Additional Proxy Soliciting Materials (definitive) (defa14a)

June 15 2017 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

Argan, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

One Church Street

Suite 201

Rockville, MD 20850

301-315-0027

fax 301-315-0064

www.arganinc.com

June 14, 2017

AN IMPORTANT REMINDER TO SUBMIT YOUR PROXY TO VOTE AT OUR ANNUAL MEETING OF STOCKHOLDERS ON JUNE 22, 2017

Argan’s Independent Directors and Compensation Committee Urge Stockholders to Vote FOR Our Say on Pay Proposal (Proposal No. 3)

Dear Fellow Argan Stockholder:

In connection with our 2017 Annual Meeting of Stockholders to be held on June 22, 2017, we are writing to ask for your support by voting in accordance with the recommendations of our Board of Directors for each proposal in our 2017 Proxy Statement. In particular, we ask that you

consider our philosophy of paying for performance

that successfully aligned executive pay for the fiscal year ended January 31, 2017 (“Fiscal 2017”) to the achievement of our strategic objectives by voting

FOR our Say on Pay Proposal (Proposal No. 3).

We believe that our executive officers have continued to take action to create long-term value for our stockholders, which has resulted in industry-leading total shareholder return over one, three, and five-year periods. Our Board of Directors strongly believes that our executive compensation program, which enables us to attract and retain high-performing executives, has played a significant role in driving our growth over the past several years.

Additionally, in connection with your consideration of our Say on Pay Proposal, we would like to provide additional context beyond our 2017 Proxy Statement and emphasize the following key points:

1.

In Fiscal 2017, we achieved record year-over-year growth in a number of key financial and operational measurements, including revenues, net income, and EBITDA, and our Compensation Committee believes that our executive compensation arrangements for 2017 are aligned with this exceptional performance.

Fiscal 2017 was another record year of growth for Argan. Revenues increased to an annual record $675 million, up 63% compared to the prior year. Gross profit increased 48% to $147 million, while net income attributable to our stockholders increased 94% to $70 million, or

$4.50 per diluted share, from $36 million, or $2.42 per diluted share, compared to the prior year. EBITDA attributable to our stockholders for Fiscal 2017 also increased 76% to $111 million, or $7.09 per diluted share, from $63 million, or $4.19 per diluted share, for the prior year. Our balance sheet also continues to strengthen; as of April 30, 2017, our cash, cash equivalents and short-term investments totaled $563 million and net liquidity was $259 million, and we have no bank debt.

Over the long-term, our performance has been similarly exceptional. We strongly believe that this level of sustained performance over several years demonstrates management’s focus on executing against our long-term strategy for the benefit of our stockholders.

Annual Return

|

|

|

1 Year

|

|

3 Year

|

|

5 Year

|

|

|

Revenue Growth

|

|

63

|

%

|

44

|

%

|

37

|

%

|

|

Net Income Growth

|

|

94

|

%

|

21

|

%

|

50

|

%

|

|

EBITDA Growth

|

|

76

|

%

|

19

|

%

|

32

|

%

|

|

Return on Equity

|

|

28

|

%

|

21

|

%

|

23

|

%

|

|

Total Stockholder Return(1)

|

|

149

|

%

|

40

|

%

|

42

|

%

|

This outstanding performance — which includes eight consecutive quarters of increasing revenues — drove the compensation of William F. Griffin, the CEO of our Gemma Power Systems subsidiary, in Fiscal 2017. In particular, Mr. Griffin’s short-term compensation is a reflection of three objective and quantifiable performance metrics specific to Gemma: Adjusted EBITDA, the OSHA Recordable Incident Rate (“RIR”), and success fees related to the development of power plants and received by Gemma. In Fiscal 2017, Gemma’s

(1) As of the last day of Fiscal 2017.

2

Adjusted EBITDA of $116.9 million significantly exceeded our target of $40 million. And, Gemma’s RIR for the 2016 calendar year of 0.43 was below the national average and significantly less than our acceptable target of 1.00, again indicating exceptional performance. Gemma did not receive any success fees in Fiscal 2017, however.

