Today, Jabil Inc. (NYSE: JBL), reported preliminary, unaudited

financial results for its third quarter of fiscal year 2017,

including third quarter net revenue of $4.5 billion.

For the third quarter of fiscal year 2017, U.S. GAAP (as defined

below) operating income was $43.4 million and U.S. GAAP diluted

loss per share was $(0.14). Core operating income ((Non-U.S. GAAP)

as defined below) was $113.8 million and core diluted earnings per

share ((Non-U.S. GAAP) as defined below) was $0.31.

“I’m pleased with our third quarter results as both business

segments performed quite well,” said CEO Mark Mondello. “In

Diversified Manufacturing Services, the team delivered exceptional

execution and cost controls against product road maps exhibiting

massive scale and complexity, while we continued to see strong

double-digit growth in healthcare and packaging. At the same time,

our Electronics Manufacturing Services team continues to do an

excellent job building broad revenue diversification, while

developing end-market domain expertise, resulting in solid margin

expansion,” he added.

Fiscal Year 2017 Fourth Quarter

Guidance:

• Net revenue

$4.7 billion to $5.1 billion

• U.S. GAAP operating income

$95 million to $165 million

• U.S. GAAP diluted earnings per share

$0.13 to $0.48 per diluted share

• Core operating income (Non-U.S.

GAAP)

$165 million to $215 million

• Core diluted earnings per share

(Non-U.S. GAAP)

$0.50 to $0.74 per diluted share

• Diversified Manufacturing Services

Increase revenue 26 percent year-on-year

• Electronics Manufacturing Services

Increase revenue 2 percent year-on-year

• Total company

Increase revenue 11 percent year-on-year

“Near-term, we expect to deliver the best fourth quarter in the

company’s history in terms of core operating income. Beyond that,

our forecast suggests the growth in both DMS and EMS in fiscal 2018

will result in core EPS in the neighborhood of $2.60. We remain

committed to complete our two-year capital return framework plan,

achieve $3.00 per share in core EPS in fiscal 2019, and ultimately

become the world’s most technologically advanced manufacturing

solutions company,” said Mondello.

(U.S. GAAP diluted earnings per share for the fourth quarter of

fiscal year 2017 are currently estimated to include $0.05 per share

for amortization of intangibles, $0.08 per share for stock-based

compensation expense and related charges and $0.24 to $0.13 per

share for restructuring and related charges.)

(Definitions: “U.S. GAAP” means U.S. generally accepted

accounting principles. Jabil defines core operating income as U.S.

GAAP operating income before amortization of intangibles,

stock-based compensation expense and related charges, restructuring

and related charges, distressed customer charges, acquisition costs

and certain purchase accounting adjustments, loss on disposal of

subsidiaries, settlement of receivables and related charges,

impairment of notes receivable and related charges and goodwill

impairment charges. Jabil defines core earnings as U.S. GAAP net

income before amortization of intangibles, stock-based compensation

expense and related charges, restructuring and related charges,

distressed customer charges, acquisition costs and certain purchase

accounting adjustments, loss on disposal of subsidiaries,

settlement of receivables and related charges, impairment of notes

receivable and related charges, goodwill impairment charges,

impairment on securities, income (loss) from discontinued

operations, gain (loss) on sale of discontinued operations and

certain other expenses, net of tax and certain deferred tax

valuation allowance charges. Jabil defines core diluted earnings

per share as core earnings divided by the weighted average number

of outstanding diluted shares as determined under U.S. GAAP. Jabil

calculates its quarterly core return on invested capital by

annualizing its after-tax core operating income for its most

recently ended quarter and dividing that by a two quarter average

of its net invested capital base. Jabil calculates its annual core

return on invested capital by taking its after-tax core operating

income for its most recently ended fiscal year and dividing that by

a two year average of its net invested capital base. Jabil reports

core operating income, core earnings, core diluted and basic

earnings per share and core return on invested capital to provide

investors an additional method for assessing operating income,

earnings, diluted earnings per share and return on invested capital

from what it believes are its core manufacturing operations. See

the accompanying reconciliation of Jabil’s core operating income to

its U.S. GAAP operating income, its calculation of core earnings

and core diluted earnings per share to its U.S. GAAP net income and

U.S. GAAP earnings per share, its calculation of core return on

invested capital and additional information in the supplemental

information.)

