918,312

|

|

|

3,918,312

|

|

|

—

|

|

|

3,376,349

|

|

|

3,376,349

|

|

|

Total receivables

|

|

131,386

|

|

|

4,178,327

|

|

|

4,309,713

|

|

|

128,017

|

|

|

3,628,325

|

|

|

3,756,342

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

59,732,734

|

|

|

140,623,485

|

|

|

200,356,219

|

|

|

53,576,012

|

|

|

134,202,751

|

|

|

187,778,763

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excess contributions payable

|

|

—

|

|

|

297,647

|

|

|

297,647

|

|

|

—

|

|

|

375,739

|

|

|

375,739

|

|

|

Total liabilities

|

|

—

|

|

|

297,647

|

|

|

297,647

|

|

|

—

|

|

|

375,739

|

|

|

375,739

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

59,732,734

|

|

|

$

|

140,325,838

|

|

|

$

|

200,058,572

|

|

|

$

|

53,576,012

|

|

|

$

|

133,827,012

|

|

|

$

|

187,403,024

|

|

See accompanying notes to financial statements.

Caleres, Inc. 401(k) Savings Plan

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

Year Ended

|

|

|

|

December 31, 2016

|

|

December 31, 2015

|

|

|

|

Non - Participant - Directed

|

|

Participant - Directed

|

|

Total

|

|

Non - Participant - Directed

|

|

Participant - Directed

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer contributions

|

|

$

|

3,691,378

|

|

|

$

|

—

|

|

|

$

|

3,691,378

|

|

|

$

|

3,827,593

|

|

|

$

|

—

|

|

|

$

|

3,827,593

|

|

|

Employee contributions

|

|

—

|

|

|

8,725,692

|

|

|

8,725,692

|

|

|

—

|

|

|

8,646,972

|

|

|

8,646,972

|

|

|

Rollovers

|

|

—

|

|

|

985,574

|

|

|

985,574

|

|

|

—

|

|

|

897,196

|

|

|

897,196

|

|

|

Total contributions

|

|

3,691,378

|

|

|

9,711,266

|

|

|

13,402,644

|

|

|

3,827,593

|

|

|

9,544,168

|

|

|

13,371,761

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

—

|

|

|

144,322

|

|

|

144,322

|

|

|

—

|

|

|

133,319

|

|

|

133,319

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

|

|

529,979

|

|

|

2,173,343

|

|

|

2,703,322

|

|

|

537,165

|

|

|

2,010,476

|

|

|

2,547,641

|

|

|

Net realized and unrealized gain (loss) on investments

|

|

11,015,518

|

|

|

10,705,273

|

|

|

21,720,791

|

|

|

(10,081,421

|

)

|

|

(3,018,539

|

)

|

|

(13,099,960

|

)

|

|

Total investment income (loss)

|

|

11,545,497

|

|

|

12,878,616

|

|

|

24,424,113

|

|

|

(9,544,256

|

)

|

|

(1,008,063

|

)

|

|

(10,552,319

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total additions

|

|

15,236,875

|

|

|

22,734,204

|

|

|

37,971,079

|

|

|

(5,716,663

|

)

|

|

8,669,424

|

|

|

2,952,761

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

5,723,982

|

|

|

19,359,920

|

|

|

25,083,902

|

|

|

4,548,174

|

|

|

11,643,082

|

|

|

16,191,256

|

|

|

Administrative and other expenses

|

|

8,050

|

|

|

223,579

|

|

|

231,629

|

|

|

143,111

|

|

|

225,131

|

|

|

368,242

|

|

|

Total deductions

|

|

5,732,032

|

|

|

19,583,499

|

|

|

25,315,531

|

|

|

4,691,285

|

|

|

11,868,213

|

|

|

16,559,498

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease)

|

|

9,504,843

|

|

|

3,150,705

|

|

|

12,655,548

|

|

|

(10,407,948

|

)

|

|

(3,198,789

|

)

|

|

(13,606,737

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant transfer (out of)/in to funds

|

|

(3,348,121

|

)

|

|

3,348,121

|

|

|

—

|

|

|

(1,845,808

|

)

|

|

1,845,808

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits at beginning of year

|

|

53,576,012

|

|

|

133,827,012

|

|

|

187,403,024

|

|

|

65,829,768

|

|

|

135,179,993

|

|

|

201,009,761

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits at end of year

|

|

$

|

59,732,734

|

|

|

$

|

140,325,838

|

|

|

$

|

200,058,572

|

|

|

$

|

53,576,012

|

|

|

$

|

133,827,012

|

|

|

$

|

187,403,024

|

|

See accompanying notes to financial statements.

