UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the year ended: December 31, 2016

or

|

|

|

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 1-1687

|

|

|

|

|

|

A.

|

Full title of the plan and address of the plan, if different from that of the issuer named below:

|

PPG Puerto Rico Employee Savings Plan

|

|

|

|

|

|

B.

|

Name of the issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

PPG Industries, Inc.

One PPG Place, Pittsburgh, Pennsylvania 15272

PPG Puerto Rico Employee Savings Plan

Table of Contents

|

|

|

|

|

|

|

|

Page

|

|

|

|

1

|

|

|

FINANCIAL STATEMENTS:

|

|

|

|

2

|

|

|

|

3

|

|

|

|

4-7

|

|

|

|

8

|

|

|

|

|

|

NOTE: All other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

|

Report of Independent Registered Public Accounting Firm

To

the Administrator of

PPG Puerto Rico Employee Savings Plan

In our opinion, the accompanying statements of net assets available for benefits and the related statements of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of PPG Puerto Rico Employee Savings Plan (the “Plan”) at

December 31, 2016 and 2015, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

The supplemental schedule of Form 5500, Schedule H, Part IV, Line 4i - Schedule of Assets (Held as of December 31, 2016) has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule

is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is

presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974.

In our opinion, the Form 5500, Schedule H, Part IV, Line 4i - Schedule of Assets is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/PricewaterhouseCoopers LLP

Pittsburgh, Pennsylvania

June 19, 2017

|

|

|

|

|

|

|

|

|

|

|

|

PPG Puerto Rico Employee Savings Plan

|

|

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

|

|

As of December 31, 2016 and 2015

|

|

|

|

|

($ in thousands)

|

2016

|

|

2015

|

|

|

|

|

|

|

ASSETS:

|

|

|

|

|

Cash and cash equivalents

|

$

|

1,809

|

|

|

$

|

1,828

|

|

|

Mutual funds

|

6,361

|

|

|

6,029

|

|

|

Investment in PPG Industries, Inc. common stock

|

2,543

|

|

|

2,811

|

|

|

Total investments at fair value

|

10,713

|

|

|

10,668

|

|

|

Receivables:

|

|

|

|

|

Employer contributions

|

—

|

|

|

2

|

|

|

Employee contributions

|

—

|

|

|

3

|

|

|

Notes receivable from participants

|

403

|

|

|

415

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS

|

$

|

11,116

|

|

|

$

|

11,088

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes to the financial statements are an integral part of this statement

|

|

|

|

|

|

|

|

|

|

|

|

|

PPG Puerto Rico Employee Savings Plan

|

|

|

|

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

For the Years Ended December 31, 2016 and 2015

|

|

|

|

|

($ in thousands)

|

2016

|

|

2015

|

|

|

|

|

|

|

ADDITIONS:

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments

|

$

|

172

|

|

|

$

|

(632

|

)

|

|

Dividends

|

129

|

|

|

210

|

|

|

Interest income on notes receivable due from participants

|

30

|

|

|

10

|

|

|

Total net investment income (loss)

|

331

|

|

|

(412

|

)

|

|

Contributions:

|

|

|

|

|

Employer

|

292

|

|

|

336

|

|

|

Employee

|

287

|

|

|

390

|

|

|

Total contributions

|

579

|

|

|

726

|

|

|

Total additions

|

910

|

|

|

314

|

|

|

|

|

|

|

|

DEDUCTIONS:

|

|

|

|

|

Withdrawals

|

838

|

|

|

949

|

|

|

Administration expenses

|

44

|

|

|

51

|

|

|

Total deductions

|

882

|

|

|

1,000

|

|

|

NET INCREASE (DECREASE)

|

28

|

|

|

(686

|

)

|

|

NET ASSETS AVAILABLE FOR BENEFITS:

|

|

|

|

|

Beginning of year

|

11,088

|

|

|

11,774

|

|

|

End of year

|

$

|

11,116

|

|

|

$

|

11,088

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes to the financial statements are an integral part of this statement

|

PPG Puerto Rico Employee Savings Plan

Notes to the Financial Statements

As of and for the years ended

December 31, 2016

and

2015

|

|

|

|

1.

|

Description of the Plan

|

The PPG Puerto Rico Employee Savings Plan (the "Plan") was established for employees of PPG Industries, Inc. (the "Company" or "PPG") and its subsidiaries residing in Puerto Rico. The Plan is a defined contribution plan and is qualified under section 1165(e) of the Puerto Rico Internal Revenue Code of 1994, as amended. The Plan was established to provide a means for participants to save for their retirement and enable participants to defer a portion of their eligible compensation. Participants are employees of PPG and its subsidiaries residing in Puerto Rico. The Plan is subject to the provisions of the Employee Retirement Income Act of 1974, as amended ("ERISA").

