UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

|

|

|

Filed by the Registrant

Filed by the Registrant

|

|

☐

Filed by a Party other than the Registrant

|

|

|

|

|

|

Check the appropriate box:

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY

RULE 14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

McKESSON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

(5) Total fee paid:

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

|

(3) Filing Party:

|

|

|

|

(4) Date Filed:

|

McKesson 2017 Annual Meeting of

Stockholders Meeting Date: July 26, 2017

Executive Summary Compensation Plans Align

Pay with Performance CEO pay magnitude continues to decline Realizable pay graph shows strong alignment between CEO pay and Company performance Recent compensation plan changes reflect shareholder feedback and are intended to strike the right

balance of pay for performance, executive retention and attraction of a diversified workforce Robust and Evolving Governance Practices McKesson values shareholder feedback in the evolution of our governance practices McKesson engaged with over 60%

of our shareholder base since the 2016 Annual Meeting Since the 2016 Annual Meeting, McKesson made the following changes as a result of shareholder feedback: Enhanced disclosure and Board oversight of corporate political contributions Increased

focus on sustainability, including Board oversight and review of the Company’s sustainability and corporate responsibility practices Independent, Experienced and Diverse Board 7 of 8 director nominees are independent, including a Lead

Independent Director with robust duties, bringing a balance of industry-specific and functional expertise McKesson is a leader in board diversity; one-half of McKesson’s 2017 director nominees are diverse and women have held three Board seats

since 2002 We ask for your support at our 2017 Annual Meeting

Governance Highlights McKesson is committed

to sound and effective governance practices, including active shareholder engagement

Our Board: Independent, Experienced and

Diverse McKesson Leading on Board Diversity One-half of McKesson’s 2017 director nominees are diverse Women have held three Board seats since 2002 for which McKesson was recognized as an Honor Roll member for the second year in a row by 2020

Women on Boards McKesson directors’ diverse backgrounds, skills and experiences align with business strategy and contribute to an effective and well-balanced Board Board Skills & Experience Align with Business Strategy

Management Team Delivers Sustained

Performance TOP LINE GROWTH $198.5B Total Revenues 5% Growth on a constant currency basis BOTTOM LINE RESULTS $4.7B Operating Cash Flow 4% Adjusted EPS Growth *Cumulative TSR is calculated as stock price appreciation (or reduction) over the

measurement period, including reinvestment of dividends when paid, divided by the stock price at the beginning of the period.

Compensation Plans Align Pay with

Performance Short-Term Incentive Pay Payouts under cash-based annual plan down 20% from FY 2016 to FY 2017 CEO’s target annual cash incentive opportunity remains flat since May 2008 (ninth consecutive year) Overall Compensation & Salary

CEO’s total reported compensation declined (fourth consecutive year) CEO’s base salary remains unchanged since May 2010 (seventh consecutive year) Payouts under cash-based long-term plan down 40% from FY 2016 to FY 2017 Stock price

performance resulted in no payout of shares under FY 2015-2017 Total Shareholder Return Unit program Stock option grants made in FY 2015, FY 2016 and FY 2017 all underwater at fiscal year-end Long-Term Incentive Pay

Total Shareholder Return of 75% CEO Direct

Pay Down 27% (1) Total shareholder return (“TSR”) assumes $100 invested at the close of trading on March 31, 2012 and the reinvestment of dividends. (2) Total direct compensation (“TDC”) refers to total compensation disclosed

in the Summary Compensation Table minus the amount displayed under the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column. We exclude this amount because it does not reflect Compensation Committee decisions

based on Company or individual performance. Total Shareholder Return(1) vs. CEO Total Direct Compensation(2)

Realizable Pay: CEO Pay Aligned with

Performance The following pay elements are included in both SCT and realizable pay. The gray bars in the graph represent values disclosed in the Summary Compensation Table (SCT) and actual payouts of the Management Incentive Plan (MIP - annual cash

incentive) and Long-Term Incentive Plan (LTIP – long-term cash incentive) The blue bars in the graph include outstanding long-term incentive awards at target payout using our stock price at the end of FY 17 This is a conservative methodology,

since some outstanding awards might not ever ultimately vest Because 100% of our CEO's long-term incentives are directly tied to stock price or operational metrics, our CEO’s realizable pay is materially lower than reported SCT amounts over

the same period Declining MIP payouts further reinforce pay for performance alignment over the same measurement period CEO Pay (denoted in thousands) FY 2015 FY 2016 FY 2017 SCT Value Realizable Value SCT Value Realizable Value SCT Value Realizable

Value Base Salary $1,680 $1,680 $1,680 $1,680 $1,680 $1,680 MIP $5,292 $5,292 $4,234 $4,234 $3,402 $3,402 Long-Term Incentives $17,504 $2,634 $17,374 $6,152 $14,470 $7,101 All Other Comp. $368 $368 $362 $362 $588 $588 Total Compensation $24,844