Caleres, Inc. 401(k) Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

1. Description of the Plan

On May 28, 2015, the shareholders of Brown Shoe Company, Inc. approved a rebranding initiative that changed the name of the company to Caleres, Inc. (the "Company"). In conjunction with the rebranding initiative, the Brown Shoe Company, Inc. 401(k) Savings Plan was amended and renamed the Caleres, Inc. 401(k) Savings Plan (the "Plan"). The following description of the Plan provides only general information about the Plan’s provisions. The Company is the plan sponsor. Participants should refer to the plan agreement for a complete description of the Plan’s provisions.

General

The Plan is a contributory 401(k) savings plan that covers eligible salaried and hourly employees of the Company and affiliates who are age 21 or older. Salaried and hourly employees are eligible to participate in the Plan beginning the first day of the first payroll period following the later of the date the employee attains age 21 and their first date of employment. Employees hired with a base salary of $100,000 or more or are projected to earn compensation equal to or in excess of $110,000 (indexed according to IRS Code Section 414(q)) for the first 12-month period of employment, may become a participant on the first day of the first payroll period following 12 months from the first date of employment if they have completed at least 1,000 hours of employment. However, if the employee was a former participant of the Plan who is re‑employed, they are eligible to become a participant in the Plan on the date of re‑employment.

Plan Administration

The Administration Committee, comprised of the Company’s Chief Financial Officer and certain employees of the Company, oversees the administration of the Plan in accordance with the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Investment Committee is responsible for the selection of the trustee, investment managers and investment funds and monitors the performance of the Plan’s investments. Wells Fargo Bank, N.A. (the "Trustee") is the trustee and recordkeeper of the Plan.

Contributions

Participants are allowed to contribute from two percent to 30% of eligible compensation annually, as defined by the Plan. Participants may also contribute amounts representing distributions from other qualified defined contribution plans. Participants who have attained age 50 before the end of the Plan year are eligible to make catch-up contributions. Participants may allocate their eligible contributions and account balances in one percent increments among any of the investment fund choices offered by the Plan, other than the Caleres, Inc. Stock Fund.

The Company matches 75% of the first two percent and 50% of the next four percent of eligible compensation that a participant contributes to the Plan. All employer contributions are invested in the Company’s common stock within the Caleres, Inc. Stock Fund.

Contributions of participants and matching employer contributions are remitted by the Company to the trustee on a bi-weekly basis. Contributions are subject to applicable limitations. Additional amounts may be contributed at the discretion of the Company’s Administration Committee.

Caleres, Inc. 401(k) Savings Plan

Notes to Financial Statements (continued)

December 31, 2016 and 2015

Participant Accounts

Each participant’s account is credited with the participant’s contribution, the Company’s matching contribution, and an allocation of plan earnings or losses. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are immediately vested in their contributions and related earnings or losses. Vesting in the employer’s matching contribution portion of their accounts and related earnings occurs if: (1) the participants' employment is terminated on account of their death, (2) the participants' employment is terminated on account of their disability, (3) the participants complete at least three years of service with the Company, (4) the participants' employment is terminated after they attain age 65, or (5) the Company completely discontinues contributions or the Plan is terminated while they are an employee.

Forfeitures

Forfeitures of non-vested employer matching contributions plus actual earnings are used to reduce future employer contributions. During the years ended December 31, 2016 and 2015, forfeitures of $250,000 and $128,674, respectively, were used to reduce employer contributions.

Notes Receivable from Participants

Participants may borrow from their fund accounts, excluding employer matching contributions held in the Caleres, Inc. Stock Fund, a minimum of $1,000 up to a maximum of (1) $50,000, adjusted for loan activity in the prior 12 months, or (2) 50% of their account balance, whichever is less. Loan terms generally range from six months to five years; however, the participant may repay eligible residential loans over 15 years. The loans are secured by the balance in the participant’s account, bear interest at the prime rate on the first business day of the month in which the funds are borrowed plus one percent and are fixed for the term of the loan. For loans initiated after April 1, 2007, the Trustee charges a monthly fee per loan to the participant’s account in each month that a loan is outstanding. Principal and interest are paid ratably through payroll deductions; however, the participant may prepay the entire amount of the loan in one lump sum at any time.

