By Paul Ziobro

United Parcel Service Inc. will for the first time charge

retailers extra fees to deliver packages during the busiest weeks

before Christmas, creating a new challenge for an industry already

coping with a shift away from traditional stores.

The surcharges, announced Monday, are a shot across the bow for

retailers, including giants such as Wal-Mart Stores Inc. and Macy's

Inc., that have been ramping up their e-commerce businesses as they

seek to offset declining foot traffic to shopping centers. It also

adds to the costs of Amazon.com Inc. and other online players,

which rely on UPS and rival FedEx Corp. to handle a surge in

holiday shipments.

The fees will force retailers to decide over the next few months

whether to raise shipping prices -- something that is difficult to

do when online shoppers are reluctant to pay shipping fees --

increase the prices of goods or eat the extra costs themselves.

Some may seek to avoid the surcharges by spreading holiday deals to

other weeks during the season.

Patrick Gill, chief executive of the high-end fishing gear site

TackleDirect.com, said news of the surcharge was frustrating since

it is going to be applied when his site needs lower rates to

compete against Amazon.com Inc., Wal-Mart Stores Inc. and

others.

"This will add up to be another unaccounted for expense during

the holiday season," Mr. Gill said. "It will force us to push some

product away from UPS in some cases."

For UPS, the move signifies a need to get paid for a service

that has become an integral cog in the holiday shopping period,

when it must add planes, trucks and thousands of staffers. While

Amazon and countless other websites are the front door to millions

of products on the web, UPS, FedEx and the U.S. Postal Service do

the heavy lifting that eliminates trips to stores and delivers

packages to homes.

UPS is "trying to make sure they are, at the margin, getting

compensated for stretching their network," said Sanford C.

Bernstein analyst David Vernon, adding that the carriers have the

power to raise prices given how critical they have become to the

period. "Without them, Christmas kind of doesn't happen."

Some analysts expect FedEx to follow in some way, as the two

rivals often take pricing cues from each other. A FedEx spokesman

declined to comment. The company reports its fiscal fourth-quarter

earnings Tuesday.

The surcharges unveiled by UPS will hit its customers during the

busiest shipping weeks and on the most popular products during that

time. Between Nov. 19 and Dec. 2 -- the weeks encapsulating Black

Friday and Cyber Monday -- UPS is adding a 27-cent charge on all

ground packages sent to homes. Ground orders typically arrive

within five days and are a heavily used shipping option during that

time since shoppers don't necessarily need the items quickly.

Last year, UPS collected on average $7.97 in revenue per item

shipped in its U.S. ground network.

The peak surcharges won't be in effect for the following two

weeks, when shoppers typically take a pause, but they will return

for the final holiday rush. From Dec. 17-23, UPS will charge an

extra 27 cents for each ground shipment, 81 cents for next-day air

and 97 cents for two- or three-day delivery.

In a twist, the UPS surcharge includes an element that gives

stores an advantage.

The charges apply only to residential deliveries, so retailers

and shoppers may be able to avoid the charges by getting orders

shipped to stores, an option retailers have been pushing for the

past few yearswith varying success.

UPS Chief Commercial Officer Alan Gershenhorn said the

per-package cost will only "marginally increase" during this time.

As an example, UPS said a five-pound next-day air package from

Atlanta to Philadelphia will cost 1% more to ship. Another example

offered by UPS showed a 2% increase with the added fee.

UPS daily volume swells to more than 30 million in the weeks

before Christmas versus more than 19 million on a normal day. Citi

Research estimates the new surcharges will add $50 million in

revenue and profit at UPS this year.

The carrier declined to provide a projection on the revenue

impact from the surcharges, but said it already was factored into

its outlook. The company had more than $60 billion in revenue last

year.

Shippers may try to avoid the surcharge by offering more deals

in October and early November, or by negotiating a discount. "The

real objective for the surcharge is to motivate shippers to do

their part in avoiding such volume increases," said Satish Jindel,

president of ShipMatrix Inc., a software provider that analyzes

shipping data.

UPS, FedEx and the U.S. Postal Service are all looking to recoup

massive investments they are making in their delivery

infrastructure to accommodate the surge of packages flowing into

their networks in recent years as more people shop online.

UPS is spending $4 billion this year alone as it automates more

package-sorting hubs and opens new warehouses.

UPS is looking at other ways to recoup costs during peak

periods, so it isn't left holding the bag for the additional

investments. Last month, UPS CEO David Abney said the carrier is

negotiating with retailers to help them pay for the any additional

investments, even the capacity goes unused.

On Monday, UPS said will also impose surcharges on all large

packages above a certain threshold, which cost more to ship and

sort, throughout the entire period. Those surcharges will be more

onerous, tacking an additional $24 fee to an existing surcharge of

$70 for a package weighing more than 150 pounds and over a certain

size.

UPS also will charge a peak surcharge of $249 per package on the

largest packages, on top of a $150 fee for such "overmax" packages.

A UPS spokesman said that such items only represent a small sliver

of packages, since most are shipped through its freight

business.

The company is encouraging shippers to instead send such

packages through its freight network, where it recently imposed a

second 4.9% increase in shipping rates the past year.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

June 19, 2017 18:56 ET (22:56 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

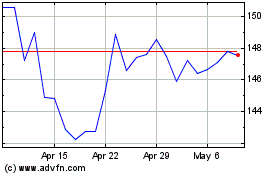

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

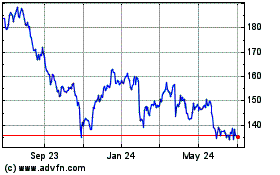

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024