The named fiduciary for the operation and administration of the Plan is the PPG Global Director, Compensation and Benefits (the “Plan Administrator”). The named fiduciary with respect to control and management of the assets of the Plan is the Company. PPG's responsibilities include, but are not limited to, approval of trustees, investment options, and investment managers and establishing performance benchmarks. The PPG Employee Benefits Committee has responsibility for establishing, maintaining, and amending the Plan.

Trustee of the Plan

- Banco Popular de Puerto Rico (the "Trustee") was the trustee of the Plan assets for the years-ended December 31, 2016 and 2015.

Recordkeeper of the Plan

- On January 1, 2016, Aon Hewitt superseded Banco Popular de Puerto Rico as the recordkeeper of the Plan.

Administrative Expenses

- The Plan or the Company pays all reasonable and necessary costs to manage and operate the Plan as determined by the Plan Administrator. These expenses, including recordkeeping fees, administrative charges, professional costs, and trustee costs, are paid from the assets of the Plan or are paid directly by the Company. The Plan Administrator has adopted uniform and nondiscriminatory procedures to allocate these expenses to participant accounts. In

2016

and

2015

, administrative expenses were $43,856 and $51,062, respectively. Administrative expenses paid by PPG on behalf of the Plan were $16,257 in 2016.

Eligibility to Participate in the Plan

- The Plan is available for employees of PPG and its subsidiaries residing permanently in Puerto Rico. An eligible employee may become a participant as of the first day of any month that is coincident with or following his or her hire date.

Investment Options

- Participants of the Plan are eligible to invest in money market funds, mutual funds and PPG Industries, Inc. common stock.

Contributions

- Contributions under the Plan are made by the participants and, for certain participants, by the Company.

Employee

Participants can contribute on a before-tax or after-tax basis. Before-tax contributions were restricted to $15,000 in

2016

and

2015

. After-tax contributions in a plan year may not exceed 10% of the aggregate compensation paid to the employee during all the years he or she has been a Plan participant. Catch-up contributions may only be made by participants who reach age 50 by the end of the plan year and are limited to $1,500 per plan year. Employee contributions may also include rollovers from other qualified plans. There were no rollover contributions in 2016. Rollover contributions were $51,409 in

2015

.

Employer

Employer Company-matching contributions are applied to each participant's monthly contribution subject to a maximum of 6% of the eligible participant's compensation contributed. The Company match rate established each year is at the discretion of the Company. The Company-matching contribution was 100% during

2016

and

2015

.

Employer contributions also include "Employer Additional Contributions" where the Company deposits additional retirement plan monies into eligible participant accounts. These contributions are between 2% and 5% of the eligible participants' eligible Plan compensation. The applicable contribution percentage is based on a combination

of the participants' age plus the benefit received as of the end of the current Plan year. Total Employer Additional Contributions were $63,652 and $85,275 in

2016

and

2015

, respectively.

Participant Accounts

- Individual accounts are maintained for each Plan participant. Each participant's account is credited with the participant's contribution, the Company's matching contribution, the Employer Additional Contribution, if applicable, and allocations of fund earnings and is charged with an allocation of fund losses and administrative expenses. Allocations are based on participant account balances, as defined by the Plan. Participants direct the investment of their contributions and Company contributions into various investment options offered by the Plan.

Vesting

- All participant contributions and Company-matching contributions and their related earnings are vested immediately. All Employer Additional Contributions have a three year vesting period.

Payment of Benefits

- Upon termination from service as a result of a voluntary or involuntary separation, retirement, or being approved for a Company sponsored long-term disability program, a participant may elect how to receive payment of his or her account from several options, including a total distribution or installment payments. The benefit to which a participant is entitled is the participant's vested account balance. Upon reaching the age of 70 and one-half, distribution of the vested balance to an active participant is at the discretion of the participant.