Participant Transfers

Participants may transfer their existing account balances, excluding the matching contribution amounts received, among investment fund choices offered by the Plan (other than the Caleres, Inc. Stock Fund) daily. Participants who are 55 or older or have completed at least three years of service may transfer their matching contribution amounts received out of and subsequently back into the Caleres, Inc. Stock Fund and into any other investment fund choices offered by the Plan daily. As further discussed in Note 2 to the financial statements, effective May 1, 2017, the Plan was amended to permit participants to diversify amounts in their matching contribution accounts. Participant transfers between participant-directed investments and non-participant-directed investments totaled $3,348,121 and $1,845,808 in 2016 and 2015, respectively.

Payment of Benefits

Hardship

Participants may withdraw their contributions while still an employee only if they suffer a substantial financial hardship, as defined by the Plan, that cannot otherwise be relieved. The minimum hardship withdrawal a participant may receive is $1,000.

Caleres, Inc. 401(k) Savings Plan

Notes to Financial Statements (continued)

December 31, 2016 and 2015

Age 59

1

/

2

Withdrawals

Participants who have attained the age of at least 59

1

/

2

may elect to withdraw the vested amounts from their participant and matching contribution accounts.

Termination of Service

Upon termination of service due to death, disability or retirement, a participant or beneficiary generally receives a lump-sum amount equal to the value of all amounts credited to the participant’s accounts. For termination of service due to other reasons, participants may receive the value of the vested interest in their accounts as a lump-sum distribution. Certain participants who were covered by a prior plan agreement will receive a distribution in the form of an actuarial survivor annuity unless the participant elects to receive a lump-sum payment of his or her vested interest in the account.

Retirement

Participants must begin to receive their benefits from the Plan no later than April 1 following the calendar year in which they reach age 70

1

/

2

or the date they terminate employment, whichever occurs later. Participants who are five percent or greater shareholders of the Company must begin to receive their benefits from the Plan no later than April 1 following the calendar year in which they reach age 70

1

/

2

.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

Plan Expenses

In 2016, all expenses incurred in connection with the operation of the Plan were paid by the Plan. In 2015, all expenses were paid by the Plan’s sponsor with the exception of the trustee fees, which were paid by the Plan.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements have been prepared on the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Risks

and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

Caleres, Inc. 401(k) Savings Plan

Notes to Financial Statements (continued)

December 31, 2016 and 2015

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned.

Related fees are recorded as administrative expenses and are expensed when they are incurred. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Excess Contributions Payable

Amounts payable to participants for contributions in excess of amounts allowed by the Internal Revenue Service (“IRS”) are recorded as a liability. The Plan distributed the 2016 excess contributions to the applicable participants prior to March 15, 2017.

Subsequent Events

The Administration Committee evaluated subsequent events for the Plan through June 20, 2017, the date the financial statements were available to be issued.

Effective May 1, 2017, the Plan was amended to permit participants to diversify amounts in their matching contribution accounts currently invested in the Caleres, Inc. Stock Fund to other investments.

3. Fair Value Measurements

Fair value measurement disclosure requirements specify a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (“observable inputs”) or reflect the Plan’s assumptions of market participant valuation (“unobservable inputs”). In accordance with these requirements, the hierarchy is categorized into three levels based on the reliability of the inputs as follows:

|

|

|

|

Level 1 -

|

Quoted prices in active markets that are unadjusted and accessible at the measurement date for identical, unrestricted assets or liabilities;

|

|

|

|

|

Level 2 -

|

Quoted prices for identical assets and liabilities in markets that are not active, quoted prices for similar assets and liabilities in active markets or financial instruments for which significant inputs are observable, either directly or indirectly;

|

|

|

|

|

Level 3 -

|

Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

|

In determining fair value, the Plan uses valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible, as well as considers counterparty credit risk in its assessment of fair value. Classification of the financial asset or liability within the hierarchy is determined based on the lowest level input that is significant to the fair value measurement. The Plan measures fair value as an exit price, the price to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date.

Caleres, Inc. 401(k) Savings Plan

Notes to Financial Statements (continued)

December 31, 2016 and 2015

The following is a description of the valuation methodologies used for assets measured at fair value. There are currently no redemption restrictions on these investments.

Money Market Funds

The Vanguard Federal Money Market Fund and the Vanguard Prime Money Market Fund seek to provide current income and liquidity with preservation of capital by investing in high-quality money market securities. The goal of these funds is to seek a competitive return on the liquid portion of an investment portfolio. The money market funds are classified within Level 1 of the fair value hierarchy because the fair value is based on unadjusted quoted market prices in an active market with sufficient volume and frequency.

