By Lara O'Reilly

Facebook Inc. and Alphabet Inc.'s Google tower so far above the

rest of the digital advertising world that no company can claim the

mantle of No. 3. But many are trying.

Snapchat parent Snap Inc. believes it has the young eyeballs

advertisers crave. Amazon.com Inc., ever the disrupter, has the

ability to upend the whole business with its extensive data.

Verizon Communications Inc. is betting on its blend of web content,

location data and ad technology following the purchases of AOL and

Yahoo, while AT&T Inc. thinks buying Time Warner Inc. will give

it an edge.

With the exception of Chinese internet giants Alibaba Group

Holding Ltd., Baidu Inc. and Tencent Holdings Ltd., which dominate

their home market -- where their Western rivals are restricted --

none of the would-be challengers to the Google-Facebook "duopoly"

even cracks a 3% share of global digital advertising.

Google and Facebook together collect nearly half of global

spending. Last year, the U.S. online ad market expanded by nearly

$12 billion and the two firms accounted for over 77% of that

spending growth, according to eMarketer.

Advertisers are hoping for the emergence of a legitimate third

player to provide competition that can give them more leverage and

help keep prices in check. For ad agencies, the matter is

existential: Google and Facebook have the resources to deploy

entire teams to work with marketers directly, cutting out the

middleman.

Wenda Harris Millard, vice chairman at advertising and media

consulting firm MediaLink, said that to compete with Google and

Facebook, other players will need to create premium content that

appeals to advertisers or use new technologies that aren't yet

mainstream.

"Maybe the third player competes on different grounds," Ms.

Millard said.

Many ad executives believe Amazon, which has expanded

successfully beyond its core retail business into areas like

streaming video and artificial intelligence, has the greatest

chance of taking on the "duopoly."

Amazon already allows marketers to place search ads on its

website, as well as display ads on all its platforms. The company

also built a tool that lets companies tap the e-commerce giant's

data on its consumers' shopping habits in order to more efficiently

place ads elsewhere on the web. And Amazon is helping publishers

make more money from the ads on their sites with a so-called

"header bidding" product that gives multiple buyers a chance to bid

on their ads at the same time.

EMarketer predicts Amazon will generate $1.81 billion in ad

revenue world-wide in 2017, a tiny fraction of Google's $74

billion. Amazon declined to comment.

"Amazon is going to be an increasingly important force and one

we have to better understand and link with effectively for our

clients," Martin Sorrell, the chief executive of ad holding giant

WPP PLC said at the company's annual meeting earlier this month. He

said the company was "highly disruptive in many ways."

On Amazon's first-quarter earnings call in April, Chief

Financial Officer Brian Olsavsky said the company was "very happy"

with the growth of its ad business.

Snap is the newest contender for the third-place rosette. In 5

1/2 years, Snapchat has grown to 166 million active users -- a mere

blip compared with Facebook's 1.24 billion daily active users,

though the gap is much narrower in strong ad markets like the U.S.

and Canada.

Snapchat's advantage is that its audience is mostly made up of

the 18- to 34-year-old segment. On average, each Snapchatter spends

more than 30 minutes daily in the app, giving advertisers lots of

opportunities to target them. Snapchat has also brought on board

several TV companies and publishers for the app's "Discover"

section, offering marketers the opportunity to position their ads

next to curated content.

Snap's ad business still has some catching up to do: Its average

revenue per user in North America in its first quarter was $1.81,

while Facebook clocked $16.56 per user in the U.S. and Canada.

Snap declined to comment.

Verizon also is emerging as a "new" player, having just merged

AOL and Yahoo to form an advertising and content unit of the

company called "Oath."

"There are only three companies in the world that touch one

billion consumers digitally -- Facebook, Google, and Oath," said

former AOL boss Tim Armstrong -- now the CEO of Oath -- in an

interview.

Mr. Armstrong believes the company can expand its reach to two

billion people world-wide and ratchet up revenue to between $10

billion and $20 billion by around 2020. The recipe: ad technology

it has spent years investing in, location data and well-known web

brands including HuffPost and Yahoo Sports.

He said rivals to Google and Facebook can zero in on "white

spaces" with no dominant player: promoting brands instead of

specific products, and using newer technologies such as augmented

reality and virtual reality, for example.

Verizon's chief rival, AT&T, has its own lofty ambitions.

AT&T CEO Randall Stephenson said at a conference in May that

the Time Warner acquisition would create an entity that delivers

nearly "one trillion" ad impressions a year. Mr. Stephenson said

his company will be able to make money from Warner Bros. and Turner

shows at a higher rate because it has data on AT&T subscribers'

internet usage that can help marketers more accurately target their

intended audiences.

For the foreseeable future, Madison Avenue will have to get used

to dealing with two dominant players, a dynamic that isn't totally

alien in the ad business.

"From a small-business perspective it's not much different than

when Yellow Pages was the only game in town," said Pivotal Research

analyst Brian Weiser. "For large brands, it's not that different

than the era where there were three [TV] networks."

Write to Lara O'Reilly at lara.o'reilly@wsj.com

(END) Dow Jones Newswires

June 20, 2017 02:48 ET (06:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

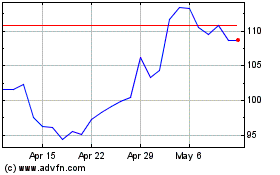

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

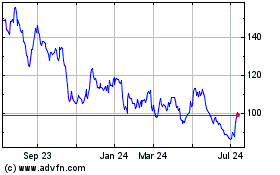

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024