Forward Looking Statements: This news release contains

forward-looking statements, including those regarding our

anticipated financial results for our third quarter of fiscal year

2017; our guidance for future financial performance in our fourth

quarter of fiscal year 2017 (including, net revenue, total company

and segment revenue, U.S. GAAP operating income, U.S. GAAP diluted

earnings (loss) per share, core operating income (Non-U.S. GAAP),

and core diluted earnings per share (Non-U.S. GAAP) results and the

components thereof, in each case for our fourth quarter of fiscal

year 2017); statements that relate to the Company’s capital

allocation framework, including our share repurchase program

thereunder, the amount of shares to be repurchased and the timing

of such repurchase; and statements regarding our future earnings

per share expectations. The statements in this press release are

based on current expectations, forecasts and assumptions involving

risks and uncertainties that could cause actual outcomes and

results to differ materially from our current expectations. Such

factors include, but are not limited to: our determination as we

finalize our financial results for our third quarter of fiscal year

2017 that our financial results and conditions differ from our

current preliminary unaudited numbers set forth herein; unexpected,

adverse seasonal impacts on demand; performance in the markets in

which we operate; changes in macroeconomic conditions; the

occurrence of, success and expected financial results from, product

ramps; our ability to maintain and improve costs, quality and

delivery for our customers; whether our restructuring activities

and the realignment of our capacity will adversely affect our cost

structure, ability to service customers and labor relations;

changes in technology; competition; anticipated growth for us and

our industry that may not occur; managing rapid growth; managing

rapid declines in customer demand and other related customer

challenges that may occur; our ability to successfully consummate

acquisitions and divestitures; managing the integration of

businesses we acquire; risks associated with international sales

and operations; retaining key personnel; and our dependence on a

limited number of large customers. Additional factors that could

cause such differences can be found in our Annual Report on

Form 10-K for the fiscal year ended August 31, 2016

and our other filings with the Securities and Exchange Commission.

We assume no obligation to update these forward-looking

statements.

Supplemental Information Regarding Non-GAAP Financial

Measures: Jabil provides supplemental, non-U.S. GAAP

financial measures in this release to facilitate evaluation of

Jabil’s core operating performance. These non-U.S. GAAP

measures exclude certain amounts that are included in the most

directly comparable U.S. GAAP measures, do not have standard

meanings and may vary from the non-U.S. GAAP financial

measures used by other companies. Management believes these “core”

financial measures are useful measures that facilitate evaluation

of the past and future performance of Jabil’s ongoing operations on

a comparable basis.

Jabil reports core operating income, core return on invested

capital, core earnings and core diluted and basic earnings per

share to provide investors an additional method for assessing

operating income, return on invested capital, earnings and earnings

per share from what it believes are its core manufacturing

operations. Among other uses, management

uses non-U.S. GAAP financial measures to make operating

decisions, assess business performance and as a factor in

determining certain employee performance when determining incentive

compensation. The Company determines the tax effect of the items

excluded from core earnings and core basic and diluted earnings per

share based upon evaluation of the statutory tax treatment and the

applicable tax rate of the jurisdiction in which the pre-tax items

were incurred, and for which realization of the resulting tax

benefit, if any, is expected. In certain jurisdictions where the

Company does not expect to realize a tax benefit (due to a history

of operating losses or other factors resulting in a valuation

allowance related to deferred tax assets), a 0% tax rate is

applied. Detailed definitions of certain of the core financial

measures are included above under “Definitions” and a

reconciliation of the disclosed core financial measures to the most

directly comparable U.S. GAAP financial measures is included under

the heading “Supplemental Data” at the end of this release.

Company Conference Call Information: Jabil will hold a

conference call to discuss its third quarter results and fiscal

2017 outlook today at 4:30 p.m. ET live on the Internet at

http://www.jabil.com. The call will be recorded and archived on the

web at http://www.jabil.com. A taped replay of the conference call

will also be available June 14, 2017 at approximately 7:30 p.m. ET

through midnight on June 21, 2017. To access the replay, call (855)

859-2056 from within the United States, or (404) 537-3406 outside

the United States. The pass code is: 24813639. An archived webcast

of the conference call will be available at

http://www.jabil.com/investors/.

