By Corrie Driebusch and Riva Gold

Shares of retailers fell during a heavy day of trading after

Amazon.com said it would buy Whole Foods Market, potentially

squeezing their competitors.

Grocers were already under pressure after Kroger, the biggest

supermarket chain in the U.S., warned of disappointing earnings a

day earlier.

Retailers from traditional grocers to big-box operators tumbled

Friday on fears that Amazon would do to them what it did to

bookstores, analysts and fund managers said.

"This is a shot across the bow," said Sean Lynch, co-head of

global equities at the Wells Fargo Investment Institute. "The worry

is that Amazon is going to impact the market, drive margins

down."

The giant internet retailer's stock rose $23.54, or 2.4%, to

$987.71 Friday, while Whole Foods shares jumped 9.62, or 29%, to

42.68.

Rival grocers Supervalu and Kroger both tumbled, capping a

brutal week for the industry. Kroger shares sank 19% Thursday after

it said increasing competition would hurt earnings for the year.

That competition isn't letting up -- this week German grocery chain

Lidl opened its first stores in the U.S.

Big-box operators such as Wal-Mart Stores and Target fell

roughly 5% on Friday.

Food and staples companies in the S&P 500 shed 5.5% during

the week, the group's worst weekly decline in nearly two years.

Technology stocks also slipped, extending losses for a sector

that has been under pressure lately.

The tech-heavy Nasdaq Composite fell 13.74 points, or 0.2%, to

6151.76 Friday, notching a 0.9% weekly loss. Meanwhile, the Dow

Jones Industrial Average closed at a record, rising 24.38 points,

or 0.1%, to 21384.28 and the S&P 500 added 0.69 point, or less

than 0.1%, to 2433.15 on the largest-volume day of 2017 for stock

trading on major U.S. exchanges.

Tech remains the best-performing S&P 500 sector in the index

in 2017, up 17% year to date. But some recent sessions have been

rough for the group.

Declines in stocks including Apple and Google parent Alphabet

have dragged the sector down 3.4% over the past two weeks -- its

biggest such decline since Brexit.

"Tech has done exceptionally well this year," said Yogi Dewan,

chief executive at Hassium Asset Management, pointing to signs of

solid revenue growth in the sector. "But at these valuations, we're

not putting new money into it," Mr. Dewan said.

Among the tech companies that fell in the past week: Snap, one

of the most-anticipated initial public offerings in recent years.

The parent of disappearing-message app Snapchat closed down at its

$17 IPO price on Thursday and rose 54 cents, or 3.2%, to 17.54 on

Friday, shedding 3% for the week.

Medical-robotics maker Myomo ended its first week of trading up

5.45, or 61%, at 14.45. Myomo was the first company to list on a

major U.S. exchange through a provision of federal law known as Reg

A+, which was designed to help fund small-business growth.

Despite the recent wobble in some of this year's best-performing

stocks, both U.S. and global equities posted their biggest weekly

inflows this year in the week ended June 14, according to EPFR

Global data.

Mr. Dewan said pullbacks this year have been short and overall

volatility has been low because of the high cash levels he has seen

among investors, with many clients waiting for any drop in the

market to add to their stockholdings.

Fund managers surveyed by Bank of America increased cash in

their portfolios in June, bringing their cash allocations well

above the historical average.

U.S. government bond yields steadied on Friday after an eventful

week. The yield on the 10-year Treasury note eased to 2.157% Friday

from 2.160% on Thursday.

Earlier in the week, yields dropped following

weaker-than-expected inflation data, then retraced some of that

decline after Federal Reserve officials decided to raise interest

rates at Wednesday's meeting and signaled further increases. Yields

fall as prices rise.

Energy stocks climbed Friday as the price of oil rose slightly.

U.S.-traded crude added 0.6%, to $44.74 a barrel Friday, but prices

have fallen more than 11% over the past four weeks on oversupply

concerns.

Write to Corrie Driebusch at corrie.driebusch@wsj.com and Riva

Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

June 16, 2017 17:34 ET (21:34 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

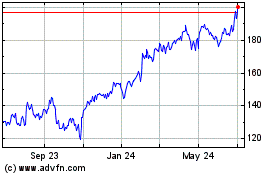

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

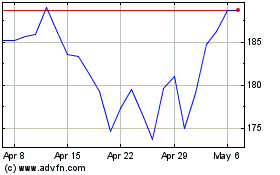

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024