Mutual Funds

Mutual funds include equity funds, fixed income funds and target date funds. Equity funds have a goal of capital appreciation and consist of American Funds EuroPacific Growth Fund Class R6, American Funds EuroPacific Growth Fund Class R4, American Funds Growth Fund of America Class R6, American Funds Growth Fund of America Class R4, DFA Emerging Markets Value Fund Class I, Dodge & Cox Stock Fund, Principal Diversified Real Asset Fund Institutional Class, Vanguard Extended Market Index Fund, Vanguard FTSE All-World ex-US Index Fund, Vanguard Institutional Index Fund and William Blair Small Cap Growth Fund Class I. Fixed income funds seek a stable rate of current income and consist of Dodge & Cox Income Fund, Vanguard Total Bond Market Index Fund and Vanguard Target Retirement Income Fund. Target date funds seek to provide growth of capital and current income and consist of Vanguard Target Retirement 2015 - 2060. The Plan’s mutual funds are classified within Level 1 of the fair value hierarchy because the fair values are based on unadjusted quoted market prices in active markets with sufficient volume and frequency.

Caleres, Inc. Stock Fund

The Caleres, Inc. Stock Fund is a unitized fund that invests in the Company’s common stock, which is classified within Level 1 of the fair value hierarchy because the fair value is based on the closing price on the New York Stock Exchange on the last business day of the year. A portion of the fund may also be invested in money market funds to accommodate daily transactions. As of December 31, 2016 and 2015, the fair value of the Caleres, Inc. Stock Fund includes $2,995,943 of assets invested in the Wells Fargo Government Money Market Fund and $2,541,314 of assets invested in the Vanguard Prime Money Market Fund, respectively, which are classified within Level 1.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

The fair values of the Plan's investments by asset class are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements

|

|

December 31, 2016

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

Money market fund

|

|

$

|

12,312,036

|

|

|

$

|

12,312,036

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Mutual funds

|

|

124,133,122

|

|

|

124,133,122

|

|

|

—

|

|

|

—

|

|

|

Caleres, Inc. Stock Fund

|

|

59,601,348

|

|

|

59,601,348

|

|

|

—

|

|

|

—

|

|

|

Total investments

|

|

$

|

196,046,506

|

|

|

$

|

196,046,506

|

|

|

$

|

—

|

|

|

$

|

—

|

|

Caleres, Inc. 401(k) Savings Plan

Notes to Financial Statements (continued)

December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements

|

|

December 31, 2015

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

Money market fund

|

|

$

|

13,744,027

|

|

|

$

|

13,744,027

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Mutual funds

|

|

116,830,399

|

|

|

116,830,399

|

|

|

—

|

|

|

—

|

|

|

Caleres, Inc. Stock Fund

|

|

53,447,995

|

|

|

53,447,995

|

|

|

—

|

|

|

—

|

|

|

Total investments

|

|

$

|

184,022,421

|

|

|

$

|

184,022,421

|

|

|

$

|

—

|

|

|

$

|

—

|

|

For the years ended December 31, 2016 and 2015, there were no transfers in or out of Levels 1, 2, or 3.

4. Federal Income Taxes

The Plan has received a determination letter from the IRS dated February 21, 2017, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the “Code”) and, therefore, the related trust is exempt from taxation. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. Although the Plan has been amended since receiving the determination letter, the plan administrator believes the Plan is being operated in compliance with the applicable requirements of the Code. Therefore, the plan administrator believes the Plan is qualified, and the related trust is tax-exempt.

U.S. GAAP requires plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2016, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions. However, there are currently no audits for any tax periods in progress. The plan administrator believes the Plan is no longer subject to income tax examinations for years prior to 2013.

5. Related Party Transactions

The Plan's investments are investment funds managed by Wells Fargo Bank, N.A., the trustee of the Plan. The Plan also invests in the Caleres, Inc. Stock Fund. These transactions qualify as party-in-interest transactions. During the years ended December 31, 2016 and 2015, the Plan received $11,545,497 and $(9,544,256), respectively, in investment income (loss) from the Company.

