Additional Proxy Soliciting Materials (definitive) (defa14a)

June 16 2017 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

Argan, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

ARGAN, INC.

ADDITIONAL INFORMATION MATERIAL

WITHDRAWAL OF PROPOSAL NO. 2

This supplement to the definitive proxy statement (the “Supplement”) for the 2017 Annual Meeting of Stockholders of Argan, Inc. (the “2017 Annual Meeting”) provides additional information to the Notice of Annual Meeting of Stockholders and Proxy Statement (the “Proxy Statement”) which was filed by Argan, Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC”) on May 8, 2017.

The Supplement is being filed with the SEC and being made available to stockholders on June 16, 2017. The information in this Supplement is in addition to the information provided by the Proxy Statement, and except for the changes described herein, this Supplement does not modify any other information set forth in the Proxy Statement.

THE PROXY STATEMENT CONTAINS IMPORTANT ADDITIONAL INFORMATION AND THIS SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

REMOVAL OF PROPOSAL NO. 2 FROM STOCKHOLDER CONSIDERATION

The Proxy Statement includes Proposal No. 2, pursuant to which the Company requested that the stockholders approve the amendment to the Company’s 2011 Stock Plan (the “Stock Plan”) in order to increase the total number of shares of the Company’s common stock reserved for issuance under the Stock Plan from 2,000,000 shares to 2,750,000 shares.

The Company included Proposal No. 2 in the Proxy Statement with a focus on its ability to continue to grow the Company for many years to come by awarding options to purchase its common stock as a means to attract and retain talented employees and directors. The Company’s standard practice is to reserve enough shares of the Company’s common stock in order to continue to make periodic stock option awards to directors, executive officers and other current or new employees of the Company in accordance with the terms of the 2011 Stock Plan and in a manner consistent with past practice. Since 2011, the Company has followed a pattern of requesting the stockholders to approve additional shares for award under the Stock Plan every two years. The most recent request was approved by the stockholders in 2015.

On June 14, 2017, the Company was notified that a single stockholder had brought a court action claiming that our Proxy Statement did not adequately disclose the number of directors, executive officers, other employees and consultants that are eligible for awards under the Stock Plan, among other claims. Our Proxy Statement did state that all of our directors, executive officers, other employees and consultants would be eligible for such awards. Based on the volume and completeness of the information available to stockholders in the Proxy Statement and elsewhere relating to the Stock Plan, the Company does not believe that the omitted disclosure is material to the consideration of Proposal No. 2.

This Supplement hereby provides notice to the Company’s stockholders of its decision to remove Proposal No. 2 from consideration at the 2017 Annual Meeting

, which is scheduled to occur on June 22, 2017. The Company was faced with three alternatives to respond to the court action. First, the Company could oppose the action. The Company believes if it did so, it

was

likely that it would ultimately prevail. However, this option would involve a significant waste of management time as well as expenditure of the Company’s cash for attorney fees. Second, the Company could simply make the requested disclosure, i.e., state the total number of directors, executive officers, employees and consultants. This option, however, would subject the Company to a claim, which the Company believes is meritless, that the plaintiff in the court action conferred a benefit on the other shareholders and, therefore, plaintiff’s attorneys may claim to be entitled to significant fees under the securities laws. Third, the Company could simply remove Proposal No. 2 from consideration. Since, as described below, the immediate increase in the total number of shares of the Company’s common stock available for issuance under the Stock Plan is not necessary, there are no significant adverse consequences to the Company as a result of the removal of this proposal at this time. Moreover, the Company believes that by removing the proposal, this should moot the court action. By so doing, the Company will avoid substantial waste of management time and a substantial amount of attorney fees. In addition, the Company believes that this option should obviate any claim by the plaintiff that the court action conferred any benefit on the other shareholders and thereby entitled plaintiff’s attorneys to recovery of fees.

The Company has determined that the third option, i.e., removal of Proposal No. 2, is in the best interests of the shareholders in that it minimizes the waste of the Company’s resources without adversely affecting the Company’s ability to continue to utilize the Stock Plan. Accordingly, the Company chose to implement the third option and is withdrawing Proposal No. 2.

The Company expresses its disappointment with making this decision as, to date, the proposal has received overwhelmingly positive stockholder support. However, as recently disclosed in the Company’s Form 10-Q Report for the Quarterly Period Ended April 30, 2017 filed with the SEC on June 7, 2017, the Company has 340,000 shares of its common stock reserved for the award of stock options in the future, which is a number of shares that should be sufficient for the Company to make awards in the ordinary course of business for the next twelve months. Therefore, the Company does not believe that the stockholder approval of Proposal No. 2 is imperative at this time. The Company expects that it will make a proposal similar to Proposal No. 2 in the future when the need is more immediate.

As a result of the removal of Proposal No. 2, the Company notes the following important matters regarding voting:

·

proxy cards or voting instructions previously received by the Company and providing directions for the voting on Proposal No. 1 (the election of Directors) will remain valid and in effect, and will be voted as directed;

·

proxy cards or voting instructions previously received by the Company and providing directions for the voting on Proposal No. 2

will not be voted;

·

proxy cards or voting instructions previously received and providing directions for the voting on Proposal No. 3 (the advisory vote on executive compensation) will remain valid and in effect, and will be voted as directed;

·

proxy cards or voting instructions previously received and providing directions for the voting on Proposal No. 4 (the ratification of public accountants) will remain valid and in effect, and will be voted as directed;

2

·

the Company will not make available or distribute, and stockholders do not need to sign, new proxy cards or submit new voting instructions solely as a result of the removal of Proposal No. 2; and

·

if a stockholder has already submitted a proxy card or voting instructions to the Company, there is no need to resubmit a proxy card or voting instructions with different directions, unless the stockholder wishes to change the votes previously cast on Proposals 1, 3 or 4.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the 2017 Annual Meeting, the Company filed its Proxy Statement and accompanying proxy card with the SEC on May 8, 2017, made electronic copies of the proxy materials available to stockholders of record on or about May 11, 2017, and mailed copies of the proxy materials to those stockholders who had previously requested hard copies between May 11 and 15, 2017.

Before making any voting decision and because each vote is important, the Company urges all stockholders to read carefully the proxy materials, including the Proxy Statement and the 2017 Annual Report which contains the Company’s Form 10-K Annual Report for the year ended January 31, 2017 filed with the SEC on April 11, 2017, and Amendment No. 1 to the Proxy Statement filed by the Company with the SEC on June 14, 2017. Electronic copies of the Proxy Statement and the 2017 Annual Report are available for viewing or printing at http://www.cstproxy.com/arganinc/2017.

The Company files annual, quarterly and current reports, proxy statements and other information with the SEC. Stockholders can read these SEC filings over the Internet at the SEC’s website at www.sec.gov.

Stockholders may also read and copy any materials the Company files with the SEC at its public reference facilities at 100 F Street, N.E., Washington, D.C. 20549 on official business days during the hours of 10:00 a.m. to 3:00 p.m. Stockholders may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities.

Finally, stockholders may also access annual, quarterly and current reports, proxy statements and other information that the Company files with the SEC on the Company’s website at www.arganinc.com.

3

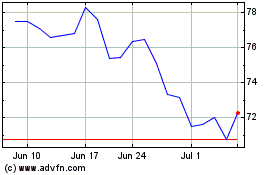

Argan (NYSE:AGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

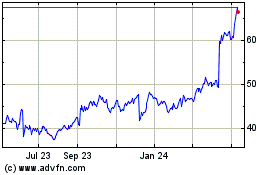

Argan (NYSE:AGX)

Historical Stock Chart

From Apr 2023 to Apr 2024