Notification That Annual Report Will Be Submitted Late (nt 10-k)

June 14 2017 - 5:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

|

|

|

|

|

(Check one):

|

x

Form 10-K ☐ Form 20-F ☐ Form 11-K ☐ Form 10-Q

☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR

|

|

|

|

|

|

For Period Ended:

March 31, 2017

|

|

|

|

|

|

☐ Transition Report on Form 10-K

|

|

|

☐ Transition Report on Form 20-F

|

|

|

☐ Transition Report on Form 11-K

|

|

|

☐ Transition Report on Form 10-Q

|

|

|

☐ Transition Report on Form N-SAR

|

|

|

|

|

|

For the Transition Period Ended:

|

|

|

|

|

|

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

World Acceptance Corporation

Full Name of Registrant

Former Name if Applicable

108 Frederick Street

Address of Principal Executive Office

(Street and Number)

Greenville, SC 29607

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

|

|

|

|

|

x

|

|

(a)

|

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

(b)

|

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

|

The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

World Acceptance Corporation (the “Company”) is currently unable to file, without unreasonable effort and expense, its Annual Report on Form 10-K for the fiscal year ended March 31, 2017 (the “Form 10-K”). The Company is conducting an internal investigation of its operations in Mexico, focusing on the legality under the U.S. Foreign Corrupt Practices Act and certain local laws of certain payments related to loans, the maintenance of the Company’s books and records associated with such payments, and the treatment of compensation matters for certain employees. Womble Carlyle Sandridge & Rice, LLP, the Company’s outside legal counsel, and Ernst & Young LLP have been retained to lead the investigation.

The Company commissioned the internal investigation in March 2017 after its independent registered public accounting firm received an anonymous letter regarding compliance matters, which letter was then forwarded to the Audit Committee of the Company’s Board of Directors. The Audit Committee reviewed and considered the complaint, and the Company promptly commenced its investigation.

The Company has voluntarily contacted the U.S. Securities and Exchange Commission and the U.S. Department of Justice to advise both agencies that an internal investigation is underway and that the Company intends to cooperate with both agencies. A conclusion cannot be drawn at this time as to whether either agency will open a proceeding to investigate this matter, or, if a proceeding is opened, what potential remedies these agencies may seek. In addition, although management will seek to avoid disruption to its operations in Mexico, the Company cannot determine at this time the ultimate effect that the investigation or any remedial measures will have on such operations.

As a result of the ongoing investigation, the Company is currently unable to file the Form 10-K until more information becomes available pursuant to the investigation, including for purposes of evaluating the effectiveness of the Company’s disclosure controls and procedures and internal control over financial reporting. The Company expects to file the Form 10-K by June 29, 2017, which is within the permitted extension provided by Rule 12b-25 under the Securities Exchange Act of 1934 (the “Exchange Act”).

PART IV — OTHER INFORMATION

|

|

|

|

|

|

1.

|

Name and telephone number of person to contact in regard to this notification

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John L. Calmes, Jr.

|

|

|

|

(864)

|

|

|

|

298-9800

|

|

(Name)

|

|

|

|

(Area Code)

|

|

|

|

(Telephone Number)

|

|

|

|

|

|

|

2.

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed ? If answer is no, identify report(s).

Yes

x

No ☐

|

|

|

|

|

|

|

3.

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

Yes

x

No ☐

|

On May 9, 2017, the Company announced preliminary results for the fiscal year ended March 31, 2017. The Company announced that net income decreased 15.8% in fiscal 2017 to $73.6 million, compared with $87.4 million in fiscal 2016. Fully diluted income per share decreased 16.6% to $8.38 in fiscal 2017, compared with $10.05 in fiscal 2016.

Total revenues in fiscal 2017 declined 4.6% to $531.7 million, compared with $557.5 million in fiscal 2016. Net charge-offs as a percent of average net loans increased from 14.8% in fiscal 2016 to 15.7% in fiscal 2017. Revenues were impacted by a decrease in average earning loans during the year, and net charge-offs were negatively impacted by the cessation of in-person collection visits.

Notes payable decreased 21.2% and income tax payable increased 51.6% at March 31, 2017, compared to March 31, 2016. For additional information, refer to the Company’s Current Report on Form 8-K and accompanying press release, furnished to the Securities and Exchange Commission on May 9, 2017.

Forward-Looking Statements

This Form 12b-25 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, including, without limitation, the Company’s expectations as to the timing and outcome of its investigation and the filing of the Form 10-K.

These forward-looking statements involve risks and uncertainties, and actual results could vary materially from these forward-looking statements. Factors that may cause future results to differ materially from management’s current expectations include, among other things, the discovery of additional information relevant to the Company’s investigation; the conclusions of the Company and the Audit Committee (and the timing of the conclusions) concerning matters relating to the investigation; the timing of the review by, and the conclusions of, the Company’s independent registered public accounting firm regarding the Company’s investigation and its impact on the financial statements; the risk that the completion and filing of the Form 10-K will take longer than expected; and the risk that the Company will be unable to file the Form 10-K within the extension period of 15 calendar days provided by Rule 12b-25 of the Exchange Act. The Company disclaims any obligation to update information contained in these forward-looking statements, except as may be required by law.

|

|

|

|

|

|

|

|

World Acceptance Corporation

|

|

|

|

(Name of Registrant as Specified in Charter)

|

|

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: June 14, 2017

|

|

|

|

By

|

|

/s/ John L. Calmes, Jr.

|

|

|

|

|

|

Name:

|

|

John L. Calmes, Jr.

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

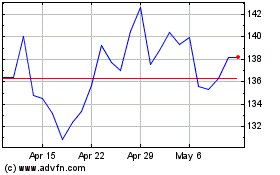

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

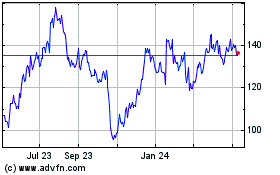

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Apr 2023 to Apr 2024