Caleres, Inc. 401(k) Savings Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year)

EIN: 43-0197190 Plan Number: 006

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b) Identity of Issue, Borrower, Lessor or Similar Party

|

|

(c) Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

(d) Cost

(1)

|

|

(e) Current Value

|

|

|

|

American Funds EuroPacific Growth Fund Class R6

|

|

231,185

|

|

|

|

|

$

|

10,412,588

|

|

|

|

|

American Funds Growth Fund of America Class R6

|

|

336,301

|

|

|

|

|

15,402,951

|

|

|

*

|

|

Caleres, Inc. Stock Fund

|

|

630,941

|

|

|

$

|

32,564,248

|

|

|

59,601,348

|

|

|

|

|

DFA Emerging Markets Value Fund Class I

|

|

61,245

|

|

|

|

|

1,466,828

|

|

|

|

|

Dodge & Cox Income Fund

|

|

854,022

|

|

|

|

|

11,606,157

|

|

|

|

|

Dodge & Cox Stock Fund

|

|

138,285

|

|

|

|

|

25,485,973

|

|

|

|

|

Principal Diversified Real Asset Fund Institutional Class

|

|

9,374

|

|

|

|

|

101,241

|

|

|

|

|

Vanguard Extended Market Index Fund

|

|

4,306

|

|

|

|

|

313,130

|

|

|

|

|

Vanguard Federal Money Market Fund

|

|

12,312,036

|

|

|

|

|

12,312,036

|

|

|

|

|

Vanguard FTSE All-World ex-US Index Fund

|

|

6,893

|

|

|

|

|

189,205

|

|

|

|

|

Vanguard Institutional Index Fund

|

|

122,661

|

|

|

|

|

22,963,715

|

|

|

|

|

Vanguard Target Retirement Income Fund

|

|

34,159

|

|

|

|

|

437,573

|

|

|

|

|

Vanguard Target Retirement 2015

|

|

133,014

|

|

|

|

|

1,936,108

|

|

|

|

|

Vanguard Target Retirement 2020

|

|

119,631

|

|

|

|

|

3,380,772

|

|

|

|

|

Vanguard Target Retirement 2025

|

|

338,231

|

|

|

|

|

5,530,075

|

|

|

|

|

Vanguard Target Retirement 2030

|

|

99,164

|

|

|

|

|

2,895,585

|

|

|

|

|

Vanguard Target Retirement 2035

|

|

171,904

|

|

|

|

|

3,049,570

|

|

|

|

|

Vanguard Target Retirement 2040

|

|

89,376

|

|

|

|

|

2,700,064

|

|

|

|

|

Vanguard Target Retirement 2045

|

|

117,004

|

|

|

|

|

2,210,207

|

|

|

|

|

Vanguard Target Retirement 2050

|

|

64,556

|

|

|

|

|

1,961,861

|

|

|

|

|

Vanguard Target Retirement 2055

|

|

46,678

|

|

|

|

|

1,536,158

|

|

|

|

|

Vanguard Target Retirement 2060

|

|

2,605

|

|

|

|

|

75,650

|

|

|

|

|

Vanguard Total Bond Market Index Fund

|

|

34,396

|

|

|

|

|

366,315

|

|

|

|

|

William Blair Small Cap Growth Fund Class I

|

|

369,839

|

|

|

|

|

10,111,396

|

|

|

|

|

Total investments (held at end of year)

|

|

|

|

|

|

196,046,506

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Various participants

|

|

Notes receivable from participants

(2)

|

|

|

|

3,918,312

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

199,964,818

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Exempt party-in-interest to the plan

|

|

|

|

|

|

|

|

(1)

Cost basis is not required for participant-directed investments.

|

|

|

|

|

|

|

|

(2)

Notes receivable from participants have interest rates of 4.25% - 4.75% and maturities through 2031.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Caleres, Inc. 401(k) Savings Plan has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CALERES, INC. 401(k) SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

Date: June 20, 2017

|

|

/s/ Kenneth H. Hannah

|

|

|

|

Kenneth H. Hannah

|

|

|

|

Senior Vice President and

|

|

|

|

Chief Financial Officer of

|

|

|

|

Caleres, Inc. and

|

|

|

|

Member of the Administration Committee

|

|

|

|

Under the Caleres, Inc.

|

|

|

|

401(k) Savings Plan

|

|

|

|

On Behalf of the Plan

|

INDEX TO EXHIBITS

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

23

|

|

Consent of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

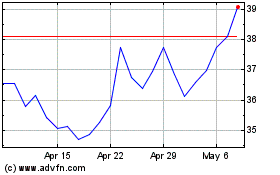

Caleres (NYSE:CAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caleres (NYSE:CAL)

Historical Stock Chart

From Apr 2023 to Apr 2024