About Jabil: Jabil (NYSE: JBL) is a product solutions

company providing comprehensive electronics design, production and

product management services. Offering complete product supply chain

management from facilities in 28 countries, Jabil provides

comprehensive, individualized-focused solutions to customers in a

broad range of industries. Further information is available on

Jabil’s website: jabil.com.

JABIL INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEETS (in thousands)

May 31, 2017

August 31,

(Unaudited)

2016

ASSETS Current assets: Cash and cash equivalents $ 743,931 $

912,059 Accounts receivable, net 1,445,148 1,359,610 Inventories

2,706,530 2,456,612 Prepaid expenses and other current assets

997,752 1,120,100 Total current assets 5,893,361

5,848,381 Property, plant and equipment, net 3,210,107 3,331,879

Goodwill and intangible assets, net 896,534 891,727 Deferred income

taxes 189,881 148,859 Other assets 139,766 101,831

Total assets $ 10,329,649 $ 10,322,677

LIABILITIES AND

EQUITY Current liabilities: Current installments of notes

payable, long-term debt and capital lease obligations $ 538,985 $

45,810 Accounts payable 3,641,247 3,593,195 Accrued expenses

1,937,003 1,929,051 Total current liabilities 6,117,235

5,568,056 Notes payable, long-term debt and capital lease

obligations, less current installments 1,644,590 2,074,012 Other

liabilities 80,943 78,018 Income tax liabilities 92,197 90,804

Deferred income taxes 51,841 54,290 Total liabilities

7,986,806 7,865,180 Commitments and contingencies

Equity: Jabil Inc. stockholders’ equity: Preferred stock ― ― Common

stock 253 250 Additional paid-in capital 2,078,833 2,034,525

Retained earnings 1,698,704 1,660,820 Accumulated other

comprehensive income (loss) 15,927 (39,877) Treasury stock, at cost

(1,466,240) (1,217,547) Total Jabil Inc.

stockholders’ equity 2,327,477 2,438,171 Noncontrolling interests

15,366 19,326 Total equity 2,342,843

2,457,497 Total liabilities and equity $ 10,329,649 $ 10,322,677

JABIL INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except for per share

data) (Unaudited) Three

months ended Nine months ended May 31, May

31, May 31, May 31, 2017

2016 2017 2016 Net revenue $ 4,489,557

$ 4,310,752 $ 14,040,092 $ 13,922,323 Cost of revenue

4,163,142 3,989,665 12,920,267

12,718,268 Gross profit 326,415 321,087 1,119,825 1,204,055

Operating expenses: Selling, general and administrative 233,884

239,646 665,879 716,097 Research and development 7,274 7,675 21,982

24,431 Amortization of intangibles 9,174 9,711 26,262 26,150

Restructuring and related charges 32,700 4,460

113,529 8,349 Operating income 43,383 59,595

292,173 429,028 Interest and other, net 47,601

35,322 117,552 102,202 (Loss) income before

income tax (4,218 ) 24,273 174,621 326,826 Income tax expense

21,481 18,434 93,495

110,639 Net (loss) income (25,699 ) 5,839 81,126 216,187 Net (loss)

income attributable to noncontrolling interests, net of tax

(418 ) 626 (2,285 ) 159 Net (loss) income

attributable to Jabil Inc. $ (25,281 ) $ 5,213 $ 83,411 $

216,028 (Loss) earnings per share attributable to the stockholders

of Jabil Inc.: Basic $ (0.14 ) $ 0.03 $ 0.46 $ 1.13 Diluted

$ (0.14 ) $ 0.03 $ 0.45 $ 1.12 Weighted average

shares outstanding: Basic 181,038 191,206

182,982 190,841 Diluted 181,038

193,069 186,621 193,058

JABIL INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands) (Unaudited)

