Byline Bancorp Announces Launch of Initial Public Offering

June 19 2017 - 8:00AM

Business Wire

Byline Bancorp, Inc. (“Byline” or the “Company”) today announced

the launch of its initial public offering of shares of its common

stock. Of the 5,700,000 shares of Byline’s common stock to be sold

in the offering, Byline is offering 3,775,194 shares and certain

selling stockholders are offering 1,924,806 shares. Byline expects

to grant the underwriters a 30-day option to purchase up to an

additional 855,000 shares of its common stock. The initial public

offering price is currently expected to be between $19.00 and

$21.00 per share of common stock. Byline’s common stock has been

approved for listing on the New York Stock Exchange (NYSE) under

the ticker symbol “BY,” subject to official notice of issuance.

Byline intends to use the net proceeds that it receives from

this offering to repay the outstanding balance under its line of

credit, to repurchase, subject to regulatory approval, its

outstanding Series A Preferred Stock, and for general corporate

purposes.

BofA Merrill Lynch and Keefe, Bruyette & Woods are acting as

joint book-running managers for the proposed offering. Piper

Jaffray & Co., Sandler O’Neill + Partners, L.P. and Stephens

Inc. are acting as co-managers.

The proposed offering will be made only by means of a

prospectus. Copies of the preliminary prospectus may be obtained

from: BofA Merrill Lynch, attention: Prospectus Department,

NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte, NC

28255-0001, or by email at dg.prospectus_requests@baml.com; or

Keefe, Bruyette & Woods, Inc., Attention: Equity Capital

Markets, 787 Seventh Avenue, 4th Floor, New York, NY 10019; or by

calling Keefe, Bruyette & Woods, Inc. toll-free at (800)

966-1559.

A registration statement relating to these securities has been

filed with the U.S. Securities and Exchange Commission (the “SEC”),

but has not yet become effective. These securities may not be sold,

nor may offers to buy be accepted, prior to the time the

registration statement becomes effective. This press release shall

not constitute an offer to sell or the solicitation of an offer to

buy, nor shall there be any sale of these securities in any state

or jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Byline Bancorp, Inc.

Headquartered in Chicago, Byline is the holding company for

Byline Bank, a full service commercial bank serving small- and

medium-sized businesses, financial sponsors, and consumers. Byline

Bank had $3.3 billion in assets at March 31, 2017, and operates

more than 50 full service branch locations throughout the Chicago

metropolitan area. Byline Bank offers a broad range of commercial

and retail banking products and services including small ticket

equipment leasing solutions and is one of the top 10 Small Business

Administration lenders in the United States.

Forward Looking Statements

This communication contains forward-looking statements within

the meaning of the U.S. federal securities laws. Forward-looking

statements include, without limitation, statements concerning

plans, estimates, calculations, forecasts and projections with

respect to the anticipated future performance of the Company. These

statements are often, but not always, made through the use of words

or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’,

‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’,

‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’,

‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and

‘‘outlook’’, or the negative version of those words or other

comparable words or phrases of a future or forward-looking nature.

Forward-looking statements reflect various assumptions and involve

elements of subjective judgement and analysis which may or may not

prove to be correct and which are subject to uncertainties and

contingencies outside the control of Byline and its respective

affiliates, directors, employees and other representatives, which

could cause actual results to differ materially from those

presented in this communication. No representations, warranties or

guarantees are or will be made by Byline as to the reliability,

accuracy or completeness of any forward-looking statements

contained in this communication or that such forward-looking

statements are or will remain based on reasonable assumptions. You

should not place undue reliance on any forward-looking statements

contained in this communication.

We have filed a registration statement on Form S-1 (including a

preliminary prospectus) with the SEC for the offering to which this

communication relates. Before making any investment decision,

investors are urged to carefully read the preliminary prospectus in

that registration statement, any amendments or supplements to the

preliminary prospectus, and other documents we have filed with the

SEC for more complete information about us and the proposed

offering. Investors may obtain the registration statement and

prospectus free of charge from the SEC’s website at

www.sec.gov.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170619005459/en/

MediaByline BankErin O’Neill,

773-475-2901Director of

Marketingeoneill@bylinebank.comorInvestorsFinancial Profiles, Inc.Allyson

Pooley/Tony RossiBY@finprofiles.com

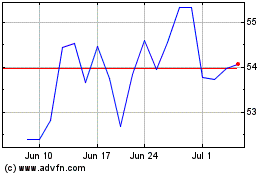

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Apr 2023 to Apr 2024