Payments to designated beneficiaries upon the death of the participant are made as a lump-sum distribution as soon as administratively possible from the date such payments are requested by the designated beneficiary or beneficiaries.

Notes Receivable from Participants

- All active participants, excluding (a) those with a vested account balance less than $2,000 and (b) those who have two existing loans, may borrow for either general purposes or for a primary residence, from their account a minimum of $1,000, up to a maximum equal to the lesser of $50,000 or 50% of their vested account balance, reduced by the highest outstanding participant loan balance over the past 12 months. General purpose loans have a loan term of 12 to 60 months. Primary residence loans have a loan term of 72 to 120 months. The loans are secured by the participants' account balance and are issued at an interest rate equal to the prime interest rate on the 15

th

of the previous month plus 1%. Principal and interest payments are generally repaid by payroll deductions.

Transfers -

Transfers in primarily occur when PPG acquires a new business and the existing plan(s) of the acquired company are legally moved into the Plan. Transfers out primarily occur when PPG divests part or all of one of its strategic business units and portions of the Plan related to the divested business are legally moved out of the Plan. There were no transfers in the years ended December 31,

2016

and

2015

.

The above brief description of the Plan is provided for general information purposes only. Participants should refer to the Summary Plan Description for a complete description of the Plan, which is available from the Plan Administrator.

2.

Summary of Significant Accounting Policies and Related Matters

Basis of Accounting

- The financial statements of the Plan are prepared on the accrual basis of accounting, except for amounts due to participants who had requested withdrawals, which are not recorded as a liability of the Plan as of

December 31, 2016

and

2015

, in accordance with the American Institute of Certified Public Accountants Audit and Accounting Guide,

Audits of Employee Benefit Plans

.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends on the PPG common stock are recorded as investment income on the ex-dividend date.

Use of Estimates

- The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP) requires Plan management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein. Actual results could differ from those estimates.

Risk and Uncertainties

- The Plan invests in various investment securities. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment

securities will occur in the near term and that such changes could be material in relation to the amounts reported in the financial statements.

Cash Equivalents

- Cash and cash equivalents are highly liquid investments (valued at cost, which approximates fair value) acquired with an original maturity of three months or less.

Investment Valuation

- Investments are stated at fair value.

Investments in securities traded on securities exchanges are valued at the closing sales price on the last business day of the Plan year. Listed securities for which no sale was reported on that date are valued at bid quotations.

See Note 3 for further information pertaining to fair value measurements.

Notes Receivable from Participants

- Notes receivable from participants are measured at their unpaid principal balance, plus any accrued interest. Delinquent participant loans are recorded as withdrawals based on the terms of the Plan document.

3.

Fair Value Measurement

Accounting guidance on fair value measurements establishes a hierarchy of inputs employed to determine fair value measurements, which has three levels.

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets and liabilities. Level 1 inputs are considered to be the most reliable evidence of fair value as they are based on unadjusted quoted market prices from various financial information service providers and securities exchanges.

Level 2 inputs are directly or indirectly observable prices that are not quoted on active exchanges, which include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability and inputs that are derived principally from or corroborated by observable market data by correlation or other means.

Level 3 inputs are unobservable inputs employed for measuring the fair value of assets or liabilities.

The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at the beginning of the reporting period. PPG evaluates the significance of transfers between levels based upon the nature of the financial instrument and size of the transfer relative to total net assets available for benefits. For the years ended,

December 31, 2016

and

2015

, there were no transfers between levels.

The financial assets that are reported at fair value on a recurring basis as of

December 31, 2016

, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands)

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Cash and cash equivalents

|

$

|

1,809

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,809

|

|

|

Mutual funds

|

6,361

|

|

|

—

|

|

|

—

|

|

|

6,361

|

|

|

PPG Industries, Inc. common stock

|

2,543

|

|

|

—

|

|

|

—

|

|

|

2,543

|

|

|

Total Investments at fair value

|

$

|

10,713

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

10,713

|

|

The financial assets that are reported at fair value on a recurring basis as of

December 31, 2015

, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands)

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Cash and cash equivalents

|

$

|

1,828

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,828

|

|

|

Mutual funds

|

6,029

|

|

|

—

|

|

|

—

|

|

|

6,029

|

|

|

PPG Industries, Inc. common stock

|

2,811

|

|

|

—

|

|

|

—

|

|

|

2,811

|

|

|

Total Investments at fair value

|

$

|

10,668

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

10,668

|

|

4.