Nine months ended May 31, May 31,

2017 2016 Cash flows from operating activities: Net

income $ 81,126 $ 216,187 Adjustments to reconcile net income to

net cash provided by operating activities: Depreciation and

amortization 570,557 512,972 Restructuring and related charges

58,613 ― Recognition of stock-based compensation expense and

related charges 33,377 58,505 Deferred income taxes (44,916)

(24,403) Loss on sale of property, plant and equipment 1,362 13,229

Other, net 24,928 6,408 Change in operating assets and liabilities,

exclusive of net assets acquired: Accounts receivable (85,761)

180,830 Inventories (216,149) 229,187 Prepaid expenses and other

current assets 100,397 (131,682) Other assets (28,852) (7,466)

Accounts payable, accrued expenses and other liabilities

38,341 (565,558) Net cash provided by operating activities

533,023 488,209 Cash flows from investing activities:

Acquisition of property, plant and equipment (482,739) (668,505)

Proceeds from sale of property, plant and equipment 43,437 18,710

Cash paid for business and intangible asset acquisitions, net of

cash (36,620) (206,039) Issuance of notes receivable ― (29,300)

Other, net (1,360) (5,250) Net cash used in investing

activities (477,282) (890,384) Cash flows from

financing activities: Borrowings under debt agreements 5,432,503

4,748,060 Payments toward debt agreements (5,370,936) (4,268,839)

Payments to acquire treasury stock (237,135) (54,567) Dividends

paid to stockholders (45,550) (47,122) Net proceeds from exercise

of stock options and issuance of common stock under employee stock

purchase plan 11,246 10,660 Treasury stock minimum tax withholding

related to vesting of restricted stock (11,558) (10,490) Other, net

(1,496) (1,958) Net cash (used in) provided by

financing activities (222,926) 375,744 Effect of

exchange rate changes on cash and cash equivalents (943)

(541) Net decrease in cash and cash equivalents (168,128)

(26,972) Cash and cash equivalents at beginning of period

912,059 913,963 Cash and cash equivalents at end of period $

743,931 $ 886,991

JABIL INC. AND SUBSIDIARIES

SUPPLEMENTAL DATA RECONCILIATION OF U.S. GAAP FINANCIAL

RESULTS TO NON-U.S. GAAP MEASURES (in thousands, except for

per share data) (Unaudited)

Three months ended Nine months ended

May 31, May 31, May 31, May 31,

2017 2016 2017 2016 Operating income

(U.S. GAAP) $ 43,383 $ 59,595 $ 292,173 $ 429,028 Amortization

of intangibles 9,174 9,711 26,262 26,150 Stock-based compensation

expense and related charges 18,350 13,445 33,377 58,505

Restructuring and related charges 32,700 4,460 113,529 8,349

Distressed customer charges 10,198 ― 10,198

―

Core operating income (Non-U.S. GAAP) $ 113,805 $

87,211 $ 475,539 $ 522,032

Net (loss) income attributable

to Jabil Inc. (U.S. GAAP) $ (25,281) $ 5,213 $ 83,411 $ 216,028

Amortization of intangibles 9,174 9,711 26,262 26,150 Stock-based

compensation expense and related charges 18,350 13,445 33,377

58,505 Restructuring and related charges 32,700 4,460 113,529 8,349

Distressed customer charges 10,198 ― 10,198 ― Impairment on

securities 11,539 ― 11,539 ― Adjustments for taxes 431

(866) (2,793) (2,842)

Core earnings

(Non-U.S. GAAP) $ 57,111 $ 31,963 $ 275,523 $ 306,190

(Loss) earnings per share (U.S. GAAP): Basic $ (0.14) $ 0.03

$ 0.46 $ 1.13 Diluted $ (0.14) $ 0.03 $ 0.45 $ 1.12

Core

earnings per share (Non-U.S. GAAP): Basic $ 0.32 $ 0.17 $ 1.51

$ 1.60 Diluted $ 0.31 $ 0.17 $ 1.48 $ 1.59

Weighted

average shares outstanding used in the calculations of

earnings per share (U.S. GAAP): Basic 181,038 191,206 182,982

190,841 Diluted 181,038 193,069 186,621 193,058

Weighted

average shares outstanding used in the calculations of

earnings per share (Non-U.S. GAAP): Basic 181,038 191,206

182,982 190,841 Diluted 184,940 193,069 186,621 193,058

JABIL

INC. AND SUBSIDIARIES SUPPLEMENTAL DATA

RECONCILIATION OF U.S. GAAP FINANCIAL RESULTS TO NON-U.S. GAAP

MEASURES (in thousands) (Unaudited)

