UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

(Check One)

[ ]

Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

[ X ]

Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

For fiscal year ended:

March 31, 2017

|

Commission File number:

001-34184

|

SILVERCORP METALS INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

British Columbia, Canada

|

1041

|

Not Applicable

|

|

(Province or Other Jurisdiction of

|

(Primary Standard Industrial Classification

|

(I.R.S. Employer Identification

|

|

Incorporation or Organization)

|

Code Number, if applicable)

|

Number, if applicable)

|

Suite 1378-200 Granville Street

Vancouver, British Columbia V6C 1S4 Canada (604) 669-9397

(Address and Telephone Number of Registrant’s principal executive office)

Corporation Service Company

84 State Street, Boston MA 02109

617-227-9590

(Name, Address and Telephone Number of Agent for Service in the United States)

Copies to:

Jeff Hammel

Latham & Watkins LLP

885 Third Avenue

New York, NY 10022-4834

USA (212) 906-1260

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

Common Shares, without par value

|

NYSE MKT

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

none

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

none

For annual reports, indicate by check mark the information filed with this Form:

[ X ] Annual information form [ X ] Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Silvercorp Metals Inc. had 167,889,636 Common Shares

Outstanding as of March 31, 2017

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements in the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Yes [ ] No [ X ]

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company [ ]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 40-F of Silvercorp Metals Inc. (the “Company”) and the exhibits attached hereto contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. All statements and information concerning mineral resource and mineral reserve estimates may also be deemed to constitute “forward-looking statements” to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Forward-looking statements or information relate to, among other things:

-

the price of silver, lead, and other metals;

-

the accuracy of mineral resource and mineral reserve estimates at the Company’s material properties;

-

estimated production from the Company’s mines in the Ying Mining District and from the GC Mine (each as discussed in the Company’s Annual Information Form for the year ended March 31, 2017 (the “Annual Information Form”), which is attached hereto as Exhibit 99.1);

-

availability of funds from production to finance the Company’s operations; and

-

access to and availability of funding for future construction and development of the Company’s properties or for acquisitions.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to:

-

fluctuating commodity prices;

-

estimation of mineral resources, reserves and mineralization and precious and base metal recovery;

-

interpretations and assumptions of mineral resource and mineral reserve estimates;

-

exploration and development programs;

-

permits and licenses;

-

title to properties;

-

joint venture partners;

-

acquisition of commercially mineable mineral rights;

-

financing;

-

recent market events and conditions;

-

economic factors affecting the Company;

-

timing, estimated amount, capital and operating expenditures and economic returns of future production;

-

integration of future acquisitions into the Company’s existing operations;

-

competition;

-

operations and political conditions;

-

regulatory environment in China;

-

environmental risks;

-

foreign exchange rate fluctuations;

-

insurance;

-

risks and hazards of mining operations;

-

dependence on management and key personnel;

-

conflicts of interest;

-

internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act of 2002; and

-

bringing actions and enforcing judgments under U.S. securities laws.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form, which is attached hereto as Exhibit 99.1, under the heading “Risk Factors” and elsewhere. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this Annual Report on Form 40-F and the Annual Information Form, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report on Form 40-F are in United States dollars. The exchange rate of Canadian dollars into United States dollars, on March 31, 2017, based upon the Bank of Canada nominal noon exchange rate, was U.S.$1.00 = CDN$1.3322.

RESOURCE AND RESERVE ESTIMATES

The Company’s Annual Information Form, which is attached hereto as Exhibit 99.1, has been prepared in accordance with the requirements of the securities laws in effect in Canada as of March 31, 2017, which differ in certain material respects from the disclosure requirements of U.S. securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101

Standards of Disclosure for Mineral Projects

(“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”)

Standards on Mineral Resources and Mineral Reserves Definitions and Guidelines

, adopted by the CIM Council, as amended. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The definitions of these terms differ from the definitions of such terms for purposes of the disclosure requirements of the Securities and Exchange Commission (the “Commission”).

Under U.S. securities laws, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The Commission’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources,” “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the Commission. Investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable.

Disclosure of “contained metal” in a resource is permitted disclosure under Canadian regulations; however, the Commission normally only permits issuers to report mineralization that does not constitute “reserves” by the Commission’s standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the Commission, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under the Commission’s standards.