$9,974 $23,650 $12,427 $20,140 $12,771 CEO Summary Compensation Table Pay vs. Realizable Pay at March 31, 2017

FY 2017 Compensation is Heavily

Performance-Based Incentive Pay Element Performance Metric Target Pay Management Incentive Plan (annual cash incentive) Adjusted EPS 150% of base salary Adjusted OCF Individual Modifier Long-Term Incentive Plan (long-term

cash incentive) Cumulative Adjusted OCF 20% of target LTI value Average ROIC Total Shareholder Return Units (long-term equity incentive) MCK TSR vs. S&P 500 Health Care Index 40% of target LTI value Stock Options (long-term equity

incentive) Stock Price 40% of target LTI value FY 2017 CEO Incentive Pay FY 2017 CEO Compensation Mix

Item 5. Independent Board Chairman Board

Perspectives on Shareholder Proposals Given the robust Lead Independent Director role, the need for Board flexibility to select Chairman best suited to drive shareholder value, and the strong financial performance under current leadership, the Board

recommends a vote “AGAINST” The Company’s structure is working effectively as evidenced by the strong financial performance during Mr. Hammergren’s tenure as Chairman/CEO Mr. Hammergren’s in-depth knowledge of the

healthcare industry and the Company’s complex businesses and operations best equips him to lead and focus the Board on the most critical issues Effective Company Structure Board Should Select Leadership Structure Board uses its judgment to

select the most qualified and appropriate individual to serve as Chairman at any given time based on the needs of the Company Board selected an independent director as Chairman in the past, and may do so again in the future Robust Lead Independent

Director role provides management oversight and independent leadership since July 2013 Strong Lead Independent Director

Best-in-Class Lead Independent Director

Duties and Powers On May 24, 2017, the Board of Directors reelected Edward A. Mueller to serve a two-year term as the Board’s Lead Independent Director, effective July 26, 2017. Lead Independent Director Duties and Powers Preside at all

meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors Serve as liaison between the Chairman and the independent directors Approve Board meeting agendas Approve meeting schedules to

assure that there is sufficient time for discussion of all agenda items Call meetings of the independent directors, as appropriate Lead the Board’s annual evaluation of the CEO succession process Lead the Board’s annual evaluation of

directors and the CEO If requested by major shareholders, ensure that he or she is available for consultations and direct communication Carry out the responsibilities of the Lead Independent Director specified in the Company's CEO Absence Event

Management Process Upon the occurrence of a temporary or permanent incapacity or disability or other similar temporary or permanent absence of the Chairman, assume the day-to-day duties and authorities of the Chairman on an interim basis Recommend

to the Governance Committee membership of various Board committees, as well as selection of committee chairs Retain, or recommend retention of, independent legal, accounting, consulting and other advisors Assist in assuring compliance with, and

implementation of, the Corporate Governance Guidelines

Item 6. Right to Act by Written Consent

Board Perspectives on Shareholder Proposals Shareholders Have Right to Call a Special Meeting Committed to Governance Best Practices In recent years, McKesson has enhanced its governance practices, including: Proxy Access, No Supermajority Vote

Provisions, No Poison Pill, Robust Lead Independent Director role, Declassified Board, and Disclosure of Political Contributions Shareholders have opportunity to communicate directly with members of the Board, including the Lead Independent Director

A By-Law amendment in 2013 established the right to call a special meeting of shareholders for record holders who have held a net long position of at least 25% of the Company’s outstanding shares for at least one year Given shareholders’

right to call a special meeting, and the lack of notice and other protections for shareholders in the written consent context, the Board recommends a vote “AGAINST” Not in Best Interest of Company or Shareholders Permits shareholders to

take action without input from, and notice and dissemination of corresponding materials to, all of our shareholders No requirement to satisfy any holding requirements with respect to our common stock Does not give Board sufficient opportunity to

analyze actions and make recommendations

McKesson is Committed to Diversity,

Inclusion and Pay Equity i care McKesson’s core values – our ICARE shared principles – provide us with a foundation for fostering an inclusive workplace while ILEAD, our leadership values, provides for the development of

diverse and inclusive teams. McKesson’s Diversity Council, an executive-level body, is responsible for ensuring that the enterprise’s diversity strategy is understood and embraced at all levels of our Company. Senior leaders are expected

to be proactive in recruiting and retaining diverse teams and, to make that real, McKesson has tied diversity goals to the compensation of our leaders. McKesson is committed to providing equal opportunity for all applicants and employees. Our Equal