CALCULATION OF RETURN ON INVESTED CAPITAL

AND CORE RETURN ON INVESTED CAPITAL The Company

calculates: (1) its "Return on Invested Capital" by annualizing its

"after-tax U.S. GAAP operating income" for its most recently-ended

quarter and dividing that by the average of its "net invested

capital asset base" and (2) its "Core Return on Invested Capital"

by annualizing its "after-tax non-U.S. GAAP core operating income"

for its most recently-ended quarter and dividing that by the

“average net invested capital asset base." The Company

calculates: (1) its "after-tax U.S. GAAP operating income" by

subtracting a certain tax effect (the calculation of which is

explained below) from its U.S. GAAP operating income and (2) its

"after-tax non-U.S. GAAP core operating income" as its non-U.S.

GAAP core operating income less a certain tax effect (the

calculation of which is explained below). See elsewhere in this

earnings release for a reconciliation of the Company's non-U.S.

GAAP core operating income to its U.S. GAAP operating income.

The Company calculates its "average net invested capital

asset base" as the sum of the averages (the calculations of which

are explained below) of its stockholders’ equity, current and

non-current portions of its notes payable, long-term debt and

capital lease obligations less the average (the calculation of

which is explained below) of its cash and cash equivalents.

The following table reconciles (1) "Return on Invested Capital," as

calculated using "after-tax U.S. GAAP operating income" to (2)

"Core Return on Invested Capital," as calculated using "after-tax

non-U.S. GAAP core operating income":

Three months ended

May 31,

May 31,

2017

2016

Numerator: Operating income (U.S. GAAP) $ 43,383 $

59,595 Tax effect(1) (21,481 ) (18,516 ) After-tax

operating income 21,902 41,079

x4

x4

Annualized after-tax operating income $ 87,608

$ 164,316

Core operating income (Non-U.S.

GAAP) $ 113,805 $ 87,211 Tax effect(2) (21,218 )

(19,340 ) After-tax core operating income 92,587 67,871

x4

x4

Annualized after-tax core operating income $ 370,348

$ 271,484

Denominator: Average total

Jabil Inc. stockholders’ equity(3) $ 2,369,391 $ 2,479,722 Average

notes payable, long-term debt and capital lease obligations, less

current installments(3) 1,850,068 1,801,124 Average current

installments of notes payable, long-term debt and capital lease

obligations(3) 293,154 449,089 Average cash and cash equivalents(3)

(749,514 ) (885,104 )

Net invested capital asset

base $ 3,763,099 $ 3,844,831

Return on

Invested Capital (U.S. GAAP) 2.3 % 4.3

% Adjustments noted above 7.5 %

2.8 % Core Return on Invested Capital (Non-U.S.

GAAP) 9.8 % 7.1 %

__________

(1) This amount is calculated by adding the amount of income

taxes attributable to its operating income (U.S. GAAP) and its

interest expense.

(2) This amount is calculated by adding the amount of income

taxes attributable to its core operating income (Non-U.S. GAAP) and

its interest expense.

(3) The average is based on the addition of the account balance

at the end of the most recently-ended quarter to the account

balance at the end of the prior quarter and dividing by two.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170614006027/en/

Jabil Circuit, Inc.Beth Walters, 727-803-3511Senior Vice

President, Investor Relations &

Communicationsbeth_walters@jabil.comorAdam Berry,

727-803-5772Senior Director, Investor

Relationsadam_berry@jabil.com

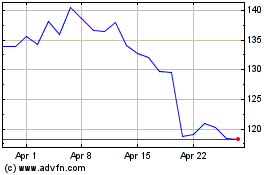

Jabil (NYSE:JBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jabil (NYSE:JBL)

Historical Stock Chart

From Apr 2023 to Apr 2024