Amended Statement of Beneficial Ownership (sc 13d/a)

June 15 2017 - 11:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

ADESTO TECHNOLOGIES CORPORATION

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

00687D101

(CUSIP Number)

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, New Jersey 07042

Attention: Daniel B. Wolfe

Telephone: 973-746-4500

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 15, 2017

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 00687D101

|

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSONS:

180 Degree Capital Corp.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) (b)

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

1,769,868 shares

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

1,769,868 shares

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,769,868 shares

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

13

|

PERCENT OF CLASS REPRESENTED IN ROW (11)

8.8% (1)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO

|

|

|

|

|

(1)

|

Based upon 20,213,638 shares of common stock outstanding as of June 15, 2017, calculated by adding 15,838,638 shares of Common Stock outstanding as of May 9, 2017, as reported on the Issuer's quarterly report filed on Form 10-Q on May 15, 2017, to 4,375,000 shares of Common Stock issued in a underwritten public offering announced in a press release on June 15, 2017, available at http://www.globenewswire.com/news-release/2017/06/15/1024654/0/en/Adesto-Technologies-Corporation-Prices-Public-Offering-of-Common-Stock.html.

|

CUSIP No. 00687D101

|

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSONS:

Kevin M. Rendino

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) (b)

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

1,769,868 shares

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

1,769,868 shares

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,769,868 shares

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

13

|

PERCENT OF CLASS REPRESENTED IN ROW (11)

8.8% from 180 Degree Capital Corp. (1)(2)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

|

|

(1)

|

Based upon 20,213,638 shares of common stock outstanding as of June 15, 2017, calculated by adding 15,838,638 shares of Common Stock outstanding as of May 9, 2017, as reported on the Issuer's quarterly report filed on Form 10-Q on May 15, 2017, to 4,375,000 shares of Common Stock issued in a underwritten public offering announced in a press release on June 15, 2017, available at http://www.globenewswire.com/news-release/2017/06/15/1024654/0/en/Adesto-Technologies-Corporation-Prices-Public-Offering-of-Common-Stock.html.

|

|

|

|

|

(2)

|

As described in Item 2, Mr. Rendino is deemed to have shared voting and dispositive power over the shares of the Company held by 180 Degree Capital Corp. ("180") as a result of his position as Chief Executive Officer of 180. Reference is made to Item 2 to this Schedule 13D.

|

CUSIP No. 00687D101

|

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSONS:

Daniel B. Wolfe

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) (b)

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

1,769,868 shares

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

1,769,868 shares

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,769,868 shares

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

13

|

PERCENT OF CLASS REPRESENTED IN ROW (11)

8.8% from 180 Degree Capital Corp. (1)(2)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

|

|

(1)

|

Based upon 20,213,638 shares of common stock outstanding as of June 15, 2017, calculated by adding 15,838,638 shares of Common Stock outstanding as of May 9, 2017, as reported on the Issuer's quarterly report filed on Form 10-Q on May 15, 2017, to 4,375,000 shares of Common Stock issued in a underwritten public offering announced in a press release on June 15, 2017, available at http://www.globenewswire.com/news-release/2017/06/15/1024654/0/en/Adesto-Technologies-Corporation-Prices-Public-Offering-of-Common-Stock.html.

|

|

|

|

|

(2)

|

As described in Item 2, Mr. Wolfe is deemed to have shared voting and dispositive power over the shares of the Company held by 180 as a result of his position as President, Chief Financial Officer, and Chief Compliance Officer of 180. Reference is made to Item 2 to this Schedule 13D.

|

CUSIP No. 00687D101

The following constitutes Amendment No. 2 to the Schedule 13D filed by the undersigned on November 2, 2015, and amended on January 9, 2017. This Amendment No. 2 amends the Schedule 13D as specifically set forth herein.

Item 2. Identity and Background

Item 2(a)-(c) and (f) is hereby amended and restated to read as follows:

(a) - (c) This Statement is filed by 180 Degree Capital Corp. (“180”), Daniel B. Wolfe and Kevin M. Rendino (each, a "Reporting Person"). Mr. Wolfe and Mr. Rendino may be deemed to have shared voting and shared dispositive power over the Common Stock owned by 180 (the "Shares") as result of their respective positions as President, Chief Financial Officer and Chief Compliance Officer (Mr. Wolfe) and Chief Executive Officer (Mr. Rendino) of 180. The principal business address of each Reporting Person is 7 N. Willow Street, Suite 4B, Montclair, NJ 07042. None of the Reporting Persons is considered to be part of a group, and this Schedule 13D has been filed by the Reporting Persons as a joint filing pursuant to Rule 13d–1(k)(1) promulgated by the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended.