Accordingly, information contained in this Annual Report on Form 40-F, the documents attached hereto and the documents incorporated by reference herein containing descriptions of our mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations of the Commission thereunder.

DISCLOSURE CONTROLS AND PROCEDURES

A. Evaluation of Disclosure Controls and Procedures.

Based on an evaluation by the Company’s management, including the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), the CEO and CFO have concluded that as of March 31, 2017, the Company’s disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are effective in providing reasonable assurance that information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms, see Section 17, entitled “Disclosure Controls and Procedures”, of Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Year Ended March 31, 2017 (“Management’s Discussion and Analysis”), filed as Exhibit 99.2 to this Annual Report on Form 40-F.

B. Management’s Annual Report on Internal Control Over Financial Reporting.

Management of the Company is responsible for establishing and maintaining an adequate system of internal control over financial reporting, and used the Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) to evaluate the effectiveness of internal controls in fiscal year 2017. Based on this evaluation, management concluded that the Company’s internal control over financial reporting was effective as of March 31, 2017 and provided a reasonable

assurance of the reliability of the Company’s financial reporting and preparation of the financial statements. The entire report is at Section 18, entitled “Management’s Report on Internal Control over Financial Reporting,” of Management’s Discussion and Analysis, filed as Exhibit 99.2 to this Annual Report on Form 40-F.

C. Attestation Report of the Independent Registered Public Accounting Firm.

The Company’s independent registered public accounting firm, Deloitte LLP, which audited the consolidated financial statements included in this Annual Report on Form 40-F, has issued an attestation report on management’s assessment of the Company’s internal control over financial reporting, entitled “Report of Independent Registered Public Accounting Firm,” contained in Exhibit 99.3 to this Annual Report on Form 40-F.

D. Changes in Internal Control Over Financial Reporting.

There was no change in the Company’s internal control over financial reporting during the period covered by this Annual Report on Form 40-F that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

The Company was not required by Rule 104 of Regulation BTR to send any notices to any of its directors or executive officers during the fiscal year ended March 31, 2017.

AUDIT COMMITTEE FINANCIAL EXPERT

The Company’s board of directors (the “Board”) has determined that it has at least one audit committee financial expert serving on its audit committee. The Board has determined that David Kong is an audit committee financial expert and is independent (as determined under Rule 10A-3 of the Exchange Act and the rules of the NYSE MKT).

Mr. David Kong holds a Bachelor in Business Administration and earned his Chartered Accountant designation in British Columbia in 1978 and U.S. CPA (Illinois) designation in 2002. From 1981 to 2004, he was partner of Ellis Foster Chartered Accountants and a partner at Ernst & Young LLP from 2005 to 2010. Currently, Mr. Kong is a director of New Pacific Metals Corp., Uranium Energy Corp., and Gold Mining Inc. Mr. Kong is a certified director (ICD.C) of the Institute of Corporate Directors.

CODE OF ETHICS

The Board has adopted a written code of ethics entitled, “Code of Business Conduct and Ethics” (the “Code”), by which it and all officers and employees of the Company, including the Company’s principal executive officer, principal financial officer and principal accounting officer or controller, are required to abide. There were no amendments, or waivers granted in respect of, the Code during the fiscal year ended March 31, 2017. The Code is posted on the Company’s website at www.silvercorpmetals.com. A copy of the Code may also be obtained, without charge, by contacting the Corporate Secretary of the Company at the address or telephone number indicated on the cover page of this Annual Report on Form 40-F. If there is an amendment to the Code, or if a waiver of the Code is granted to any of the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, the Company intends to disclose any such amendment or

waiver by posting such information on the Company’s website. Unless and to the extent specifically referred to herein, the information on the Company’s website shall not be deemed to be incorporated by reference in this Annual Report on Form 40-F.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Our independent registered public accounting firm for the years ended March 31, 2017 and 2016 was Deloitte LLP. The following table sets forth the Company’s fees (in Canadian dollars) paid or accrued by Deloitte LLP in the last two years:

