Current Report Filing (8-k)

June 16 2017 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported):

June 12, 2017

CAREVIEW

COMMUNICATIONS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-54090

|

95-4659068

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

405 State Highway 121, Suite B-240,

Lewisville, TX 75067

(Address of principal

executive offices and Zip Code)

(972) 943-6050

(Registrant’s

telephone number, including area code)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Indícate

by check mark whether the registrant is an emerging growth Company as defined in Rule 405 of the Securities Act of 1933 (§

230-405 of this chapter) or Rule 12v-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

individual by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

On June 12, 2017,

CareView Communications, Inc. (the "Company") hired Jon E. Freeman as its Chief Financial Officer. The Company and Mr.

Freeman entered into an employment agreement with an effective date of June 12, 2017 (the "Effective Date") which terminates

in one year from the Effective Date unless earlier terminated.

Mr. Freeman's salary

will be $180,000 annually, which amount will be reviewed annually or more frequently in the Company's sole discretion, for an upward

adjustment (but never a downward adjustment). At the end of each annual year, Mr. Freeman is eligible to receive a bonus as directed

by the Company's Board of Directors. The Company issued Mr. Freeman a non-qualified stock option pursuant to the 2016 Stock Option

Plan for 500,000 shares with an exercise price of $0.11 per share. The shares underlying the option vest at the rate of 33.3% on

the first and second anniversaries of the date of grant and 33.4% on the third anniversary of the date of grant, subject to his

continued service to the Company. In addition, Mr. Freeman is eligible to receive the type of medical benefits and paid time off

commensurate with other executives.

Either party may

terminate the agreement at any time with a ninety (90) day written notice. The Company may terminate the agreement at any time

for cause upon notice. The agreement may be terminated by Mr. Freeman for good reason at any time upon written notice by Mr. Freeman.

If the agreement is terminated for cause by the Company or not for good reason by the employee, then Mr. Freeman is not entitled

to all salary or benefits beyond the date of the termination. If the Company terminates for no reason or Mr. Freeman terminates

for good cause, Mr. Freeman shall be entitled to severance for a period beginning with the date of termination and continuing for

twelve months from the Effective Date (the "Severance Period"), which severance will include (i) payment of base salary

for the entire Severance Period, (ii) immediate vesting of all granted but unvested stock options including an extended time to

exercise the options beginning on the date of termination and to be reviewed for an annual extension at the sole discretion of

the Board's Compensation Committee not to extend past its original expiration date, and (iii) continuation in all benefits plans

and payments with the Company continuing to make the employer's portion during the Severance Period.

There are no arrangements

or understandings between Mr. Freeman and any other persons pursuant to which he was selected as Chief Financial Officer. There

are also no family relationships between Mr. Freeman and any director or executive officer of the Company and he has no direct

or indirect material interest in any transaction required to the disclosed pursuant to Item 404(a) of Regulation S-K.

The foregoing description

of the employment agreement is qualified in its entirety by reference to the full text of the employment agreement, which is filed

as Exhibit 10.1 to this Current Report on Form 8-K and are incorporated by reference.

Mr. Freeman has

over 25 years of finance, operations and management experience across a variety of industries including medical device, technology,

industrial manufacturing, and professional services. He has worked in environments ranging from large public multi-national to

smaller, emerging private companies. Prior to accepting the position with the Company, Mr. Freeman provided CFO consulting services

to a variety of companies with a particular focus on early-stage life science companies since January 2014. The services he provided

ranged from accounting, business and financial plan development, capital raises, financial reporting and investor relations. From

September 2011 to November 2013, he served as Chief Financial Officer and Vice President of Medafor, Inc. in Minneapolis, MN, a

privately-held, post-FDA approved medical device corporation developing, manufacturing and selling a hemostatic agent product line.

Medafor was acquired by C.R.Bard [NYSE: BCR] in October 2013. Mr. Freeman earned his B.A. in Economics from St. Olaf College and

his MBA from University of Texas. He is also a member of the CFM-Institute of Management Accountants.

On June 16, 2017, the Company issued a

press release announcing the hiring of Mr. Freeman. A copy of that press release is furnished as Exhibit 99.1 hereto and is incorporated

herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

_____________________

*

Filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

June 16, 2017

|

CAREVIEW COMMUNICATIONS, INC.

|

|

|

|

|

|

By:

|

/s/ Steven G.

Johnson

|

|

|

|

Steven G. Johnson

|

|

|

|

Chief Executive Officer

|

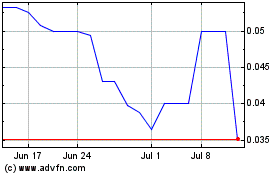

Careview Communications (QB) (USOTC:CRVW)

Historical Stock Chart

From Mar 2024 to Apr 2024

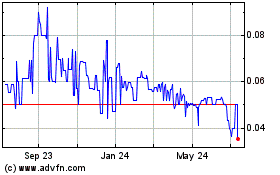

Careview Communications (QB) (USOTC:CRVW)

Historical Stock Chart

From Apr 2023 to Apr 2024