In order to limit the potential for an excessive cash-based award resulting from a calculation, our Compensation Committee included a provision in Mr. Griffin’s plan that limits the total amount of performance-based compensation for any fiscal year earned as a result of the attainment of one or more of the performance goals described to $4,000,000. As such, Mr. Griffin earned non-equity incentive plan compensation of $4,000,000 for Fiscal 2017.

With respect to our other executives, the Compensation Committee determined that a strict formula-based approach is not the best policy. For example, the performance of Rainer Bosselmann, our CEO, and David Watson, our CFO, should be evaluated with a broader measure than the strict financial performance of the operating subsidiaries. These officers are responsible for the long-term profitable and reliable growth of all of our business units and compensation arrangements tied to the performance of our Company’s equity is a more direct indicator of success. For this reason, the compensation of Mr. Bosselmann and other executive officers is largely equity-based, with base salaries and short-term cash awards that are very modest as compared to executive compensation of industry peers. Because these cash awards are modest, and the major portion of long-term compensation for these executives is equity-based, we believe it is best to establish compensation as determined appropriate by the Compensation Committee following a holistic review of the

overall

performance of the Company, including total stockholder return, at the end of the year.

Considering these and other factors, we believe that the annual incentive compensation of our executive officers for Fiscal 2017 is strongly aligned with their exceptional performance, which delivered record operating results.

2.

Between our 2015 and 2016 Annual Meetings of Stockholders, our Compensation Committee took a series of actions to further align our compensation program with evolving “best practices.”

Our 2015 Say on Pay Proposal failed to receive the support of a majority of our stockholders at our 2015 Annual Meeting. Following the meeting, our Compensation Committee undertook a comprehensive evaluation of our compensation policies, particularly in comparison to those of our direct peers and wider “best practices” in corporate governance.

Based on what we determined to be an evolving compensation landscape, our Compensation Committee introduced several changes intended to align our executive compensation program with general market practices, including:

·

Implementing stock ownership guidelines for the Named Executive Officers and non-employee directors;

·

Adopting a Clawback Policy which provides the Board of Directors with discretion to seek reimbursement of all or part of paid incentive compensation awarded to executive officers under specific circumstances;

·

Adopting a No Pledging Policy where there is a prohibition on pledging Argan equity interests obtained under Company compensation plans;

3

·

Adopting an Anti-Hedging Policy which prohibits all Company insiders from hedging Argan equity interests and trading in derivatives of the Company equity securities; and

·

Designing and implementing the 2016 Executive Compensation Plan for Mr. Griffin, in order to align performance with the amount of awards and to preserve tax deductions for compensation payments.

We believe these actions, in part, helped us obtain the stockholders’ approval of our Say on Pay Proposal at the 2016 Annual Meeting for which we achieved a significant increase year over year in the approval percentage. In addition, we regularly engage with many of our stockholders in a variety of forums in the ordinary course of business. Over the course of a given year, we speak with over 100 stockholders or potential stockholders. Many of our stockholders appreciate the unique nature of our business and generally understand our compensation structure, which we believe is appropriately tailored to our strategic plan. Consistent with its fiduciary duties and our standard practice, the Compensation Committee will continue to evaluate certain elements of compensation in light of evolving governance practices and feedback we may receive from stockholders.

3.

Our recent compensation actions focused on retaining the high-performing team in place at Gemma, our principal subsidiary, which has delivered records results over the past 10 years.

As outlined above, the Compensation Committee put in place for Fiscal 2017 a compensation plan for Mr. Griffin based on the performance of Gemma.

Since that time, we have established a deferred compensation plan covering a broad set of managers and key employees of Gemma. The Compensation Committee believes this plan will both support the continued performance of Gemma and encourage these managers and employees to remain with the company over the long-term. The individuals covered by the program are significant contributors to the operational excellence of the company, and the vesting of the deferred compensation plan is designed to encourage long-term employee retention.

4.

While cash bonuses awarded to our CEO and CFO have not been subject to specific “caps” on individual awards, our historical grant practices are indicative of the Compensation Committee’s restraint.

Since inception, the annual cash bonuses awarded to our CEO and CFO have

never

exceeded $225,000 and $200,000, respectively. While, our cash bonus payments are not subject to a strict “cap” on compensation, in practice, these awards have remained within an identifiable range.