|

|

|

|

|

Nature of Services

|

Year Ended March 31, 2017

|

Year Ended March 31, 2016

|

|

Audit Fees

(1)

|

$702,000

|

$794,000

|

|

Audit-Related Fees

(2)

|

Nil

|

Nil

|

|

Tax Fees

(3)

|

Nil

|

$64,000

|

|

All Other Fees

(4)

|

Nil

|

Nil

|

|

Total

|

$702,000

|

$858,000

|

|

|

|

|

Notes:

|

|

|

|

|

|

(1)

|

"Audit Fees" include the aggregate fees billed for each of the last two fiscal years for professional services of the principal accountant for the audit of the Company’s annual financial statements and the audit of the Company's internal control over financial reporting for Fiscal 2017 and Fiscal 2016, or review services that are normally provided by the principal accountant in connection with interim filings or engagements for those fiscal years.

|

|

|

|

|

(2)

|

"Audit-Related Fees" include the aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under above note (1).

|

|

|

|

|

(3)

|

"Tax Fees" include the aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. For fiscal year 2016, tax fees were for corporate tax returns, tax advice, and general tax inquiries.

|

|

|

|

|

(4)

|

"All Other Fees" include the aggregate fees billed in each of the last two fiscal years for services provided by the principal accountant, other than the services reported in the above items.

|

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

See Item 11 of the Company’s Annual Information Form, which is attached hereto as Exhibit 99.1. All audit-related fees, tax fees, or all other fees were approved by the Audit Committee pursuant to Rule 2-01(c)(7)(i) of Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

As reported in Section 9, entitled “Off-Balance Sheet Arrangements” of Management’s Discussion and Analysis, filed as Exhibit 99.2 to this Annual Report on Form 40-F, the Company does not have any off-balance sheet arrangements.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table presents information regarding the Company’s material contractual obligations by maturity as of March 31, 2017:

|

|

|

|

|

|

|

|

|

Payment due by period

|

|

(

in thousands

)

|

Total

|

Less than 1 year

|

1-3 years

|

3-5 years

|

After 5 years

|

|

Operating leases

|

$3,849

|

$845

|

$1,241

|

$1,763

|

$-

|

|

Commitments

|

$6,418

|

$ -

|

$ -

|

$ -

|

$6,418

|

IDENTIFICATION OF THE AUDIT COMMITTEE

The Company’s Board of Directors has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act and satisfies the requirements of Exchange Act Rule 10A-3. The Company’s Audit Committee is comprised of Paul Simpson, David Kong and Malcolm Swallow all of whom, in the opinion of the Company’s Board of Directors, are independent (as determined under Rule 10A-3 of the Exchange Act and the rules of the NYSE MKT) and are financially literate.

MINE SAFETY DISCLOSURE

Not applicable.

CORPORATE GOVERNANCE PRACTICES

The Company has reviewed its corporate governance practices against the requirements of the NYSE MKT and determined that its corporate governance practices do not differ significantly from those followed by U.S. companies under the NYSE MKT listing standards for corporate governance.

UNDERTAKING AND CONSENT TO

SERVICE OF PROCESS

Silvercorp Metals Inc. undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission

staff, information relating to: the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

|

|

|

|

B.

|

Consent to Service of Process

|

The Company has previously filed with the Commission an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities in relation to which the obligation to file this Form 40-F arises.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

Date: June 16, 2017

|

SILVERCORP METALS INC.

|

|

|

|

|

|

By:/s/ Dr. Rui Feng

|

|

|

|

|

|

Name: Dr. Rui Feng

|

|

|

|

|

|

Title: Chief Executive Officer

|

EXHIBIT INDEX

EXHIBITS

Annual Information

Certifications

Consents

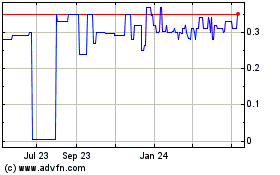

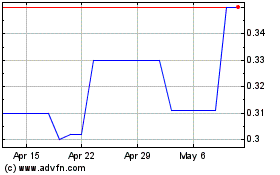

Sovereign Metals (PK) (USOTC:SVMLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sovereign Metals (PK) (USOTC:SVMLF)

Historical Stock Chart

From Apr 2023 to Apr 2024