Employment Opportunity Policy prohibits employment decisions, including compensation decisions, based on protected characteristics such as gender or race. McKesson’s compensation programs use quantifiable guiding principles and are designed to

drive equitable pay decisions. The Company has systems in place to address employee pay concerns. As a result, McKesson is confident that its compensation practices will address and eliminate any unexplained pay inequities that are identified,

including with respect to gender and race. icare Diversity and inclusion are integral to McKesson’s culture, and pay equity is fundamental to McKesson’s compensation systems

Political Contributions Disclosure View

a complete list of McKesson’s 2016 corporate political contributions at http://www.mckesson.com/about-mckesson/public-affairs/political-engagement Political Contributions Transparency Governance Committee reviews contributions and related

policies Enhanced Board Oversight Trade Association Transparency The Company discloses annual payments to health policy, industry and/or trade organizations in excess of $50,000 on its website McKesson prohibits trade associations, and other

tax-exempt organizations, such as 501(c)(4)s, from using our corporate funds for political purposes McKesson voluntarily discloses corporate political contributions to state and local candidates, parties, committees, ballot measures, and political

organizations on its website This report also includes payments to entities organized under Section 527 of the Internal Revenue Code Political Contribution Policy McKesson does not make “independent expenditures” or “Super

PAC” contributions Political contributions must be reviewed by outside counsel, approved by the Senior Vice President of Public Affairs, with contributions greater than $1,000 approved by the CEO McKesson uses rigorous objective criteria that

promote the interests of the Company

McKesson Strives to Operate in an

Environmentally Sustainable Way Environmental Sustainability Disclosure: We also report our environmental impacts to the Carbon Disclosure Project (CDP) McKesson’s commitment to environmental sustainability focuses on costs savings, reducing

our carbon footprint and our impact on the planet, while ensuring the long-term financial viability of our Company A core tenet of our Company is operational excellence. We continually seek business efficiencies that also ameliorate environmental

impact and result in reducing greenhouse gas emissions. We have standard operating procedures for environmental, health and safety McKesson’s Real Estate group initiative to consolidate and benchmark environmental

data, and work towards internal target-setting for CO2 reductions Every year, we publish an update on our progress via our Corporate Social Responsibility report, which references Global Reporting Initiative guidelines. To learn

more, please visit: www.mckesson.com/csr We have standardized a path to LEED and WELL certification for our office buildings Board-level review of environmental sustainability. Senior stakeholders are engaged, including executive management

Supporting the communities in which we operate is a core value demonstrated through McKesson’s employee volunteer programs Multi-year decrease in our sales fleet CO2 emissions. Via telepresence technology we also reduced emissions from

employee travel The Board has oversight and reviews the Company’s sustainability and corporate responsibility practices

Executive Summary Compensation Plans

Align Pay with Performance CEO pay magnitude continues to decline Realizable pay graph shows strong alignment between CEO pay and Company performance Recent compensation plan changes reflect shareholder feedback and are intended to strike the right

balance of pay for performance, executive retention and attraction of a diversified workforce Robust and Evolving Governance Practices McKesson values shareholder feedback in the evolution of our governance practices McKesson engaged with over 60%

of our shareholder base since the 2016 Annual Meeting Since the 2016 Annual Meeting, McKesson made the following changes as a result of shareholder feedback: Enhanced disclosure and Board oversight of corporate political contributions Increased

focus on sustainability, including Board oversight and review of the Company’s sustainability and corporate responsibility practices Independent, Experienced and Diverse Board 7 of 8 director nominees are independent, including a Lead

Independent Director with robust duties, bringing a balance of industry-specific and functional expertise McKesson is a leader in board diversity; one-half of McKesson’s 2017 director nominees are diverse and women have held three Board seats

since 2002 We ask for your support at our 2017 Annual Meeting

2017 Annual Meeting of Stockholders This

information is being provided to shareholders in addition to the proxy statement filed by McKesson Corporation (the “Company”) with the Securities and Exchange Commission (the “SEC”) on June 16, 2017. Please read the complete

proxy statement and accompanying materials carefully before you make a voting decision. Even if voting instructions for your proxy have already been given, you can change your vote at any time before the annual meeting by giving new voting

instructions as described in more detail in the proxy statement. The proxy statement, and any other documents filed by the Company with the SEC, may be obtained free of charge at www.sec.gov and from the Company’s website at www.mckesson.com.

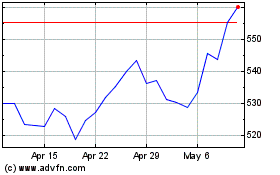

McKesson (NYSE:MCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

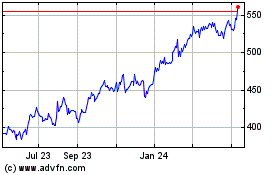

McKesson (NYSE:MCK)

Historical Stock Chart

From Apr 2023 to Apr 2024