Annual Bonus Awards Since 2008

|

|

|

2008

|

|

2009

|

|

2010

|

|

2011

|

|

2012

|

|

2013

|

|

2014

|

|

2015

|

|

2016

|

|

2017

|

|

|

CEO

|

|

$

|

175,000

|

|

$

|

175,000

|

|

$

|

125,000

|

|

$

|

125,000

|

|

$

|

125,000

|

|

$

|

150,000

|

|

$

|

200,000

|

|

$

|

175,000

|

|

$

|

175,000

|

|

$

|

225,000

|

|

|

CFO

|

|

$

|

150,000

|

|

$

|

150,000

|

|

$

|

100,000

|

|

$

|

100,000

|

|

$

|

100,000

|

|

$

|

150,000

|

|

$

|

200,000

|

|

$

|

175,000

|

|

$

|

170,000

|

|

$

|

200,000

|

|

Our Compensation Committee does not believe that placing an arbitrary cap on these bonus awards is in the best interest of stockholders, given the potential that such a cap may actually discourage the significant outperformance that has delivered so much value to our stockholders over the last several years. However, we are mindful of our role as stewards of

4

stockholder capital, and are focused on maintaining responsible incentive compensation practices, as our track record demonstrates.

5.

Executive compensation at Argan is comprised primarily of elements that reward outstanding performance and are substantially “at-risk” of forfeiture or loss of value in the event of subpar individual or company implementation.

In Fiscal 2017, approximately 79% of Mr. Griffin’s compensation was incentive-based, and approximately 75% of Mr. Bosselmann’s compensation consisted of a modest short-term cash incentive award and a stock option award, which our Compensation Committee considered inherently performance-based due to the fact that the stock option is essentially worthless unless stockholder values appreciate.

We believe that this balance, which is heavily tilted in favor of incentive-based compensation, appropriately encourages operational excellence while mitigating the potential for unnecessary risk-taking.

6.

Our executives and directors collectively own approximately 7.64% of our outstanding shares, and our interests are directly aligned with your own.

Although equity-based compensation was not a significant element of Mr. Griffin’s total compensation in Fiscal 2017, we note that, as you are aware, Mr. Griffin is one of our largest individual stockholders, owning more than 2% of the Company (and the same holds true for Mr. Bosselmann, who owns approximately 2.9% of the Company). Given his significant financial stake — to say nothing of his substantial personal, emotional, and time commitment — our Board strongly believes that Mr. Griffin is intensely focused on driving stockholder value over the long-term. In that sense, his interests in seeing the Company continue to grow are directly aligned with those of all stockholders, whether or not his compensation includes equity awards.

We firmly believe that our program of executive compensation has enabled us to attract and retain highly talented executives who are highly motivated to the achievement of both the short-

(2) “At-risk” compensation includes Cash Bonus Awards, Non-equity Incentive Plan Compensation, and Stock Option Awards as listed in the Fiscal Year 2017 Summary Compensation Table. “Fixed” compensation includes Salary Earned and All Other Compensation.

5

term and long-term success of our Company, thereby significantly enhancing shareholder value. Unquestionably, the financial performance of the Company, whether measured on a one-year, three-year or five-year basis, reflects the effectiveness of our program. We ask you to consider the

foregoing additional context regarding our executive compensation and to

vote FOR our Say on Pay Proposal (Proposal No. 3) at our 2017 Annual Meeting.

If you have any questions, or need assistance in submitting your proxy to vote your shares, please call our proxy solicitor, MacKenzie Partners, Inc., at (800) 322-2885.

Thank you for your support.

6

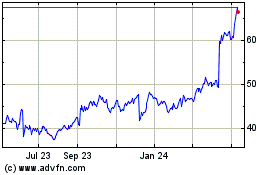

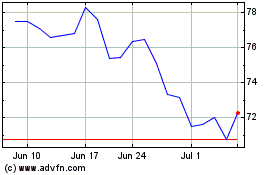

Argan (NYSE:AGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argan (NYSE:AGX)

Historical Stock Chart

From Apr 2023 to Apr 2024