Current Report Filing (8-k)

June 14 2017 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

_____________________

Date of Report

(Date of earliest event reported)

June 12, 2017

TIDEWATER INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

(State of incorporation)

|

1-6311

(Commission File Number)

|

72-0487776

(IRS Employer Identification No.)

|

|

|

|

|

601 Poydras Street, Suite 1500

New Orleans, LA

(Address of principal executive offices)

|

70130

(Zip Code)

|

(504) 568-1010

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the Company notes that certain statements set forth in this Current Report on Form 8-K provide other than historical information and are forward looking. The actual achievement of any forecasted results, or the unfolding of future economic or business developments in a way anticipated or projected by the Company, involve numerous risks and uncertainties that may cause the Company’s actual performance to be materially different from that stated or implied in the forward-looking statement. Among those risks and uncertainties, many of which are beyond the control of the Company, include, without limitation,

the ability to confirm and consummate a plan of reorganization in accordance with the terms of a previously-disclosed prepackaged plan of restructuring (the “Prepackaged Plan”); risks attendant to the bankruptcy process, including the effects thereof on our business and on the interests of various constituents, the length of time that we might be required to operate in bankruptcy; risks associated with third party motions in the bankruptcy cases, which may interfere with the ability to confirm and consummate a plan of reorganization in accordance with the terms of the Prepackaged Plan; effects on the market price of our common stock and on our ability to access the capital markets; our ability to maintain our listing on the New York Stock Exchange (the “NYSE”); the potential need to sell certain assets to raise additional capital; volatility in worldwide energy demand and oil and gas prices, and continuing depressed levels of oil and gas prices without a clear indication of if, or when, prices will recover to a level to support renewed offshore exploration activities; consolidation of our customer base; fleet additions by competitors and industry overcapacity; our views with respect to the need for and timing of the replenishment of our asset base, including through acquisitions or vessel construction; changes in capital spending by customers in the energy industry for offshore exploration, field development and production; loss of a major customer; changing customer demands for vessel specifications, which may make some of our older vessels technologically obsolete for certain customer projects or in certain markets; delays and other problems associated with vessel construction and maintenance; uncertainty of global financial market conditions and difficulty in accessing credit or capital; acts of terrorism and piracy; integration of acquired businesses and entry into new lines of business; disagreements with our joint venture partners; significant weather conditions; unsettled political conditions, war, civil unrest and governmental actions, such as expropriation or enforcement of customs or other laws that are not well developed or consistently enforced, or requirements that services provided locally be paid in local currency, in each case especially in higher political risk countries where we operate; foreign currency fluctuations; labor changes proposed by international conventions; increased regulatory burdens and oversight; changes in laws governing the taxation of foreign source income; retention of skilled workers; enforcement of laws related to the environment, labor and foreign corrupt practices; and the resolution of pending legal proceedings

. Readers should consider all of these risk factors as well as other information contained in this report.

On June 12, 2017, the Company issued an earnings release announcing its financial results for the quarter and year ended March 31, 2017.

The press release is filed as Exhibit 99.1 to this Current Report and is incorporated herein by reference as if fully set forth.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

The following exhibits are furnished with this Form 8-K:

|

99.1

|

Press Release dated June 12, 2017.

|

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

TIDEWATER INC.

|

|

|

|

|

|

By:

|

|

/s/ Quinn P. Fanning

|

|

|

|

Quinn P. Fanning

|

|

|

|

Executive Vice President and Chief Financial Officer

|

Date: June 14, 2017

3

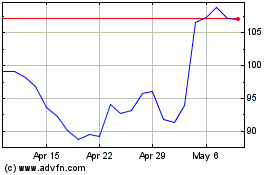

Tidewater (NYSE:TDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

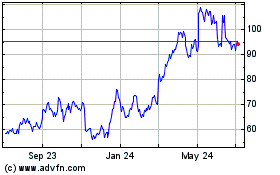

Tidewater (NYSE:TDW)

Historical Stock Chart

From Apr 2023 to Apr 2024