(f) 180 is a New York corporation. Mr. Wolfe and Mr. Rendino are citizens of the United States of America.

Item 4. Purpose of Transaction

Item 4 is hereby amended and restated to read as follows:

The description set forth in Item 3 of this Schedule 13D is incorporated herein by reference. 180 acquired such securities in the Company for investment purposes. Depending upon overall market conditions, other investment opportunities available to 180, the availability of Shares at prices that would make the purchase of additional Shares desirable, or the market price at which Shares are then currently trading that would make the sale of Shares desirable (in either case, including market prices that may exist as a result of this filing or other filings by 180), 180 may increase or decrease its position in the Issuer through, among other things, the purchase or sale of Shares on the open market or in private transactions or otherwise, on such terms and at such times as 180 may deem advisable. 180 does not have any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D, except as set forth herein or such as would occur upon completion of any of the actions discussed herein.

180 intends to review its investment in the Issuer on a continuing basis and to engage in discussions with management and the Board of Directors of the Issuer concerning the business, operations, corporate governance and future plans of the Issuer. Depending on various factors including, without limitation, the Issuer's financial position and investment strategy, the price levels of the Shares, conditions in the securities market and general economic and industry conditions, 180 may in the future take such actions with respect to their investment in the Issuer as they deem appropriate including, without limitation,

|

|

|

|

•

|

communicating privately or publicly with other stockholders, the Issuer's Board of Directors or other persons;

|

|

|

|

|

•

|

making proposals or director nominations to the Issuer;

|

|

|

|

|

•

|

soliciting proxies with respect to proposals or director nominees made by 180;

|

|

|

|

|

•

|

supporting proposals or director nominations made by 180 or other stockholders;

|

|

|

|

|

•

|

purchasing additional Shares or selling some or all of their Shares; or

|

|

|

|

|

•

|

changing their intention with respect to any and all matters referred to in this Item 4.

|

Item 5. Interest in Securities of the Issuer

Item 5(a)-(b) is hereby amended and restated in its entirety as set forth below:

(a)-(b) The aggregate percentage of Common Stock reported owned by each person named herein is based upon 20,213,638 shares of common stock outstanding as of June 15, 2017, calculated by adding 15,838,638 shares of Common Stock outstanding as of May 9, 2017, as reported on the Issuer's quarterly report filed on Form 10-Q on May 15, 2017, to 4,375,000 shares of Common Stock issued in a underwritten public offering announced in a press release on June 15, 2017, available at http://www.globenewswire.com/news-release/2017/06/15/1024654/0/en/Adesto-Technologies-Corporation-Prices-Public-Offering-of-Common-Stock.html. As of June 15, 2017, 180 beneficially owned 1,769,868 shares of Common Stock, constituting approximately 8.8% of the shares outstanding of the Issuer. Mr. Rendino and Mr. Wolfe may be deemed to have shared voting and dispositive power over the Common Stock owned by 180 as a result of Mr. Rendino's position as Chief Executive Officer of 180 and Mr. Wolfe's position as President, Chief Financial Officer and Chief Compliance Officer of 180.

Item 7. Material to Be Filed as Exhibits

|

|

|

|

99.1

|

Joint Filing Agreement

|

SIGNATURE

After reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: June 15, 2017

180 GROUP, INC.

By:

/s/ Daniel B. Wolfe

Name: Daniel B. Wolfe

Title: President

/s/ Daniel B. Wolfe

Daniel B. Wolfe

/s/ Kevin M. Rendino

Kevin M. Rendino

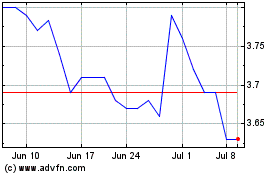

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

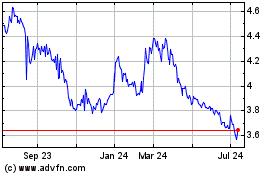

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Apr 2023 to Apr 2024