Related-Party Transactions

The Trustee manages the BPPR time deposit open account, one of the accounts within Cash and cash equivalents of the Plan. These transactions are considered exempt party-in-interest transactions. The Plan holds common shares of

PPG, the Plan sponsor, and these shares are considered exempt party-in-interest transactions. Eligible participants may borrow from their individual account balance in the Plan as discussed in Note 1, and these transactions are considered exempt party-in-interest transactions.

Dividends earned on PPG Industries, Inc. common stock were $40,332 and $36,126 in

2016

and

2015

, respectively.

5.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to terminate the Plan, subject to the provisions of ERISA. In the event the Plan is terminated, Plan participants will receive all amounts credited to their accounts.

6.

Income Tax Status

In April 2015, the Plan received a favorable tax determination letter from the Treasury of the Commonwealth of Puerto Rico stating that the Plan is qualified and that the trust established under the Plan is tax-exempt under the appropriate sections of the Puerto Rico Internal Revenue Code of 1994, as amended. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

Participants in the Plan are not liable for federal income tax on amounts allocated to their accounts resulting from their before-tax deferrals, employer contributions, or investment income until such time as a withdrawal is requested.

|

|

|

|

|

|

|

|

PPG Puerto Rico Employee Savings Plan

|

|

|

|

|

|

Supplemental Schedule

|

|

|

Form 5500, Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year)

|

|

|

As of December 31, 2016

|

|

|

($ in thousands)

|

|

|

|

|

|

Identity of Issuer and Title of Issue

|

Current Value

|

|

Cash and cash equivalents:

|

|

|

DWS Investments (DWS) Money Market Series

|

$

|

1,809

|

|

|

Investment in PPG Industries, Inc. common stock — at fair value*

|

2,543

|

|

|

Mutual funds — at fair value:

|

|

|

Blackrock Lifepath Index 2020 Fund

|

411

|

|

|

Blackrock Lifepath Index 2025 Fund

|

419

|

|

|

Blackrock Lifepath Index 2030 Fund

|

575

|

|

|

Blackrock Lifepath Index 2035 Fund

|

786

|

|

|

Blackrock Lifepath Index 2040 Fund

|

667

|

|

|

Blackrock Lifepath Index 2045 Fund

|

348

|

|

|

Blackrock Lifepath Index 2050 Fund

|

258

|

|

|

Blackrock Lifepath Index 2055 Fund

|

21

|

|

|

Blackrock Life Index Retirement

|

16

|

|

|

Fidelity Contrafund

|

164

|

|

|

Fidelity Growth Fund

|

374

|

|

|

Vanguard 500 Index Fund

|

1,020

|

|

|

Vanguard FTSE All World ex-US Index Fund

|

282

|

|

|

Vanguard Small-Cap Index Fund

|

613

|

|

|

Vanguard Total Bond Market Index Fund

|

407

|

|

|

Loans to participants with interest rates ranging from 4.25% to 4.50% and maturity dates through June 2021*

|

403

|

|

|

Total

|

$

|

11,116

|

|

|

|

|

|

* Party in interest

|

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Global Director, Compensation and Benefits of PPG Industries, Inc., and Administrator of the Plan, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PPG Puerto Rico Employee Savings Plan

|

|

|

|

|

(Name of Plan)

|

|

|

|

|

|

|

Date:

|

June 19, 2017

|

|

/s/ Karen P. Rathburn

|

|

|

|

|

Karen P. Rathburn

|

|

|

|

|

Global Director, Compensation and Benefits of PPG Industries, Inc. and Administrator of the Plan

|

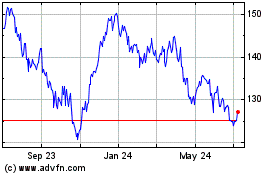

PPG Industries (NYSE:PPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

PPG Industries (NYSE:PPG)

Historical Stock Chart

From Apr 2023 to Apr 2024