Battle of Behemoths Turns Up a Notch -- WSJ

June 17 2017 - 3:02AM

Dow Jones News

By Sarah Nassauer and Imani Moise

Amazon.com Inc.'s purchase of Whole Foods Market Inc. isn't just

a $13.7 billion bet that many shoppers still want to buy groceries

at physical stores. It is a direct strike at the world's biggest

retailer: Wal-Mart Stores Inc.

Wal-Mart generates more than half of its $486 billion in annual

revenue from groceries and is the country's largest grocer.

Shoppers' penchant for picking their own produce and the

unprofitable nature of delivering fresh food to homes has given

Wal-Mart a rare edge over Amazon and breathing room while ramping

up its digital business with a string of e-commerce acquisitions

and other investments.

"I feel great about how we are positioned with 4,700 stores,"

Wal-Mart's e-commerce chief Marc Lore said Friday in an interview.

"It's fun playing offense and I like the fact that we aren't

chasing."

That edge may narrow for Wal-Mart and other retailers who have

relied on a grocery advantage. In the wake of Amazon's acquisition,

Wal-Mart shares fell 4.7% in Friday afternoon trading. Costco

Wholesale Corp. dropped 6% while Kroger Co. slid 11.6%.

"This deal just accelerates where we thought the world was going

with Wal-Mart and Amazon fighting over price, assortment, and

convenience as titans for the next decade," said Brandon Fletcher,

retail analyst at Bernstein in a research note.

On Friday morning, five minutes after Amazon's mega-deal was

announced, Wal-Mart said it completed another small web purchase:

It said it was paying $310 million for online menswear retailer

Bonobos, known for its $98 chinos. The purchase gives Wal-Mart

access to a brand that exists primarily online for the first time,

said Mr. Lore, as well as talent. Bonobos founder, Andy Dunn, will

head Wal-Mart's efforts to build online, direct-to-consumer

brands.

It is the fourth small e-commerce acquisition for Wal-Mart this

year and the latest salvo between the behemoths.

The rivalry heated up last fall as Wal-Mart bought Mr. Lore's

startup Jet.com for $3.3 billion and put him in charge of its

e-commerce operations. Mr. Lore, who had sold a previous startup to

Amazon, vowed to use his Wal-Mart perch to take on Amazon.

Mr. Lore has since engineered a series of small acquisitions,

adding niche online chains that appeal to wealthier or more

fashion-forward shoppers than Wal-Mart's core customer such as

Moosejaw and Modcloth. Wal-Mart has also ramped up efforts to use

its stores to ship online orders. It is also expanding its online

grocery pickup service to around a thousand stores and testing

using store workers to deliver online orders on their way home from

work.

Earlier this month Amazon took direct aim at Wal-Mart by

discounting its Prime membership program for shoppers on government

assistance, a core Wal-Mart cohort.

Wal-Mart executives have repeatedly cited their massive U.S

store base as an advantage over Amazon. "Will it be easier for an

e-commerce company to build out a massive store network and create

a customer service culture at scale? Or are we better able to add

digital and supply chain capabilities and leverage our existing

stores?" Chief Executive Doug McMillon told investors in 2015. At

the time, Wal-Mart discussed a plan to invest billions of dollars

in online operations and stores, triggering a steep selloff in

stock.

Since then Wal-Mart has put particular focus on improving the

quality and selection of fresh produce and meat, adding new

lighting and more organic food to the section, in part because

those items are primarily bought in stores.

Only around 9% of households who shopped at Whole Foods in April

also shopped at a Wal-Mart, according to data from Kantar Retail.

"Outside of Texas, there just aren't that many areas that matter to

Wal-Mart's grocery business that also matter to Whole Foods," said

Bryan Gildenberg, analyst at Kantar. Still, Amazon could bring

Whole Foods "to a much larger audience" over time, he said.

Wal-Mart's digital push is an extreme departure from its

historical model of building hundreds of new stores each year to

grow sales. The shift has ruffled some feathers internally and

externally, say people familiar with the situation. Billionaire

Warren Buffett sold off the majority of his long-held Wal-Mart

stock in the wake of the shift.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Imani

Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

June 17, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

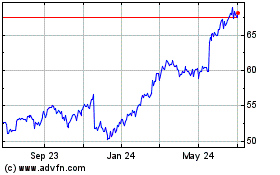

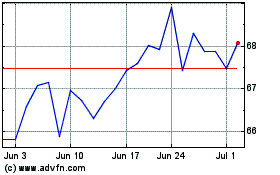

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024