Current Report Filing (8-k)

June 14 2017 - 5:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): June 8, 2017

CSI Compressco LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

1-35195

|

94-3450907

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of incorporation)

|

|

Identification No.)

|

|

|

|

|

|

24955 Interstate 45 North

|

|

The Woodlands, Texas 77380

|

|

(Address of Principal Executive Offices and Zip Code)

|

|

|

|

|

|

Registrant's telephone number, including area code:

(281) 364-2244

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

I

tem 3.02.

|

Unregistered Sales of Equity Securities

|

As previously reported in Current Reports on Form 8-K filed on August 8, 2016 and September 21, 2016 by CSI Compressco LP, a Delaware limited partnership (the “Partnership”), the Partnership issued Series A Convertible Preferred Units representing limited partner interests in the Partnership (the “Preferred Units”) to certain purchasers thereof (the “Preferred Unitholders”).

Pursuant to the terms of the Second Amended and Restated Agreement of Limited Partnership of the Partnership (the “Partnership Agreement”), ratable portions of the Preferred Units have been and will continue to be converted each month over a period of thirty months that began in March 2017 (each, a “Conversion Date”), subject to certain provisions of the Partnership Agreement that may delay or accelerate all or a portion of such monthly conversions. On each Conversion Date, a portion of the Preferred Units will convert into common units representing limited partner interests in the Partnership (“Common Units”) in an amount equal to, with respect to each Preferred Unitholder, the number of Preferred Units held by such Preferred Unitholder divided by the number of Conversion Dates remaining, subject to adjustment as described in the Partnership Agreement, with the conversion price determined

by the trading price of the Common Units over the month prior to such Conversion Date among other factors and as otherwise impacted by the existence of certain conditions related to the common units. On June

8, 2017, the Partnership issued 591,828 Common Units to Preferred Unitholders as a result of the June monthly conversion of Preferred Units.

In addition, pursuant to that certain Omnibus Agreement dated June 20, 2011, TETRA Technologies, Inc. is entitled to reimbursement for certain costs incurred in operating and maintaining the business of the Partnership (the “Quarterly Reimbursement”). The Board of Directors of the general partner of the Partnership has approved the Partnership issuing to CSI Compressco Investment LLC, an affiliate of TETRA Technologies, Inc., an amount of Common Units (the “Common Unit Issuance”) equal in value to $1,746,000, the amount of the first quarter 2017 Quarterly Reimbursement, instead of making a cash payment for such amount.

The Conflicts Committee of the Board of Directors of our general partner approved the Common Unit Issuance with such number of Common Units determined by the quotient of (x) the amount of the first quarter 2017 Quarterly Reimbursement divided by (y) 98% of the arithmetic average of the volume weighted average trading price of the Common Units on each trading day during the twenty trading day period beginning on the third trading day after the Partnership filed its Quarterly Report on Form 10-Q for the quarter ended March 31, 2017 (the 'VWAP"); provided, however that (a) if the VWAP is less than $6.23, then (y) shall be equal to $6.23 and (b) if the VWAP is greater than $7.77, then (y) shall be equal to $7.77.

On June 14, 2017, the Partnership issued 280,257 Common Units to CSI Compressco Investment LLC in connection with the first quarter 2017 Quarterly Reimbursement.

The issuances of Common Units described in this Current Report on Form 8-K by the Partnership to the Preferred Unitholders and CSI Compressco Investment LLC were undertaken in reliance upon exemptions from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CSI Compressco LP

|

|

|

|

|

|

|

By:

|

CSI Compressco GP Inc.,

|

|

|

|

its general partner

|

|

|

|

|

|

|

By:

|

/s/Bass C. Wallace, Jr.

|

|

|

|

Bass C. Wallace, Jr.

|

|

|

|

General Counsel

|

|

2

CSI Compressco (NASDAQ:CCLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

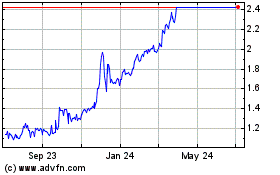

CSI Compressco (NASDAQ:CCLP)

Historical Stock Chart

From Apr 2023 to Apr 2024