Rio Tinto Picks Yancoal as Preferred Buyer of Thermal Coal Assets

June 20 2017 - 6:09AM

Dow Jones News

By Razak Musah Baba

LONDON--Rio Tinto PLC (RIO.LN) on Tuesday reconfirmed its

recommendation that shareholders vote in favor of the sale of its

Coal & Allied Industries Ltd. subsidiary to Yancoal Australia

Ltd.

Rio Tinto said the recommendation follows consideration by the

board of a counter $2.5 billion proposal from fellow miner Glencore

PLC (GLEN.LN) and an improved proposal from Yancoal.

"We believe Yancoal's offer to purchase our thermal coal assets

for $2.45 billion offers the best value and greater transaction

certainty for shareholders," Rio Tinto's Chief Executive

Jean-Sebastien Jacques said.

Mr. Jacques said Yancoal's revised offer is the most attractive

because it removes a deferred payment structure, can meet the

timeline set for the transaction, and has given the company

certainty regarding the outstanding regulatory approvals

required.

Under U.K. and ASX listing Rules, the transaction with Yancoal

requires the approval of Rio Tinto shareholders. Rio Tinto PLC has

called a general meeting for June 27 and Rio Tinto Ltd. for June

29.

The transaction is expected to be completed in the third quarter

of 2017.

-Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

(END) Dow Jones Newswires

June 20, 2017 05:54 ET (09:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

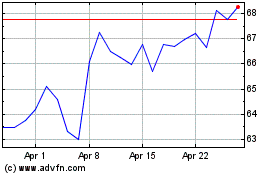

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

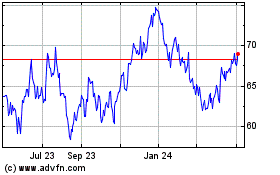

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024